CFD’er er komplekse instrumenter, og der er en stor risiko forbundet med disse for at miste penge på grund af gearing. 77.3 % af detailinvestorerne har tab på deres konto, når de handler CFD’er med denne udbyder. Du skal overveje, om du forstår, hvordan CFD’er fungerer, og om du har råd til at løbe en stor risiko for at miste dine penge.

Torsdag Apr 24 2025 10:06

7 min

The Bank of Japan's interest rate decision is set for May 1 at 0300 GMT, with the current rate at 0.5%. The U.S. ISM Manufacturing PMI for April is scheduled for May 1 at 1400 GMT, with a slight increase to 49.2 expected. Australia's PPI for Q1 is due on May 2 at 0130 GMT, with a forecasted decrease to 3.4% year-on-year. The Eurozone's flash inflation rate for April is expected on May 2 at 0900 GMT, with a slight decrease to 2.0% year-on-year. Finally, the U.S. non-farm payrolls report for April is anticipated on May 2 at 1230 GMT, with forecasts ranging from 100,000 to 140,000 new jobs.

Here are the week’s key events:

Canada is set to hold its federal election on April 28, 2025, with preliminary results expected to start coming in shortly after polls close across the country’s six time zones. While early results may emerge within hours, a full national picture may not be clear until late evening or the following morning due to staggered voting times. The election outcome will be closely watched amid shifting political dynamics and public concerns on key national issues.

Top US company earnings: Schneider Electric (SBGSF), Hitachi (HTHIY)

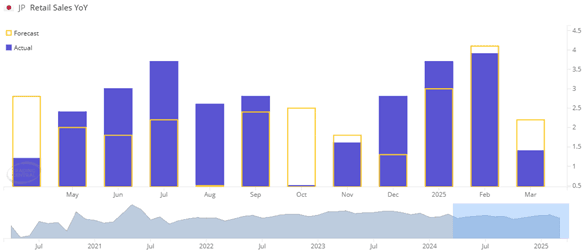

Japan’s retail sales rose 0.5% month-on-month in February but are expected to dip by 0.2% in March. Year-on-year sales are forecast to rise 2.3%, up from 1.4% in February. The monthly decline likely reflects a pullback after seasonal strength in February, while the stronger annual figure may be due to a lower base in March 2024, making this year’s growth appear more robust. This data is set to be released on 29 April at 2350 GMT.

(Japan Retail Sales YoY Chart, Source: Trading Central)

Top US company earnings: Visa A (V), Coca-Cola (KO)

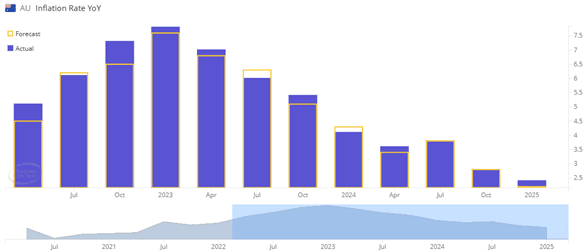

Australia’s annual inflation rate was 2.4% in Q4 2024, with expectations for a slight easing to 2.2% in Q1 2025. The anticipated moderation likely reflects continued cooling in energy and goods prices, along with the impact of earlier rate hikes filtering through the economy, helping to gradually bring inflation closer to the Reserve Bank of Australia's target range. This data is set to be released on 30 April at 0130 GMT.

(Australia Inflation Rate YoY Chart, Source: Trading Central)

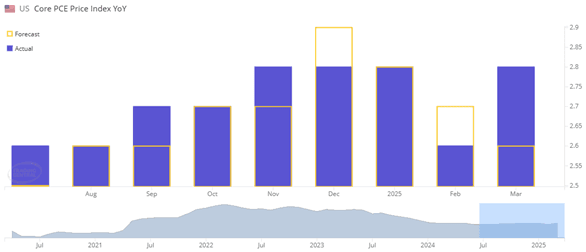

The U.S. core PCE price index rose 2.8% year-on-year in February, with the March reading expected to ease to 2.5%. This projected decline suggests continued disinflation momentum, driven by softer goods prices, slower wage growth, and the lagged effects of tighter monetary policy. This will gradually bring core inflation closer to the Federal Reserve's 2% target. This data is set to be released on 30 April at 1230 GMT.

(U.S. Core PCE Price Index YoY Chart, Source: Trading Central)

Top US company earnings: Microsoft (MSFT), Meta (META)

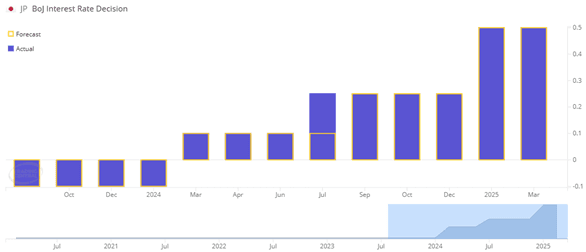

The Bank of Japan previously set its benchmark interest rate at 0.5%, and markets widely expect the upcoming decision to maintain the rate at the same level. This steady outlook reflects the central bank’s cautious approach as it monitors inflation stability and wage growth to ensure that recent policy normalisation does not derail Japan’s fragile economic recovery. This data is set to be released on 1 May at 0300 GMT.

(BoJ Interest Rate Decision Chart, Source: Trading Central)

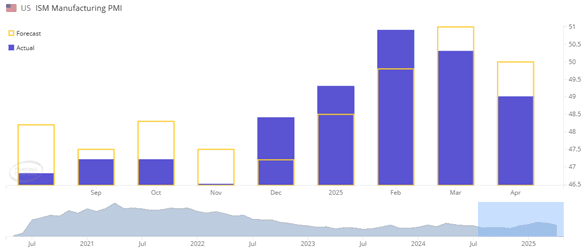

The U.S. ISM manufacturing PMI registered 49 in March, with a slight uptick to 49.2 expected for April. The modest improvement reflects cautious optimism, suggesting that while the sector remains in contraction territory, stabilising input costs and a gradual recovery in new orders may be helping to support sentiment and slow the pace of decline. This data is set to be released on 1 May at 1400 GMT.

(U.S. ISM Manufacturing PMI Chart, Source: Trading Central)

Top US company earnings: Amazon (AMZN), P&G (PG)

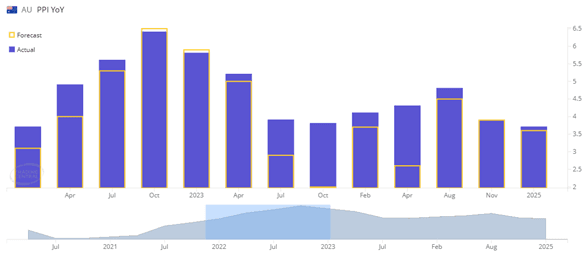

Australia’s Producer Price Index (PPI) rose 3.7% year-on-year in Q4 2024, with expectations for a slight easing to 3.4% in Q1 2025. The projected slowdown likely reflects easing cost pressures across manufacturing and construction, as global supply chains continue stabilising and domestic demand growth softens, aligning with broader disinflation trends. This data is set to be released on 2 May at 0130 GMT.

(Australia PPI YoY Chart, Source: Trading Central)

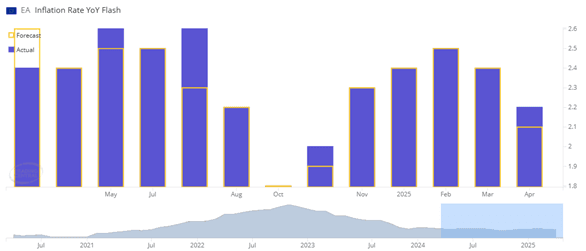

The Eurozone's flash inflation rate for March stood at 2.2%, and the forecast for April is a slight decrease to 2%. This expected decline is due mainly to moderating energy costs and the ongoing effects of monetary policies from the European Central Bank, which are helping to reduce inflationary pressures. Additionally, softer demand in certain sectors is contributing to a more stable price environment, aligning with the ECB's efforts to bring inflation closer to its target. This data is set to be released on 2 May at 0900 GMT.

(Eurozone Inflation Rate YoY Flash Chart, Source: Trading Central)

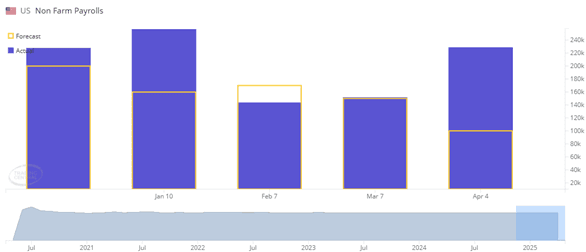

The U.S. economy added 228,000 jobs in March 2025, surpassing expectations. However, economists anticipate a moderation in April's nonfarm payrolls, with forecasts ranging from 100,000 to 140,000. This expected slowdown might be attributed to new tariffs that have introduced volatility into the economy, leading to cautious hiring practices among businesses. This data is set to be released on 2 May at 1230 GMT.

(U.S. Non-Farm Payrolls Chart, Source: Trading Central)

Top US company earnings: Exxon Mobil (XOM), Chevron (CVX)

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.