Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Jan 30 2026 09:27

22 min

CFD trading basics: Contract for Difference (CFD) trading offers a unique way for traders to speculate on the price movements of various assets without actually owning the underlying assets.

CFD trading has become increasingly popular due to its flexibility and the ability to engage in both long and short positions. This article delves into the basics of CFD trading, elaborates on long and short positions, and presents a comparison to determine which may be better for different trading strategies.

What is a CFD?

A Contract for Difference is a financial derivative that allows traders to speculate on the rising or falling prices of assets, including stocks, commodities, indices, and currencies, without owning the underlying asset. When a trader enters a CFD, they are agreeing to pay the difference between the opening and closing prices of the asset.

Key Features of CFDs

To understand how CFDs operate, consider the following mechanics:

Opening a Position: A trader identifies an asset, analyzes its market potential, and decides to either go long or short. For instance, if a trader believes that the price of an asset will rise, they will buy a CFD contract. Conversely, if they expect the price to fall, they will sell a CFD contract.

Price Movements: The value of the CFD will fluctuate with the value of the underlying asset. If the asset appreciates in value, a long position will increase in value. If the asset depreciates, the short position will gain.

Closing a Position: To realize profits or losses, the trader must close the position by either selling (for long positions) or buying back (for short positions) the CFD.

Settlement: Upon closing a position, the difference in price is settled in cash taken from the trading account. If the trader makes a profit, the account is credited; if they incur a loss, the account is debited.

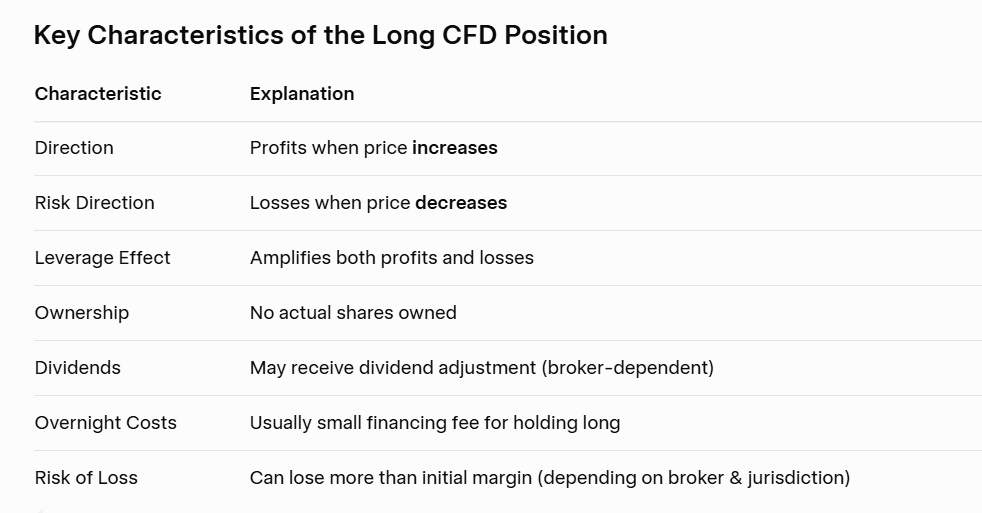

What is a Long Position?

A long position in CFD trading occurs when a trader speculates that the price of an asset will rise. When a trader takes a long position, they buy a CFD contract with the expectation that the asset’s price will increase, allowing them to sell it later at a higher price for a profit.

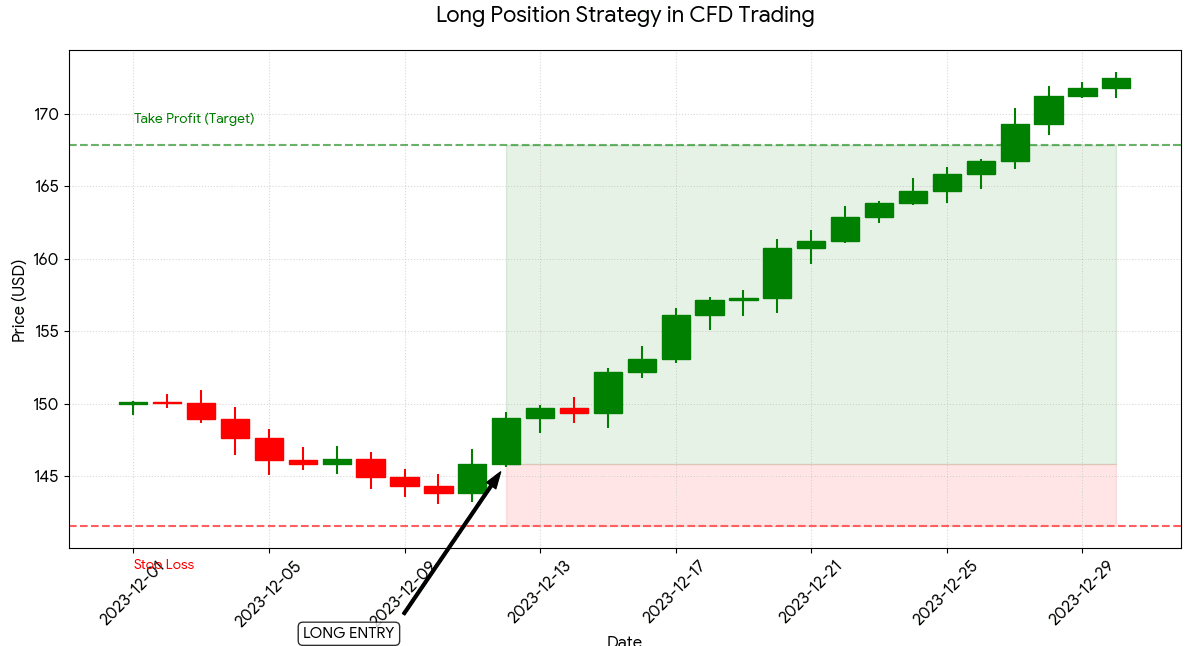

Mechanics of a Long Position

Opening a Long Position: To open a long position, a trader selects an asset and buys a CFD contract at the current market price. This action locks in the price at which they believe the asset will increase.

Holding the Position: The trader can hold the position for as long as they wish, provided they maintain the necessary margin in their trading account. During this time, they may also earn interest or dividends from the underlying asset.

Closing a Long Position: To close the position, the trader sells the CFD at the current market price. The difference between the opening and closing prices determines the profit or loss.

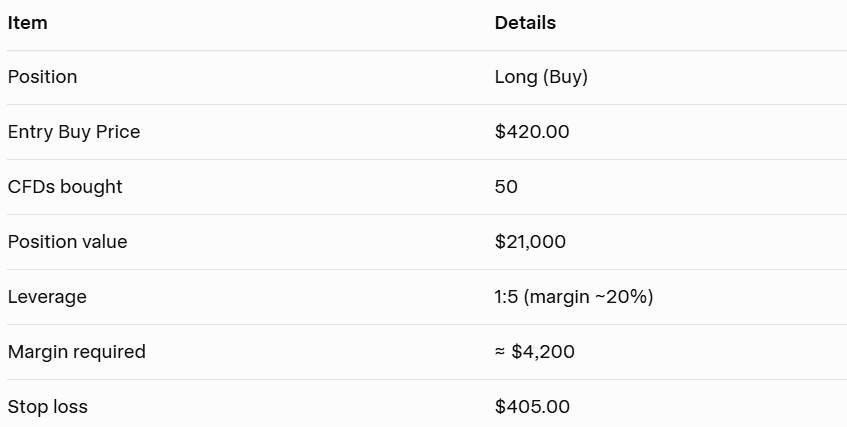

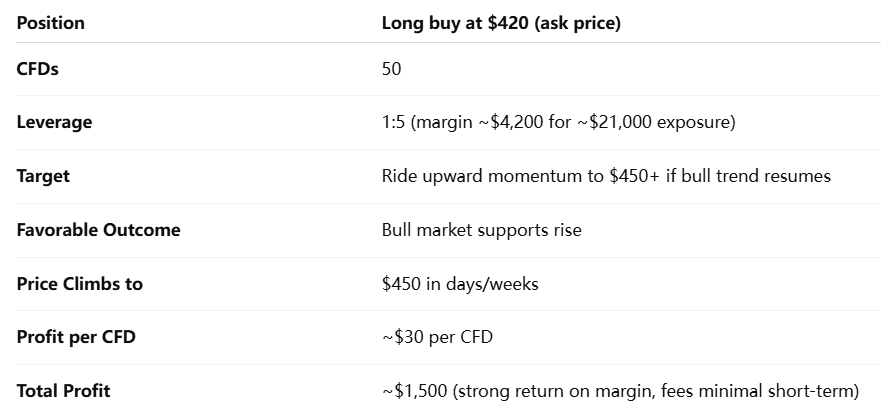

Scenario (hypothetical but realistic CFD setup):

You expect TSLA to rebound after a dip (e.g., post-earnings optimism).

Profitable outcome (price rises in a week):

Advantages of Long Positions

Potential for Unlimited Profits: If the asset’s price rises significantly, the potential profit is theoretically unlimited.

Simplicity: Long positions are straightforward, making them easier for beginner traders to understand.

Market Confidence: Taking a long position often reflects confidence in the asset’s growth and a bullish market sentiment, which can be psychologically rewarding.

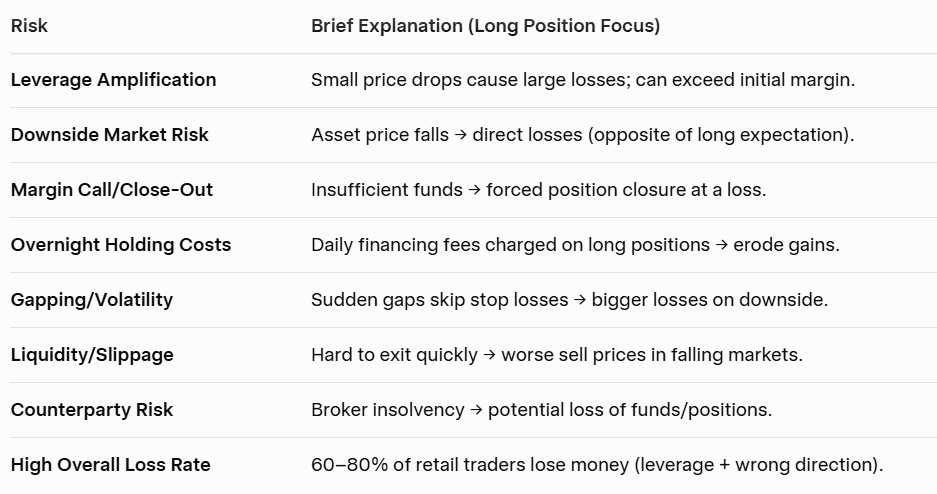

Risks of Long Positions

Market Downturns: If the market turns against the position, the trader can incur substantial losses.

Leverage Risks: While leverage can amplify profits, it can equally magnify losses, leading to a margin call if the position moves significantly against the trader.

Cost of Holding: Extended holding periods can incur fees or commissions, eating into profits.

Bull Markets

In a bull market, where asset prices are generally rising, long positions are in favor. Traders often capitalize on the upward momentum to generate profits by buying low and selling high.

Positive Economic Indicators

Indicators such as rising GDP, declining unemployment rates, and positive consumer spending can signal a strong economy, encouraging long positions as traders speculate on further price increases.

Earnings Reports

For stocks, favorable earnings reports can result in significant price increases. Traders may take long positions in anticipation of such reports, aiming to profit from the subsequent price rises.

Why Bull Markets Favor Long CFD Positions

Tesla has been volatile but benefited from broader bull trends (EV growth, autonomy hype, strong 2025 momentum before recent dips).

Setup (realistic as of late Jan 2026, with TSLA recently closing ~$416.56 after a pullback):

You spot bullish signals: potential rebound from dip, upcoming positive news (e.g., delivery updates or robotaxi progress) in a supportive bull market.

Position: Long buy at $420 (ask price).

CFDs: 50.

Leverage: 1:5 (margin ~$4,200 for ~$21,000 exposure).

Target: Ride upward momentum to $450+ if bull trend resumes.

Favorable outcome (bull market supports rise):

Price climbs to $450 in days/weeks.

Profit: ~$30 per CFD → total ~$1,500 (strong return on margin, fees minimal short-term).

What is a Short Position?

A short position occurs when a trader speculates that the price of an asset will fall. In a CFD context, the trader sells contracts with the expectation that they will be able to buy them back at a lower price in the future.

Mechanics of a Short Position

Opening a Short Position: To open a short position, a trader sells a CFD contract at the current market price. They effectively "borrow" the asset to sell it, with the intention of repurchasing it later at a lower price.

Holding the Position: Similar to long positions, a trader can hold a short position for as long as they maintain the required margin and interest fees.

Closing a Short Position: To close the position, the trader buys back the CFD at the current market price. The profit or loss is calculated by the difference between the selling and buying prices.

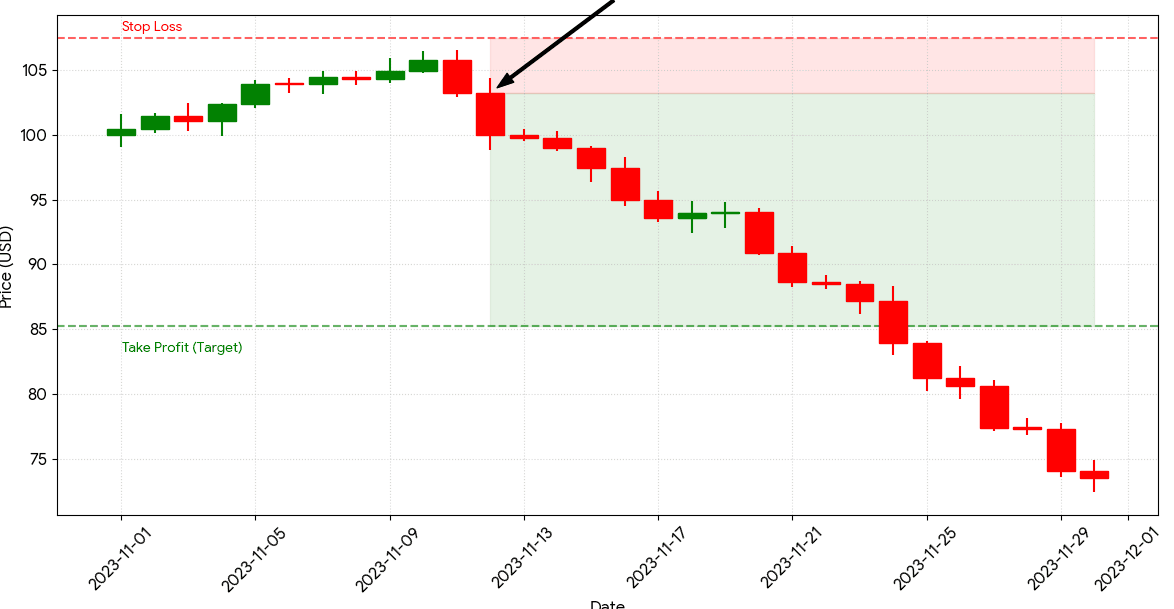

NVDA closed at $192.51 on January 29, 2026, after a +0.52% gain, trading in the $186–$193 range recently amid AI sector volatility and high valuations.)

Scenario (hypothetical but realistic CFD setup):

You anticipate a pullback (e.g., profit-taking after recent highs near $212 in late 2025, concerns over AI spending slowdown, or broader tech correction).

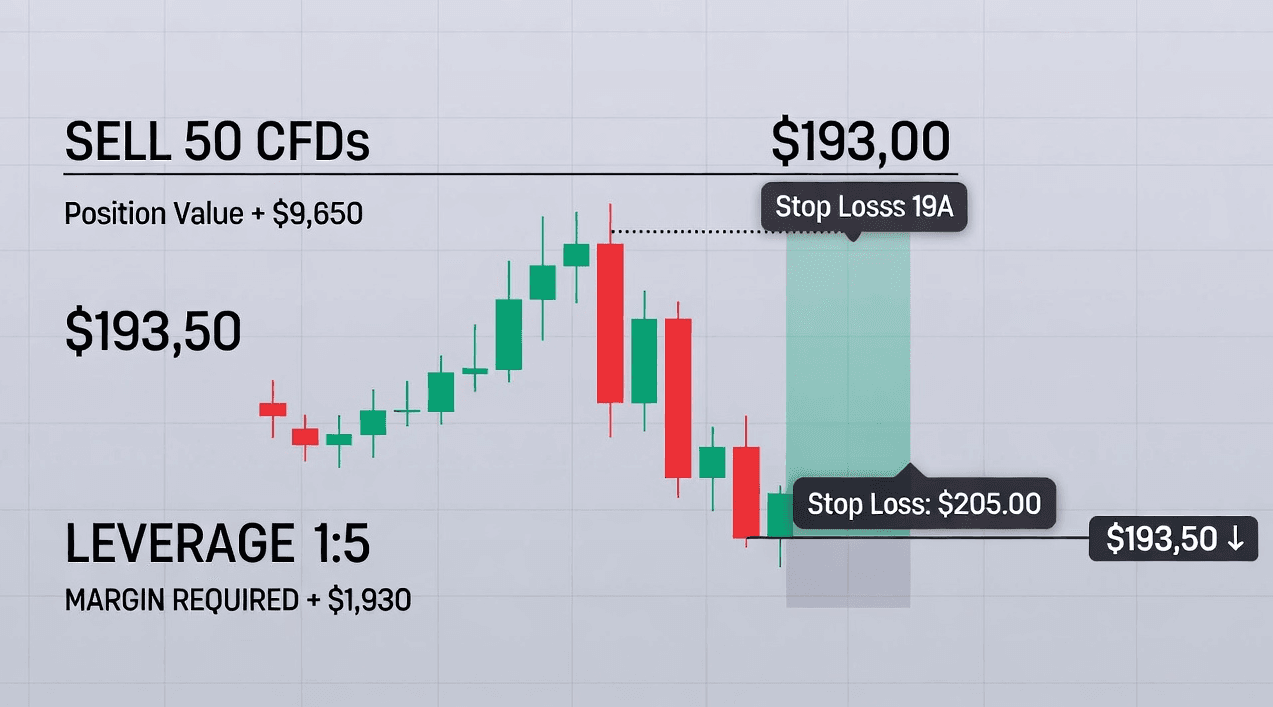

Position: Short (Sell)

Entry Sell Price: $193.00 (bid price, assuming typical CFD spread)

CFDs sold: 50

Position value: ≈ $9,650 (exposure)

Leverage: 1:5 (margin ~20%)

Margin required: ≈ $1,930

Stop loss: $205.00 (to cap upside risk if rally resumes)

Advantages of Short Positions

Profit from Declines: Short positions allow traders to profit from falling markets, offering a way to hedge against other long positions they may hold.

Market Volatility: During downturns or bearish markets, short positions can be particularly lucrative, capitalizing on rapid price declines.

Diverse Strategies: Short selling adds depth to trading strategies, allowing traders to diversify their approaches and manage risk.

Risks of Short Positions

Unlimited Loss Potential: Unlike long positions, where losses are capped to the initial investment, short positions carry the risk of unlimited losses if the asset price rises significantly.

Margin Calls: If the market moves against a short position, the trader may receive a margin call requiring them to add funds to their account to maintain the position.

Short Squeeze: A rapid price increase can trigger a short squeeze, forcing short sellers to buy back shares at much higher prices to cover their positions, leading to significant losses.

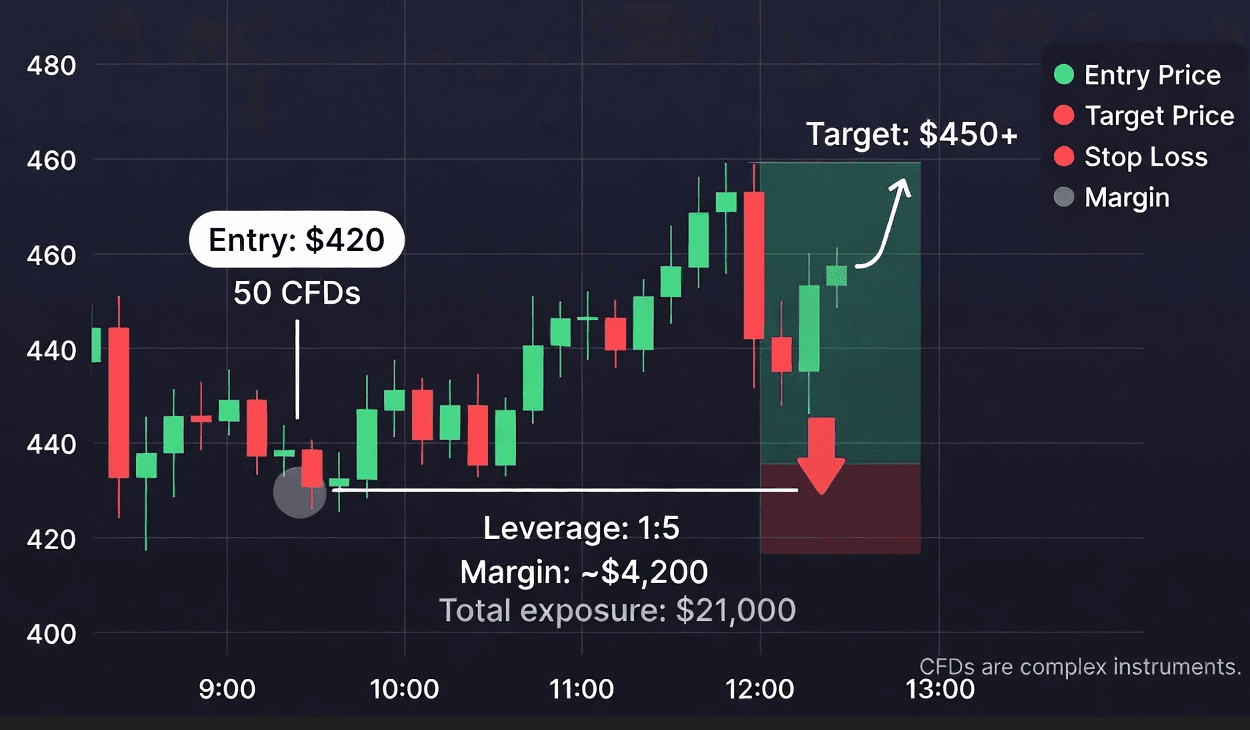

Bear Markets

In a bear market, where asset prices are generally falling, short positions are favored. Traders may capitalize on the downward pressure, profiting from price drops.

Negative Economic Indicators

Indicators such as rising unemployment rates, decreasing GDP, and declining consumer spending can signal a weakening economy. In such cases, traders may take short positions by anticipating further price declines.

Earnings Misses

Poor earnings reports, especially from well-known companies, can trigger sell-offs. Traders may take short positions ahead of such reports, theorizing that the stock price will drop once bad news is revealed.

Potential Profit Scenarios

Long Position: Potential profit is unlimited as the price can continue to rise indefinitely. The trader benefits from upward market trends.

Short Position: Profit potential is capped at the initial selling price, as the lowest the price can go is zero. The trader benefits from downward market movements.

Risk Assessment

Long Position: Risk is limited to the initial capital invested, but market downturns can lead to large financial losses.

Short Position: The risk is theoretically unlimited since there is no cap on how high the price can rise. If the price increases significantly, losses can quickly outstrip initial investments.

Market Conditions Favorability

Long Position: Best suited for bullish market conditions where traders expect prices to rise due to increased demand, solid earnings reports, or favorable economic indicators.

Short Position: Most beneficial during bearish market conditions where traders anticipate price declines due to recessionary signals, negative news, or underperformance in an asset class.

Tax Implications

Long Position: Gains from long positions are generally considered capital gains and are subject to capital gains tax when the asset is sold.

Short Position: Short selling may have different tax implications based on the jurisdiction and the duration of the short position. Regulations might apply differently to short-term versus long-term capital gains.

Psychological Factors

Long Position: Traders holding long positions may experience a sense of security and optimism, particularly in a rising market. This confidence can lead to more calculated risks and better decision-making.

Short Position: The psychological impact of short selling can differ significantly. Short sellers often experience anxiety and stress, particularly during market rallies, as their potential losses can be unlimited. This stress can lead to impulsive decision-making.

Key Metrics: Traders should look at metrics such as pricing power, earnings growth, market share, and competitive advantages when evaluating whether to go long or short on a stock.

Technical Analysis

Technical analysis employs historical price charts and trading volume patterns to forecast future price movements. By analyzing trends, support/resistance levels, and chart patterns, traders can determine optimal entry and exit points for long or short positions.

Indicators: Popular technical indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands. These tools help traders identify the appropriateness of taking a long or short position based on price momentum.

Risk Tolerance

The individual trader’s risk tolerance is crucial. Those who prefer lower risk may lean toward long positions, particularly in stable markets. Conversely, those with a higher risk appetite might find value in short positions, particularly in volatile environments.

Assessing Risk: Traders should assess their financial situation, investment goals, and emotional capacity to withstand volatility when determining how much risk to take on with long or short positions.

Trading Strategy

Different trading strategies inherently favor one position over another. For instance, swing trading may often involve taking long positions in rising markets and short positions in declining ones. Scalping, a strategy that focuses on small price changes, may utilize both long and short positions to maximize returns.

Day Trading

Day traders often look for quick profits and might switch between long and short positions multiple times within a single day based on market momentum. Their strategy is highly reactive and relies on real-time data and chart patterns.

Hedging

Traders with existing long positions may use short positions on correlated assets as a hedging strategy. This approach protects against potential losses in a bearish market environment while maintaining exposure to long-term growth.

Time Frame

The time frame for the trade plays an essential role in determining the position. Long-term investors might favor long positions, betting on the overall growth story of the underlying asset. Short-term traders may take short positions to capitalize on immediate trends or market reactions.

Long-Term Investments

Investors taking a long-term view may ignore short-term volatility, focusing instead on the overall growth potential of an asset. Such traders typically maintain longer holding periods to ride out market fluctuations.

Short-Term Trading

For short-term traders, timing is often critical. They need to monitor market trends closely and may adopt both long and short positions to capitalize on specific market movements.

Economic Environment

The broader economic landscape can heavily influence the decision-making process regarding long and short positions.

Economic Indicators

Indicators such as unemployment rates, inflation rates, and GDP growth provide crucial context. Strong economic indicators might favor long positions, while signs of recession could prompt short selling.

Market Sentiment

Traders must remain aware of overall market sentiment. Fear and pessimism could lead to a sell-off and validate short positions, while optimism could enhance the performance of long positions.

Understanding Leverage

Leverage involves borrowing capital to increase the size of a trading position. In CFD trading, leverage allows traders to open larger positions with a smaller amount of invested capital. While leverage can magnify gains, it also elevates risks.

Leverage Example

For instance, if a trader uses a leverage ratio of 10:1, they can control a position worth ten times their initial investment. If the position performs well, gains are significantly enhanced. Conversely, losses are similarly amplified, making it essential for traders to manage their leverage responsibly.

Managing Leverage Risks

Risk Assessment: Traders should assess their comfort level with leverage based on their trading experience and risk tolerance. Newer traders may opt for lower leverage ratios until they gain more experience.

Stop-Loss Orders: Implementing stop-loss orders can help protect against large losses that may occur due to unexpected market movements. This is especially critical when using leverage.

Regular Monitoring: Continuously monitoring positions and market conditions is essential when operating with leveraged trading.

The Impact of Emotions

Trading is not just a numbers game; it’s also heavily influenced by emotions. Understanding how emotions can affect decision-making is vital for effectively trading long and short positions.

Fear and Greed

Fear can often lead to panic selling, while greed can cause traders to hold onto losing positions in hopes of a recovery. Recognizing these emotions and developing a plan to manage them is crucial.

Discipline and Patience

Successful trading often requires discipline and patience. Traders need to adhere to their trading strategies without succumbing to impulsive decisions driven by short-term market movements.

Maintaining a Trading Journal

Keeping a trading journal can help traders reflect on their decisions, both successful and unsuccessful. Documenting reasons for trades, emotional responses, and market conditions helps improve future decision-making and develop a more disciplined approach.

In the realm of CFD trading, both long and short positions offer unique benefits and risks. Long positions allow traders to profit from upward price movements, while short positions enable speculation on downward trends. The choice between the two ultimately depends on individual trading strategy, market conditions, risk tolerance, and overall market sentiment.

Understanding the mechanics and implications of each position is key for successful CFD trading. Continuous education, market analysis, and adaptive strategies will equip traders to navigate the complexities of both long and short positions effectively.

Ultimately, neither position can be deemed universally better; rather, both serve as essential components of a comprehensive trading strategy that responds effectively to market dynamics. Whether choosing to go long or short, a balanced approach that considers all factors will be more conducive to thriving in the CFD trading landscape.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.