Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Tuesday Nov 4 2025 10:15

7 min

Crypto market analysis: Chainlink (LINK) plays a pivotal role in the cryptocurrency ecosystem by connecting smart contracts with real-world data, which expands the usability and scope of decentralized applications.

Understanding current market dynamics and potential future trends around LINK/USD requires a comprehensive look at several factors influencing its trajectory without relying on specific price points or forecasts.

The LINK/USD pair operates within a broader cryptocurrency market that remains sensitive to macroeconomic developments, regulatory shifts, and technological advancements. As the digital asset landscape evolves, Chainlink's position as a leading oracle network contributes to its visibility and market activity.

Present-day trading of LINK is influenced by general market sentiment toward cryptocurrencies, including regulatory developments worldwide. Uncertainty or clarity in policies from major economies can impact trading volumes and liquidity. Additionally, broader market trends such as shifts in risk appetite or capital flows affect LINK's movement, as market participants adjust their allocations based on changing conditions.

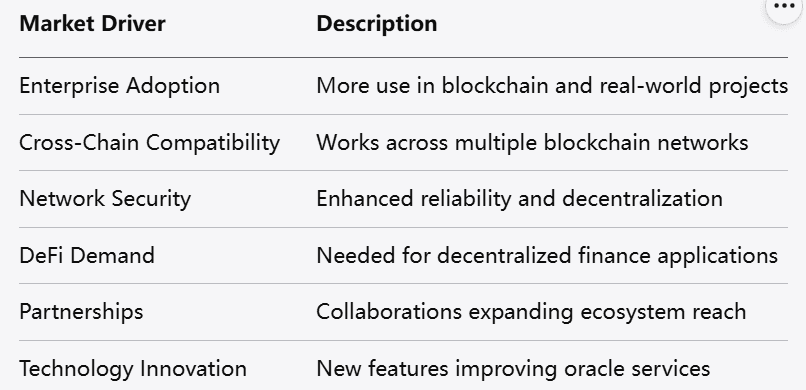

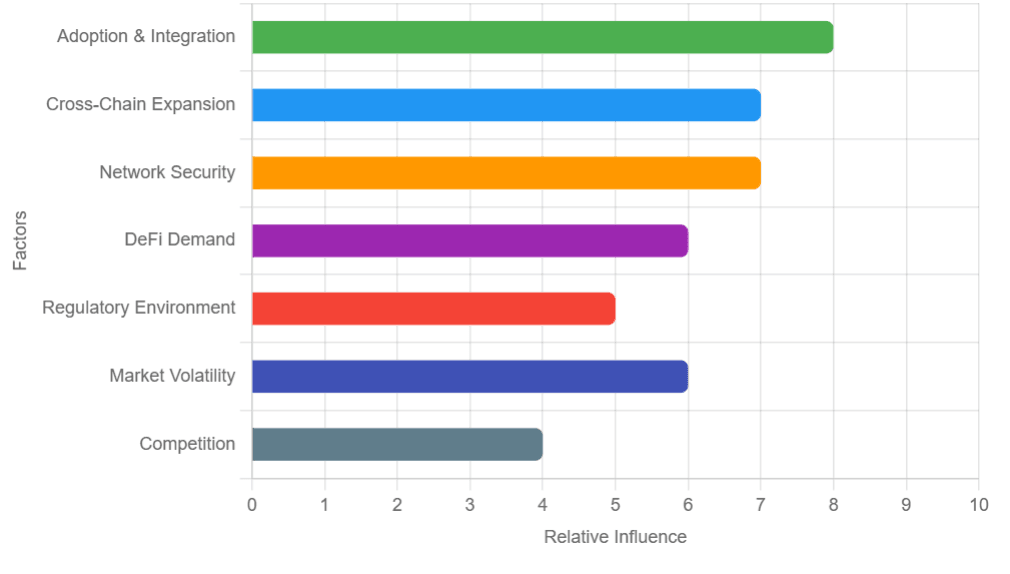

Chainlink's integration in decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain projects continues to support its relevance. Partnerships and collaborations with blockchain platforms can lead to increased adoption, which, in turn, influences market interest.

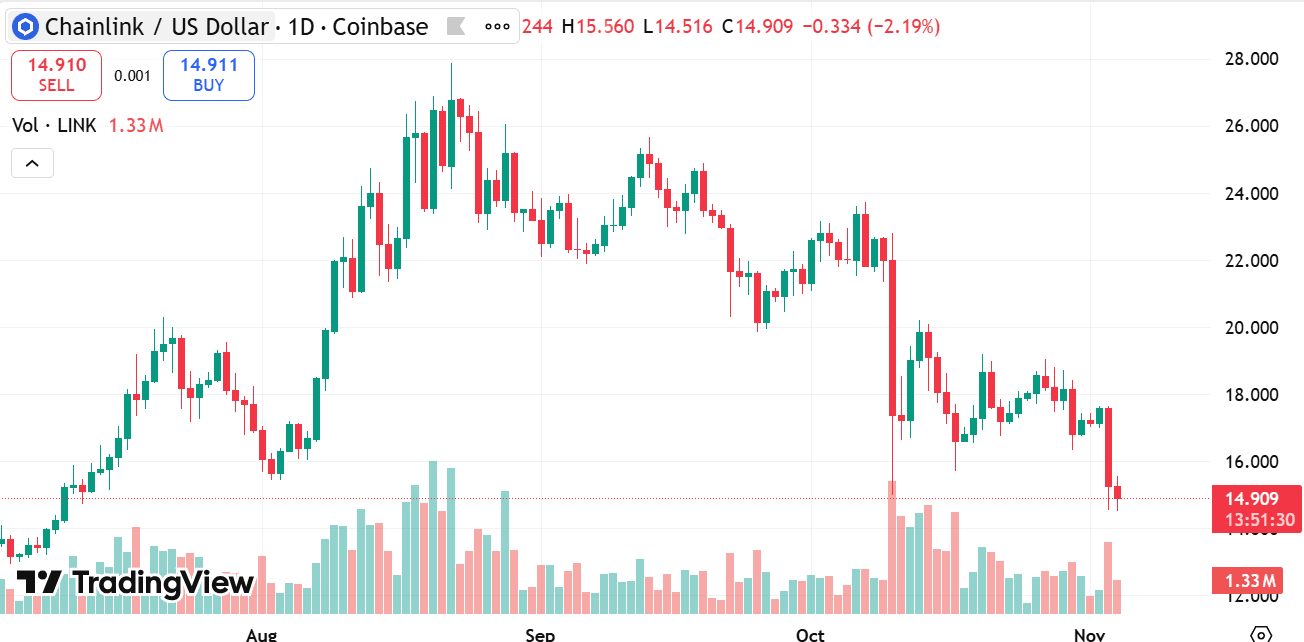

source: tradingview

Technological Developments and Network Upgrades

Chainlink’s ongoing efforts to improve its network capabilities, including expanding data sources and enhancing security, shape perceptions around its future usability. New features or upgrades that improve efficiency or broaden the use cases for oracles can impact market activity surrounding LINK.

The introduction of cross-chain compatibility and decentralized randomness functions further bolster Chainlink’s utility. Such innovations strengthen its role in the wider blockchain ecosystem, potentially influencing participant sentiment.

LINK’s price behavior is closely tied to the overall sentiment in the crypto market. When markets lean toward risk-taking, assets like LINK tend to experience increased activity. Conversely, during periods of uncertainty or tightening liquidity, trading volumes and price stability can be affected.

Movements in Bitcoin and Ethereum often ripple through altcoins, including Chainlink. As these major cryptocurrencies set the tone, LINK's patterns typically follow broader market cycles, reflecting correlations seen across the crypto space.

Regulatory Environment

The regulatory landscape for digital assets continues to evolve, with governments considering frameworks to govern cryptocurrency markets. Any shifts in regulations concerning data privacy, smart contracts, or decentralized finance can influence Chainlink’s adoption and, by extension, its market dynamics.

Clarity on regulatory matters may reduce uncertainty and encourage broader integration of oracle services, while restrictive measures could lead to cautious trading behavior.

Chainlink’s decentralized oracle network is critical for enabling smart contracts to securely interact with off-chain data. This function is essential for many DeFi applications, which rely on accurate, tamper-proof information for lending, derivatives, insurance, and more.

As DeFi continues growing and diversifying, Chainlink’s services remain in demand. Expanding use cases and the increasing complexity of decentralized applications create a foundation for sustained interest in LINK tokens.

Furthermore, Chainlink’s collaboration with projects across multiple blockchain platforms enhances its network effect, encouraging integration and use beyond any single ecosystem.

Adoption by Enterprises and Blockchain Projects

Broader adoption of Chainlink’s technology by enterprises and emerging blockchain projects can contribute to increased demand for LINK tokens. Real-world partnerships that demonstrate the utility of decentralized oracles in various industries may stimulate market activity.

The ability to bridge on-chain and off-chain data securely opens new pathways for blockchain applications in finance, supply chain, insurance, and gaming, among others.

Expanding Cross-Chain Functionality

Chainlink’s efforts to support multiple blockchain environments through cross-chain compatibility can increase its footprint. This expansion allows different blockchain networks to access reliable external data, enhancing interoperability and value proposition.

As more ecosystems integrate Chainlink oracles, this broader reach could influence trading sentiment and interest in LINK.

Network Security and Decentralization

The security and decentralization of oracle data are vital for maintaining trust in Chainlink’s services. Improvements in these areas, including increased node operator diversity and enhanced validation methods, help reinforce confidence in the network’s reliability.

Strong network security reduces the risk of data manipulation, which is critical for applications that depend on accurate information feeds.

Competition from Other Oracle Providers

The decentralized oracle space is becoming increasingly competitive, with several projects vying to provide reliable external data to smart contracts. This competition places pressure on Chainlink to maintain its technological edge and network reliability to retain market interest.

New entrants or innovations from competitors could shift market dynamics and influence perceptions around Chainlink’s growth potential.

Market Volatility and External Factors

Cryptocurrency markets are known for their volatility, and LINK is no exception. Price fluctuations can be influenced by broader economic factors such as shifts in monetary policy, global financial uncertainty, or changes in investor sentiment toward digital assets.

External shocks or changes in regulation can also lead to rapid market adjustments, affecting LINK’s trading patterns.

While specific price predictions are not the focus, the overall outlook for Chainlink depends on how effectively it continues to expand its use cases and maintain network integrity. Market conditions, evolving blockchain adoption, and regulatory developments will shape the path forward.

Participants should monitor Chainlink’s technological progress, partnerships, and integration across blockchain ecosystems, alongside broader crypto market trends. Maintaining awareness of these elements helps form a clearer picture of the potential directions for LINK/USD.

In a rapidly changing environment, Chainlink’s role as a leading oracle provider positions it as a notable player in the ongoing evolution of decentralized applications, affecting its market dynamics.

Chainlink remains a foundational component in the expanding world of blockchain applications by enabling smart contracts to interact with real-world data securely. The LINK/USD market moves in response to a mix of technological advances, market sentiment, regulatory changes, and broader crypto trends.

The interplay of adoption growth, innovation, and external market forces will continue to influence how LINK performs within the digital asset landscape. Keeping an eye on these factors provides valuable context for understanding Chainlink’s evolving position and potential trajectories in the crypto market.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.