Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Nov 6 2025 09:19

5 min

Bitcoin Price Annual Forecast: Bitcoin continues to be one of the most discussed and analyzed digital assets worldwide.

Its price movements have attracted attention from traders, enthusiasts, and institutions alike. While exact predictions are challenging due to the volatile nature of cryptocurrencies, examining key factors and trends can help frame expectations for Bitcoin’s price trajectory in upcoming years — 2025, 2026, and 2030.

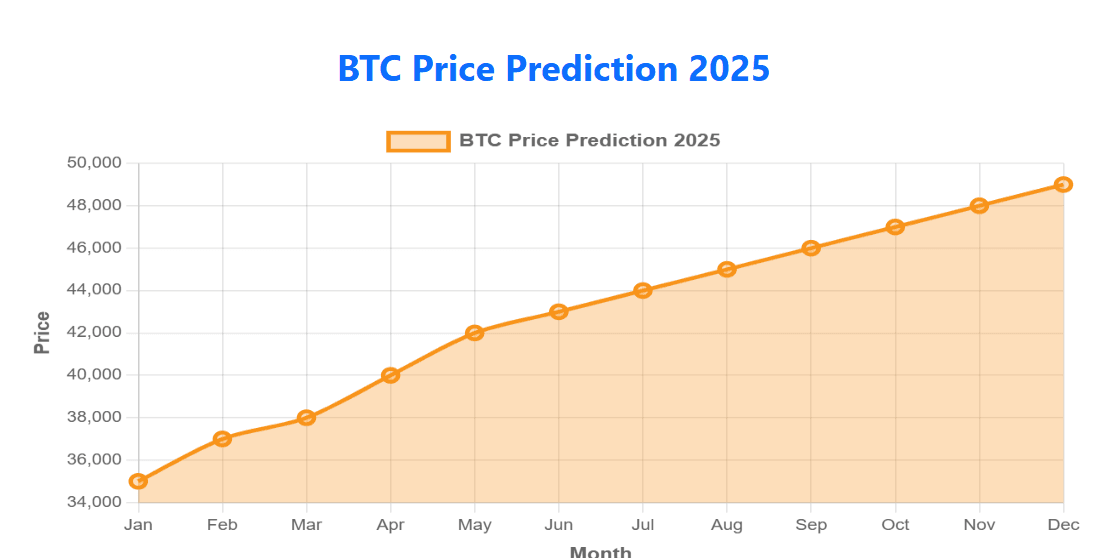

By 2025, Bitcoin is expected to experience a phase characterized by consolidation and gradual maturation. Several forces will likely shape its price development:

Increasing Institutional Interest

An expanding number of companies and institutional entities are exploring Bitcoin, either as a treasury asset or as part of diversified portfolios. This gradual adoption tends to support price stability and growth over time, as larger players bring more discipline and liquidity to the market.

Regulatory Clarity

Regulatory frameworks around digital assets are anticipated to become clearer and more harmonized globally by 2025. While regulations can create short-term uncertainty, in the medium term, they often bring legitimacy and reduce risks of sudden crackdowns. Clearer rules can foster wider use, positively influencing Bitcoin’s perceived value.

Technological Improvements

Innovations in Bitcoin’s network, such as enhancements to scalability and privacy, are expected to increase usability and efficiency. Layer 2 solutions and improvements to transaction speed and cost will likely enhance the user experience, encouraging greater adoption and supporting upward price momentum.

Macro Environment Influence

Global macroeconomic factors such as inflation trends, currency fluctuations, and geopolitical tensions may also impact Bitcoin’s appeal as an alternative store of value. If traditional markets experience volatility or monetary policies lead to currency devaluation, Bitcoin could attract more attention as a non-traditional asset.

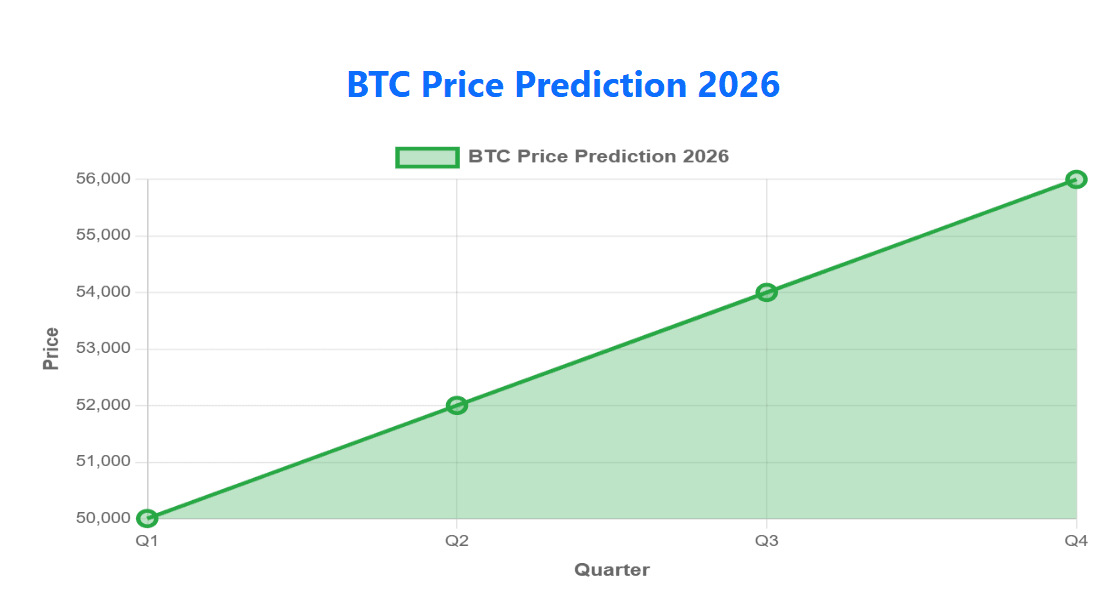

Moving into 2026, Bitcoin’s market dynamics may reflect further maturation and integration into broader financial systems.

Wider Retail and Payment Integration

By this time, Bitcoin might be more commonly accepted for everyday transactions, both online and offline. Enhanced payment infrastructure and partnerships with financial services could simplify spending and increase demand, influencing price positively.

Improved Institutional Frameworks

Custody solutions, insurance products, and regulated investment vehicles are likely to become more sophisticated and widely available. These advancements can lower barriers for larger scale buying and holding, supporting price growth and reducing volatility.

Market Cycles and Sentiment

Bitcoin’s price historically follows cycles of expansion and contraction. By 2026, a new cycle may unfold, driven by factors like halvings or shifts in market psychology. Understanding these cycles helps frame the timing and magnitude of price movements.

Competition and Innovation in Crypto Space

The rise of competing digital assets and innovations in decentralized finance (DeFi) could influence Bitcoin’s dominance. While Bitcoin remains the flagship cryptocurrency, evolving market competition may impact price growth patterns.

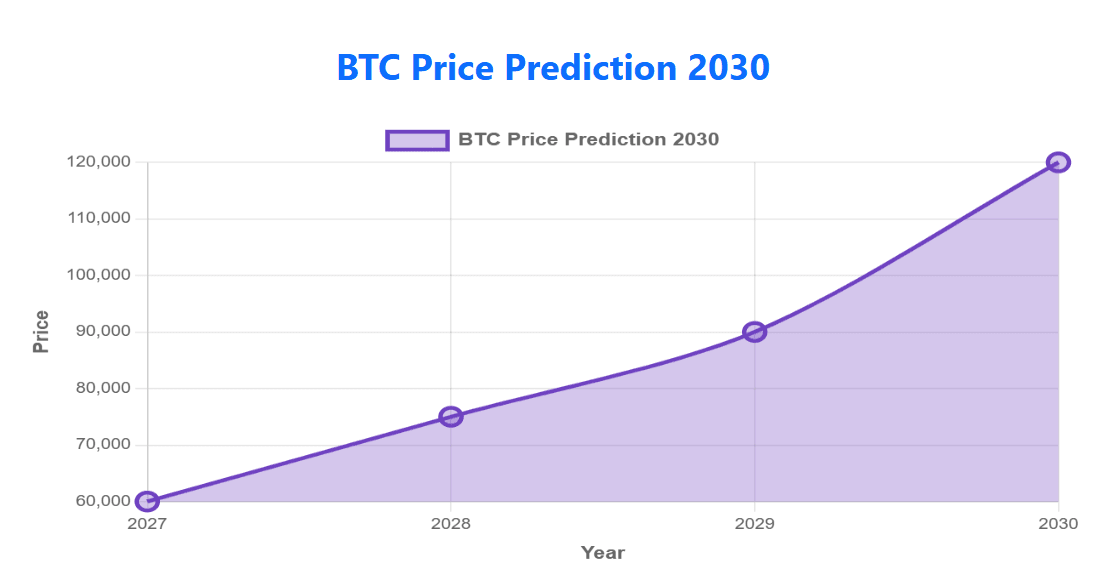

Looking further ahead to 2030, Bitcoin’s price forecast becomes more speculative but can be framed by broad thematic trends.

Global Digital Economy Integration

Bitcoin is expected to be deeply embedded in the global digital economy by 2030. As digital currencies and blockchain technologies become foundational to finance, commerce, and data integrity, Bitcoin’s role as a digital store of value could become more entrenched.

Scarcity and Supply Dynamics

Bitcoin’s fixed supply and programmed issuance schedule create a scarcity dynamic that differentiates it from traditional assets. Over time, as fewer new bitcoins enter circulation, this scarcity could enhance demand-driven price appreciation.

Institutional and Sovereign Adoption

Beyond corporations, some governments might integrate Bitcoin into their financial systems, either as legal tender or reserve assets. This would represent a monumental shift and could drive considerable price increases, reflecting broader acceptance and utility.

Technological and Environmental Advances

Ongoing upgrades to Bitcoin’s protocol, including energy efficiency improvements and enhanced security features, may address some current concerns. This could improve public perception and strengthen the case for long-term holding.

Potential Challenges

Despite positive trends, Bitcoin could face challenges such as regulatory hurdles, technological risks, or competition from central bank digital currencies (CBDCs). These factors might introduce volatility or limit price growth, emphasizing the importance of monitoring broader ecosystem developments.

Forecasting Bitcoin’s price for 2025, 2026, and 2030 involves careful consideration of multiple evolving factors. Near-term years may focus on adoption growth, regulatory clarity, and technological improvements supporting more stable price appreciation. The longer-term outlook envisions Bitcoin’s deeper integration into the global financial system, increasing scarcity, and broader institutional acceptance potentially driving substantial value growth.

As with any emerging asset, uncertainties remain, and price movements can be influenced by unpredictable external events. Continuous observation of technological progress, market trends, and regulatory environments is important for understanding Bitcoin’s evolving price landscape.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.