Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Tuesday Dec 23 2025 08:17

18 min

Crypto Trading Strategies for beginners: Cryptocurrency trading has captured the imagination of many due to its potential for high returns and the excitement of a rapidly evolving market.

How to Invest in Crypto as A BEGINNER In 2026: However, for beginners, the volatility and complexity of the crypto space can be daunting. Developing effective trading strategies is essential to navigate these challenges and build a foundation for success. This article explores four fundamental crypto trading strategies tailored for beginners, providing detailed insights on how to approach the market with confidence and discipline.

Before diving into any trading strategy, it is crucial to understand the fundamental concepts of cryptocurrency and trading itself. Crypto markets operate differently from traditional financial markets, often with higher volatility, 24/7 trading hours, and unique factors influencing price movements.

Know Your Assets

Begin by familiarizing yourself with the cryptocurrencies you intend to trade. Each digital asset has its own purpose, technology, and market dynamics. For instance, some cryptocurrencies serve as payment systems, while others support decentralized applications or focus on privacy. Understanding what drives demand and adoption can help you anticipate potential price movements.

Market Mechanics

Grasp how crypto exchanges work, including order types such as limit, market, and stop orders. Learn about bid-ask spreads, liquidity, and trading pairs. These elements affect how quickly and efficiently you can execute trades.

Risk Management Foundations

One of the cornerstones of trading is risk management. Decide in advance how much of your capital you are willing to risk on any single trade and establish stop-loss levels to limit potential losses. Never risk more than you can afford to lose.

Emotional Discipline

The crypto market’s volatility can trigger emotional responses like fear and greed. Developing discipline to stick to your strategy, avoid impulsive decisions, and manage emotions is vital for long-term success.

Trend following is one of the simplest and most popular strategies for beginners. It involves identifying the overall direction of the market and making trades that align with that trend, whether it is upward (bullish) or downward (bearish).

Identifying Trends

Trends can be observed on various timeframes, from minutes to months. Beginners should start with daily or weekly charts to spot broader market movements. A generally rising price over time indicates an uptrend, while a falling price suggests a downtrend.

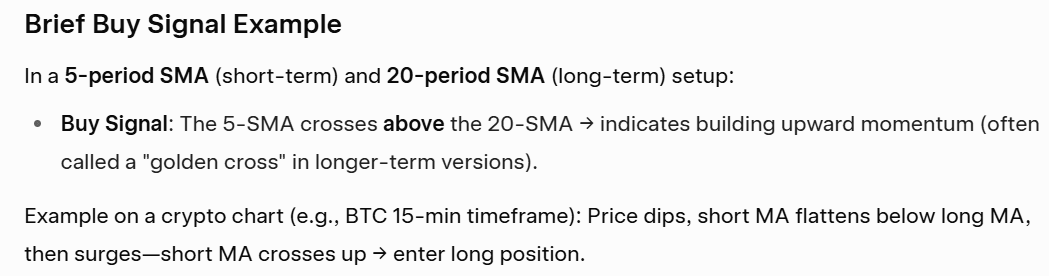

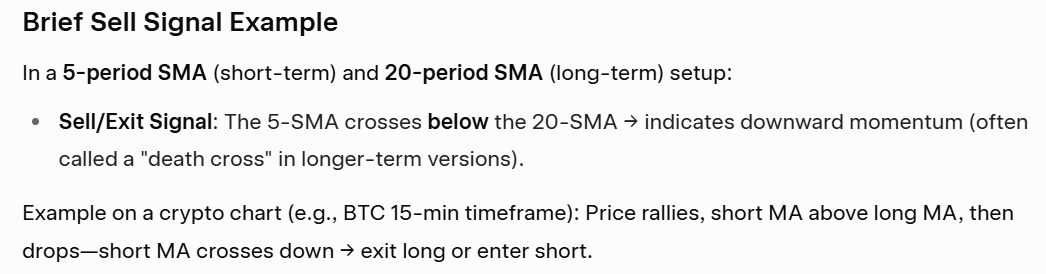

Using Moving Averages

Moving averages smooth out price data to help identify trends. The most common types are the simple moving average (SMA) and the exponential moving average (EMA). A popular approach is to look at the relationship between a shorter-term moving average and a longer-term moving average. For example, when a short-term average crosses above a long-term average, it may signal the start of an uptrend.

Entry and Exit Points

In an uptrend, consider entering a trade when the price pulls back toward a moving average or a support level before resuming its upward movement. Set stop losses below recent lows to protect your capital. In a downtrend, short selling (where allowed) or avoiding buying can help manage risk.

Patience and Confirmation

It is important not to jump into trades prematurely. Wait for confirmation signals such as volume increases or price breaking above key resistance levels. Trend following requires patience but can be effective in capturing sustained price movements.

Swing trading aims to profit from short- to medium-term price swings, typically lasting several days to weeks. This strategy involves buying low during a pullback and selling high at resistance levels, or vice versa.

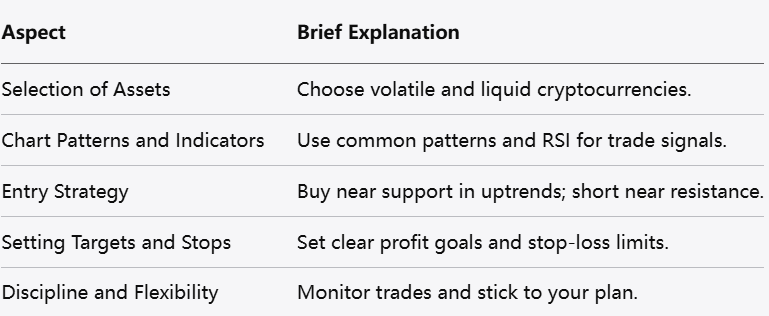

Selection of Assets

Swing traders generally focus on cryptocurrencies with sufficient volatility and liquidity, as these offer more predictable swings. Avoid assets with extremely low trading volume to reduce the risk of price manipulation or illiquidity.

Chart Patterns and Indicators

Learning to recognize chart patterns such as head and shoulders, double tops and bottoms, and flags can help identify potential reversal or continuation points. Indicators like the Relative Strength Index (RSI) can signal overbought or oversold conditions, suggesting potential entry or exit points.

Entry Strategy

Buy near support zones or after a price has retraced during an uptrend. The goal is to enter the market at a favorable price before the next move upward. In a downtrend, consider shorting near resistance or after a price bounce.

Setting Targets and Stops

Define clear profit targets based on previous resistance or support levels. Use stop-loss orders to exit trades if the market moves against you beyond a predetermined threshold.

Discipline and Flexibility

Swing trading requires monitoring positions regularly and adapting to changing market conditions. Maintain discipline to close trades at your targets or stops without hesitation.

For beginners who prefer a less active trading style, dollar-cost averaging (DCA) offers a simple and effective method to build a crypto position over time without worrying about market timing.

What is Dollar-Cost Averaging?

DCA involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This approach reduces the impact of volatility by spreading purchases over time, lowering the average cost per unit.

Benefits for Beginners

This strategy removes the stress of trying to predict market tops or bottoms. It encourages steady accumulation and helps avoid emotional decision-making driven by sudden price swings.

Implementation

Choose a cryptocurrency or a portfolio of assets you believe in for the long term. Decide on the frequency and amount of your investments—such as weekly or monthly contributions.

Long-Term Perspective

DCA works best with a long-term horizon, allowing your holdings to grow as the market matures. It is less suited for short-term trading but can be combined with other strategies for a balanced approach.

Combining with Portfolio Management

DCA can be integrated into a broader portfolio strategy, diversifying across multiple assets to reduce risk while participating in the growth of the crypto market.

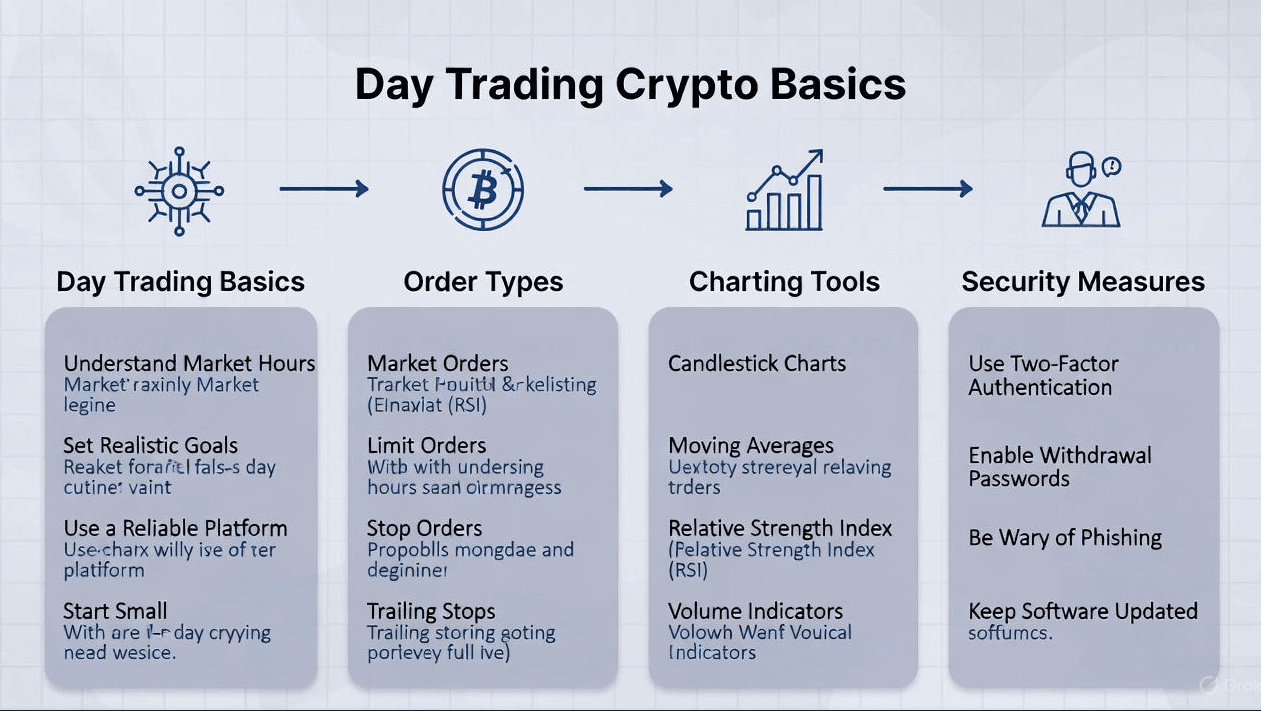

Cryptocurrency trading has attracted a vast number of enthusiasts and professionals alike, drawn by its volatility and the potential for quick gains. Among various trading styles, day trading in cryptocurrencies is particularly popular for those seeking to capitalize on short-term price movements. This guide will walk you through the essentials of crypto day trading, why it’s appealing, how to get started, a simple trading strategy, and an introduction to using markets.com, a platform that supports crypto day trading.

Crypto day trading involves buying and selling cryptocurrencies within a single trading day to profit from short-term price fluctuations. Unlike long-term investing, where one holds assets for extended periods, day traders aim to capitalize on rapid changes in market price, often entering and exiting multiple positions throughout the day.

Why Day Trade Cryptos and Bitcoin?

Cryptocurrencies, especially Bitcoin, are known for their high volatility. Price swings can be dramatic over minutes or hours, providing numerous opportunities for traders to make gains. This volatility is driven by factors such as market sentiment, news events, regulatory announcements, and the relatively smaller market capitalization compared to traditional assets.

Day trading cryptos also appeals because the market operates 24/7, unlike stock markets that close during weekends and overnight. This continuous trading allows flexibility in timing and the chance to respond instantly to global events affecting prices.

Additionally, the crypto markets are accessible to individual traders worldwide, often with low barriers to entry, meaning anyone with an internet connection can participate.

Starting as a crypto day trader requires preparation and discipline. Day trading, while potentially rewarding, is risky without a clear approach. Below are the key steps to begin your journey.

6.1 First, You Need a Trading Plan

A trading plan is your roadmap. It outlines your goals, risk tolerance, trading style, and specific rules for entering and exiting trades. Without a plan, decisions tend to be impulsive, increasing the risk of losses.

Your plan should include:

Keeping a trading journal to record your trades, rationale, and outcomes helps refine your strategy over time.

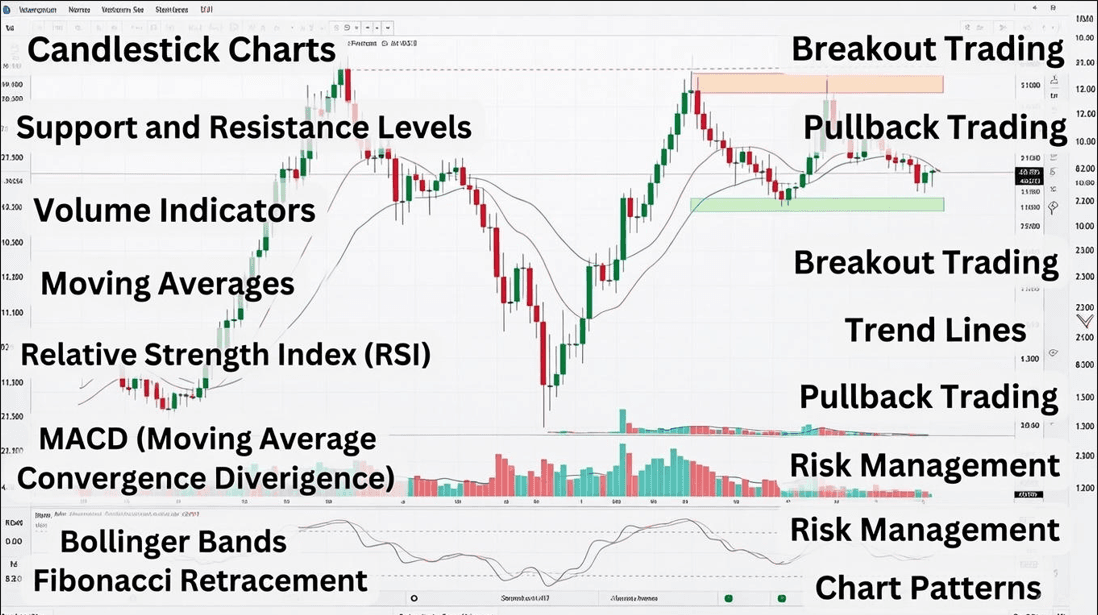

6.2 Understand How to Read Charts

Chart reading is fundamental to day trading. Price charts visually represent how an asset’s price moves over time and help traders identify trends, support and resistance levels, and potential entry or exit points.

Familiarize yourself with:

6.3 Create an Account and Get Familiar with the Platforms

To trade cryptocurrencies, you need to create an account on a trading platform or exchange. Choose a reliable and secure platform that offers the cryptocurrencies you want to trade, competitive fees, and user-friendly tools.

Key features to explore on the platform include:

Spend time navigating the platform interface, executing test trades, and understanding how to manage your portfolio.

6.4 Explore Cryptocurrencies for Day Trading

Not all cryptocurrencies are equally suited for day trading. Focus on those with:

High Liquidity: Assets with high trading volume enable easier entry and exit without large price slippage.

Volatility: Price fluctuations create opportunities for profit within short timeframes.

Market News and Developments: Cryptos with frequent news or updates tend to have more price movement.

Bitcoin, Ethereum, and other large-cap coins often provide stable liquidity and volatility, making them popular choices for beginners. However, some traders pursue smaller altcoins for potentially larger swings, though this comes with higher risk.

Stay updated with market news and monitor trending coins using tools and communities for timely insights.

For beginners, starting with a straightforward strategy helps avoid overwhelm. Here is a simple approach focusing on Bitcoin, the most widely traded cryptocurrency.

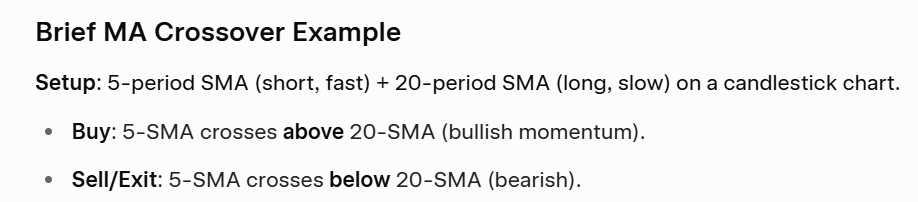

Moving Average Crossover Strategy

This strategy uses two moving averages – a short-term and a long-term – to identify trend changes and potential entry or exit points.

Implementation Tips:

Confirm signals with volume indicators to ensure strength behind moves.

Use stop-loss orders below recent support levels to limit losses.

Set profit targets at resistance levels or a fixed percentage gain.

Avoid trading during low volume or highly volatile news events to reduce unpredictable swings.

This approach simplifies decision-making and provides clear rules for entering and exiting trades, which is essential when starting out.

Markets.com is a popular platform offering a comprehensive environment for crypto day trading, combining ease of use with advanced features.

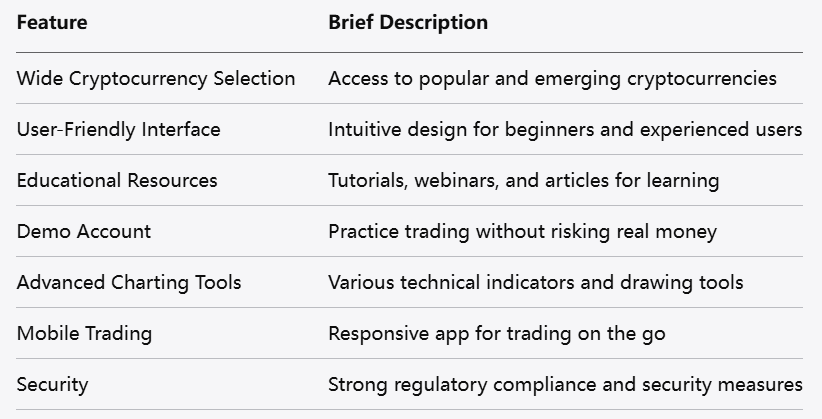

Why Choose markets.com?

Wide Cryptocurrency Selection: Access to many popular and emerging cryptocurrencies.

User-Friendly Interface: Intuitive design suitable for both beginners and experienced traders.

Educational Resources: Tutorials, webinars, and articles to support learning.

Demo Account: Practice trading without financial risk.

Advanced Charting Tools: Includes a variety of technical indicators and drawing tools.

Mobile Trading: Trade on the go with a responsive mobile app.

Security: Strong regulatory framework and security protocols.

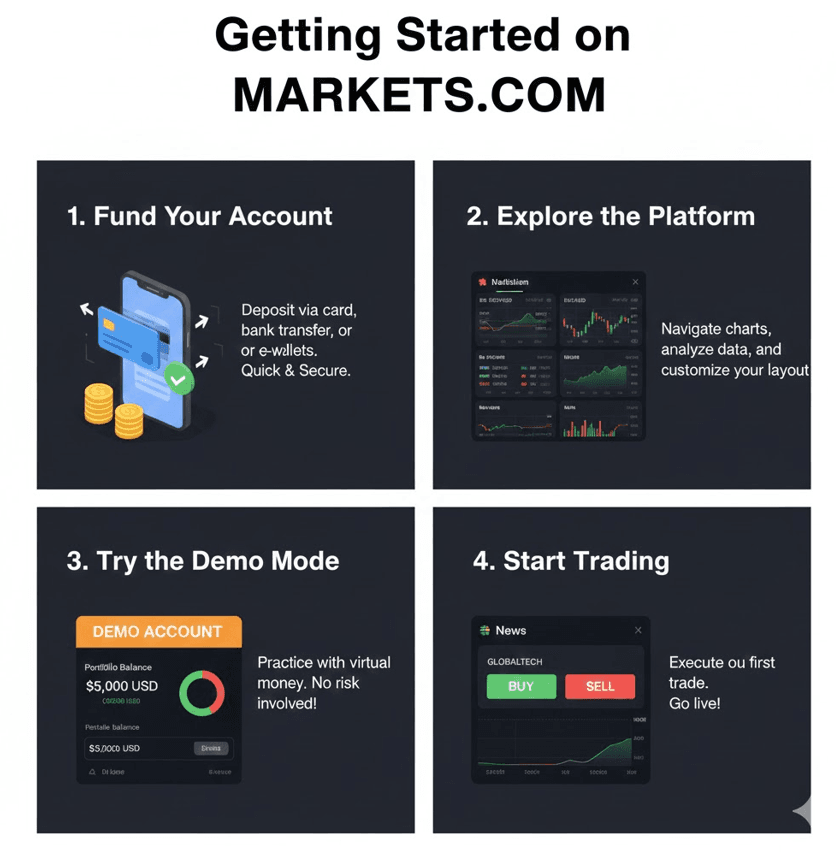

Getting Started on markets.com

Open an Account: Complete the registration process with KYC verification.

Fund Your Account: Deposit funds using your preferred payment method.

Explore the Platform: Familiarize yourself with the trading dashboard, charts, and order types.

Try the Demo Mode: Practice your strategies before committing real funds.

Start Trading: Begin with small positions, apply your trading plan, and manage risks carefully.

Markets.com provides a balanced environment where you can access necessary tools and support to grow your day trading skills.

Starting your journey in cryptocurrency trading requires a solid foundation built on knowledge, discipline, and effective strategies. Understanding market basics, trend following, swing trading, and dollar-cost averaging are four practical approaches that beginners can adopt and refine over time.

Each strategy offers distinct advantages and suits different trading styles and risk tolerances. By combining education with disciplined execution and risk management, beginners can navigate the volatile crypto world while minimizing unnecessary risks.

Remember, there is no one-size-fits-all approach in trading. The key is to start simple, learn continuously, and adapt your strategies as you gain experience. With patience and perseverance, crypto trading can become a rewarding endeavor.

Day trading cryptocurrencies can be an engaging and dynamic way to participate in the crypto market. Understanding what crypto day trading entails, developing a solid trading plan, mastering chart reading, and choosing the right platform are critical steps to begin.

Starting with simple strategies like moving average crossovers helps build confidence while minimizing complexity. Platforms like markets.com offer the necessary infrastructure and learning resources to support your development as a trader.

Remember that day trading requires discipline, continuous learning, and risk management. By approaching it methodically and practicing consistently, you can navigate the fast-paced world of crypto day trading with greater clarity and control.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.