You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Minggu Aug 10 2025 05:36

5 min

Canada's Employment Change for June saw a surprising surge of 83.1K jobs, significantly higher than typical monthly gains. However, the July figure is expected to moderate sharply to just 15.3K, suggesting a normalisation in hiring activity. Meanwhile, the unemployment rate, which stood at 6.9% in June, is forecasted to tick up slightly to 7.0% in July. This data is set to be released today at 1230 GMT.

The sharp drop in expected employment gains for July likely reflects a correction following June’s outsized jump, which may have been driven by temporary or seasonal hiring. The anticipated uptick in the unemployment rate to 7.0% aligns with signs of a gradually cooling labour market, where job seekers may be increasing faster than available positions amid slower hiring across sectors.

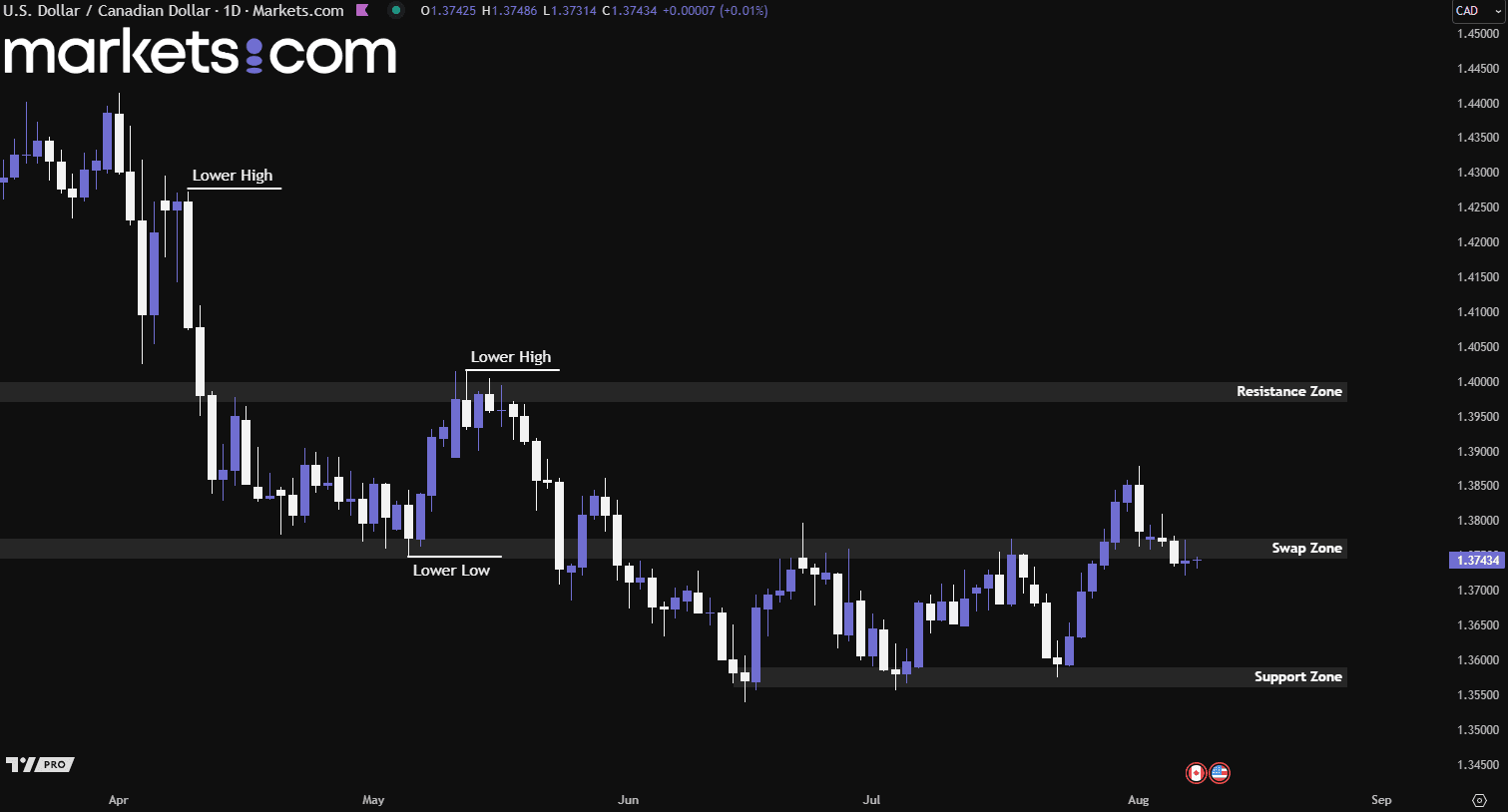

(USD/CAD Daily Chart, Source: Trading View)

From a technical analysis perspective, the USD/CAD currency pair has rebounded from the support zone of 1.3560 – 1.3590 after failing to break below it despite three retests. The pair then gained bullish momentum and eventually broke above the swap zone of 1.3745 – 1.3775, but has since pulled back and is currently retesting that zone.

If the swap zone fails to hold as support, the pair could potentially decline further. Conversely, if it finds support at this level, the bullish momentum may resume, potentially pushing the pair higher.

Federal Reserve Governor Christopher Waller is reportedly emerging as a leading candidate for the Fed chair position under Donald Trump's potential administration, according to Bloomberg News. While Waller has not yet met with Trump himself, he has held discussions with members of Trump’s team, who are said to be impressed by him. Trump has repeatedly criticised current Fed Chair Jerome Powell, whose term ends in May 2026[GU1] , for being too slow in cutting interest rates.

This has raised concerns among investors about the Fed’s future independence. However, Waller is widely respected in both financial markets and central banking circles, and his appointment is generally viewed as supportive of the U.S. dollar. Separately, Trump announced on Wednesday that he plans to nominate a candidate within the next two to three days to fill the upcoming vacancy on the Federal Reserve Board. This follows the unexpected resignation of Governor Adriana Kugler last week.

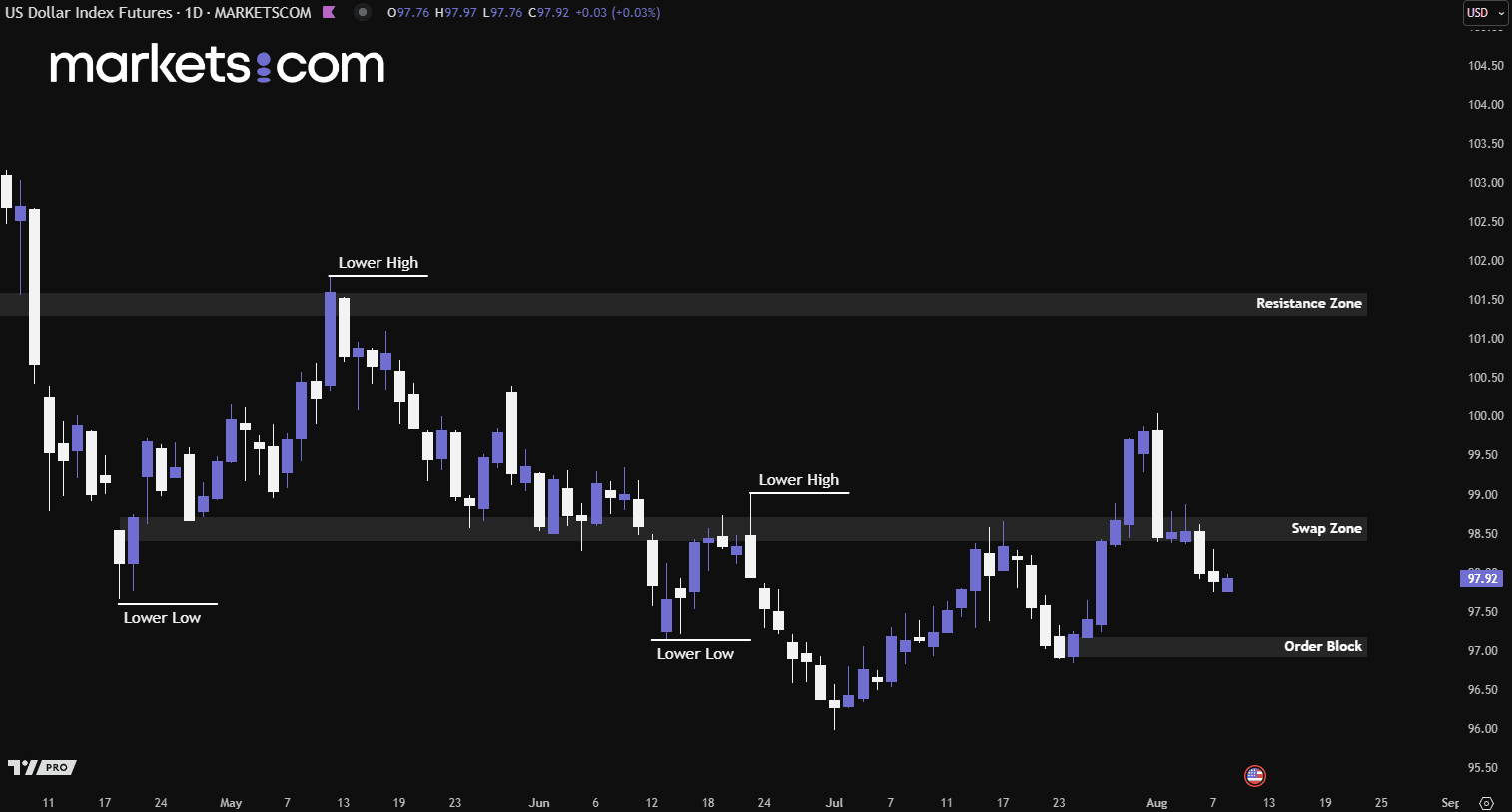

(U.S Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the U.S. Dollar Index has been in a bearish trend since mid-January 2025, as indicated by lower highs and lower lows. Recently, it rebounded in early July, surged upward, and broke above the swap zone of 98.40 – 98.70. However, it then pulled back, consolidated within the swap zone for two days, failed to gain support, and dropped lower. As a result, the index may potentially decline further to retest the order block around 96.90 – 97.20.

The Bank of England lowered interest rates by 25 basis points to 4.00% on Thursday, but the decision revealed a deep division within the Monetary Policy Committee (MPC). Four out of nine members voted to hold rates steady, citing persistent inflation concerns. The split vote led to the first two-stage voting process since the MPC's creation in 1997.

Initially, the vote stood at 4-4-1, with external member Alan Taylor backing a larger half-point cut before switching to support the 25bps reduction. Governor Andrew Bailey and four colleagues ultimately supported the cut, emphasising the need to act cautiously given inflation’s temporary spike and worsening labour market conditions.

Bailey stressed the importance of avoiding overly aggressive easing, warning that cutting rates too fast could backfire. "We stand ready to adjust our course if the inflation outlook changes," he said. Those voting to hold rates included Deputy Governor Clare Lombardelli—breaking with the majority for the first time, and Chief Economist Huw Pill. The internal division signals that the BoE’s rate-cutting cycle may be nearing its end, especially with inflation expected to remain well above the 2% target in the near term.

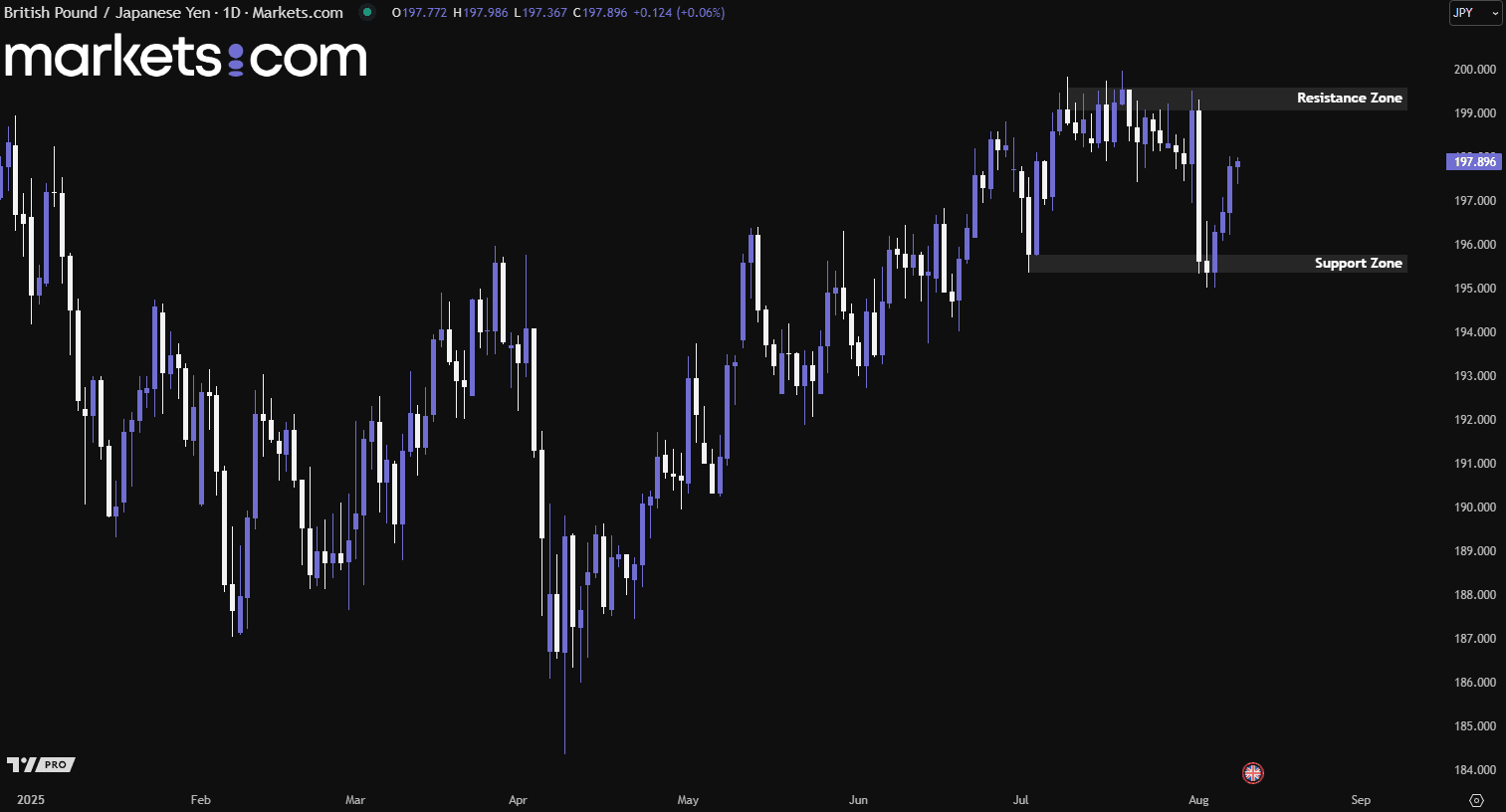

(GBP/JPY Daily Chart, Source: Trading View)

From a technical analysis perspective, the GBP/JPY currency pair has been in a bullish trend since mid-April 2025, as indicated by higher highs and higher lows. Recently, it was rejected from the resistance zone of 199.00 – 199.60, dropped lower, but found support at the 195.30 – 195.80 zone before surging upward again. Such valid bullish momentum could potentially drive the pair higher to retest the resistance zone.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.