Monday Nov 10 2025 08:50

15 min

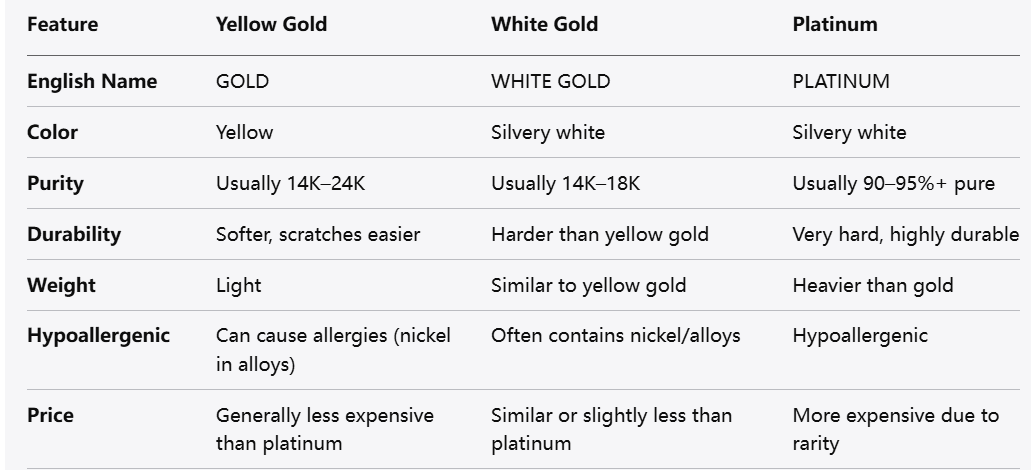

Commodity trading: Understanding precious metals is essential for anyone interested in commodity trading, wealth preservation, or diversifying assets.

Commodity market today: Among precious metals, platinum and gold have long histories of use in industry, jewelry, and as stores of value. This article examines platinum in detail, how it compares with gold and white gold, and what factors influence its price. It also discusses ways to gain exposure to precious metals and the considerations involved.

Platinum is a precious metal known for its silvery-white appearance and remarkable properties, including high density, malleability, and resistance to corrosion. It is part of a group of metals known as the platinum group metals (PGMs), which includes palladium, rhodium, iridium, osmium, and ruthenium. Platinum is among the rarest metals in the Earth's crust, which adds to its allure and value in various applications.

The origins of platinum can be traced back to the early civilizations in South America, where it was used by indigenous populations. However, it was not until the 18th century that platinum was recognized as a distinct metal. Today, platinum is celebrated for its versatility and is used in a wide range of applications, from jewelry to industrial processes.

Platinum's unique properties make it an essential component in several industries. One of its primary uses is in catalytic converters for automobiles, where it plays a crucial role in reducing harmful emissions. This application accounts for a significant portion of global platinum demand. Beyond automotive uses, platinum is pivotal in electronics, where it is used in connectors, capacitors, and other components due to its excellent conductivity and resistance to oxidation.

In the medical field, platinum is utilized in various treatments, including chemotherapy drugs, as it has the ability to interact with cellular processes. Furthermore, platinum is used in dental materials, where its durability and biocompatibility are highly valued.

Platinum is valued not only for its rarity but also for its physical and chemical properties. It possesses a high melting point, making it suitable for high-temperature applications. Additionally, platinum is less reactive than other metals, which enhances its longevity and makes it ideal for jewelry and industrial uses. Its malleability allows it to be easily shaped and molded, further expanding its applications.

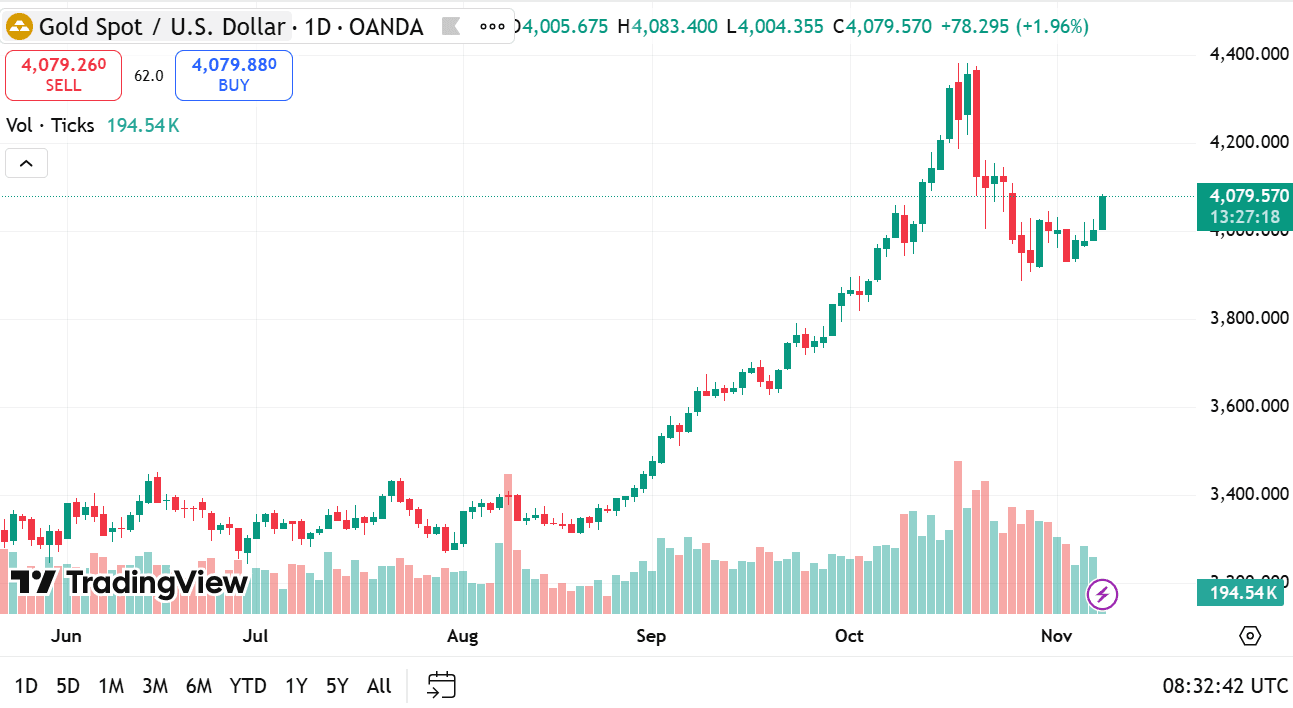

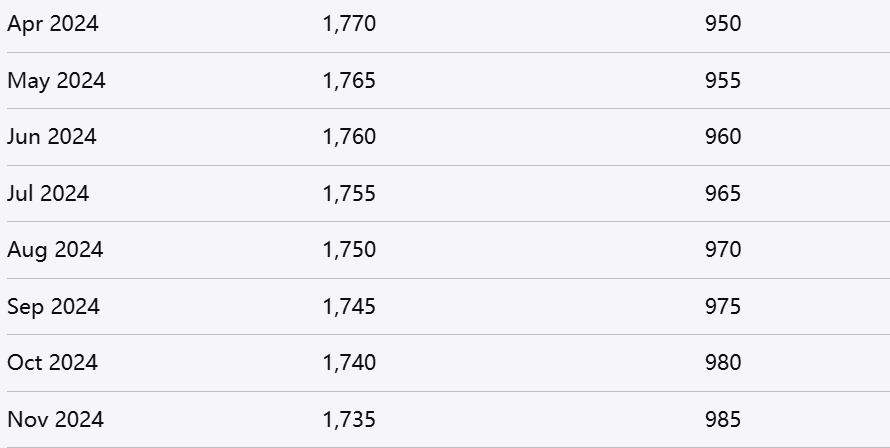

The price of platinum has experienced considerable fluctuations over the years, influenced by various economic, industrial, and geopolitical factors. Understanding these price movements is essential for anyone interested in investing in platinum or comparing it with other precious metals like gold.

Geopolitical events also impact platinum prices. Political instability in major platinum-producing regions, such as South Africa and Russia, can disrupt supply chains, leading to price volatility. Additionally, changes in market sentiment, driven by shifts in consumer preferences or economic forecasts, can further influence the price of platinum.

source: tradingview

Understanding these historical price movements provides valuable context for current market conditions and future projections. Investors should consider both short-term volatility and long-term trends when evaluating platinum as an investment.

Investing in platinum can be approached through various methods, each with its own advantages and considerations. Here are some common ways to gain exposure to this precious metal:

1. Physical Platinum

One of the most straightforward methods of investing in platinum is by purchasing physical metal in the form of bars, coins, or jewelry. This allows for direct ownership, providing a tangible asset. However, it also comes with considerations regarding storage and security. Proper storage solutions are essential to protect against theft or damage.

When buying physical platinum, it's important to source from reputable dealers to ensure authenticity and quality. Investors should also be aware of the premiums associated with physical purchases, which can vary based on market conditions and the specific form of platinum being acquired.

2. Platinum ETFs

Exchange-traded funds (ETFs) that focus on platinum offer an accessible way to gain exposure without the need to handle physical metal. These funds typically track the price of platinum and can be traded on stock exchanges like shares. Investing in platinum ETFs provides liquidity and ease of transaction, making it a popular choice for many.

ETFs often hold physical platinum or invest in platinum-related securities, providing a diversified approach to exposure. Investors should carefully review the fund's holdings, management fees, and performance history before investing.

3. Mining Stocks

Investing in companies that mine platinum allows for indirect exposure to the metal. Mining stocks can offer potential gains tied to platinum prices, but they also introduce risks associated with individual company performance and the mining sector as a whole. Factors such as operational efficiency, management decisions, and geopolitical risks can significantly impact mining stocks.

Investors should conduct thorough research on mining companies, considering their production levels, costs, and market positioning. Diversifying across multiple mining stocks can help mitigate risks associated with individual company performance.

4. Futures Contracts

For more experienced traders, platinum futures contracts provide a way to buy and sell platinum at predetermined prices for future delivery. This method allows for speculation on price movements but requires a solid understanding of market dynamics and trading strategies. Futures trading can be complex and involves a higher level of risk, making it essential for participants to have a well-defined strategy and risk management plan.

Futures contracts can be influenced by various factors, including market sentiment, economic indicators, and geopolitical events. Traders must stay informed about these factors to make educated decisions regarding their positions.

5. Mutual Funds

Certain mutual funds focus on precious metals and may include platinum as part of their portfolio. These funds can provide diversification across multiple metals and mining companies, making them a convenient option for those looking to invest in platinum indirectly.

Investors should review the fund's investment strategy, fees, and performance history before committing. Mutual funds can be an appealing option for those seeking professional management of their investments.

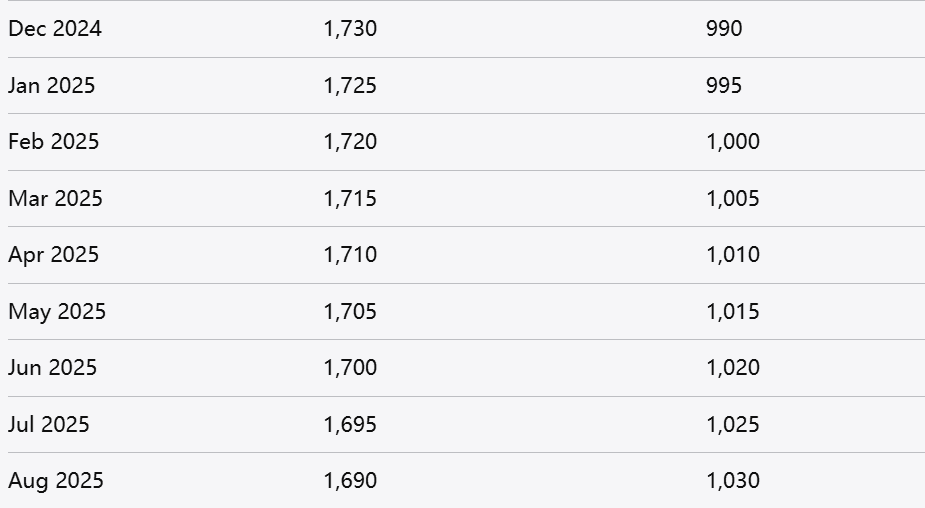

Comparing the Platinum Price with the Gold Price and White Gold Price

When comparing platinum to gold and white gold, it is essential to understand the distinctions and relationships among these precious metals. Each metal has its own characteristics and market dynamics that influence pricing.

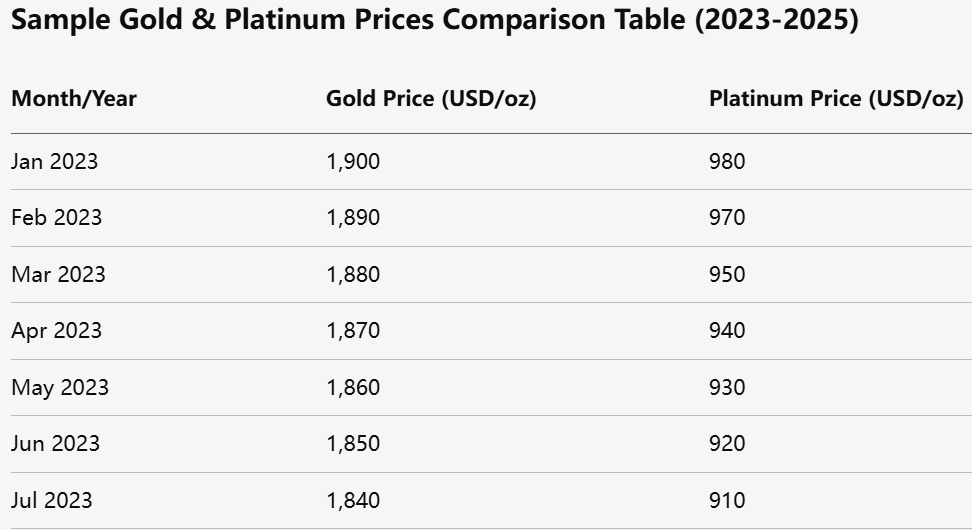

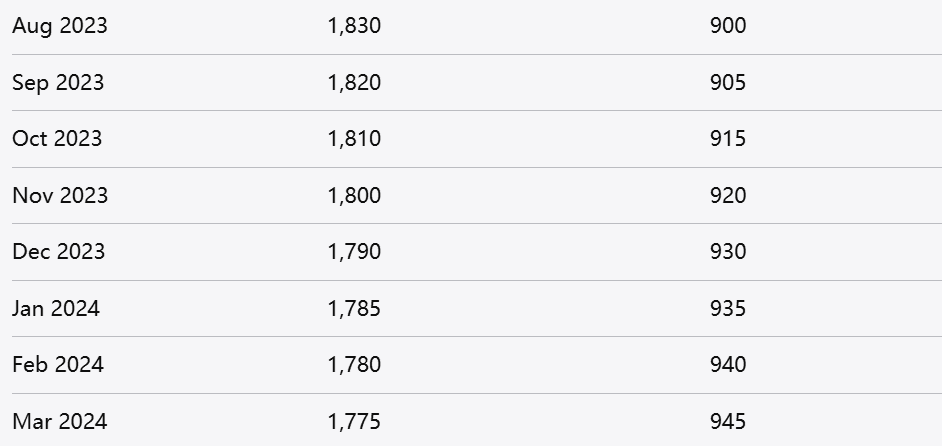

Gold has long been viewed as the benchmark for precious metals. Its historical significance as a store of value and medium of exchange has contributed to its enduring popularity. Investors often turn to gold during times of economic uncertainty, driving demand and influencing its price.

source: tradingview

The price of gold can be influenced by various factors, including inflation, interest rates, and geopolitical events. Gold typically trades at a higher price than both platinum and white gold, particularly during periods of heightened market volatility.

White gold is an alloy made from gold and other metals, such as palladium or nickel. While it is commonly used in jewelry, it does not possess the same level of industrial demand as platinum. The price of white gold is closely tied to the price of gold, but it can also be influenced by the costs of the metals used in the alloy.

Consumers often choose white gold for its aesthetic appeal and durability, but it is generally considered less valuable than platinum due to its mixed composition. Understanding the differences in value and demand between white gold and platinum is essential for those considering jewelry or investment options.

Historically, platinum has traded at a premium to gold due to its rarity and industrial applications. However, there have been instances when gold has outperformed platinum, particularly during periods of economic uncertainty. The relationship between these metals can shift based on market conditions, making it crucial for investors to stay informed about current trends.

Additionally, the price of white gold tends to follow gold prices closely, with variations based on the composition of the alloy. Investors should consider these relationships when deciding whether to invest in platinum, gold, or white gold.

Investing in platinum offers several potential benefits that can make it an appealing choice for those looking to diversify their investment portfolios. Here are some advantages to consider:

1. Diversification

Adding platinum to a collection of precious metals can enhance diversification. Different metals often react differently to market conditions, which can help mitigate risks associated with any single asset. Including platinum in a diversified portfolio can provide a hedge against inflation and economic downturns.

2. Industrial Demand

Platinum's extensive use in various industries, particularly automotive and electronics, can create strong demand. This industrial aspect provides a unique market dynamic compared to gold, which is primarily viewed as a store of wealth. The growing demand for platinum in emerging technologies, such as fuel cells and renewable energy applications, further underscores its potential as an investment.

3. Rarity

The limited availability of platinum can serve as a hedge against inflation, similar to gold. Its rarity can lead to increased interest during times of economic uncertainty, making it a worthy consideration for long-term investments. Investors often seek out platinum as a way to protect their wealth in volatile markets.

4. Jewelry Market

Platinum's desirability in the jewelry industry can further enhance its value. Many consumers prefer platinum for its durability and hypoallergenic properties, especially for high-end pieces. The growing trend of using platinum in luxury jewelry can drive demand and potentially influence prices positively.

5. Market Sentiment

Market sentiment can play a significant role in the demand for platinum. As consumers become more environmentally conscious, the demand for platinum in clean technologies may increase. This shift in consumer behavior can create new opportunities for platinum as an investment.

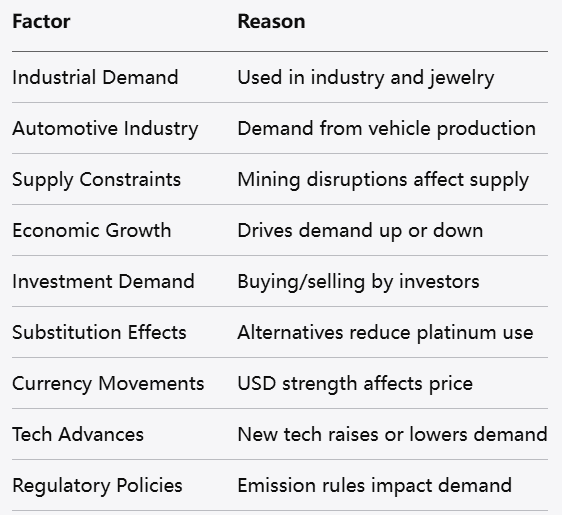

Several key factors can significantly influence the price of platinum, and understanding these factors can provide valuable insights for potential investors:

1. Supply and Demand Dynamics

The balance between supply from mining operations and demand from industries and consumers is crucial. Changes in either side of this equation can lead to fluctuations in price. For example, if demand from the automotive sector increases, it can drive up prices, while a decrease in demand can result in price declines.

2. Economic Conditions

Broader economic indicators, such as manufacturing activity and GDP growth, can affect how much platinum is utilized in various sectors. For instance, a booming automotive industry may drive demand for platinum, impacting its price. Conversely, during economic downturns, demand may decline, leading to lower prices.

3. Geopolitical Events

Political stability in major producing regions can affect supply. Disruptions due to conflicts, regulatory changes, or natural disasters can lead to price volatility, as the market reacts to potential supply shortages. Investors should stay informed about geopolitical developments that could impact platinum prices.

4. Technological Advances

Innovations that impact the use of platinum in industries can shift demand. For example, advancements in catalytic converter technologies may alter how much platinum is needed in automotive applications. Additionally, emerging technologies in clean energy, such as hydrogen fuel cells, may increase platinum demand.

5. Market Sentiment

Changes in investor perception and market trends can also influence platinum prices. Economic forecasts, news reports, and consumer behavior can all play a role in shaping market sentiment and, consequently, prices. Staying informed about market trends and investor sentiment is essential for making educated investment decisions.

In conclusion, platinum is a unique and versatile precious metal with distinct characteristics that set it apart from gold and white gold. Its industrial applications, coupled with its rarity, make it an intriguing option for those looking to diversify their investment portfolios. While the price of platinum is influenced by various factors, understanding the broader economic landscape and market dynamics is crucial when considering investments in this metal.

The decision to invest in gold or platinum ultimately depends on individual financial goals, risk tolerance, and market outlook. Both metals offer their own merits, and a thoughtful approach can lead to well-informed decisions in the realm of commodity trading. Whether one chooses to invest in platinum for its industrial demand or gold for its historical significance, understanding these intricacies is key to navigating the precious metals market effectively.

Looking to trade platinum or gold CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.