You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

วันอังคาร Aug 26 2025 06:34

5 นาที

The U.S. dollar slipped in early Asian trading on Tuesday at the time of writing, erasing Monday’s strong gains, after President Donald Trump announced the removal of Federal Reserve Governor Lisa Cook over alleged mortgage fraud. The dollar index (DXY) fell 0.3% to 98.187 following Trump’s announcement, shared in a letter posted on social media.

The move has raised concerns about the Federal Reserve’s independence and its ability to conduct monetary policy without political interference. Cook’s dismissal may increase the likelihood of earlier interest rate cuts, given Trump’s repeated pressure on the central bank to lower borrowing costs. The unprecedented decision marks an escalation of Trump’s criticism, as he continues to accuse the Fed of being too slow to cut rates.

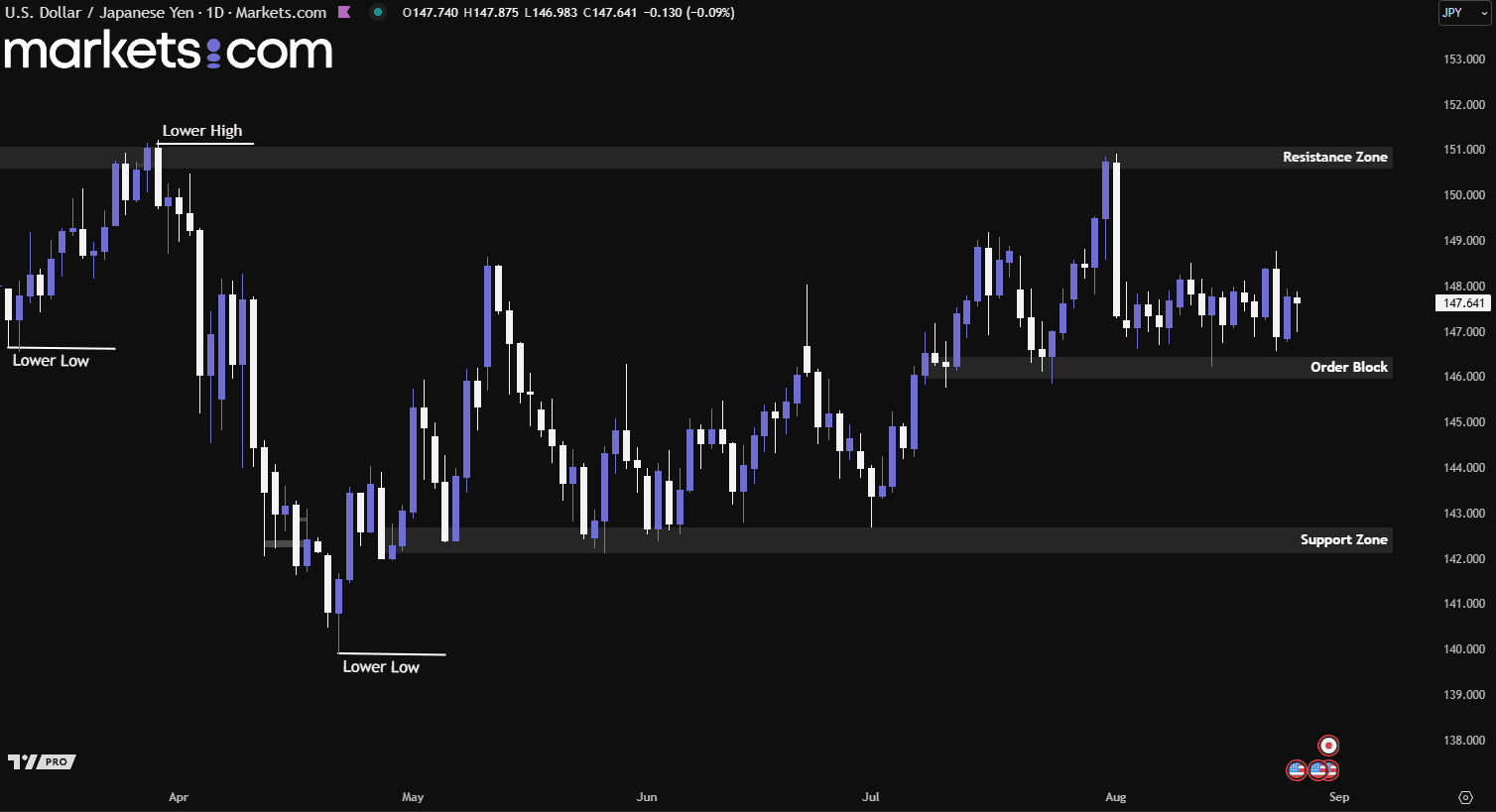

(USD/JPY Daily Chart, Source: Trading View)

From a technical analysis perspective, the USD/JPY currency pair has rebounded several times from the order block of 145.95 – 146.45, indicating that bullish pressure remains and is preventing the pair from breaking below this zone. Moreover, the pair has been consolidating since 4 August 2025 without a clear trend. Therefore, it is possible that the pair will continue moving within this consolidation range until either the order block at 145.95 – 146.45 or the resistance zone at 150.60 – 151.10 is broken.

The Australian dollar hovered around $0.648 on Tuesday at the time of writing as investors digested the latest Reserve Bank of Australia (RBA) minutes. The central bank signalled more rate cuts could follow over the coming year, with the pace depending on economic data. In August, the RBA lowered the cash rate by 25 basis points to 3.6%, citing steady progress in bringing inflation closer to its 2 – 3% target range.

While policymakers noted that gradual easing may be suitable given tight labour conditions and firm private demand, they left room for faster cuts if the job market softens or global risks, including U.S. trade tensions, dampen growth. Markets expect the RBA to hold steady in September, with a potential cut in November and rates possibly dropping toward 3.10% or even 2.85% in the longer term.

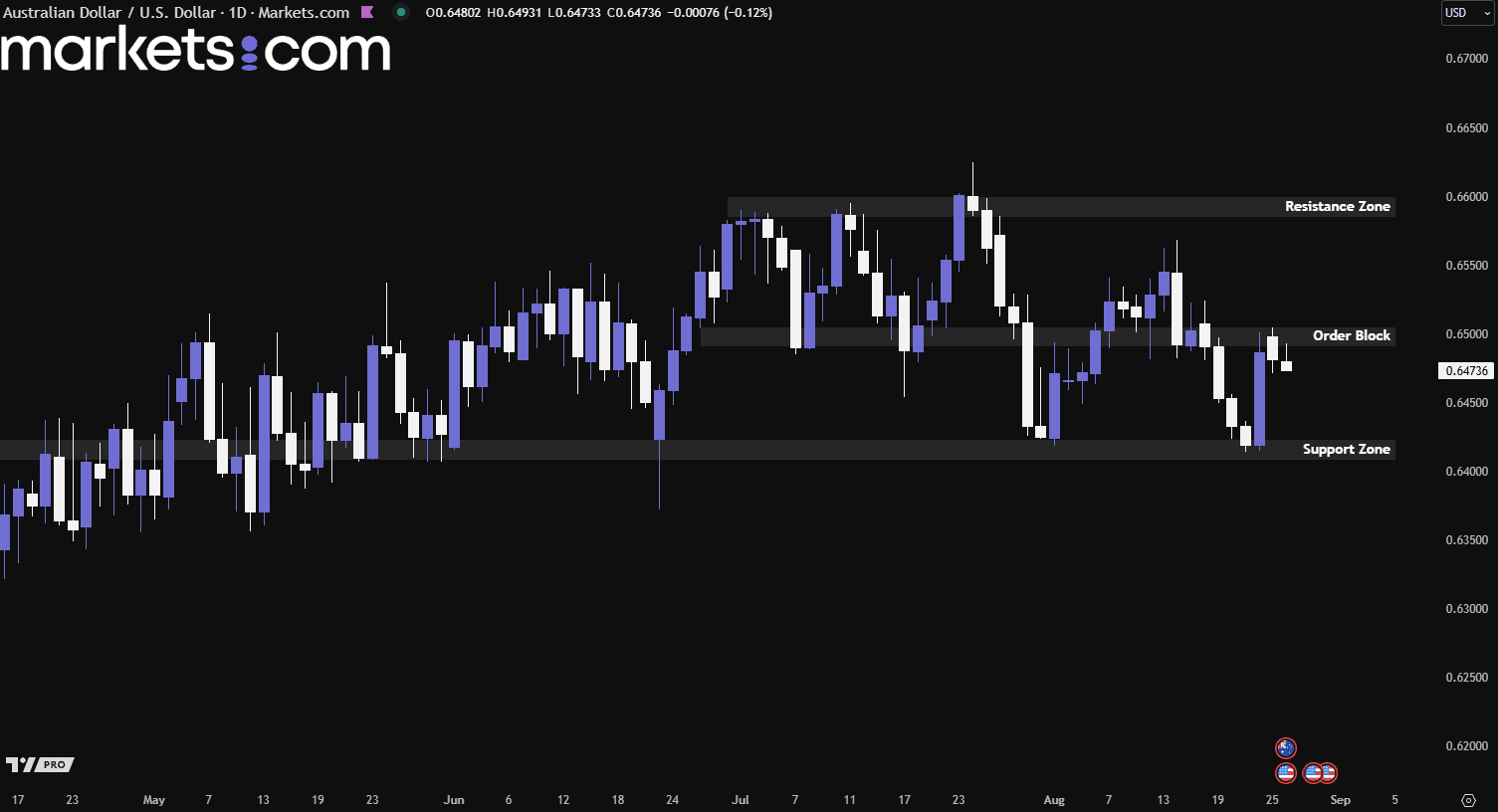

(AUD/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the AUD/USD currency pair recently rebounded from the support zone of 0.6410 – 0.6425 with a strong bullish candle, pushing the pair upward to retest the order block at 0.6490 – 0.6505. However, it was rejected from this order block with bearish momentum. Failure to close within or above this zone could potentially drive the pair downward to retest the support zone again.

Databricks has acquired Tecton, a startup founded by former Uber engineers known for developing the ride-hailing company’s in-house AI system. Tecton specialises in streaming real-time data to machine learning models, enabling AI agents to respond instantly rather than with delays.

CEO Ali Ghodsi said the deal aims to enhance the speed and responsiveness of Databricks’ Agent Bricks platform, particularly for voice assistants and other user-facing AI tools. The companies have partnered since 2022, and many of Tecton’s clients, including Coinbase, are already part of the Databricks ecosystem, making this acquisition a natural next step.

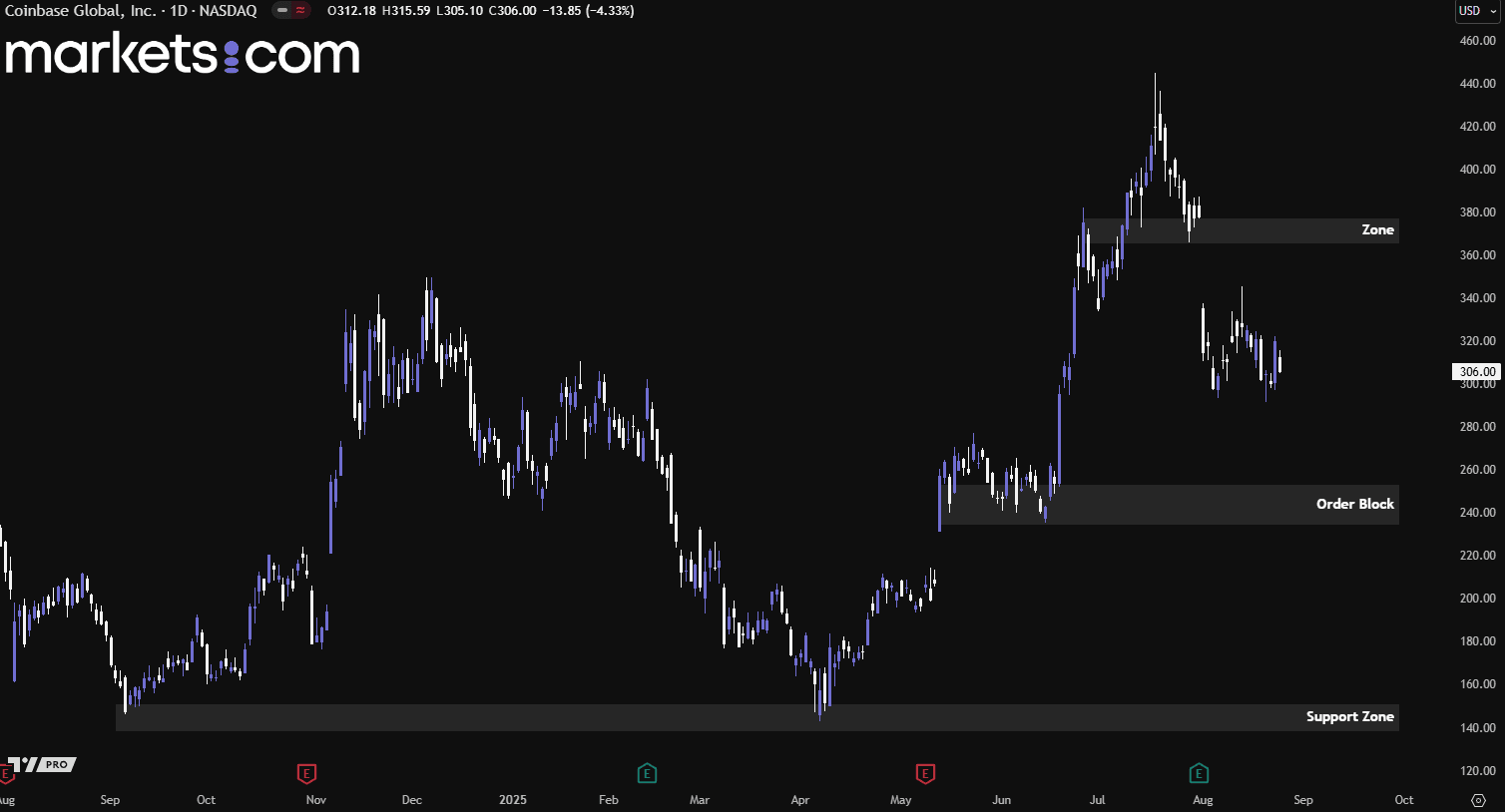

(Coinbase Daily Share Price Chart, Source: Trading View)

From a technical analysis perspective, the Coinbase daily chart has been in a bullish trend since early April 2025, rebounding from the support zone of 138 – 150, as indicated by the formation of higher highs and higher lows. Recently, it experienced a significant pullback, even dropping below the 365 – 377 zone. This indicates that bearish momentum remains intact and could potentially drive the price lower to retest the order block of 234 – 254 before determining its next directional move.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.