Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Nov 12 2025 08:44

13 min

Crude oil trading: Crude oil trading is a dynamic and intricate facet of commodities trading, drawing attention from various market participants including individual traders, institutional investors, and large corporations.

This article delves into the various aspects of crude oil trading, types of crude oil, historical price trends, investment strategies, and the essential indicators to watch for those interested in this market.

Types of Crude Oil

Crude oil is not a uniform substance; it exists in various forms and qualities. The main classifications of crude oil include:

West Texas Intermediate (WTI):

This type of oil is primarily produced in the United States. It is light and sweet, which makes it highly sought after for refining into gasoline and other products. WTI is the benchmark for oil prices in North America.

Brent Crude:

Sourced from the North Sea, Brent Crude is another major benchmark and is known for its slightly heavier and sulfur-rich characteristics compared to WTI. Brent typically trades at a different price from WTI due to varying supply and demand dynamics.

Dubai Crude:

This oil is a reference for crude oil prices in the Asian markets. It tends to be heavier and sourer compared to both WTI and Brent.

OPEC Reference Basket:

This basket includes several crude oils produced by countries within the Organization of the Petroleum Exporting Countries (OPEC). The basket serves as a reference price for oil produced by OPEC members.

The differences in crude oil types largely influence trading strategies, refining processes, and regional pricing.

source: tradingview

The history of crude oil prices is marked by periods of volatility and stability, reflecting global economic conditions, geopolitical events, supply and demand shifts, and technological advancements. Historical trends reveal patterns in oil pricing that are informative for traders and investors.

Early History: Oil began trading as a commodity in the mid-19th century. Prices were relatively low as production was limited and demand was just starting to emerge with the rise of industries.

1970s Oil Crisis: A pivotal moment in crude oil history occurred during the 1970s when OPEC imposed an oil embargo. This led to price shocks and increased awareness of oil’s strategic importance.

2000s Boom: The early 21st century saw a dramatic increase in oil prices due to rising demand from emerging markets and geopolitical instability. Prices peaked in the late 2000s, primarily driven by supply constraints and strong global demand.

Shale Revolution: The U.S. shale oil boom dramatically changed the landscape of crude oil prices. Advances in extraction technologies led to increased production, contributing to a subsequent drop in prices around the mid-2010s.

Understanding these historical contexts helps traders navigate present dynamics and anticipate future trends.

Investing or trading in crude oil can be both rewarding and challenging. Here are several aspects to consider before venturing into the crude oil market:

Pros

Market Demand: Crude oil is a critical resource for energy generation and transportation, creating a consistent demand base.

Diversification: Including commodities such as crude oil in an investment portfolio can provide diversification, potentially offsetting losses in other asset classes.

Global Events Impact: Geopolitical events often influence oil prices, offering the potential for profit through trading when correctly predicted.

Cons

Volatility: The crude oil market can experience sharp price fluctuations due to numerous factors, including geopolitical tensions, natural disasters, and economic data releases.

Complex Market Dynamics: Understanding the various factors that influence oil prices requires in-depth knowledge of market dynamics and events.

Regulatory Risk:

Changes in regulations, environmental policies, and geopolitical factors can impact crude oil trading significantly.

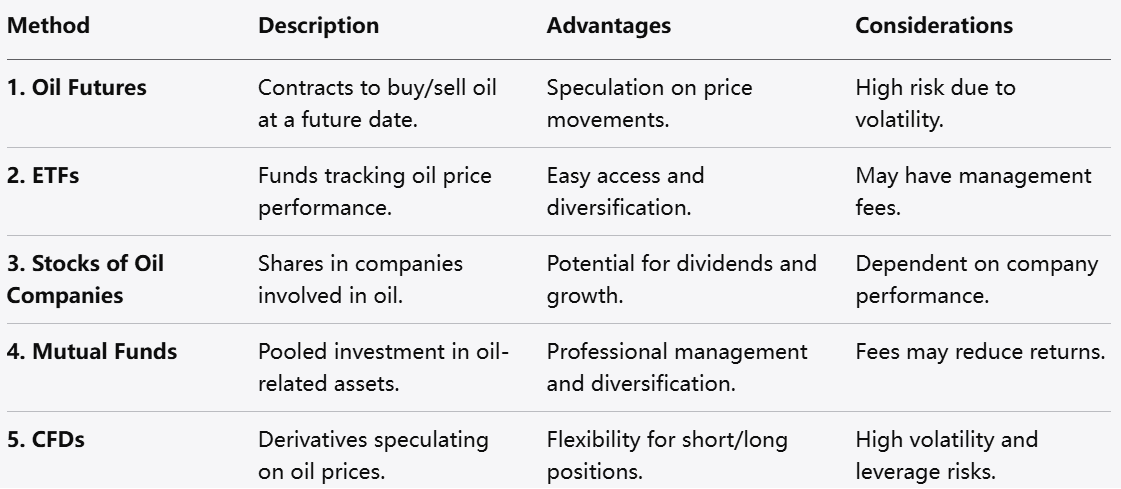

Investors and traders have several avenues available for participation in the crude oil market:

Contract for differences (CFDs) are among the most versatile options for trading crude oil. They offer various benefits that make them appealing, particularly for active traders:

Advantages of CFDs

Leverage: CFDs allow traders to open positions with a fraction of the capital required for direct oil trading, enhancing potential gains.

Flexibility: Traders can speculate on both rising and falling markets since CFDs enable going long or short on price movements.

No Ownership of Physical Oil: Traders can profit from oil price fluctuations without the complexities of storing or transporting physical oil.

Variety of Options: CFDs are available for various crude oil types, allowing traders to choose based on their strategies.

Considerations

While CFDs offer numerous advantages, they also come with risks. The use of leverage can magnify losses, and substantial market volatility can impact trading outcomes. It is essential for traders to thoroughly understand these risks before engaging with CFDs.

Investing in crude oil CFDs, while potentially rewarding, involves several inherent risks that traders must navigate:

Volatility Risk

Oil prices can fluctuate dramatically in response to geopolitical events, supply disruptions, and changes in global demand. This volatility can result in rapid losses, particularly when using leverage.

Market Liquidity

Liquidity refers to how easily an asset can be bought or sold without affecting its price. While crude oil markets are often liquid, certain market conditions can lead to reduced liquidity, impacting trade execution.

Regulatory Risks

Changes in regulations, particularly concerning environmental policies, can influence crude oil prices and impact trading conditions. Traders must stay informed about regulatory developments that could affect the market.

Counterparty Risk

Engaging in CFD trading involves a broker or financial institution as the counterparty. If the broker encounters financial difficulties, it may pose risks to the trader's capital.

Strategy Risk

Not all trading strategies are well-suited for volatile markets like crude oil. Traders must ensure that their approach is robust and adaptable to changing market conditions.

Successful trading in crude oil involves monitoring various indicators that provide insight into market conditions:

1. Supply and Demand Data

Reports detailing crude oil production levels and consumption rates are foundational in understanding market dynamics. Excess supply can lead to falling prices, while increased demand may spur price rises.

2. Geopolitical Events

Geopolitical tensions, particularly in oil-producing regions, can significantly impact supply and demand dynamics. Traders should stay updated on events that could disrupt oil production or transportation.

3. Economic Indicators

Economic indicators such as GDP growth, employment rates, and industrial production provide insight into demand for oil. Strong economic data often correlates with increased oil consumption.

4. OPEC Announcements

The Organization of the Petroleum Exporting Countries frequently affects oil prices through production decisions. Changes in OPEC policy can signal future price movements and must be closely monitored.

5. Inventory Reports

Weekly inventory reports provide information on crude oil stockpiles, influencing market sentiment and perceptions on balance between supply and demand.

Predicting future crude oil prices remains a complex endeavor influenced by numerous factors. While no forecasts are without uncertainty, several trends can be observed:

Crude oil trading offers a multifaceted approach to engaging with one of the world’s most critical commodities. Understanding the different types of crude oil, historical price movements, and the various ways to trade can empower market participants to make informed decisions.

As global dynamics evolve, so too will the landscape of crude oil trading. By paying attention to market indicators and trends, traders can navigate the complexities of this market effectively. With the right knowledge and strategies, participating in crude oil trading can be both rewarding and enlightening.

Looking to trade oil CFDs in Saudi Arabia? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.