CFD's zijn complexe instrumenten en gaan gepaard met een hoog risico snel kapitaal te verliezen als gevolg van hefboommechanismen. 77.3% an de retailbeleggers lijdt verlies op de handel in CFD's met deze aanbieder. U dient zorgvuldig te overwegen of u begrijpt hoe CFD's werken en of u het zich kunt veroorloven om hoge risico's te nemen op het verliezen van uw kapitaal.

Dinsdag Mei 20 2025 07:36

5 min.

The Reserve Bank of Australia (RBA) cut its main cash rate by 25 basis points to a two-year low of 3.85% on Tuesday, citing a weakening global outlook and easing domestic inflation. Concluding its two-day policy meeting, the RBA stated that upside risks to inflation have diminished, with international developments likely to weigh on Australia's economic performance. "Inflation is within the target band, and upside risks appear to have diminished as international developments are expected to weigh on the economy," the board noted. While this move makes monetary policy somewhat less restrictive, the RBA emphasised its cautious stance on further easing.

In the first quarter, headline consumer price inflation held steady at 2.4%, while the trimmed mean, a key measure of core inflation slowed to 2.9%, returning to the RBA’s 2%–3% target range for the first time since late 2021. The central bank also warned that inflation could fall further, and unemployment could rise, driven by the broader effects of global trade tensions, even assuming that interest rates are cut as much as markets currently expect.

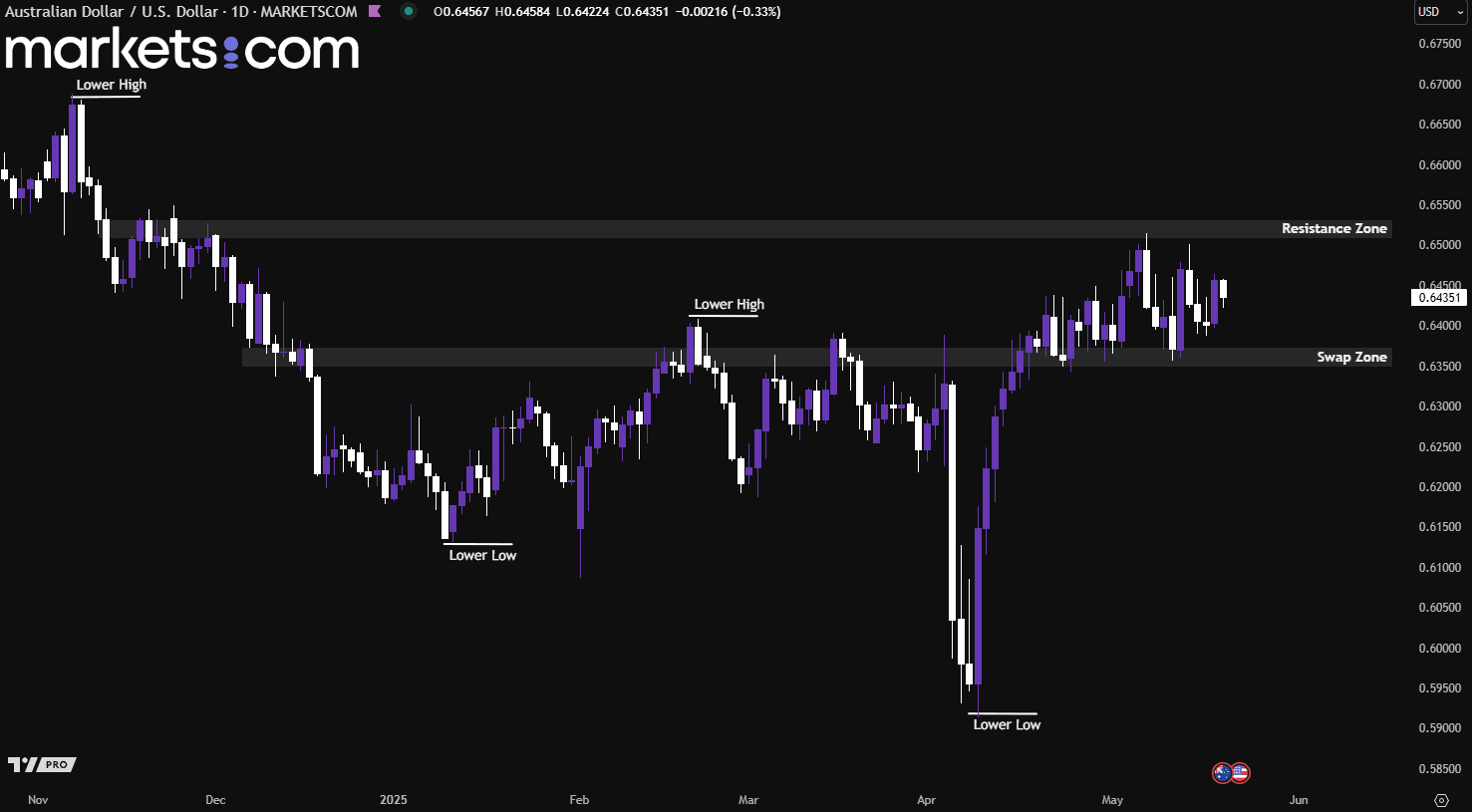

(AUD/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the AUD/USD currency pair has been in a bullish trend since early April 2025, as indicated by a series of higher highs and higher lows. Currently, the pair is trading within the range between the swap zone of 0.6350 – 0.6370 and the resistance zone of 0.6510 – 0.6530. A decisive breakout in either direction could potentially determine the next major move for the currency pair.

Canada's inflation rate came in at 2.3% year-over-year in March, but it's expected to drop to 1.7% in April, with the month-over-month rate shifting from +0.3% to an anticipated -0.2%. This sharp deceleration likely reflects base effects from elevated prices last year, a drop in energy and gasoline prices, and the continued impact of higher interest rates dampening consumer demand. Seasonal factors, such as lower utility or food prices in April, may also contribute to the expected monthly decline. This data is set to be released today at 12:30 GMT.

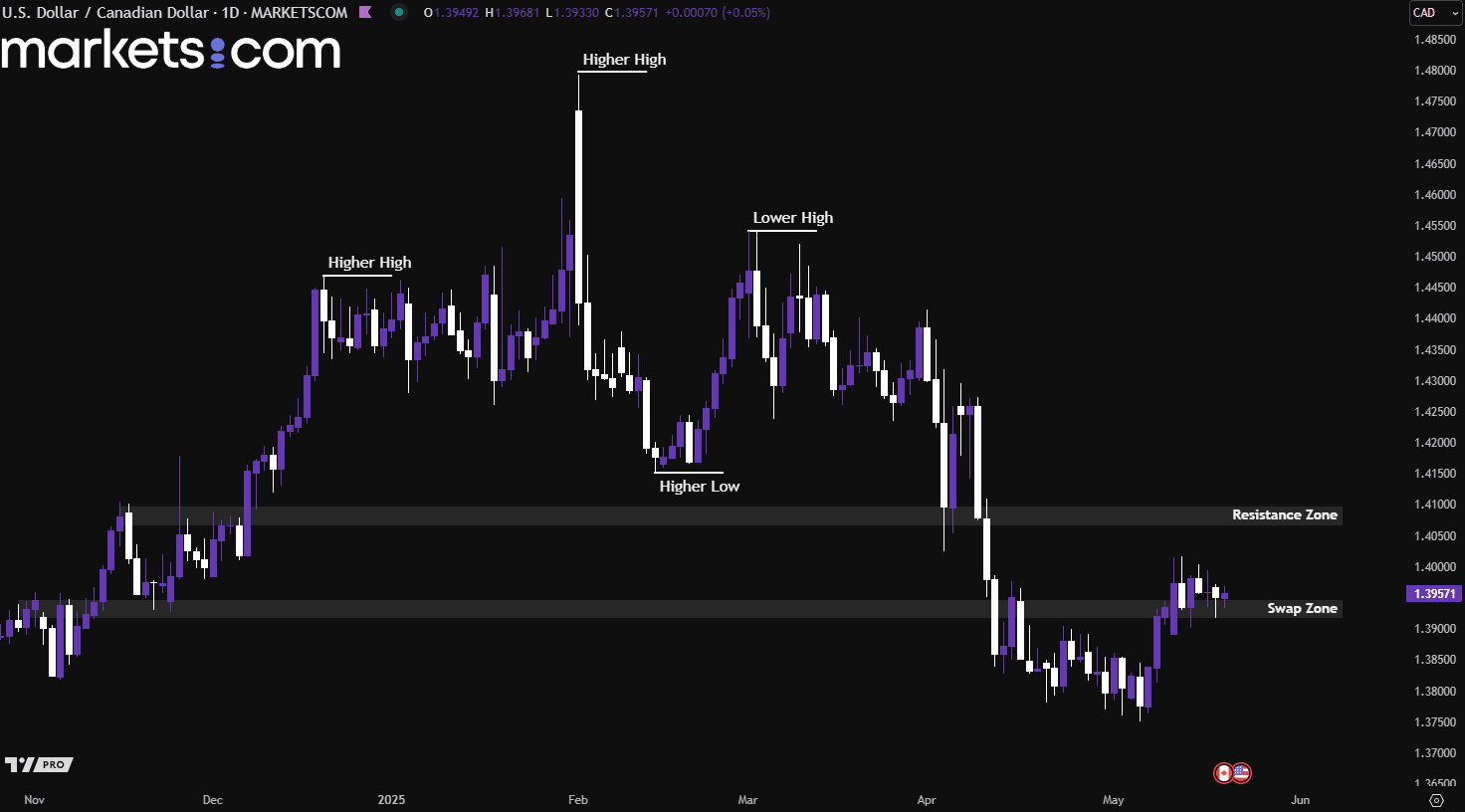

(USD/CAD Daily Chart, Source: Trading View)

From a technical analysis perspective, the USD/CAD currency pair has been in a bearish trend since early February 2025, as indicated by a series of lower highs and lower lows. Recently, the pair broke above the swap zone of 1.3920 – 1.3950 and is currently retesting it. If it can close above this zone, the pair has the potential to move higher and retest the resistance area between 1.4070 and 1.4100.

China cut its benchmark lending rates on Tuesday for the first time since October, as part of broader efforts to ease monetary policy and shield the economy from the ongoing impact of the Sino-U.S. trade war. The People’s Bank of China lowered the one-year loan prime rate (LPR) by 10 basis points to 3.0% and reduced the five-year LPR by the same margin to 3.5%. The LPR, determined by a group of commercial banks, serves as a key reference rate for lending.

These widely anticipated rate cuts are intended to stimulate consumption and loan demand amid a slowing economy, while also maintaining support for banks grappling with narrowing profit margins. The rate cut announcement came shortly after five of China’s largest state-owned banks said they had lowered deposit interest rates; an additional move designed to ease funding costs and encourage borrowing.

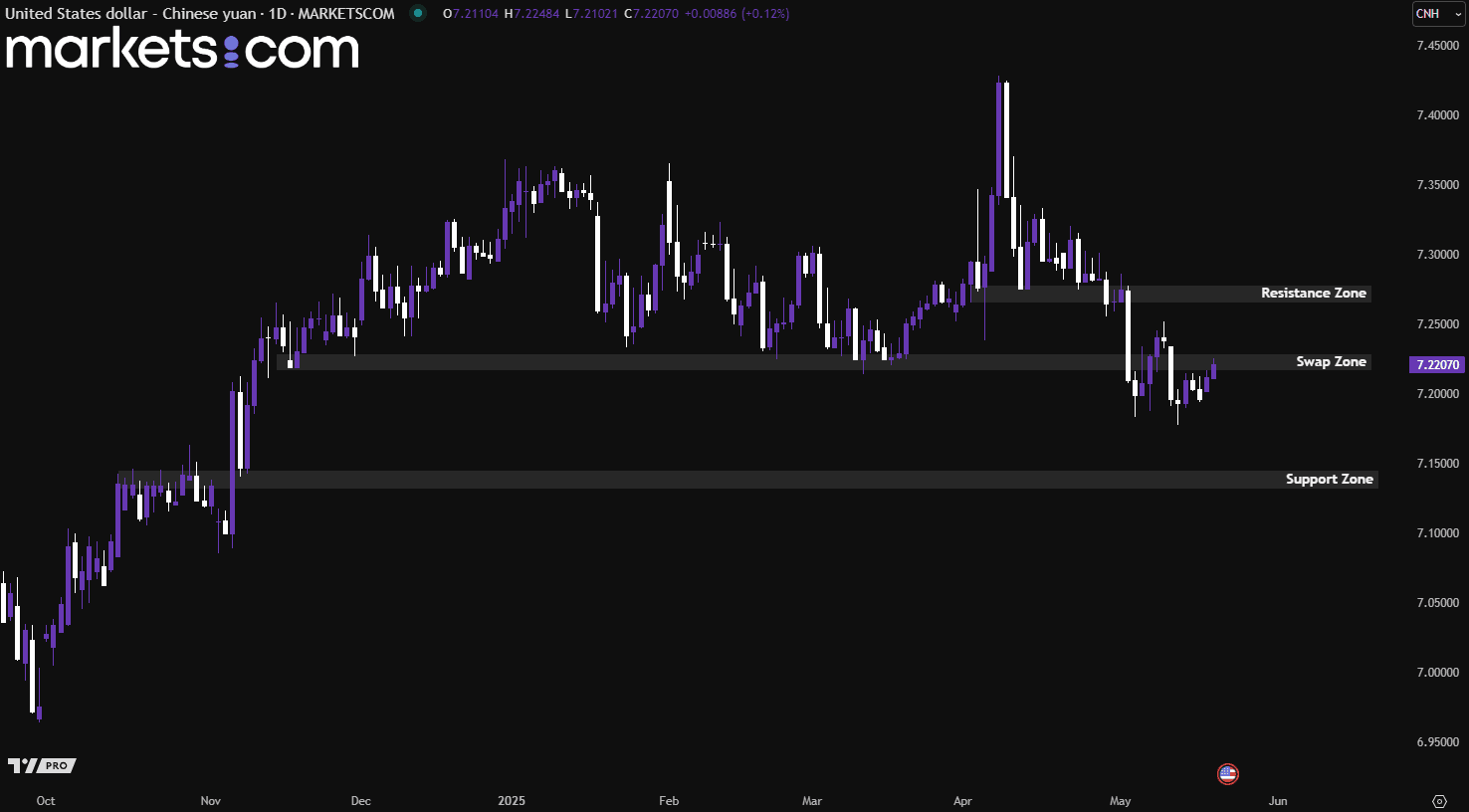

(USD/CNH Daily Chart, Source: Trading View)

From a technical analysis perspective, the USD/CNH currency pair recently broke below the swap zone of 7.2160 – 7.2290 and is now retesting it. If it can close above this zone, the pair has the potential to move higher and retest the resistance area between 7.2650 and 7.2780. Conversely, if it breaks back below the swap zone, it may move lower to retest the support area between 7.1320 and 7.1450.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.