Vi bruger cookies til bl.a. at tilbyde live chat support og vise dig indhold, som vi tror, du vil være interesseret i. Hvis du er tilfreds med markets.com’s brug af cookies, skal du klikke på acceptér.

CFD’er er komplekse instrumenter, og der er en stor risiko forbundet med disse for at miste penge på grund af gearing. 77.3 % af detailinvestorerne har tab på deres konto, når de handler CFD’er med denne udbyder. Du skal overveje, om du forstår, hvordan CFD’er fungerer, og om du har råd til at løbe en stor risiko for at miste dine penge.

Torsdag Oct 10 2024 09:59

5 min

Then he sent out a dove to see if the water had receded from the surface of the ground.

If the Federal Reserve’s 50-basis-point (bps) cut was the dove, the economic situation is still flood – record highs on Wall Street and a labour market still purring along albeit with the odd squeal. Minutes from the last FOMC meeting indicate it will be hard to repeat the September cut.

FOMC minutes showed division as “some participants observed that they would have preferred a 25--asis point reduction of the target range at this meeting, and a few others indicated that they could have supported such a decision”. Better economic data maybe requires the Fed to stay put in November after rushing in last month.

The chances of no cut next month are up to about 15% now ahead of the US inflation (CPI) reading today — with further disinflation expected. The monthly core US inflation reading (excluding volatile food and energy prices) is seen rising 0.2% from August. Core is expected to remain quite sticky annually above 3%, whilst the headline is seen down to 2.3% from 2.5%.

Beregn din hypotetiske gevinst/tab (aggregerede omkostninger og afgifter), hvis du havde åbnet en handel i dag..

Markeder

Instrument

Kontotype

Retning

Mængde

Beløb skal være lig med eller højere end

Beløb bør være mindre end eller lig med

Beløbet skal være et multiplum af det mindste antal partier

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Værdi

Kurtage

Spread

Gearing

Konverteringsgebyr

Marginkrav

Overnight Swaps

Tidligere resultater er ikke nogen pålidelig indikator for fremtidige resultater.

Alle positioner på instrumenter denomineret i en anden valuta end din kontovaluta, vil være omfattet af et konverteringsgebyr også ved lukningen af positionen.

Rates go up, rates go down; stocks in the US just cannot be held down. Whether it’s 50bps or a much more gradual easing cycle, it doesn’t seem to matter. Indeed, the only thing that can worry investors is outright recession in the US (the early August and, to a lesser extent early-September, growth scares).

Wall Street notched a couple of fresh records yesterday — the S&P 500 closed up 0.7% after hitting a record high, whilst the Dow Jones rose 1% to 42,512, a new all-time closing high. Even insurers rallied amid Hurricane Milton. Google shares fell 1.59% amid the antitrust report. S&P 500 earnings growth is expected at just 5% — low expectations coming into earnings season provide plenty of scope to beat.

European stocks are mixed early on Tuesday after a pretty choppy session in Asia turned more positive with investors squarely focused on this Saturday finance ministry announcement. The FTSE 100 rose a bit but is down on the week on China. The DAX and CAC both ticked lower but are stronger for the week.

Oil and copper have stabilised a bit after a couple of sharp moves down at the start of the week on China weakness. The dollar remains will bid with the yen offered.

France’s new government is due to present its 2025 budget today – seen as an austerity budget with tax hikes and cost-cutting measures to try to sort out France’s fiscal deficit, which far exceeds the EU’s 3% limit. This is a significant test for the new Barnier regime and it will be interesting to see if it can hold together or whether we are simply heading for more deadlock.

UK 10-year gilt yields ticked higher this morning as it becomes clear Chancellor Rachel Reeves will tweak debt rules to borrow more. The 10-year has nudged to 4.215% from around 4.0% last week. More borrowing won’t mean respite on the state-sponsored theft of more taxation. The IFS notes in its Green Budget that an extra £16 billion per year of tax rises will be required and to be careful in reclassifying government debt as valuing assets such as roads and railways was uncertain and “bears no relation whatever to our ability to raise money in gilt markets”. Watch gilts. Reeves may not be in for such an easy ride.

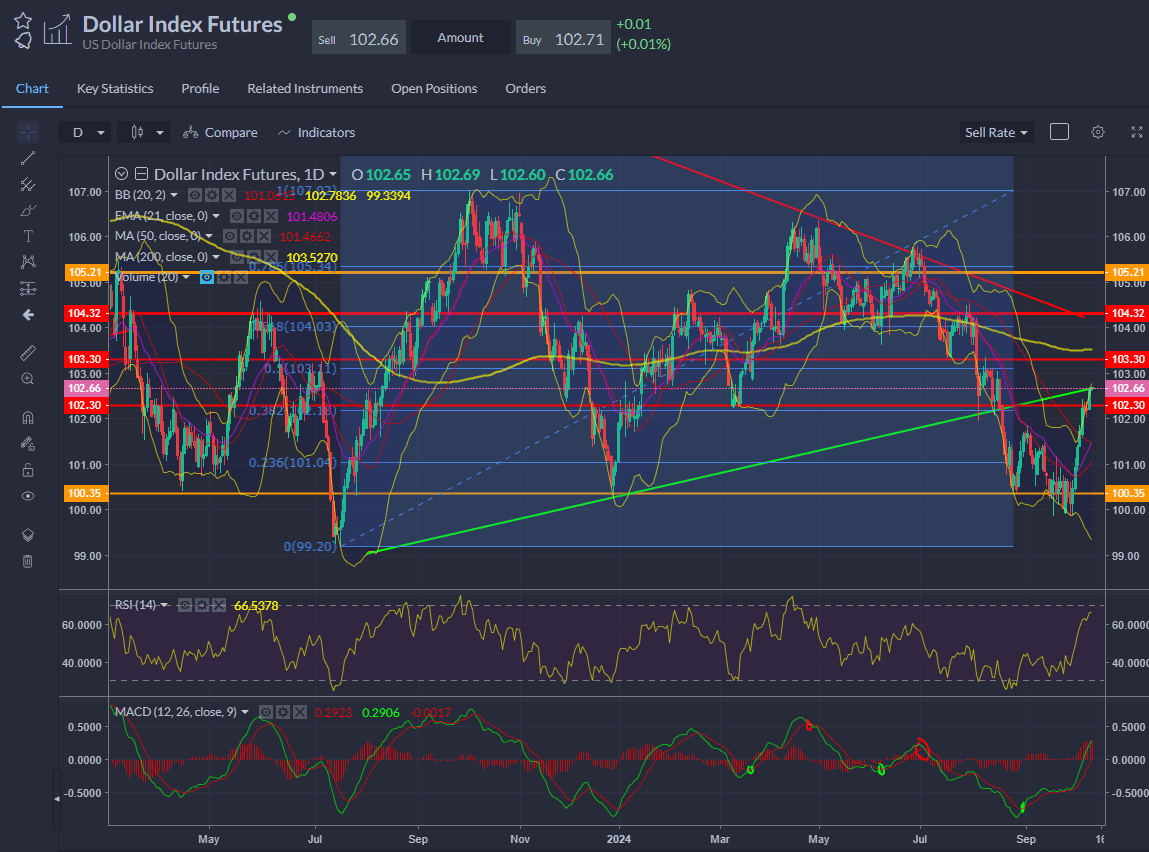

DXY retests the long-term trend but extension beyond the upper Bollinger calls for a retracement of the rally soon, albeit the RSI and MACD are not yet showing overbought.

Brent crude came off the 200-day SMA resistance and then tested the 21-day EMA.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Aktivliste

Se fuldstændig listeSeneste

Se alle

Tirsdag, 13 Maj 2025

7 min

Tirsdag, 13 Maj 2025

4 min

Mandag, 12 Maj 2025

6 min