Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Tuesday Dec 30 2025 09:04

22 min

Bitcoin for beginners: Bitcoin has gained considerable traction as a digital currency and investment asset over the past decade.

Investment for beginners: As the first decentralized cryptocurrency, it has paved the way for many others but remains the most well-known and widely used. This comprehensive guide will introduce you to Bitcoin, explaining its fundamentals, benefits, risks, and the practical steps to buying it.

The Concept of Bitcoin

Bitcoin is a decentralized digital currency created in 2009 by an anonymous individual or group known as Satoshi Nakamoto. Unlike traditional currencies issued by governments (often called fiat currency), Bitcoin operates on a technology called blockchain. This technology allows transactions to be verified and recorded across a network of computers without the need for a central authority.

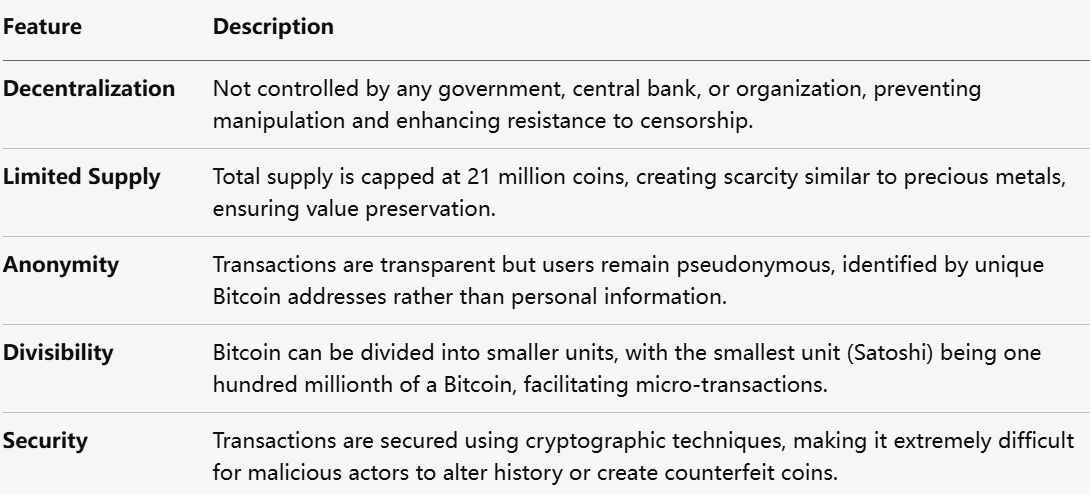

Decentralization:

Bitcoin is not controlled by any government, central bank, or organization. This decentralization means that no single entity has the power to manipulate the currency, making it resistant to censorship and interference.

Limited Supply:

The total supply of Bitcoin is capped at 21 million coins. This limited supply is a fundamental feature, designed to create scarcity similar to precious metals like gold.

Anonymity:

While Bitcoin transactions are transparent and recorded on the blockchain, users' identities remain pseudonymous. Each transaction is associated with a unique Bitcoin address rather than personal information.

Divisibility:

Bitcoin can be divided into smaller units. The smallest unit, called a Satoshi, is one hundred millionth of a Bitcoin. This allows for micro-transactions, making it accessible for various uses.

Security:

Bitcoin transactions use cryptographic techniques to ensure security. This makes it extremely difficult for malicious actors to alter transaction histories or create counterfeit coins.

Blockchain Technology:

Bitcoin operates on a blockchain—a distributed ledger that records all transactions securely. Each block contains a set of transactions that are linked together, forming a chain. This structure ensures transparency and impenetrability.

Mining:

Bitcoin is created through a process called mining, where powerful computers solve complex mathematical problems to validate transactions. When a miner successfully solves a problem, they add a new block to the blockchain and are rewarded with newly created Bitcoins and transaction fees.

Wallets:

To store and manage Bitcoins, users need a digital wallet. Wallets can be software-based (online or mobile) or hardware-based (physical devices). Wallets allow users to send, receive, and keep their Bitcoin secure.

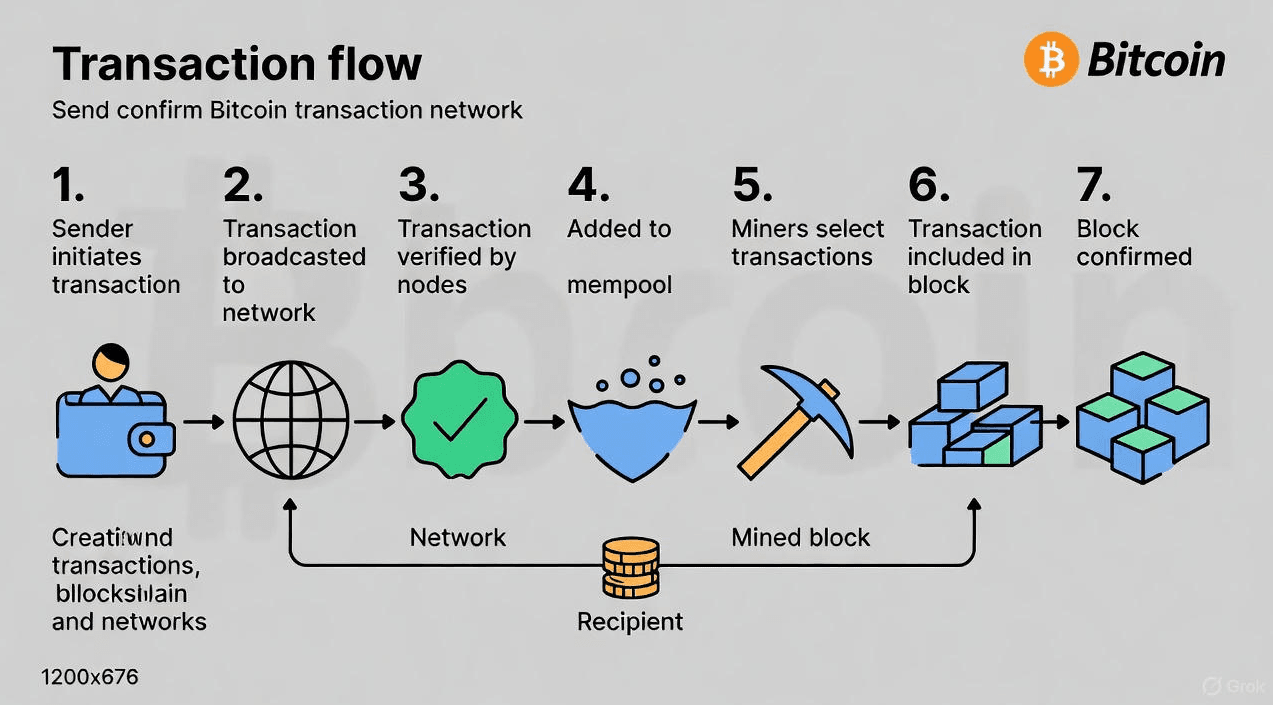

Transactions:

Bitcoin transactions involve sending Bitcoin from one wallet to another. When a transaction is initiated, it gets broadcast to the network, where miners verify and add it to the blockchain.

1. Financial Freedom

Bitcoin provides users with greater control over their finances. Because it is decentralized, individuals are not dependent on banks or governmental institutions to manage their assets. This autonomy allows for peer-to-peer transactions without intermediary fees.

2. Low Transaction Fees

Compared to traditional banking systems or payment processors, Bitcoin transactions typically have lower fees. This makes it an attractive option for both individuals and businesses, especially for international transactions.

3. Accessibility

Bitcoin can be accessed by anyone with an internet connection. This inclusivity allows individuals who may not have traditional banking access to participate in the global economy.

4. Inflation Hedge

Many view Bitcoin as a hedge against inflation, especially in times of economic instability. Its limited supply ensures that it cannot be "printed" or inflated like fiat currencies, preserving value over time.

5. Transparency and Trust

The blockchain technology underlying Bitcoin ensures that all transactions are transparent and immutable. This transparency can foster trust among users, as anyone can view the entire transaction history.

1. Volatility

Bitcoin’s price tends to be highly volatile, with significant fluctuations occurring over short periods. While this volatility can present investment opportunities, it also poses risks for users who may suffer losses if prices decline.

2. Regulatory Uncertainty

Bitcoin’s regulatory landscape is still evolving. Different countries have different approaches to cryptocurrency regulation, which can impact its legality and use. Changes in regulation could also influence its value and usability.

3. Security Concerns

While Bitcoin transactions are secure, wallets can be vulnerable to hacking and theft. Users must take precautions to safeguard their private keys and ensure their wallets are safe.

4. Limited Adoption

Although Bitcoin is gaining acceptance, it is not universally accepted for all transactions. Businesses and merchants may not yet recognize Bitcoin as a viable payment method, limiting its usability.

5. Irreversible Transactions

Once a Bitcoin transaction is confirmed and added to the blockchain, it cannot be reversed. This lack of recourse can be a disadvantage if users make mistakes or fall victim to fraud.

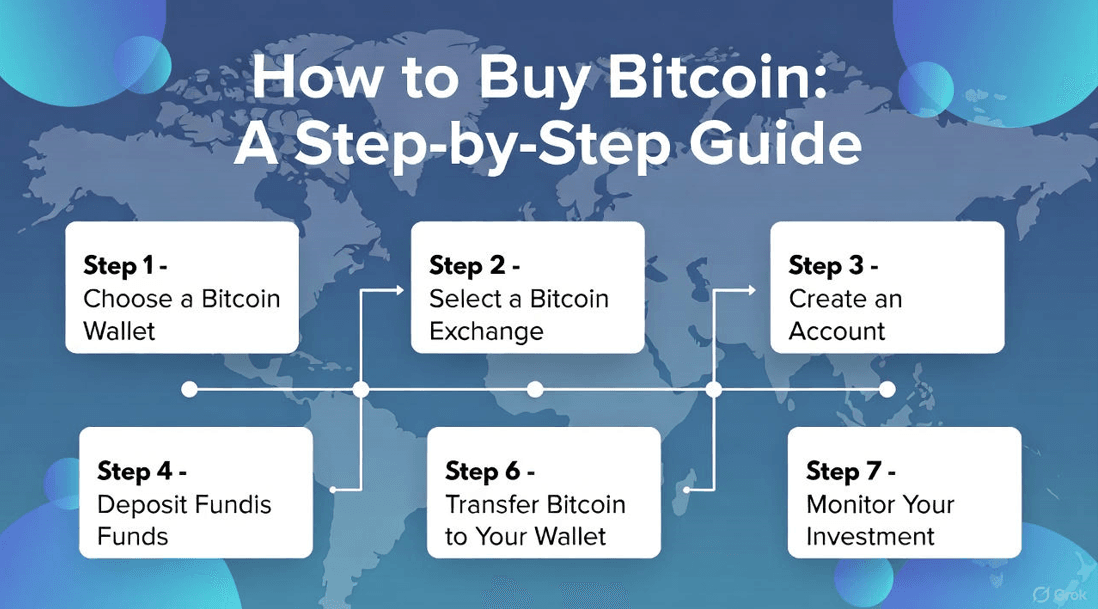

Step 1: Choose a Bitcoin Wallet

Before purchasing Bitcoin, you need a digital wallet to store it. There are several types of wallets:

Software Wallets: These are applications or software installed on your computer or mobile device. They are user-friendly and convenient but may be vulnerable to malware.

Hardware Wallets: Physical devices that store your Bitcoin offline. They are more secure against hacks but less convenient for day-to-day transactions.

Online Wallets: Web-based wallets offered by exchanges or third-party services. They are easy to use but may be less secure than hardware wallets.

Choose a wallet based on your needs, considering factors such as security, ease of use, and accessibility.

Step 2: Select a Bitcoin Exchange

To buy Bitcoin, you will need to choose a cryptocurrency exchange. There are many exchanges available, providing different features, fees, and supported currencies. Here are some popular exchanges:

Coinbase: User-friendly and well-known, making it ideal for beginners.

Binance: Offers a wide range of cryptocurrencies and advanced trading features.

Kraken: Known for its security measures and wide selection of coins.

Gemini: Regulated and secure, appealing to more cautious users.

Consider factors such as the platform’s reputation, user reviews, fees, and security measures when selecting an exchange.

Step 3: Create an Account

Once you've chosen an exchange, you’ll need to create an account. This process typically involves:

Providing Personal Information: You may need to provide your name, email address, and phone number.

Verifying Your Identity: Due to regulatory requirements, exchanges often require identity verification. This process might involve submitting a photo ID or other documentation.

Enabling Two-Factor Authentication: To enhance security, many exchanges allow or require you to set up two-factor authentication (2FA) for additional protection.

Step 4: Deposit Funds

After creating an account and completing verification, you will need to deposit funds to purchase Bitcoin. Most exchanges accept various payment methods, including:

Bank Transfers: Generally the most cost-effective method, though it may take longer to process.

Credit/Debit Cards: This method is quick but often incurs higher fees. Ensure your card allows cryptocurrency purchases.

PayPal: Some exchanges accept PayPal, which can provide added convenience but may have restrictions.

Choose the payment method that works best for you based on cost and convenience.

Step 5: Buy Bitcoin

With funds in your exchange account, you're ready to buy Bitcoin. Follow these steps:

Navigate to the Trading Section: Find the Bitcoin trading pair, usually denoted as BTC/USD or BTC/EUR, depending on your currency.

Choose the Amount: Decide how much Bitcoin you want to purchase. Many exchanges allow you to buy fractions of Bitcoin.

Place Your Order: You can typically place a market order (buying at the current price) or a limit order (specifying the price at which you're willing to buy). Review your order details before finalizing.

Confirm the Purchase: After placing your order, it should execute almost immediately, especially for market orders. You’ll see the Bitcoin credited to your account.

Step 6: Transfer Bitcoin to Your Wallet

For added security, it's advisable to transfer your Bitcoin to your personal wallet rather than keeping it on the exchange. To do this:

Access Your Wallet: Open your wallet app and find the option to receive Bitcoin.

Copy Your Wallet Address: You’ll need this address to transfer funds.

Initiate the Transfer from the Exchange: Go to your exchange account, select the option to withdraw Bitcoin, and paste in your wallet address. Specify the amount you wish to transfer.

Confirm the Transaction: After submitting the withdrawal, check your wallet to ensure the transaction was completed successfully.

Step 7: Monitor Your Investment

After purchasing Bitcoin, keep an eye on market trends, news, and price fluctuations. Cryptocurrency markets can be volatile, and staying informed will help you make intelligent decisions regarding your investments.

Consider setting up price alerts or using portfolio tracking apps to help you monitor your holdings effectively.

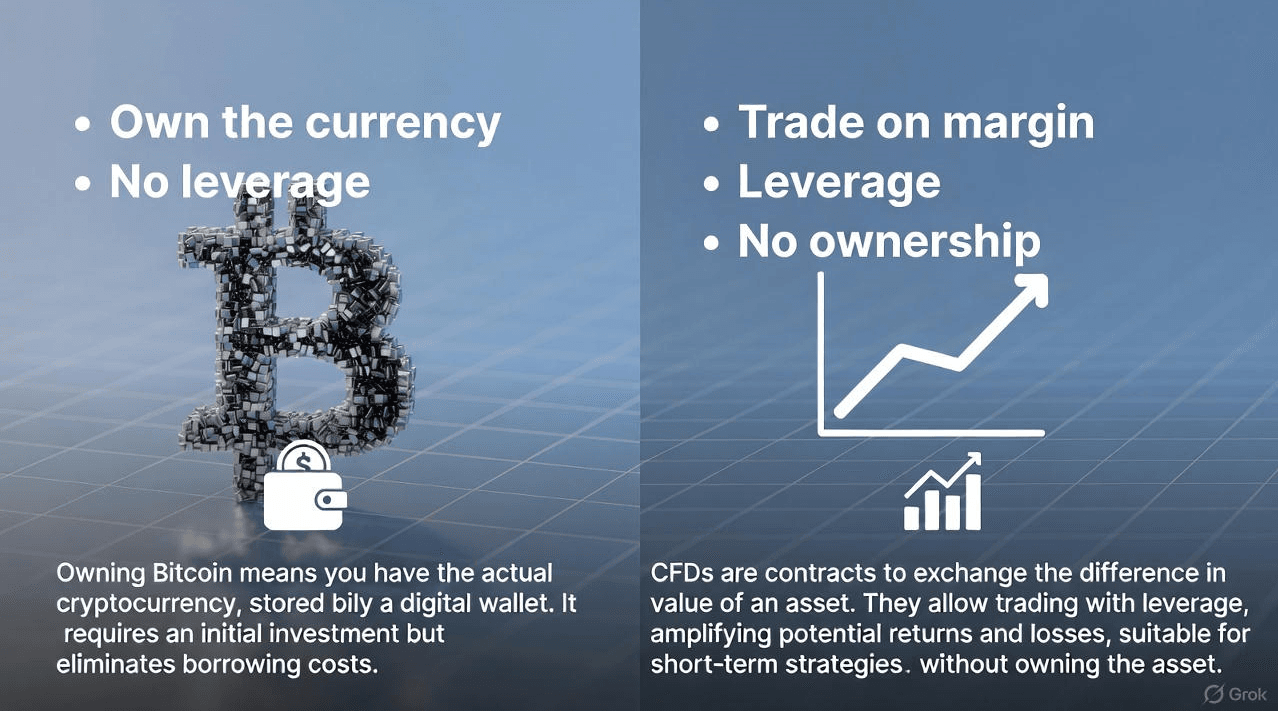

Bitcoin (BTC) has become a central figure in the cryptocurrency market, attracting the attention of traders looking to capitalize on its price fluctuations. One popular method for trading Bitcoin is through Contracts for Difference (CFDs), which allow traders to speculate on price movements without actually owning the underlying asset. Among various platforms, Markets.com stands out for its comprehensive offerings and user-friendly interface. This article will explore what CFDs are, the benefits of trading Bitcoin through Markets.com, and tips for getting started.

Understanding Bitcoin and CFDs

What is Bitcoin?

Bitcoin is the first and most widely recognized cryptocurrency, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. It operates on a decentralized blockchain system, ensuring transparency and security while allowing peer-to-peer transactions. Bitcoin's value is determined by supply and demand dynamics in the market, which can be highly volatile.

What Are CFDs?

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of an asset without owning the underlying asset. When trading BTC CFDs, you enter a contract with a broker to exchange the difference in Bitcoin's value from the moment the contract is opened to when it is closed. This means you can profit from both rising and falling prices.

Why Trade BTC CFDs?

1. User-Friendly Platform

Markets.com is known for its intuitive trading platform, which is accessible for both beginners and experienced traders. The interface is clean and organized, allowing users to find the tools and information they need quickly. The platform also offers educational resources to help new traders understand the basics of CFD trading and Bitcoin.

2. Comprehensive Market Analysis

Markets.com provides a wealth of market analysis and insights. This includes real-time charts, news updates, and expert analysis, helping traders make informed decisions based on current market conditions. Access to such resources can significantly enhance your trading strategy.

3. Regulatory Compliance

Markets.com is operated by a well-regulated company, which adds a layer of trust and security for traders. Regulatory compliance ensures that the platform operates within legal guidelines, providing a safer trading environment.

4. Variety of Account Types

Markets.com offers multiple account types to cater to different trading needs. Whether you're a beginner or an experienced trader, you can find an account type that matches your trading style. Additionally, they offer demo accounts for those who want to practice before trading with real money.

5. Competitive Spreads and Fees

The platform offers competitive spreads on BTC CFDs, which can enhance your overall profitability. While trading costs can impact your returns, Markets.com keeps fees transparent, allowing you to plan your trades accordingly.

Risk Management Tips

Use Stop-Loss Orders: Always set a stop-loss to minimize losses if the market moves against your position.

Start Small: Begin with smaller trades until you become comfortable with the platform and the volatility associated with Bitcoin.

Stay Informed: Regularly check for news and trends impacting Bitcoin's price to adapt your trading strategy accordingly.

Diversify Your Portfolio: Avoid putting all your funds into BTC. Consider trading other cryptocurrencies or assets to mitigate overall risk.

Trading BTC CFDs can be a rewarding endeavor, offering flexibility and the potential for profit in both rising and falling markets. Markets.com provides a robust platform for both newcomers and seasoned traders looking to navigate the world of cryptocurrency trading. By leveraging its user-friendly interface, extensive market analysis, and variety of account options, you can engage with Bitcoin trading confidently and effectively.

As with any investment, it's essential to understand the risks involved and to trade responsibly. By educating yourself and developing a strategic approach, you can harness the potential of trading Bitcoin while managing potential downsides. Ready to start your trading journey? Consider Markets.com for your BTC CFD trading needs and take the first step into the world of cryptocurrency investing.

1. Is Bitcoin Legal?

The legality of Bitcoin varies by country. Many countries allow its use and trading, while others impose restrictions or outright bans. It's essential to understand the regulations in your jurisdiction before engaging in cryptocurrency transactions.

2. How Can I Keep My Bitcoin Safe?

To enhance the security of your Bitcoin holdings:

Use hardware wallets for long-term storage.

Enable two-factor authentication on exchanges and wallets.

Avoid sharing your private keys or sensitive information.

3. Can I Buy Bitcoin Anonymously?

While Bitcoin offers a degree of anonymity, most exchanges require identity verification due to regulatory needs. However, some platforms and peer-to-peer methods may allow for purchases without full identity disclosure.

4. What Are the Best Practices for Trading Bitcoin?

If you’re considering trading Bitcoin, follow these best practices:

Start small and invest only what you can afford to lose.

Stay updated on market trends and news.

Have a clear trading strategy.

Utilize proper risk management techniques.

5. What Should I Consider Before Investing in Bitcoin?

Before investing, consider:

Your risk tolerance and investment goals.

The volatility of the cryptocurrency market.

The potential for long-term growth versus short-term gains.

6. What Are the Tax Implications of Bitcoin?

Tax regulations regarding Bitcoin vary by jurisdiction. In many places, Bitcoin is treated as property, meaning capital gains tax may apply to transactions. It's advisable to consult with a tax professional to understand your obligations.

7. Can I Withdraw My Bitcoin as Cash?

Yes, you can convert Bitcoin to cash by selling it on an exchange or through peer-to-peer platforms. Funds can then be withdrawn to your bank account, subject to exchange policies and fees.

8. What Are the Risks of Trading Bitcoin?

Bitcoin trading carries several risks, including market volatility, regulatory changes, and security threats. Understanding these risks and developing a solid trading plan can help mitigate potential losses.

9. How Do I Stay Informed About Bitcoin?

Staying updated on Bitcoin involves following news outlets, cryptocurrency analysts, and social media channels focused on cryptocurrencies. Engaging in forums and communities can also provide insights and perspectives on market trends.

10. How Do I Choose a Bitcoin Exchange?

When selecting an exchange, consider factors like security features, user reviews, fees, available cryptocurrencies, and customer support. Ensure the platform complies with regulations in your region.

Bitcoin has emerged as a revolutionary asset that offers users financial autonomy and potential for investment growth. Understanding its operations, advantages, and challenges is crucial for anyone interested in engaging with this digital currency.

By following the steps outlined in this guide, beginners can navigate the process of buying Bitcoin with confidence. While the cryptocurrency market carries inherent risks, it also presents unique possibilities for those who take the time to learn and adapt. As Bitcoin continues to evolve, staying informed and proactive will be essential for anyone looking to participate in this dynamic financial landscape.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.