Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Nov 6 2025 10:54

8 min

Bitcoin to Gold Analysis: Bitcoin and gold are two distinct assets that have captured the attention of market participants worldwide.

Both are often viewed as alternatives to traditional fiat currencies, but they come from very different origins and carry unique characteristics. The BTC/XAU pairing represents the relationship between Bitcoin and gold, offering insights into how these two assets compare, interact, and serve different purposes in financial markets. This analysis explores what BTC/XAU means, the factors influencing the relationship, and the implications for those monitoring this dynamic.

The BTC/XAU symbol is a way to express the value of Bitcoin relative to gold. Specifically, it shows how many ounces of gold one Bitcoin can purchase, or conversely, the price of Bitcoin measured in gold terms. This pairing is not just a price comparison but also serves as a gauge of how the digital asset compares to the traditional precious metal, often regarded as a store of value.

Unlike conventional currency pairs, which compare two fiat currencies, BTC/XAU contrasts a digital, decentralized asset with a physical commodity that has been valued for thousands of years. This duality offers a unique perspective on how modern technology-driven assets interact with time-tested stores of wealth.

Gold has been treasured for millennia due to its rarity, durability, and intrinsic qualities. It has been used as money, jewelry, and a symbol of wealth throughout human history. Its value is rooted in physical properties and cultural significance, making it a trusted asset during times of economic uncertainty.

Bitcoin, on the other hand, was introduced less than two decades ago. It was designed as a decentralized digital currency with a fixed supply, aiming to provide an alternative to traditional monetary systems. Its scarcity is coded into its protocol, mimicking gold’s limited availability but in a digital form.

Both assets share attributes such as scarcity and resistance to inflationary policies, which appeal to those looking for alternatives to fiat money. BTC/XAU captures the evolving competition and coexistence between these two forms of value storage.

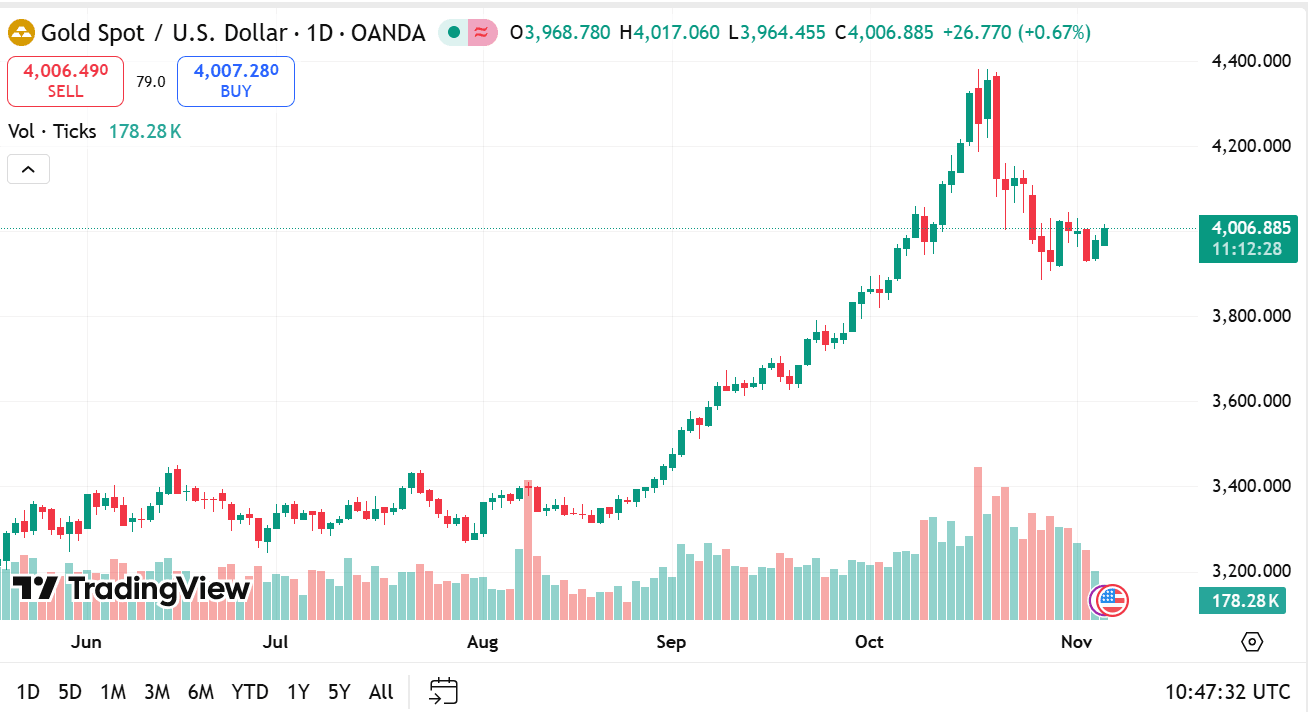

source: tradingview

The BTC/XAU ratio fluctuates based on a variety of economic, technological, and behavioral factors. Understanding these drivers is key to interpreting the relationship.

1. Market Sentiment and Risk Appetite

Bitcoin is often viewed as a more volatile and speculative asset compared to gold. When market participants have a higher appetite for risk, demand for Bitcoin may rise relative to gold, pushing the BTC/XAU ratio higher. Conversely, during periods of uncertainty or risk aversion, investors may flock to gold’s perceived stability, lowering the ratio.

2. Inflation and Monetary Policy

Both assets are considered hedges against inflation, but their responses to monetary policy can differ. Gold’s price often moves in anticipation of inflationary pressures or changes in real interest rates. Bitcoin’s response is more complex, influenced by its adoption trends and regulatory environment alongside macroeconomic factors.

3. Technological Developments and Adoption

Bitcoin’s price is strongly influenced by technological upgrades, network security, and increasing adoption by individuals, corporations, and institutions. Advances that improve Bitcoin’s usability or acceptance can increase demand, affecting the BTC/XAU ratio by elevating Bitcoin’s relative value.

4. Regulatory Environment

Government regulations targeting cryptocurrencies impact Bitcoin more directly than gold. Announcements related to legal frameworks, taxation, or restrictions can cause sharp movements in Bitcoin’s price, thereby influencing the BTC/XAU value.

5. Supply Dynamics

Gold’s supply is relatively stable and grows slowly due to mining activities. Bitcoin, however, has a fixed issuance schedule with a capped total supply. Events like Bitcoin’s halving, which reduce the rate of new coins entering circulation, can create scarcity-driven price changes that alter the BTC/XAU ratio.

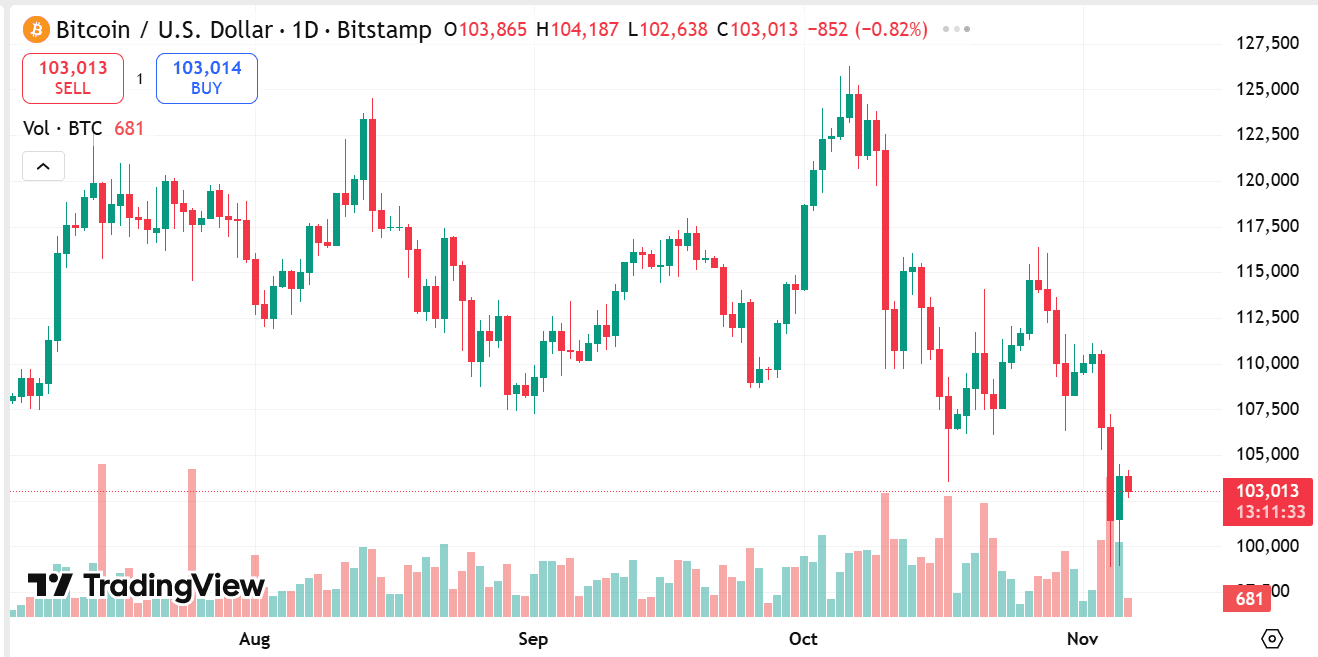

source: tradingview

Gold’s Strengths

Gold’s Weaknesses

Bitcoin’s Strengths

Bitcoin’s Weaknesses

For market watchers and asset holders, BTC/XAU serves as an insightful metric to evaluate diversification strategies. Holding both Bitcoin and gold can provide a balance between innovation-driven growth and traditional stability. The ratio helps illustrate shifts in preference between these assets and may guide allocations as market conditions evolve.

Some use the BTC/XAU trend as a signal to adjust exposure, increasing Bitcoin during periods when its value outperforms gold, or shifting toward gold as a defensive position. This dynamic interplay offers a nuanced approach to managing risk and opportunity across different market cycles.

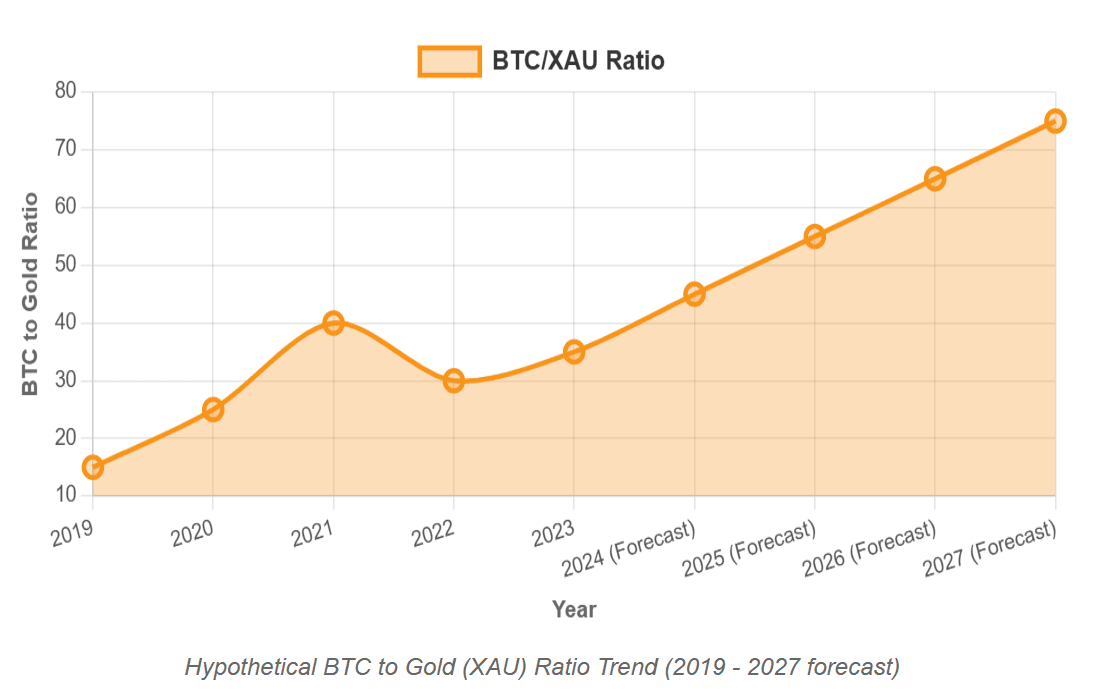

In recent years, the BTC/XAU ratio has reflected growing interest in Bitcoin as a digital alternative to gold. Bitcoin’s rising adoption, alongside institutional interest and technological progress, has increased its standing relative to gold.

Looking ahead, several scenarios could shape this relationship:

Continued Bitcoin Growth: Enhanced adoption, better infrastructure, and favorable regulations could lead to a higher BTC/XAU ratio.

Gold Resilience: In times of heightened economic uncertainty or policy tightening, gold may regain strength relative to Bitcoin.

Coexistence and Complementarity: Both assets could maintain their roles, with the ratio fluctuating in response to external factors but reflecting a broader trend toward diversified stores of value.

The BTC/XAU pairing provides a valuable lens through which to compare Bitcoin and gold, two fundamentally different yet often competing assets. Understanding this relationship requires considering a wide range of factors including market sentiment, regulatory environments, supply dynamics, and technological advancements.

As Bitcoin continues to evolve and gold maintains its historic role, the BTC/XAU ratio reflects ongoing shifts in how value is perceived and stored globally. For those following these assets, monitoring this ratio offers insights into broader market trends and the evolving landscape of alternative stores of value.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.