Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Tuesday Jan 6 2026 10:07

19 min

Crypto Trading Basics: The world of cryptocurrency has not only given rise to new forms of currency but has also birthed numerous innovative financial concepts that aim to maximize the returns on investments.

Among these concepts, yield farming has emerged as a popular practice, enticing both novice traders and seasoned investors. This article will delve deep into the concept of yield farming, exploring its mechanics, advantages, risks, and steps for getting started.

What Is Yield Farming?

Yield farming is a method of earning rewards with cryptocurrency holdings. It involves lending or staking your crypto assets in exchange for interest or additional tokens. Yield farming's primary goal is to increase the amount of cryptocurrency you possess over time.

In simpler terms, it’s akin to putting money into a savings account to earn interest—except in this case, you're using blockchain-based protocols and decentralized finance (DeFi) applications.

How Yield Farming Works

When a user engages in yield farming, they typically provide liquidity to a decentralized finance platform. This liquidity is often deposited into automated market makers (AMMs) or liquidity pools, where the funds are utilized for various purposes, such as facilitating trades or lending to other users.

Here’s a step-by-step breakdown of how yield farming works:

A variety of platforms facilitate yield farming, each with its unique features and benefits. Here are some of the most popular platforms:

1. Uniswap

Uniswap is one of the leading decentralized exchanges (DEXs) that allows users to trade various cryptocurrencies directly from their wallets. By providing liquidity to Uniswap pools, users can earn a portion of the transaction fees generated by trades.

2. Aave

Aave is a popular lending protocol where users can lend their cryptocurrency and earn interest. Users can also borrow against their collateral, giving them more flexibility in managing their assets.

3. Compound

Compound is another leading DeFi lending protocol that allows users to lend or borrow cryptocurrencies. Lenders earn interest based on the market rates set by the protocol, contributing to a dynamic yield farming experience.

4. Yearn.Finance

Yearn.Finance automates yield farming strategies, optimizing users' returns across various platforms and protocols. By aggregates liquidity across different sources, Yearn.Finance helps maximize yields effectively.

5. SushiSwap

SushiSwap is a community-driven DEX that offers yield farming opportunities, such as providing liquidity to its pools in return for SUSHI tokens, which can be staked for additional rewards.

Yield farming offers several benefits that make it an appealing opportunity for cryptocurrency enthusiasts:

1. High Returns

One of the primary attractions of yield farming is the potential for high returns. Depending on the asset and platform, yields can significantly surpass traditional interest rates found in conventional finance.

2. Flexibility

Yield farming allows for flexibility in choosing assets and protocols. Users can select the farm that best suits their risk tolerance and investment goals, whether they prefer stablecoins or more volatile assets.

3. Passive Income Generation

Yield farming offers a way to earn passive income on idle crypto assets. By lending or staking coins that might otherwise remain unused, investors can generate returns without actively trading.

4. Enhanced Liquidity

Participating in yield farming helps improve liquidity in decentralized exchanges, facilitating smoother transactions and contributing to the overall growth of the DeFi ecosystem.

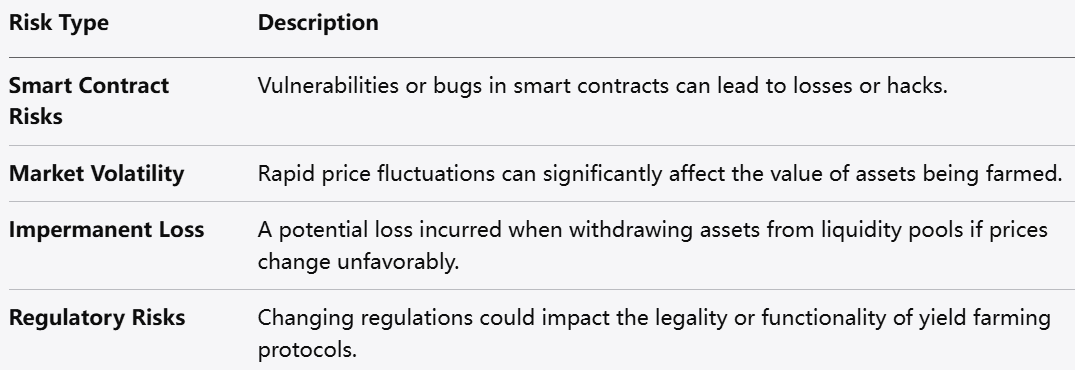

While yield farming presents lucrative opportunities, it also comes with significant risks that investors must consider:

1. Smart Contract Risks

Yield farming relies heavily on smart contracts, which are programs that execute predetermined actions on the blockchain. Bugs or vulnerabilities in smart contracts can expose users to losses or hacks.

2. Market Volatility

The crypto market is inherently volatile, and the assets in yield farming can experience rapid price fluctuations. A significant decline in asset value can result in substantial losses, particularly if liquidations occur.

3. Impermanent Loss

When providing liquidity to pools, a phenomenon called impermanent loss may occur. This happens when the price of deposited assets changes significantly compared to when they were deposited. If users withdraw their assets at that point, they may end up with less value than they initially provided.

4. Regulatory Risks

The regulatory landscape surrounding cryptocurrencies and DeFi is still evolving. Regulatory changes could impact the legality or functionality of yield farming protocols, leading to unforeseen challenges.

If you’re interested in yield farming, here’s a step-by-step guide on how to get started:

Step 1: Choose Your Crypto Wallet

Before yield farming, you’ll need a cryptocurrency wallet that supports the assets you plan to deposit. Common wallets include:

MetaMask: A popular Ethereum wallet that supports various tokens.

Trust Wallet: A mobile wallet that supports multiple blockchains.

Ledger: A hardware wallet offering enhanced security for long-term storage.

Step 2: Obtain Cryptocurrency

Once you have your wallet set up, you’ll need to acquire the cryptocurrencies you plan to use for yield farming. You can purchase crypto from exchanges like Binance, Coinbase, or Kraken and then transfer it to your wallet.

Step 3: Select a Yield Farming Protocol

Research and choose a yield farming platform that aligns with your investment goals. Consider factors such as:

APY (Annual Percentage Yield): The potential returns offered by different protocols.

Risk Level: Assess your risk tolerance and choose a platform that matches it.

Liquidity Pools: Identify available liquidity pools and the assets they support.

Step 4: Deposit Cryptocurrency

Once you’ve selected a platform, connect your wallet and deposit the cryptocurrency you wish to farm. Ensure you follow the procedures for providing liquidity or staking your assets.

Step 5: Monitor Your Investment

Yield farming requires ongoing monitoring. Track your rewards, the performance of the assets you’re farming, and any changes in the protocol’s terms that could affect your investment.

Step 6: Withdraw Your Earnings

When you’re satisfied with your returns, you can withdraw your assets and earnings. Be mindful of any potential fees involved in the withdrawal process.

As with any investment, having a strategy is crucial for maximizing returns and minimizing risks in yield farming. Here are some effective strategies:

1. Diversification

Just as with traditional investing, diversifying your yield farming investments can help mitigate risk. Consider allocating your assets across multiple protocols or liquidity pools to achieve a more balanced investment.

2. Time Your Exit

Monitoring the price trends of the assets you’re farming is essential. Timing your exit from a yield farming protocol can maximize your returns and minimize potential losses due to market fluctuations.

3. Stay Informed

Regularly staying updated on market trends, protocol updates, and community forums can help you remain informed about changes that could affect your investments.

4. Assess Risk vs. Reward

Before committing significant funds to a yield farming opportunity, evaluate the potential rewards against the associated risks. Not all yield farms are trusted, and ensuring the protocol's credibility is vital.

Yield Farming

Traditional Investing

While Yield Farming offers exciting opportunities for high yields in the decentralized world of DeFi, it requires active management, technical know-how, and tolerance for risks like impermanent loss and smart contract vulnerabilities. For many investors—especially beginners or those preferring a more familiar, regulated environment—there’s an alternative way to gain exposure to cryptocurrency price movements without directly holding digital assets: Crypto CFD Trading.

Crypto CFD (Contract for Difference) trading allows you to speculate on the price direction of popular cryptocurrencies such as Bitcoin, Ethereum, Solana, and many others without owning the underlying coins. You simply open a position predicting whether the price will rise (go long) or fall (go short), and your profit or loss is determined by the difference between the entry and exit prices. This approach offers several advantages: built-in leverage to amplify potential returns (with corresponding risk), no need for wallets or private keys, fast execution, and the ability to trade 24/7 in a centralized, regulated platform.

One highly regarded platform for crypto CFD trading is markets.com. Established and regulated in multiple jurisdictions, markets.com provides a user-friendly interface, competitive spreads, powerful charting tools via MT4/MT5 integration, and a wide selection of crypto pairs alongside traditional assets like forex, stocks, and commodities. New users can start with a demo account to practice risk-free, and the platform supports both desktop and mobile trading for convenience.

Cryptocurrency trading has gained immense popularity as more investors look for opportunities in the digital asset space. One of the effective ways to trade cryptocurrencies is through Contracts for Difference (CFDs), allowing traders to speculate on price movements without owning the underlying assets. Markets.com offers a user-friendly platform for crypto CFD trading. This guide will walk you through the steps to get started.

Understanding Crypto CFDs

What Are Crypto CFDs?

CFDs are financial derivatives that enable traders to speculate on the price movements of assets without actually buying or selling the assets themselves. In the context of cryptocurrencies, CFDs allow you to trade on the price changes of popular digital currencies like Bitcoin, Ethereum, and others.

Key Benefits of Trading Crypto CFDs

Setting Up Your Markets.com Account

1. Visit the Markets.com Website

Go to the official Markets.com site and familiarize yourself with the platform. You can explore the various resources they provide, including educational materials, market data, and more.

2. Create an Account

Click on the “Sign Up” button to start the registration process. You will need to provide:

Basic Information: Your name, email address, phone number, and a password.

Preferred Account Type: Decide whether you want a demo account for practice or a live trading account.

3. Verify Your Identity

To comply with regulatory requirements, you must verify your identity. Prepare the following documents:

Proof of Identity: Such as a government-issued ID (e.g., passport or driver's license).

Proof of Address: A recent utility bill, bank statement, or similar document.

Upload these documents as prompted. Verification usually takes a short time, and you’ll be notified once your account is approved.

Fund Your Trading Account

Once your account is verified, the next step is to deposit funds:

1. Choose a Funding Method

Markets.com supports multiple payment methods, including:

Bank Transfers

Credit/Debit Cards

E-wallets (like PayPal or Skrill, depending on availability in your region)

Choose a method that suits you and follow the prompts to complete the deposit.

2. Minimum Deposit Requirements

Be aware of the minimum deposit requirements set by Markets.com. Ensure that you deposit an amount that aligns with your trading strategy and risk management practices.

Explore the Trading Platform

Before you start trading, take some time to familiarize yourself with the Markets.com trading interface:

1. Trading Tools and Features

Markets.com offers various tools and features designed to enhance your trading experience:

Real-time Charts: Access dynamic price charts that support technical analysis.

Indicators and Analysis Tools: Utilize various indicators to inform your trading strategy.

Market News: Stay updated with the latest news and market trends impacting cryptocurrencies.

2. Demo Trading

If you initially opted for a demo account, take advantage of this opportunity to practice trading without risking real money. Use this time to test strategies and develop your trading skills.

Start Trading Crypto CFDs

1. Select Your Crypto Asset

Navigate to the crypto section within the Markets.com platform and choose the cryptocurrency you wish to trade. Popular options include:

2. Analyze the Market

Before placing any trades, perform thorough market analysis. Consider both technical and fundamental analysis to support your trading decisions. Look at price trends, market news, and any relevant economic factors.

3. Place Your Trade

To execute a trade, follow these steps:

4. Monitor Your Position

Once your trade is active, continue to monitor your position and the overall market. Markets can be volatile, and reacting to price movements can help you maximize profits or minimize losses.

Withdraw Your Profits

If your trades have been successful and you’d like to withdraw your profits, navigate to the withdrawal section of the platform. Choose your preferred withdrawal method and follow the instructions. Be mindful of withdrawal limits and any applicable fees.

Risk Management

1. Set a Trading Plan

Establish a clear trading plan that outlines your goals, risk tolerance, and strategy. Consistency is key in trading success.

2. Use Stop Loss Orders

Implement stop-loss orders to limit potential losses on your trades. This automated feature closes your position at a predetermined price, helping you manage risk effectively.

3. Diversify Your Trading Portfolio

Avoid putting all your capital into a single asset or trade. Diversifying can help mitigate risks associated with market volatility.

Starting crypto CFD trading with Markets.com involves understanding the fundamentals of CFDs, setting up an account, funding it, and executing trades. With the right research, analysis, and risk management strategies, you can take advantage of the volatility in the cryptocurrency market.

Always remember that trading carries risks, and it’s essential to trade responsibly. By continuously educating yourself and refining your trading strategies, you can improve your chances of success in the exciting world of cryptocurrency trading.

Yield farming represents a groundbreaking opportunity for cryptocurrency investors seeking to maximize returns on their assets. By lending or staking crypto holdings, investors can earn substantial rewards, making it a compelling alternative to traditional investment methods. However, potential risks—such as smart contract vulnerabilities, market volatility, and impermanent loss—must be carefully considered.

Starting yield farming involves choosing the right wallet, obtaining cryptocurrencies, selecting a suitable protocol, and actively managing investments. By implementing sound strategies, diversifying investments, and staying informed about market conditions, investors can navigate the complexities of yield farming and potentially reap the benefits of this dynamic and evolving field.

As the DeFi landscape continues to expand, yield farming will likely remain an attractive option for those looking to explore new avenues within the ever-growing cryptocurrency space.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.