You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Isnin Aug 18 2025 09:41

5 min.

Gold prices inched up to $3,340 per ounce on Monday at the time of writing but hovered near a two-week low, as easing geopolitical tensions reduced demand for the metal’s safe-haven appeal. Although Friday’s meeting between U.S. President Donald Trump and Russian President Vladimir Putin failed to secure a ceasefire, Putin agreed to let the U.S. and Europe provide Ukraine with stronger security guarantees as part of a potential peace deal.

Investors are now shifting their focus to the Federal Reserve, with minutes from the latest policy meeting due Wednesday and Chair Jerome Powell’s remarks at Jackson Hole later this week. These events could offer clearer signals on the Fed’s decision to keep rates unchanged and its broader policy outlook.

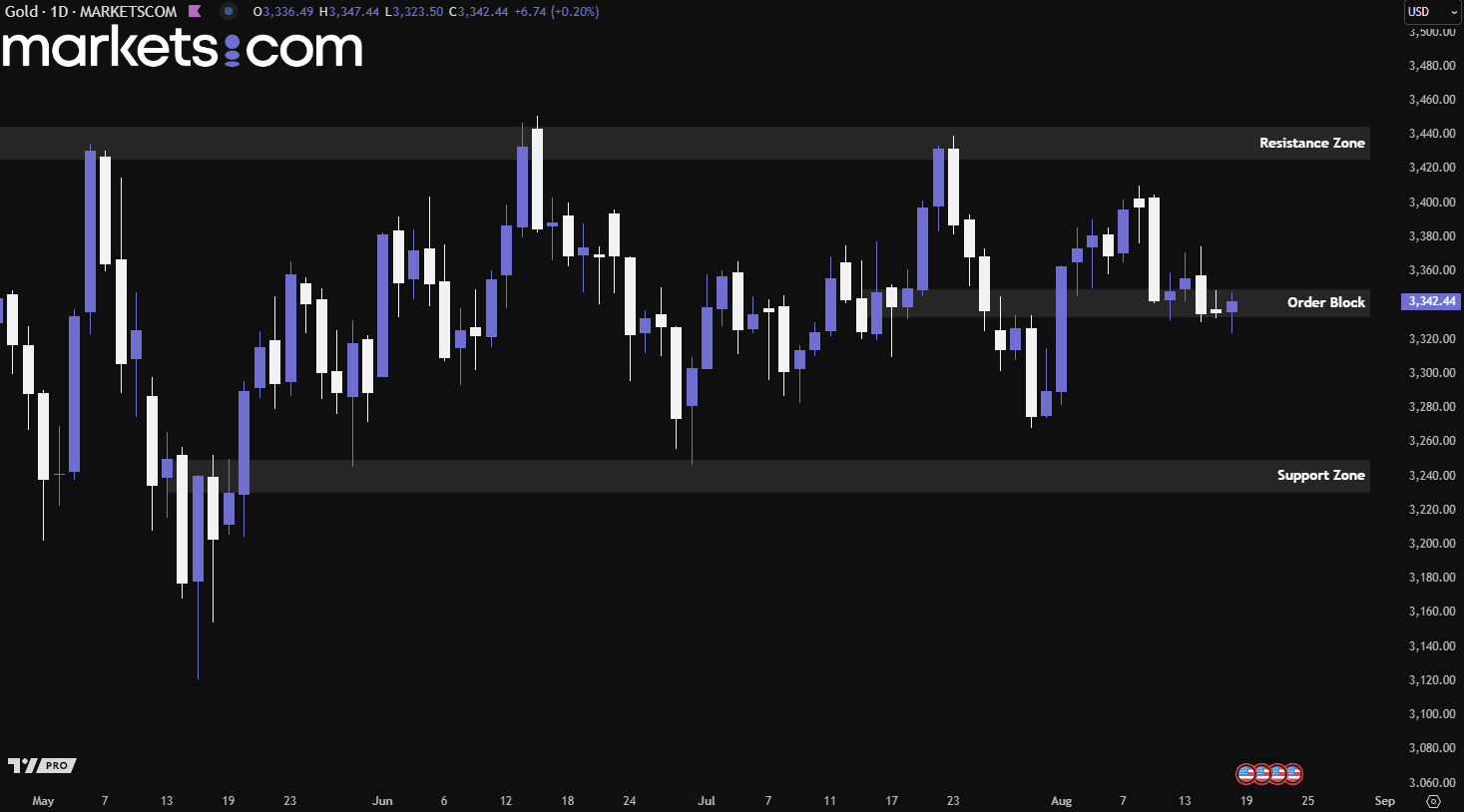

(Gold Daily Chart, Source: Trading View)

From a technical analysis perspective, the gold price has been moving in a consolidation phase since May 2025, with no significant trend moving in a single direction. Currently, the price is retesting within the order block of 3,333 – 3,350. If this zone fails to hold the price, it might potentially drive lower to retest the support zone of 3,230 – 3,250. Conversely, if it is able to find support from this zone, it might experience bullish momentum and surge upwards.

Japan’s government on Friday downplayed remarks from U.S. Treasury Secretary Scott Bessent, who said the Bank of Japan was “behind the curve” on policy, a rare and direct critique seen by some as pressure to raise rates. Economic Revitalization Minister Ryosei Akazawa dismissed the notion, insisting Bessent was not urging the BOJ to hike rates but merely predicting it might. Finance Minister Katsunobu Kato declined to comment.

Still, analysts noted that Bessent’s remarks, combined with stronger-than-expected growth data, boosted expectations of a near-term rate hike by the BOJ. The prospect drove Japanese government bond yields and the yen higher on Friday. With core inflation holding above the 2% target for over three years amid rising food and raw material costs, some policymakers fear second-round price effects. Others saw Washington’s comments as part of broader pressure on Japan to tighten policy and strengthen the yen to address the U.S. trade deficit.

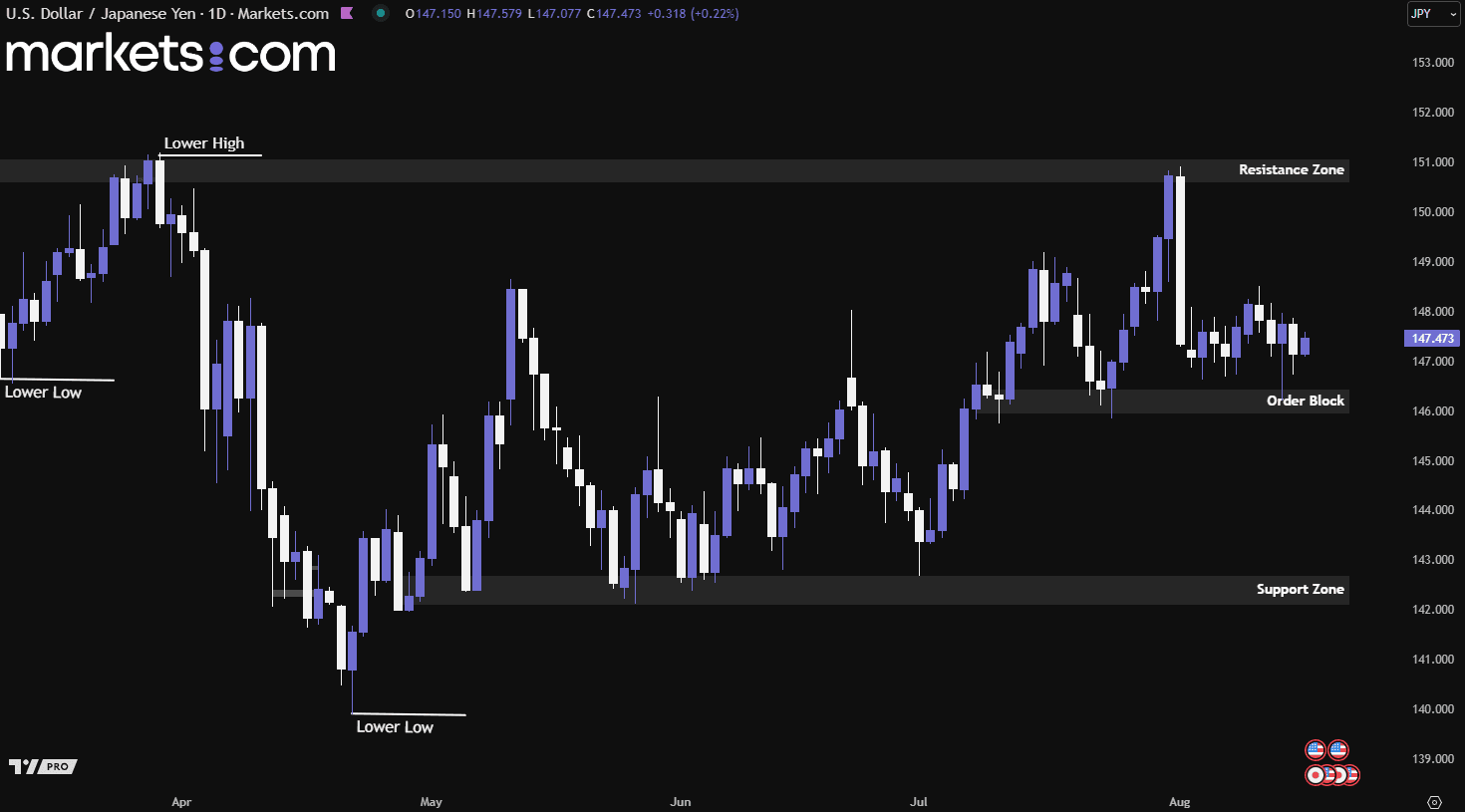

(USD/JPY Daily Chart, Source: Trading View)

From a technical analysis perspective, the USD/JPY currency pair recently retested the order block of 145.95 – 146.45, found support there, and gained bullish momentum to surge upwards. However, it then entered a consolidation phase, with the pair likely to trade between the order block and the resistance zone of 150.60 – 151.10. A decisive breakout on either side could determine the next directional move.

WTI crude futures hovered near $63 a barrel on Monday at the time of writing, extending last week’s losses as markets turned their attention to peace talks in Washington between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskiy. The meeting, also joined by European and NATO leaders, follows Trump’s discussions with Russian President Vladimir Putin, where Moscow’s territorial demands were the focus.

Trump signaled a softer stance on imposing penalties on Russia and its oil buyers, contrasting his earlier position at the Alaska summit. Oil prices have already dropped more than 10% this month, weighed down by geopolitical uncertainty, Trump’s tariffs, and rising OPEC+ supply.

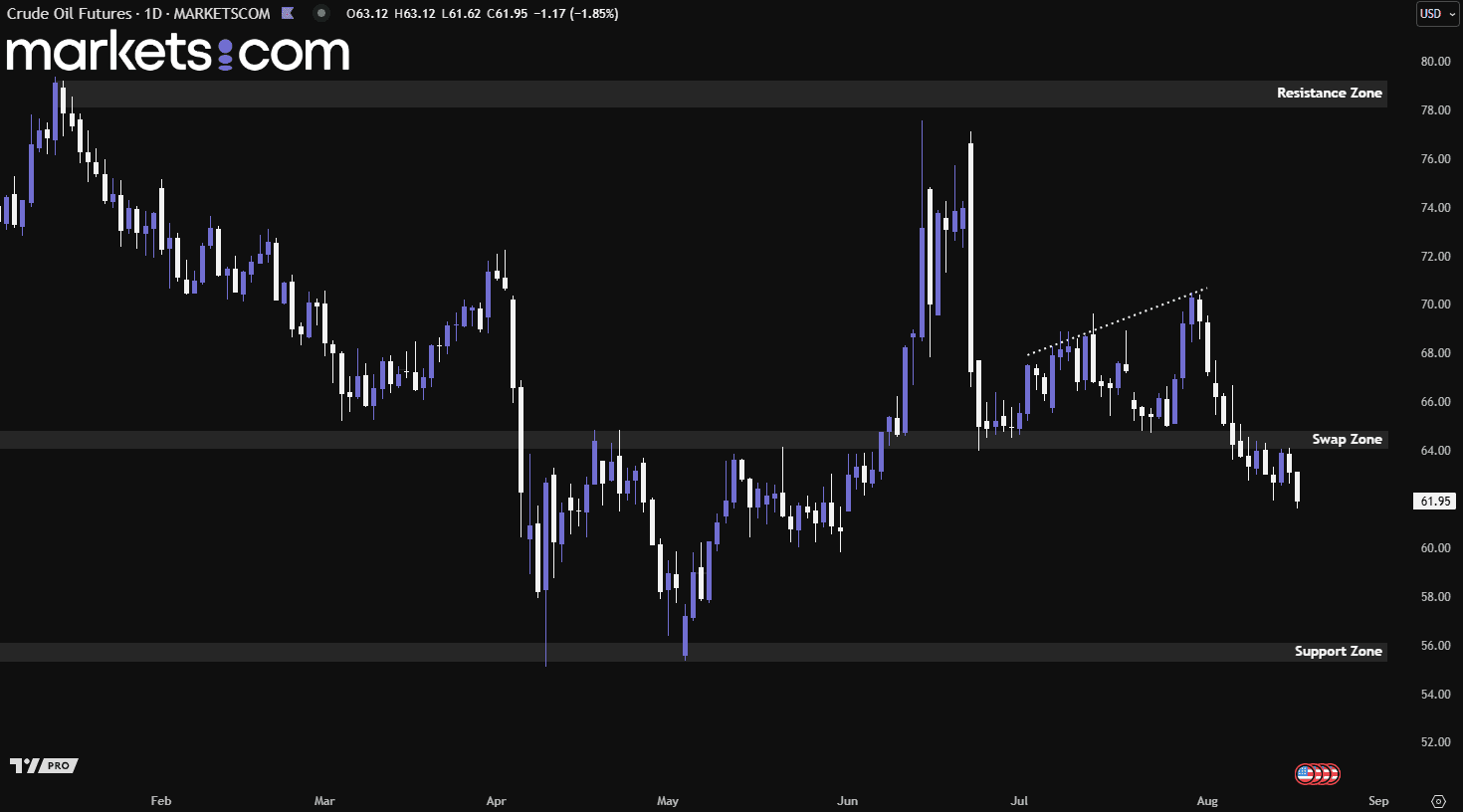

(Crude Oil Futures Daily Chart, Source: Trading View)

From a technical analysis perspective, crude oil futures recently broke below the swap zone of 64.10 – 64.80, indicating a shift in overall momentum from bullish to bearish. The price has attempted to retest this zone twice but was rejected by bearish forces, driving it lower. This valid bearish structure suggests the price could potentially continue to decline.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.