Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Nov 21 2025 03:57

12 min

10 Best Ways to trade Cryptos as Beginner: Cryptocurrency trading has become increasingly popular, attracting beginners eager to explore the digital asset market.

Crypto trading basics: However, navigating the crypto space can be overwhelming without the right guidance. This comprehensive article covers the best ways for beginners to trade cryptocurrencies, how to approach the market wisely, and practical steps for getting started on platforms like markets.com. It also discusses common challenges beginners face and how to overcome them.

The answer is yes, but it requires education, discipline, and a clear strategy. Cryptocurrency markets are highly volatile, with rapid price fluctuations that can lead to substantial gains or losses. Beginners who take time to learn the fundamentals, develop risk management techniques, and stay informed about market trends increase their chances of trading successfully. Making money in crypto trading is less about luck and more about understanding the market, practicing patience, and managing risks effectively.

1. Start with a Clear Plan and Education

Before trading, beginners should invest time in learning about cryptocurrencies, blockchain technology, and market mechanics. Understanding the basics helps avoid common mistakes. Creating a trading plan with goals, risk tolerance levels, and exit strategies is essential. This plan acts as a roadmap, helping traders make disciplined decisions rather than emotional reactions.

2. Use a Reputable Exchange

Choosing a reliable trading platform is critical. Reputable exchanges offer security, ease of use, and access to a variety of cryptocurrencies. Look for platforms with strong regulatory compliance, transparent fee structures, and responsive customer support. Signing up on a trusted exchange also helps beginners avoid scams and fraudulent schemes common in the crypto space.

3. Practice with Demo Accounts

Many platforms offer demo accounts that simulate real trading environments without risking actual funds. Beginners can use these accounts to practice executing trades, understand market order types, and test strategies. Demo trading builds confidence and reduces the chance of costly errors when transitioning to live trading.

4. Start Small and Manage Risks

It’s advisable to start with small amounts of capital to limit exposure while learning. Using techniques such as stop-loss orders can help control potential losses by automatically closing positions if prices move unfavorably. Risk management is a cornerstone of successful trading, helping protect capital and extend participation in the market.

5. Focus on Major Cryptocurrencies First

While there are thousands of cryptocurrencies, beginners should focus on well-established ones with higher liquidity and market capitalization. These tend to have more predictable price behavior and better available information. Concentrating on major coins allows beginners to understand market dynamics without the added complexity of obscure or highly volatile assets.

6. Learn to Read Market Sentiment and News

Cryptocurrency prices are often influenced by news and market sentiment. Staying updated with industry developments, regulatory announcements, and technological upgrades helps traders anticipate price movements. Using social media, crypto news sites, and community forums can provide valuable insights into market mood and potential catalysts.

7. Consider Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing fixed amounts of money at regular intervals regardless of price. This strategy reduces the impact of volatility by spreading purchases over time. For beginners uncertain about timing the market, DCA offers a disciplined approach to accumulating positions gradually.

8. Use Technical Tools with Caution

Technical tools like moving averages, volume indicators, and trend lines can assist in identifying trading signals. However, beginners should use them as part of a broader strategy instead of relying solely on charts. Combining technical analysis with fundamental understanding and market news improves decision-making.

9. Avoid Emotional Trading

Emotions such as fear and greed often lead to impulsive decisions. Beginners should cultivate patience and stick to their trading plans, avoiding panic selling or chasing rapid gains. Using pre-set rules for entry and exit helps maintain discipline and reduces the risk of costly mistakes.

10. Keep Learning and Adapting

The cryptocurrency market evolves rapidly, with new technologies and trends emerging. Continuous learning through courses, webinars, and reading helps traders stay ahead. Reviewing past trades and adjusting strategies based on experience also improves performance over time.

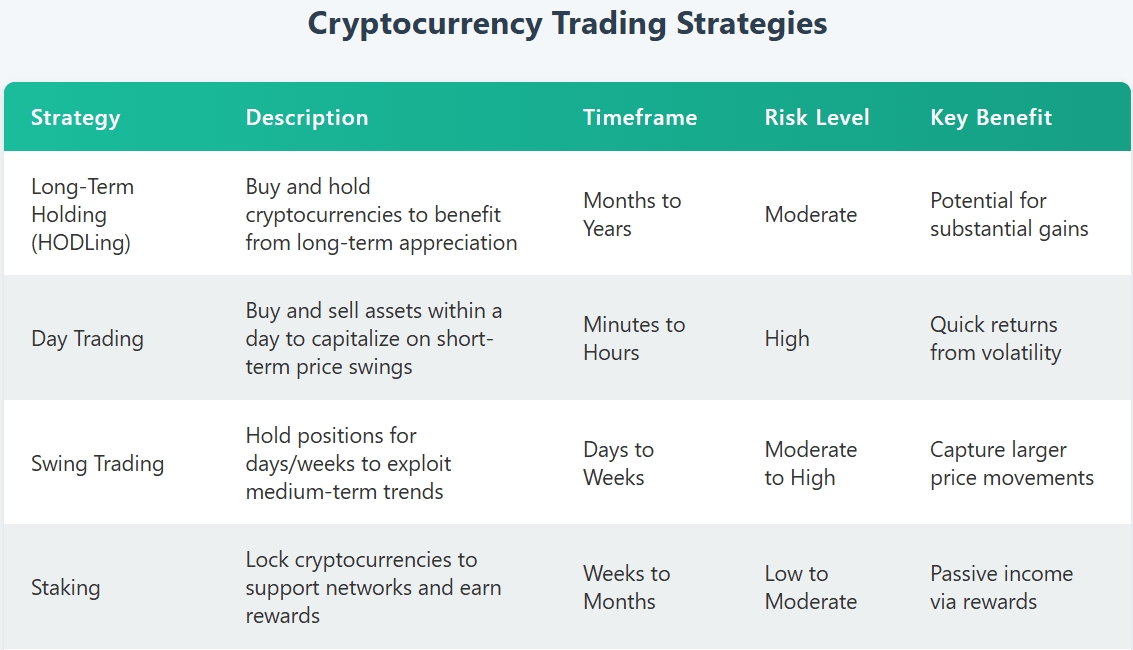

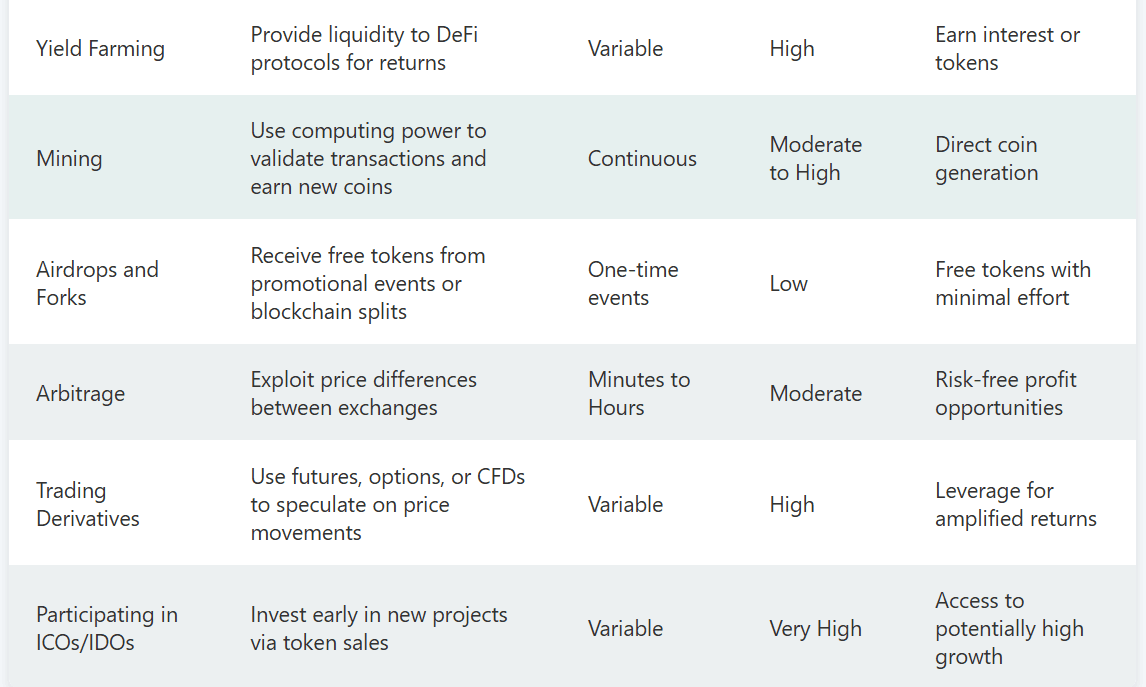

Making money with cryptocurrency is not limited to just trading. Here are ten approaches beginners can explore:

Each method comes with its own risk profile and complexity, so beginners should choose those aligning with their knowledge and risk appetite.

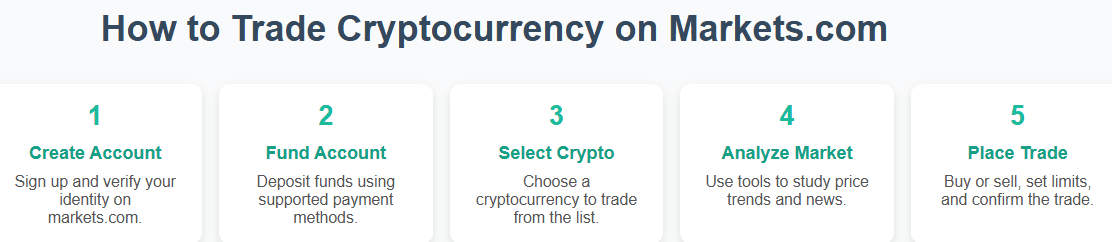

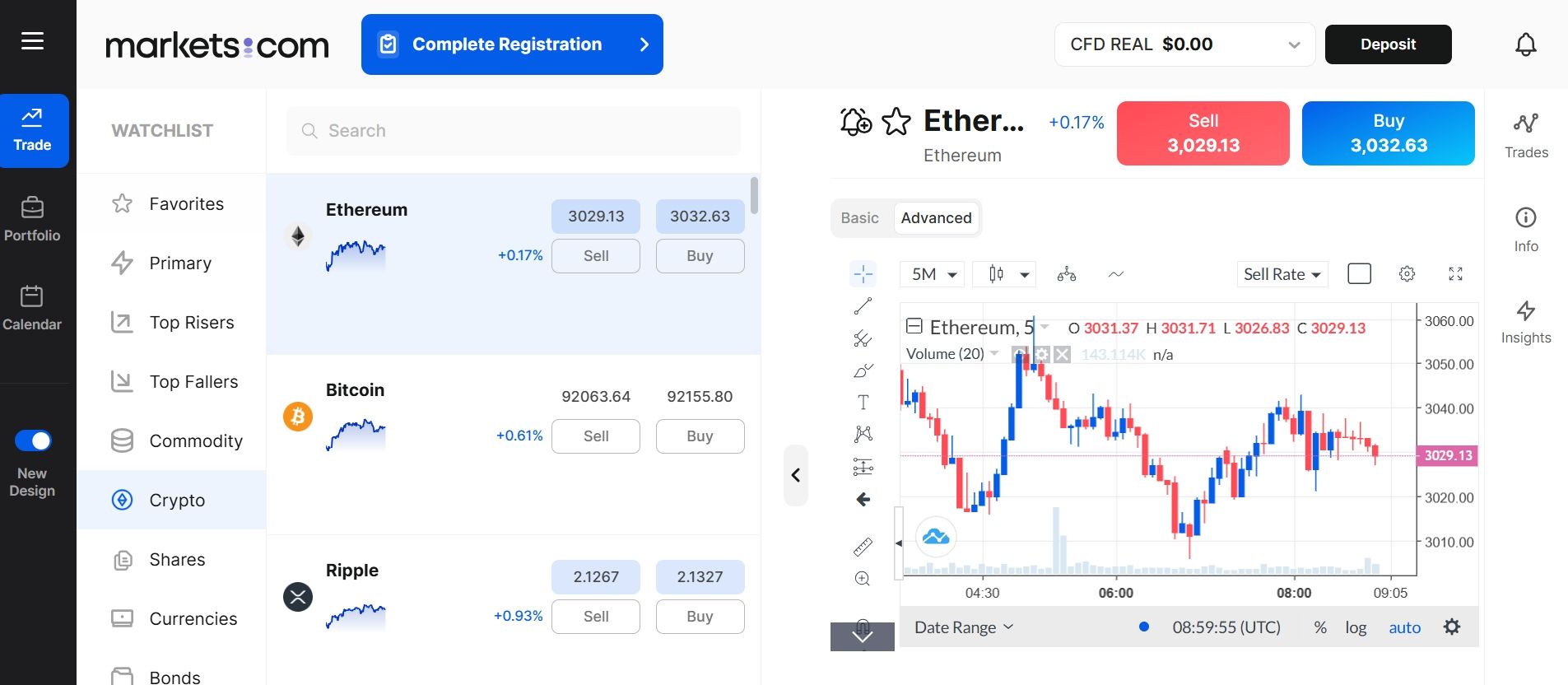

Markets.com is a popular platform for trading cryptocurrencies and other assets. Here is a simple guide for beginners to start trading on this platform:

Step 1: Create an Account

Visit markets.com and sign up by providing your personal information and verifying your identity. This process complies with regulatory standards and ensures security.

Step 2: Fund Your Account

Deposit funds using supported payment methods. Markets.com offers multiple options like bank transfers, credit cards, and e-wallets. Starting with a small amount is advisable for beginners.

Step 3: Choose Your Cryptocurrency

Browse the list of available cryptocurrencies on the platform. Markets.com offers a range of popular coins and tokens. Select the one you want to trade.

Step 4: Analyze the Market

Use the platform’s charting tools and news feed to research the selected cryptocurrency. Consider recent price trends, market news, and any upcoming events that might influence prices.

Step 5: Place Your Trade

Decide whether to buy (go long) or sell (go short), enter the amount, and set stop-loss and take-profit levels to manage risk. Confirm the trade and monitor its progress using the platform’s dashboard.

Several common obstacles prevent many beginners from achieving consistent income in cryptocurrency trading:

Lack of Education: Insufficient understanding of market mechanics leads to poor decision-making.

Emotional Trading: Reacting impulsively to price movements causes losses.

Overtrading: Frequent trading without strategy increases transaction costs and risk exposure.

Ignoring Risk Management: Failure to use stop-loss orders or position sizing can lead to large losses.

Chasing Trends: Buying at peaks or selling at lows due to hype or panic.

Fraud and Scams: Falling victim to fraudulent schemes or unreliable platforms.

Unrealistic Expectations: Expecting quick riches without effort or learning.

Ignoring Fees and Costs: Overlooking the impact of trading fees and spreads on profitability.

Poor Timing: Entering or exiting trades at inopportune moments.

Lack of Patience: Giving up too soon before strategies have time to work.

Addressing these issues requires discipline, continuous learning, and a structured trading approach.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Trading cryptocurrencies as a beginner can be rewarding but also challenging. Success depends on acquiring knowledge, developing a clear plan, managing risks, and maintaining emotional control. Starting with reputable platforms, practicing with demo accounts, and focusing on established cryptocurrencies provide a solid foundation.

Exploring various ways to make money within the crypto ecosystem beyond just trading broadens potential income streams. Platforms like markets.com offer user-friendly environments for beginners to start trading with guidance and tools.

Ultimately, patience and persistence are essential. The cryptocurrency market is dynamic and requires adaptability. By staying informed, learning from experience, and approaching trading with discipline, beginners can enhance their chances of achieving sustainable results in this exciting digital frontier.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.