CFD’er er komplekse instrumenter, og der er en stor risiko forbundet med disse for at miste penge på grund af gearing. 77.3 % af detailinvestorerne har tab på deres konto, når de handler CFD’er med denne udbyder. Du skal overveje, om du forstår, hvordan CFD’er fungerer, og om du har råd til at løbe en stor risiko for at miste dine penge.

Lørdag Maj 3 2025 03:02

5 min

The U.S. non-farm payrolls rose by 228,000 in March, but expectations for April have been lowered significantly to 140,000, while the unemployment rate is projected to remain steady at 4.2%. This anticipated slowdown in job creation reflects signs of a cooling labour market as the effects of tighter monetary policy continue to weigh on business hiring. Employers may exercise more caution amid ongoing economic uncertainty, softer consumer demand, and elevated wage costs.

Meanwhile, the unemployment rate is expected to hold steady as labour force participation and job-seeking behaviour offset any slowdown in hiring. The combination of slower job growth and a stable jobless rate points to a gradual rebalancing in the labour market rather than a sharp deterioration. These data are set to be released today at 12:30 GMT.

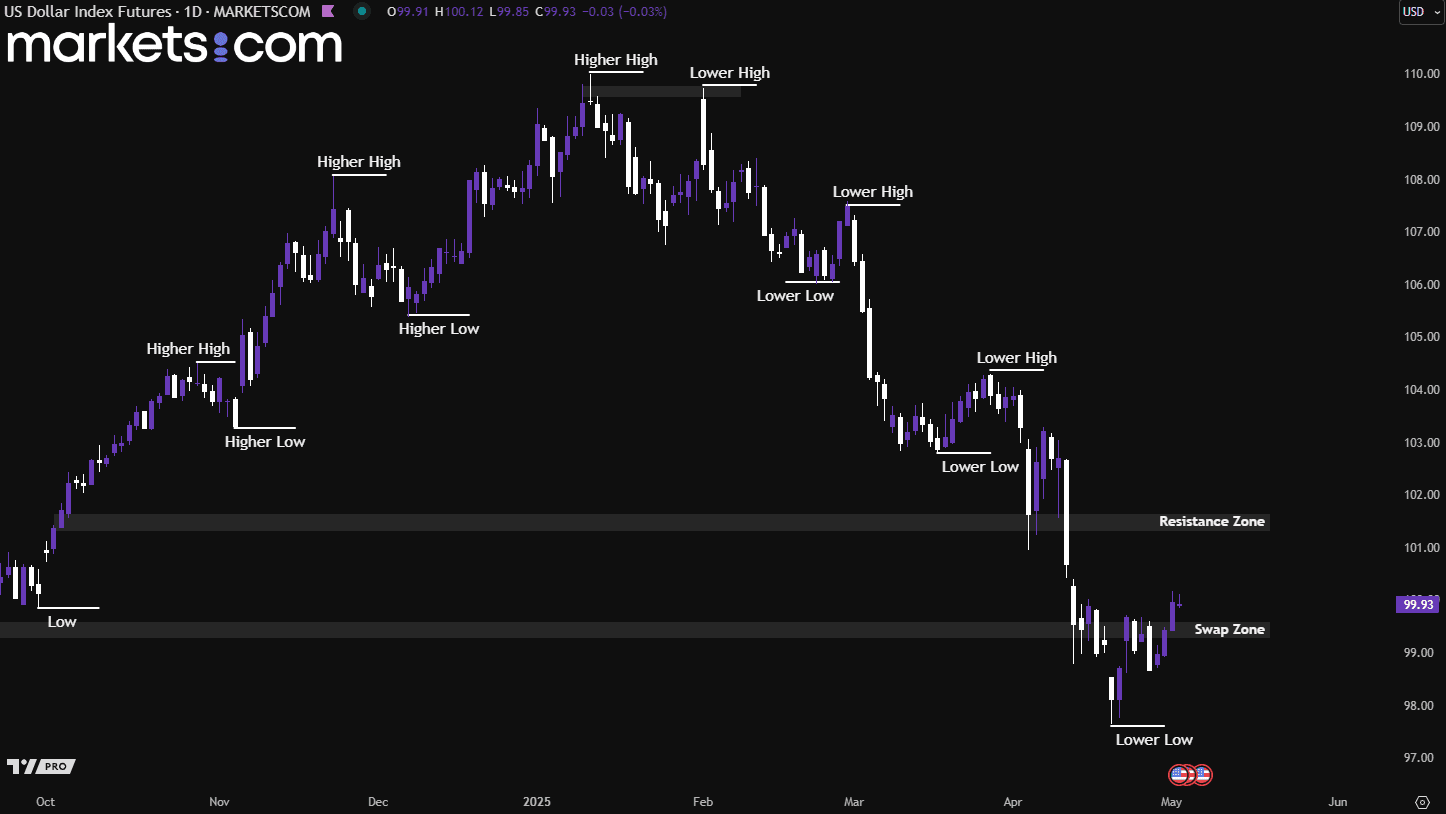

(U.S Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the U.S. Dollar Index has been trending lower, as evidenced by the formation of lower highs and lower lows. Recently, it broke above the swap zone between 99.30 and 99.60 with a strong bullish closing candle. As a result, it might be moving higher and could retest the resistance area between 101.30 and 101.60.

The Eurozone's flash year-on-year inflation rate for March was 2.2%, with expectations for April slightly lower at 2.0%. This anticipated moderation is driven by several factors, including base effects from high inflation last year, especially in energy, making current figures appear softer by comparison. Additionally, energy prices have stabilised, easing pressure on headline inflation. Slower consumer demand due to higher interest rates and tighter financial conditions is also playing its role. This data is set to be released today at 09:00 GMT.

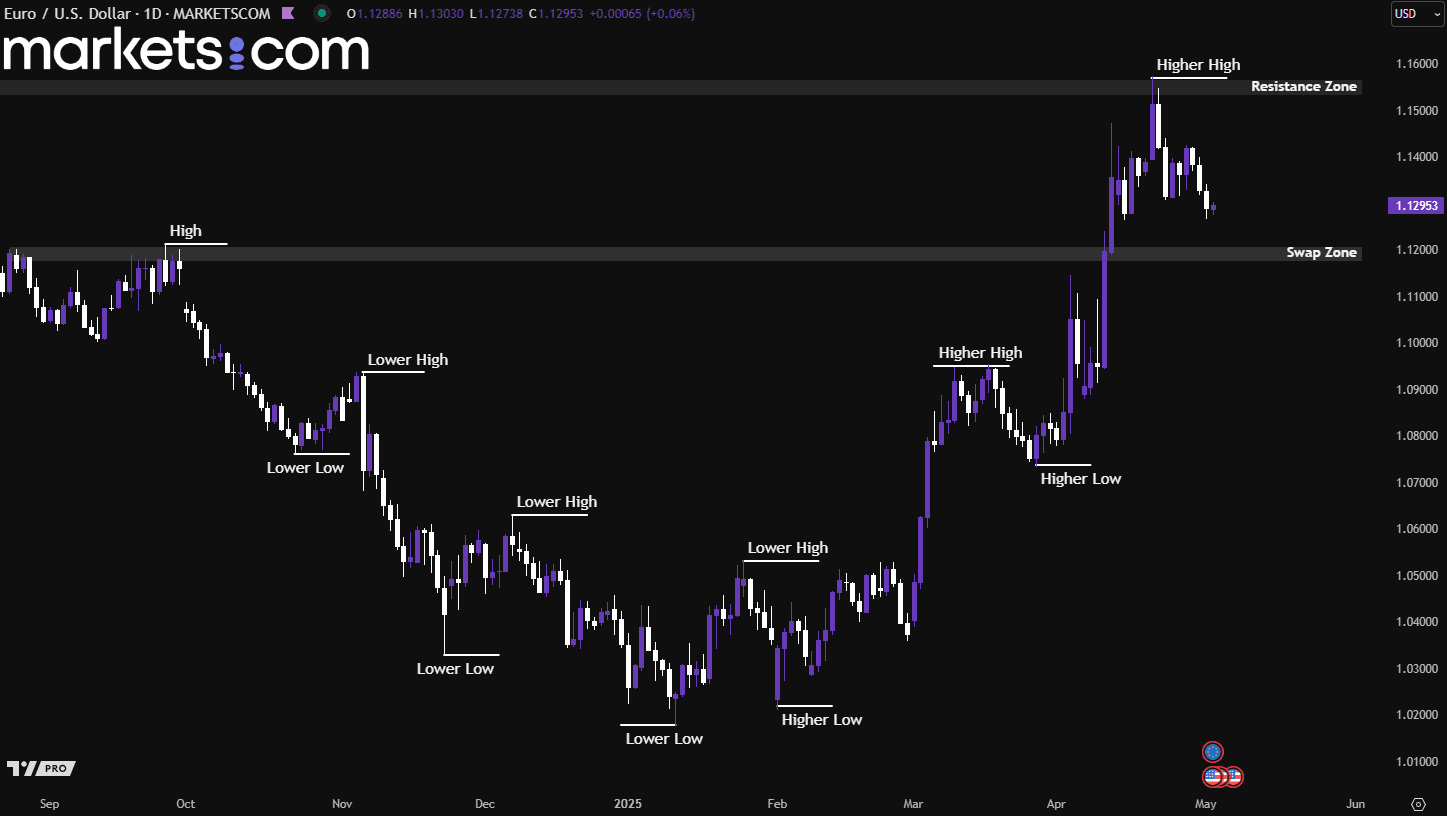

(EUR/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the EUR/USD currency pair has been in a bullish trend since mid-January 2025, as evidenced by the formation of higher highs and higher lows. Recently, it faced rejection at the resistance zone between 1.1530 and 1.1570, which pushed the pair lower. It is now approaching the swap zone between 1.1180 and 1.1210. If the pair closes above this zone in the near term, the bullish structure may continue to support upward movement. Conversely, a break below the swap zone could indicate that bearish momentum is taking over, potentially driving the pair lower.

Exxon Mobil Corporation (XOM) is scheduled to release its first-quarter 2025 earnings results today, ahead of the market open. The consensus estimate for earnings stands at $1.72 per share, reflecting a 16.5% decline compared to the same quarter last year. Over the past 30 days, the estimate has seen one downward revision and four upward revisions. Revenue for the quarter is projected at $84.5 billion, indicating a modest 1.7% increase year-over-year.

Moreover, in a recent Form 8-K filing, Exxon stated it expects upstream earnings for Q1 to rise sequentially by up to $800 million, citing favourable oil and gas prices as the primary driver. The outlook reflects the trend observed in crude prices earlier in 2025.

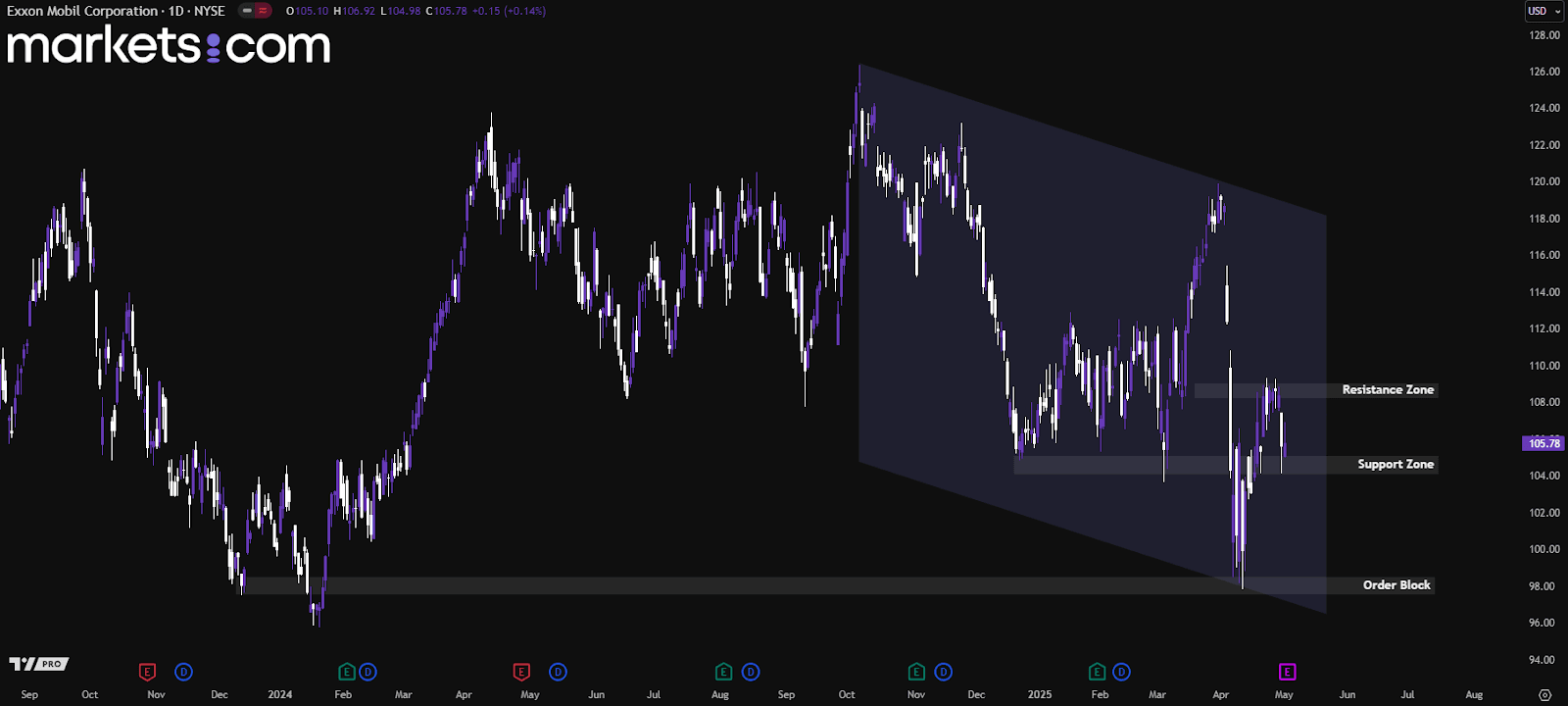

(XOM Share Price Daily Chart, Source: Trading View)

From a technical analysis perspective, XOM's share price has been in a bearish trend since early October 2024, as indicated by the formation of lower highs and lower lows. It is currently retesting the support zone between 104 and 105. If it finds support at this level, the price may potentially move higher to retest the resistance zone between 108 and 109. Conversely, a break below the support zone might be leading to a further decline to retest the order block between 97.50 and 98.50.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.