Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Nov 14 2025 08:59

11 min

Crypto day trading strategy: Cryptocurrency day trading has become increasingly popular as digital assets continue to gain mainstream attention and adoption.

Crypto market today: The volatile nature of cryptocurrencies offers day traders ample opportunities to profit from price fluctuations within short time frames. However, day trading crypto requires a solid understanding of market dynamics, technical analysis, risk management, and discipline.

This article will guide you through the essentials of day trading cryptocurrency as a beginner, covering everything from the basics to advanced strategies, tools, and psychological aspects.

Day trading in cryptocurrency involves buying and selling digital assets within the same trading day to capitalize on short-term price movements. Unlike long-term investing, where assets are held for weeks, months, or years, day traders aim to make multiple trades throughout the day to generate profits from small price changes.

Crypto day trading requires constant market monitoring and quick decision-making since cryptocurrency markets operate 24/7, unlike traditional stock markets.

Several reasons make cryptocurrency an attractive market for day traders:

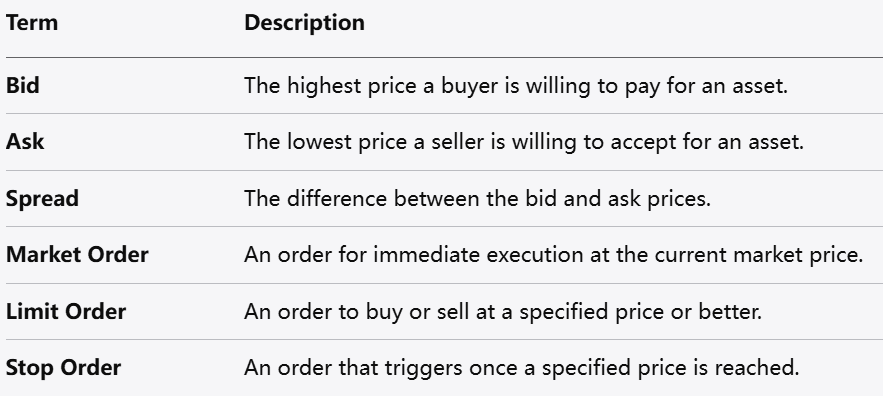

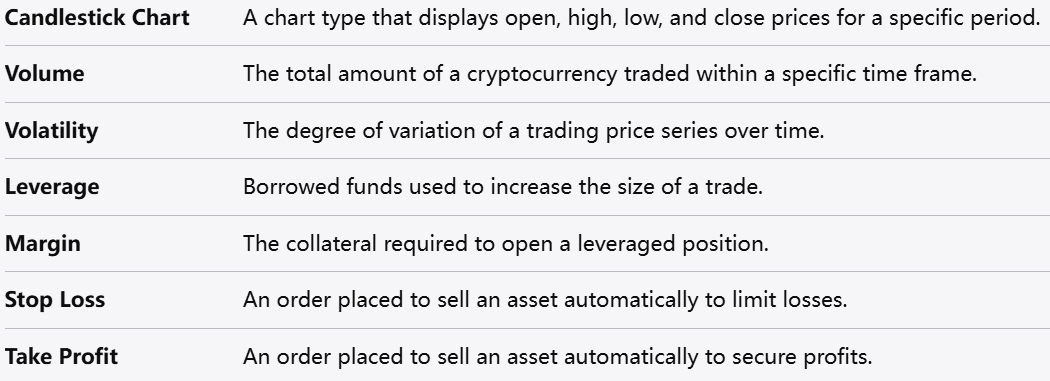

Before diving into strategies, familiarize yourself with some essential terms:

Choosing the right tools and platforms is crucial for effective day trading.

Trading Platforms and Exchanges

Binance, Coinbase Pro, Kraken, Bitfinex, and others: Offer advanced trading interfaces, various order types, and high liquidity.

Look for platforms with low trading fees, strong security, and reliable customer support.

Charting and Analysis Tools

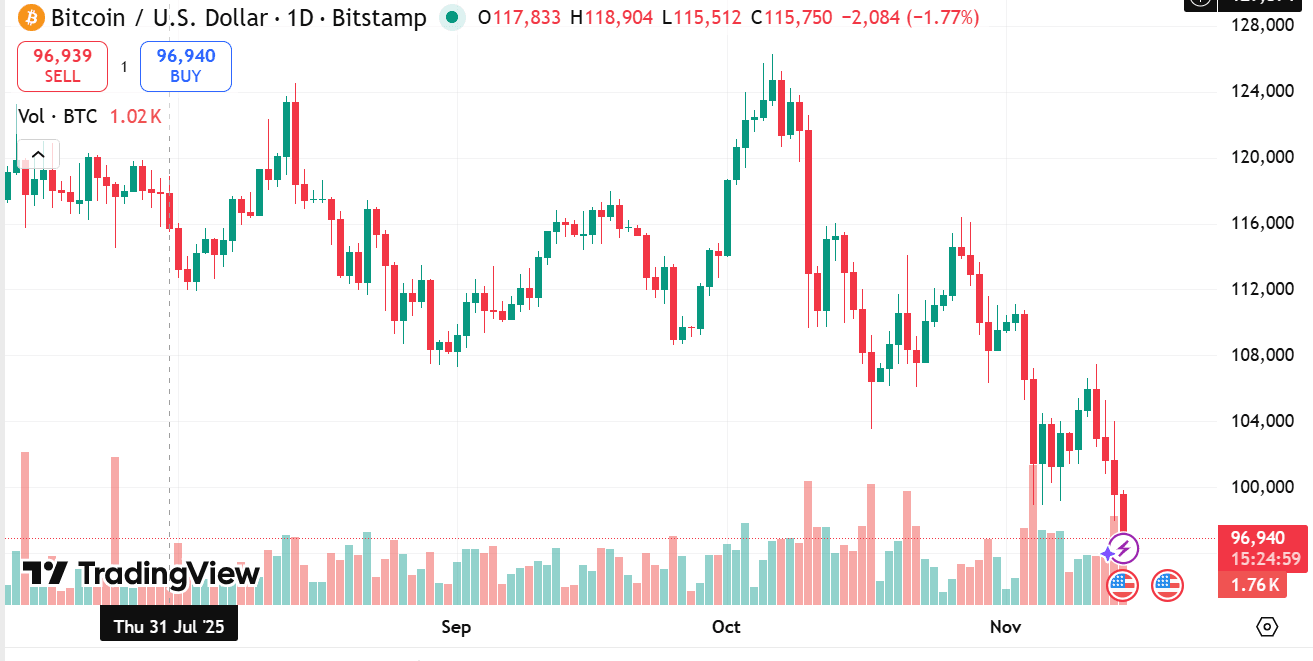

TradingView: One of the most popular charting platforms with customizable indicators and drawing tools.

Many exchanges offer integrated charts, but dedicated tools provide more flexibility.

Portfolio and Risk Management Tools

source: tradingview

Track your trades and portfolio performance.

Use tools that help calculate risk/reward ratios.

News and Data Feeds

Stay updated with crypto news from sites like CoinDesk, CoinTelegraph.

Use market sentiment tools and social media monitoring for insights.

Volatility is both a friend and foe of day traders. High volatility means bigger price swings, which translates to potential profits but also higher risk.

Factors influencing crypto volatility:

1, Regulatory news or announcements

2, Technological developments or upgrades

3, Market sentiment and social media hype

4, Large trades or “whales” moving the market

5, Macro-economic events impacting global markets

Understanding volatility helps you set appropriate stop losses and position sizes to manage risk effectively.

Fundamental Analysis (FA)

FA evaluates the intrinsic value of a cryptocurrency by analyzing its technology, team, adoption, use cases, partnerships, and overall market conditions. While FA is more common in long-term investing, day traders may use it to identify coins with strong potential or upcoming catalysts.

Technical Analysis (TA)

TA focuses on analyzing historical price data and volume to predict future price movements. It uses charts and technical indicators to identify patterns, trends, and potential entry/exit points.

For day trading, technical analysis is often the primary tool, as it aligns with short-term price action.

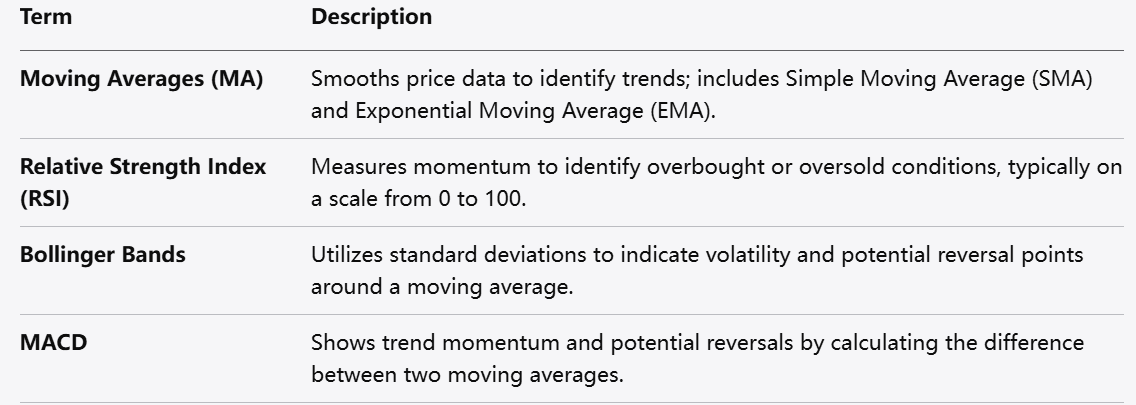

Here are some widely used indicators in crypto day trading:

Moving Averages (MA): Smooth price data to identify trends. Common types include Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Relative Strength Index (RSI): Measures momentum to identify overbought or oversold conditions.

Bollinger Bands: Use standard deviations to indicate volatility and potential reversal points.

MACD (Moving Average Convergence Divergence): Shows trend momentum and potential reversals.

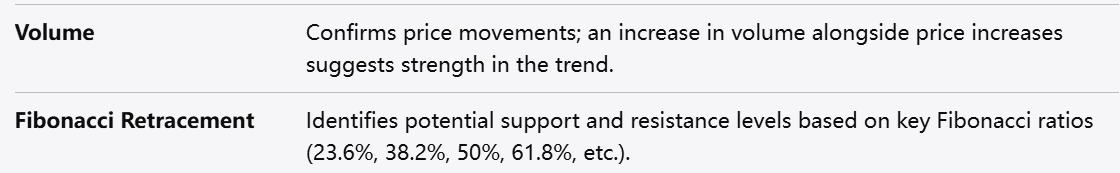

Volume: Confirms price movements; rising volume with price moves indicates strength.

Fibonacci Retracement: Identifies potential support and resistance levels based on Fibonacci ratios.

Combining multiple indicators improves decision-making.

8.1 Scalping

Scalping involves making dozens or hundreds of trades in a day to profit from small price changes. It requires:

Fast execution

Tight spreads

High liquidity pairs

Strict risk management

8.2 Momentum Trading

This strategy focuses on assets showing strong price momentum. Traders enter trades when price breaks out with volume and ride the trend until momentum fades.

8.3 Range Trading

In range trading, traders identify support and resistance levels and buy near support and sell near resistance, capitalizing on price oscillations within a range.

8.4 Breakout Trading

Breakout traders wait for price to move beyond key support or resistance levels, entering trades on the breakout with the expectation of a strong trend continuation.

8.5 News-Based Trading

Traders capitalize on market volatility following news releases, such as regulatory announcements or technological upgrades.

Risk management is critical to long-term success in day trading.

Position Sizing: Never risk more than a small percentage of your trading capital on a single trade (commonly 1-2%).

Stop Loss Orders: Always set stop losses to limit potential losses.

Take Profit Levels: Define exit points to lock in profits.

Risk/Reward Ratio: Aim for trades with a risk/reward ratio of at least 1:2 or 1:3.

Avoid Over-Leveraging: While leverage can amplify gains, it also increases risk.

Diversify Trades: Avoid putting all capital into one trade or asset.

A trading plan helps maintain discipline and consistency.

Define your trading goals and risk tolerance.

Choose your preferred trading style and strategies.

Set rules for trade entries, exits, and stop losses.

Determine how much capital to allocate.

Keep a trading journal to review performance and learn from mistakes.

Emotional control is essential when trading volatile assets like crypto.

Avoid Greed and Fear: Stick to your plan and avoid chasing losses or overtrading.

Stay Disciplined: Follow your strategy even during losing streaks.

Manage Stress: Take breaks and avoid trading when emotionally compromised.

Continuous Learning: Adapt and improve your approach based on experience.

Trading without a plan or strategy.

Ignoring risk management.

Overtrading or revenge trading.

Chasing pump-and-dump schemes.

Neglecting to keep up with market news.

Using excessive leverage.

Failing to learn from mistakes.

Day trading cryptocurrency can be a lucrative but challenging endeavor. As a beginner, success requires solid preparation, learning, discipline, and risk management. By understanding market dynamics, using the right tools, applying effective strategies, and maintaining emotional control, you can improve your chances of becoming a consistent and profitable crypto day trader.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.