Quarta-feira Maio 7 2025 08:09

4 mín

The previous U.S. Federal Reserve policy rate was 4.5%, and markets widely expect the upcoming interest rate decision to maintain the rate at 4.5%. With core inflation moderating and relatively stable labour market conditions, the Fed may choose to maintain its current stance to observe further data before committing to cuts or hikes. Holding at 4.5% allows the Fed to balance the risk of reigniting inflation against prematurely tightening financial conditions. This data is set to be released today at 18:00 GMT.

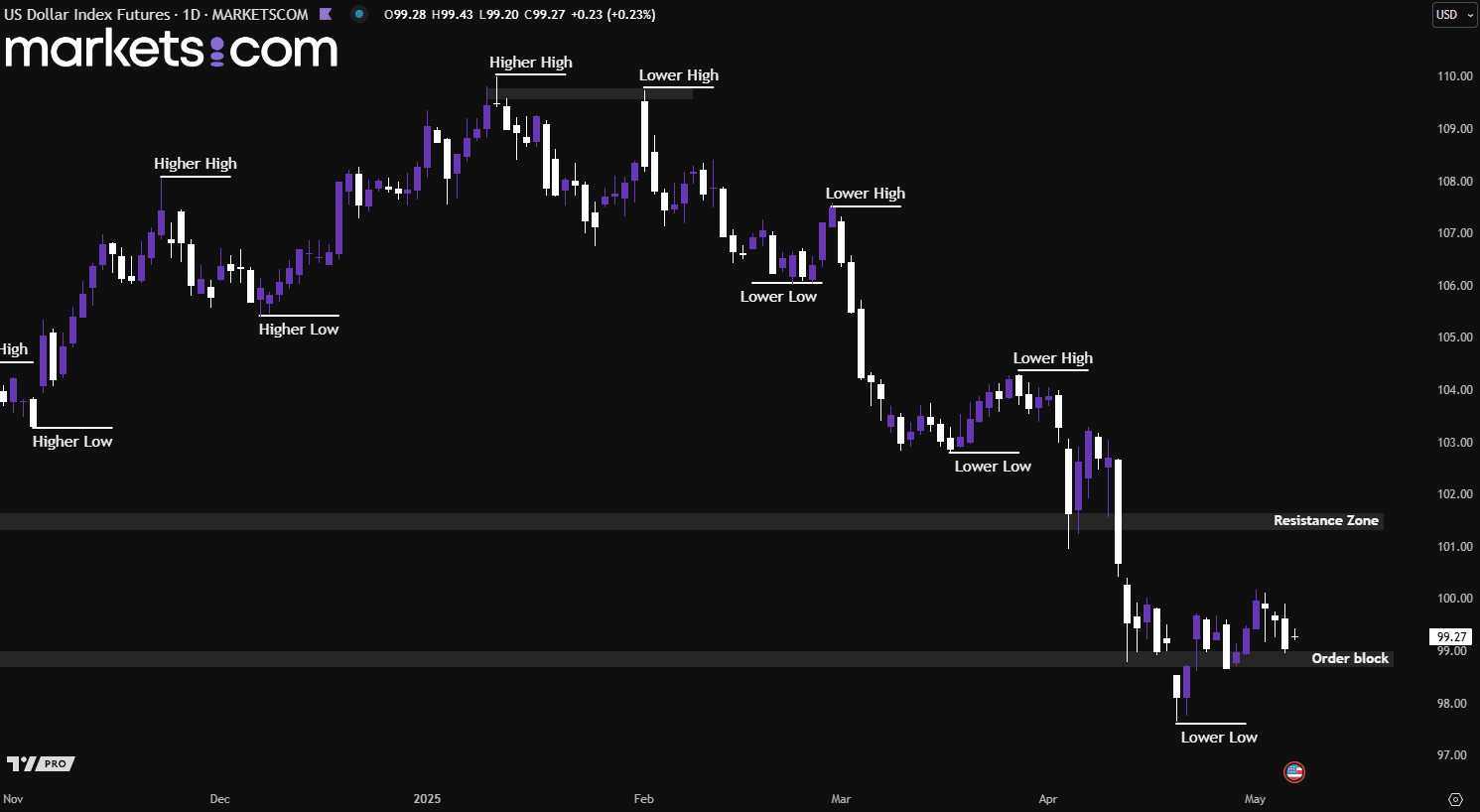

(U.S. Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the U.S. Dollar Index has been on a bearish trend since mid-January 2025, as evidenced by a series of lower highs and lower lows. Recently, it retested the order block between 98.70 and 99.00 and closed slightly above it. If the index can hold above this zone in the near term, it may potentially move upwards to retest the resistance area between 101.30 and 101.60.

Uber Technologies (UBER) is set to report its first-quarter 2025 results today, before the market opens. A key focus will be on gross bookings, a critical metric that could significantly shape the market’s reaction. In recent quarters, Uber has exceeded earnings expectations three times and missed once, with an average surprise of 133.5%.

For Q1, management projects gross bookings between $42 billion and $43.5 billion, reflecting year-over-year growth of 17 – 21% on a constant currency basis. However, growth may have been tempered by adverse currency movements and harsh winter weather during the March quarter. On a positive note, since Q1 largely preceded the implementation of new tariffs, it is set to take effect in Q2 as the impact of tariff-related pressures is unlikely to be reflected in the latest gross bookings figures.

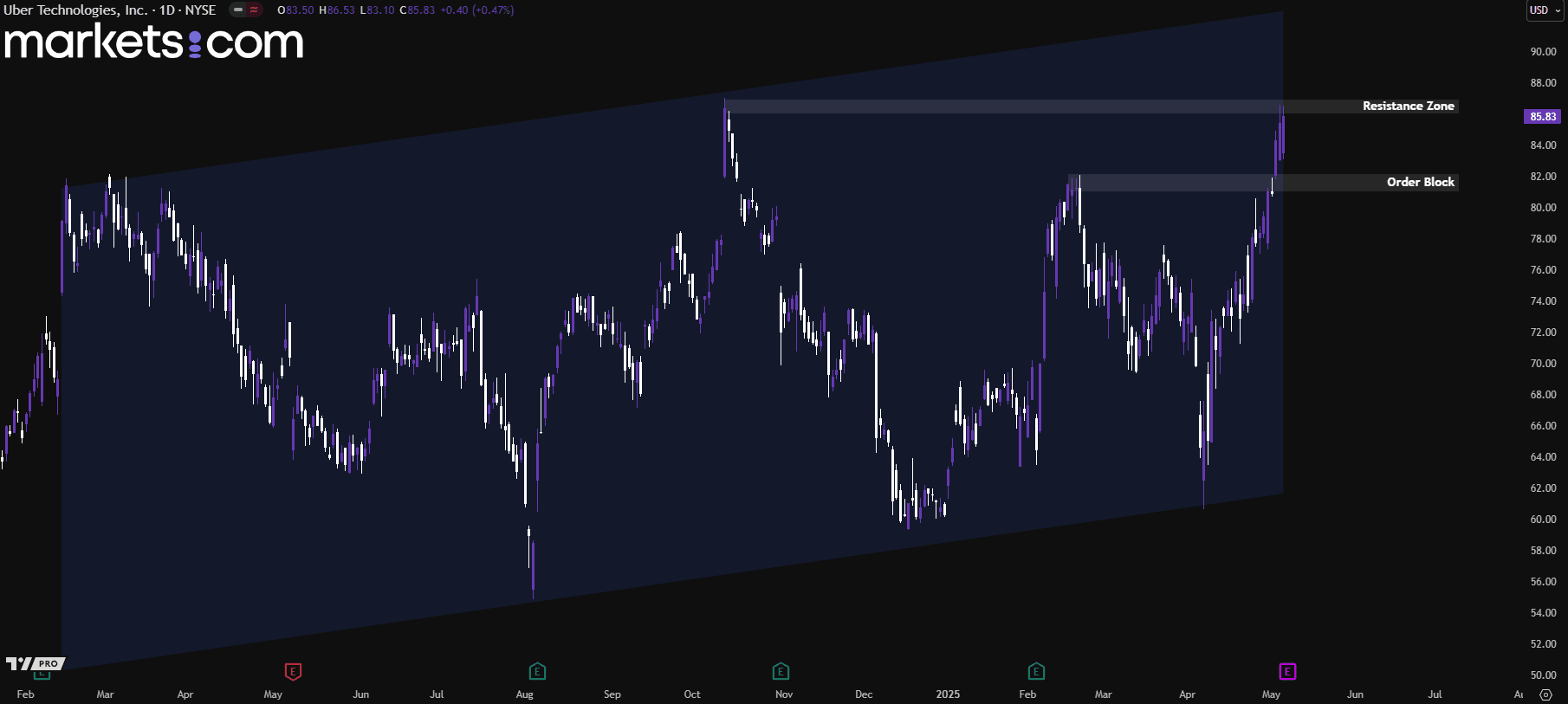

(Uber Share Price Daily Chart, Source: Trading View)

From a technical analysis perspective, Uber's share price has been in a bullish trend since August 2024, characterised by higher highs and higher lows within an ascending channel. Recently, the price broke above the order block between 81.00 and 82.00 and is currently retesting the resistance zone at 86.00 – 87.00. If it manages to break above this zone, it could potentially move higher and retest the upper boundary of the ascending channel.

Oil prices climbed on Wednesday, rebounding from recent lows amid signs of weakening U.S. production and stronger demand from Europe and China. Earlier in the week, Brent crude futures and U.S. West Texas Intermediate (WTI) crude had dropped to four-year lows following OPEC+'s move to accelerate output increases, an action that fuelled oversupply concerns, especially as U.S. tariffs raised questions about global demand.

However, the recent price drop has led some American energy firms, including Diamondback Energy (FANG.O) and Coterra Energy (CTRA.N), to announce rig reductions. These cutbacks could tighten supply over time and help lift prices.

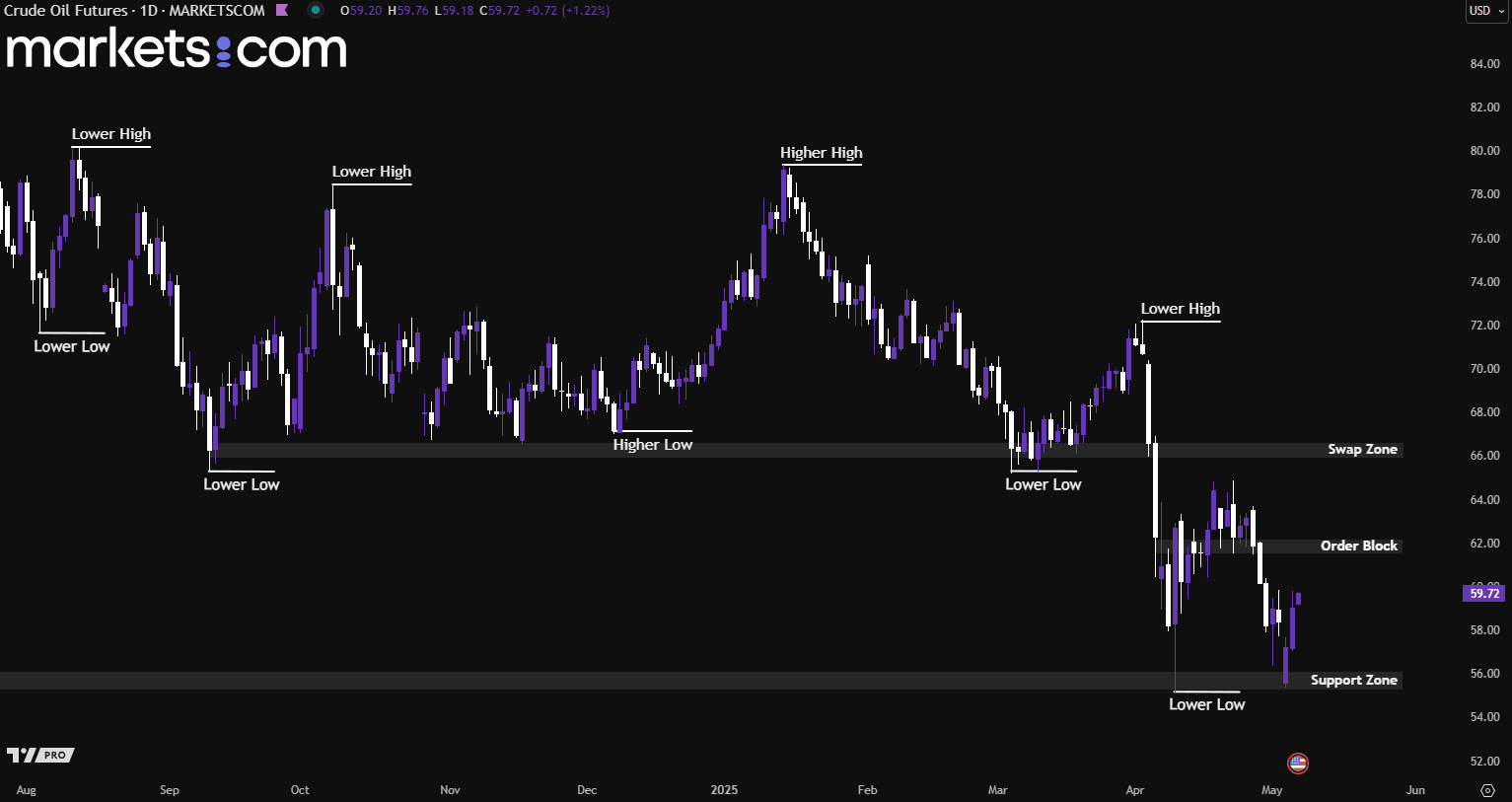

(Crude Oil Futures Daily Chart, Source: Trading View)

From a technical analysis perspective, crude oil futures have rebounded from the support zone of 55.30 – 56.00, surging upward with strong bullish momentum. The price may potentially continue rising to retest the order block between 61.50 and 62.10. If it breaks above this order block, the bullish momentum could drive it further upward to retest the swap zone at 66.00 – 66.60.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.