Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Dec 18 2025 09:13

19 min

Gold Investing Guide 2026: Gold has been a significant part of human history, serving not only as a form of currency but also as a symbol of wealth and power.

How to start investing in gold as a beginner: In today's financial markets, gold remains a popular investment choice due to its unique properties as a tangible asset. Unlike stocks or bonds, gold has intrinsic value and is often viewed as a hedge against inflation and currency fluctuations. This guide explores the essential aspects of investing in gold, including the different types and pricing mechanisms, and discusses the reasons why many investors choose to include gold in their portfolios.

Investing in gold offers several advantages. For one, it can diversify your portfolio, reducing overall risk when combined with other assets. Additionally, gold has a long history of retaining value during economic downturns, making it appealing during uncertain times. This guide will help you understand the various ways to invest in gold and formulate a strategy that aligns with your financial goals.

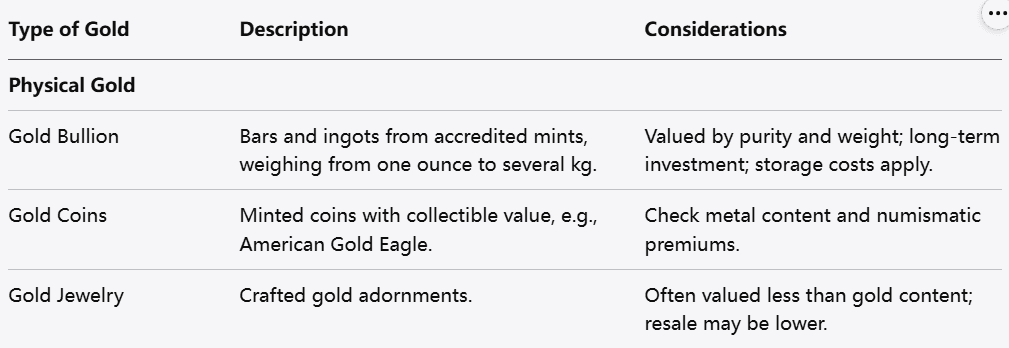

Understanding the different types of gold available for investment is crucial for making informed decisions. Each type has its own characteristics, benefits, and potential risks. Here are the primary forms of gold you can invest in:

Physical Gold

Gold Bullion

Gold bullion refers to gold bars and ingots, typically produced by accredited mints and weighing from one ounce to several kilograms. Bullion is valued based on its purity and weight. For investors, bullion is primarily seen as a long-term investment because it can be costly to store and insure. Many investors prefer bullion when looking for a secure way to hold intrinsic value.

Gold Coins

Minted gold coins are another popular form of physical gold. Unlike bars, coins often carry additional value due to their collectible nature. Some well-known examples include the American Gold Eagle, the Canadian Maple Leaf, and the South African Krugerrand. When buying coins, investors should consider both the metal content and any premiums attached to their numismatic value.

Gold Jewelry

While primarily a consumer product, gold jewelry can also serve as an investment. However, the value of gold jewelry is often less than its gold content due to craftsmanship and branding. Investors should be cautious when purchasing gold jewelry for investment purposes, as resale value may be lower than expected.

Paper Gold

Gold ETFs (Exchange-Traded Funds)

Gold ETFs offer a way to invest in gold without dealing with the challenges of physical storage. These funds hold gold bullion and trade on stock exchanges, allowing investors to buy shares that correspond to the price of gold. They provide liquidity and ease of access, making them an excellent option for both small and large investors.

Gold Mining Stocks

While not a direct investment in gold itself, shares of gold mining companies provide indirect exposure to gold prices. When gold prices rise, mining companies' profits usually increase, thus driving their stock prices higher. However, mining stocks can be volatile and are subject to operational risks, making them more suitable for experienced investors.

Gold Futures and Options

Gold futures and options are contracts entered into on commodities exchanges. A gold futures contract obligates the buyer to purchase gold at a set price on a future date, while options provide the right, but not the obligation, to buy or sell at a specified price within a certain timeframe. These instruments can be used for hedging or speculative purposes but are generally recommended for more advanced traders due to their complexity and risk.

Gold CFDs (Contracts for Difference)

Gold CFDs allow investors to speculate on the price movements of gold without owning the physical asset. With CFDs, investors can take long or short positions, meaning they can potentially profit from rising or falling gold prices. This method offers high leverage but also carries significant risk, as losses can exceed initial investments.

Digital Gold

Cryptocurrency-Backed Gold

In a modern twist on gold investment, some cryptocurrencies are backed by physical gold reserves. This allows investors to trade a digital representation of gold, offering flexibility and ease of access. While this is a newer concept, it combines the traditional value of gold with the innovative potential of blockchain technology.

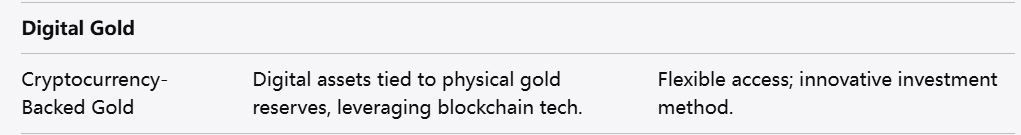

source: tradingview

Understanding how gold is priced is essential for making informed investment decisions. The price of gold is determined by various factors, including market demand, global economic conditions, and geopolitical events.

Spot Price

The spot price of gold is the current market price at which gold can be bought or sold for immediate delivery. This price fluctuates throughout the day based on trading activity in global markets. Various exchanges, including the London Bullion Market and COMEX, report the spot price, which serves as a benchmark for traders and investors.

Supply and Demand

The fundamental principles of supply and demand significantly influence gold prices. Increased demand, driven by investment interest, jewelry needs, or central bank purchases, can push prices higher. Conversely, increased supply from mining production or selling pressure can lead to lower prices.

Jewelry Demand

The jewelry market is one of the largest consumers of gold, particularly in countries like India and China. Seasonal trends and cultural practices influence demand, which can drive fluctuations in gold prices.

Investment Demand

Gold investment demand often rises during periods of economic uncertainty. Investors view gold as a safe-haven asset, leading to increased purchases during market downturns or geopolitical tensions. Central banks also play a crucial role in this segment by buying gold to diversify their reserves.

Inflation and Currency Fluctuations

Gold is often perceived as a hedge against inflation. When currency values decline, the purchasing power of money decreases, making gold an attractive alternative for preserving wealth. As inflation rises, investors flock to gold, driving up prices.

Geopolitical Events

Gold prices can spike during geopolitical unrest or financial crises. Events such as wars, natural disasters, or significant political changes often lead investors to seek the safety of gold, impacting its market price.

Investing in gold can offer various benefits, making it a favored choice for many investors. Here are some compelling reasons to consider adding gold to your investment portfolio:

Diversification

Gold serves as an effective diversification tool. It typically has a low correlation with other asset classes, such as stocks and bonds. By including gold in your portfolio, you can reduce overall risk, especially during market downturns when traditional investments may falter.

Hedge Against Inflation

As a tangible asset, gold often retains its value during inflationary periods. When purchasing power decreases due to rising prices, gold can preserve wealth and provide a buffer against the diminishing value of currency.

Safe-Haven Asset

During times of economic instability, gold is widely regarded as a safe-haven asset. Investors flock to gold to protect their capital from market volatility, currency devaluation, and other financial uncertainties.

Long-Term Store of Value

Gold has maintained its value over centuries, making it an excellent long-term investment. While its price can fluctuate in the short term, gold has historically proven resilient in preserving wealth through economic cycles.

Easy Liquidity

Gold is one of the most liquid investment assets. Whether in the form of physical gold, ETFs, or stocks, investors can quickly buy or sell gold to realize their investments.

Accessibility

With numerous forms of gold available, from coins to ETFs, investors of all sizes can access the gold market. This accessibility makes gold a practical choice for both novice and experienced investors.

Global Acceptance

Gold is universally recognized and accepted, transcending borders and currencies. This global acceptance enhances its value and stability, making it a reliable asset for investors worldwide.

Gold has historically been viewed as a reliable investment vehicle, especially during times of economic uncertainty. Understanding the performance of gold over various timeframes provides insight into its value and potential as a part of an investment portfolio.

Historical Performance

Over the past few decades, gold has demonstrated its ability to maintain value and even appreciate during periods of inflation, currency devaluation, and geopolitical instability. Historical data illustrates that gold prices tend to rise during these turbulent times as investors seek refuge in tangible assets.

For example, during the 2008 financial crisis, gold prices surged as stock markets plummeted. Similarly, recent global events such as trade tensions, wars, and the COVID-19 pandemic have led to increased demand for gold, pushing its prices higher.

Seasonal Trends

Gold often experiences seasonal trends that can affect its price. Typically, demand increases around the Indian festival season and wedding seasons, with gold being a traditional gift. This seasonal demand can create price spikes during certain months, making it essential for investors to consider timing when entering the market.

Correlation with Other Assets

Gold generally exhibits a negative correlation with equities, meaning when stock prices fall, gold prices often rise. This inverse relationship can be beneficial for investors looking to hedge against stock market volatility. By including gold in your portfolio, you can potentially reduce overall risk exposure, enhancing the stability of your investments.

Performance Metrics

When analyzing gold performance, it’s critical to look at various metrics, including:

Conducting a thorough performance analysis helps determine gold's role in your investment portfolio.

Investing in gold can take many forms, each with its advantages and considerations. Here’s an overview of the primary methods for investing in gold:

1. Physical Gold

Gold Bullion

Gold bullion consists of bars and ingots produced by accredited mints. They are typically available in various weights, allowing for flexible investment levels. Bullion is considered a long-term investment, and while it requires storage and insurance, it offers the intrinsic value of physical gold.

Gold Coins

Minted gold coins, such as the American Gold Eagle and the Canadian Maple Leaf, provide another physical investment avenue. While coins may carry a premium due to their collectible nature, they are widely recognized and easily tradable.

Gold Jewelry

While primarily a consumer product, gold jewelry can also serve as an investment. However, the value is often less than the intrinsic gold content due to additional costs associated with design and branding. Investors should weigh these factors carefully.

2. Paper Gold

Gold ETFs

Exchange-Traded Funds that hold physical gold allow investors to buy shares that represent gold bullion. This method offers liquidity and ease of access, making it popular among beginners and seasoned investors alike.

Gold Mining Stocks

Investing in shares of gold mining companies provides exposure to gold prices indirectly. While mining stocks can offer high returns during rising gold prices, they come with increased volatility and operational risks.

Gold Futures and Options

These contracts allow you to speculate on gold prices without holding physical gold. Futures obligate you to buy at a future set price, while options give you the right to buy or sell. This method requires substantial market knowledge and carries higher risk.

3. Digital Gold

Cryptocurrency-Backed Gold

Some digital currencies are backed by physical gold reserves, providing a modern way to trade gold. This option combines the advantages of digital assets with the time-tested value of gold, offering flexibility and ease of access.

4. Gold CFDs (Contracts for Difference)

Gold CFDs allow for speculation on price movements without owning the physical asset. This method enables leverage, meaning larger positions can be taken with a smaller amount of capital, but it also increases potential risk.

Gold CFDs (Contracts for Difference) have gained significant popularity among traders for various reasons. Here’s why trading gold CFDs can be a profitable strategy:

Leverage

Gold CFDs allow traders to use leverage, meaning they can control a larger position in the market without needing to invest the full value upfront. This can amplify potential returns, but it also increases the risks, as losses can also be magnified.

Flexibility

CFDs provide the flexibility to trade on both rising and falling prices. Traders can take long positions if they anticipate a price increase or short positions if they expect a decline. This versatility allows for profit potential in various market conditions.

Convenience

Trading gold CFDs is convenient and accessible through online platforms. Unlike physical gold, which requires storage and can involve logistical challenges, CFDs eliminate these concerns, allowing traders to focus solely on price movements.

No Ownership Required

With gold CFDs, you do not own the physical asset, which means you avoid costs associated with storage, insurance, and transportation. This makes it easier to manage your investments and focus on trading strategies.

Real-Time Pricing

CFDs reflect real-time market prices, allowing traders to make informed decisions based on current market conditions. This immediacy is crucial in a fast-moving market like gold.

Hedging Opportunities

Gold CFDs can be used as a hedging strategy for other investments in your portfolio. If you hold long positions in stocks, for example, you can use gold CFDs to mitigate potential losses during market downturns.

Investing in gold CFDs involves selecting a reliable trading platform and broker. Here are key steps to consider when looking for a place to invest in gold CFDs:

1. Choose a Reputable Broker

Research brokers that offer CFD trading for gold. Look for those regulated by financial authorities, as this adds a layer of security to your investments. Compare the fees, spreads, and reviews from other traders to make an informed choice.

2. Check Trading Conditions

Evaluate the trading conditions offered by different brokers, including leverage options, margin requirements, and minimum deposit amounts. Ensure that the platform aligns with your trading strategy and risk tolerance.

3. Test via Demo Accounts

Many brokers offer demo accounts that allow you to practice trading gold CFDs without risking actual capital. This is an excellent way to familiarize yourself with the platform while developing your trading strategies.

4. Understand Market Analysis Tools

Select a broker that provides robust market analysis tools, charting capabilities, and research resources. These tools can significantly enhance your trading decisions and strategies.

5. Monitor Economic Indicators

Stay informed of economic indicators affecting gold prices, such as inflation rates, interest rates, and geopolitical events. Understanding how these factors influence the gold market can help you make timely decisions.

User-Friendly Platform

Markets.com offers an intuitive interface that caters to both beginners and experienced traders, making navigation through various trading options seamless.

Competitive Spreads and Low Costs

With competitive spreads and low transaction costs, Markets.com allows traders to maximize their potential returns while taking advantage of market volatility.

Advanced Tools and Analytics

Equipped with advanced charting tools and analytical resources, the platform helps traders make informed decisions and develop effective strategies.

Security and Regulation

Markets.com emphasizes a secure trading environment, adhering to regulatory standards to protect client interests.

Exceptional Customer Support

Their dedicated customer support team is available around the clock to assist traders, ensuring a smooth trading experience.

Risk-Free Practice with Demo Accounts

The availability of demo accounts allows users to practice trading strategies without financial risk, promoting skill development and confidence.

Looking to trade gold CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

What are the benefits of investing in gold?

Gold provides diversification, serves as a hedge against inflation, offers liquidity, and has historically maintained its value during economic downturns.

How can I start investing in gold?

You can invest in physical gold, gold ETFs, gold mining stocks, gold CFDs, or even cryptocurrency-backed gold. Choose the method that aligns with your investment goals and risk tolerance.

Is gold a safe investment?

While gold is generally considered a safe-haven asset, it is not without risk. Prices can fluctuate based on market conditions, geopolitical factors, and economic data.

What is the minimum investment needed for gold CFDs?

Minimum investments can vary by broker, but many allow trading with minimal amounts, depending on the leverage offered.

How can I protect my investment in gold?

Diversifying your portfolio, staying informed about market conditions, and using risk management strategies like stop-loss orders can help protect your investment.

Can I invest in gold during economic downturns?

Yes, many investors turn to gold during economic downturns as a safe-haven asset. Its historical performance during such times has made it a popular choice for preserving wealth.

How do I determine the right time to invest in gold?

Monitoring market trends, economic data, geopolitical developments, and seasonal patterns can help identify optimal times to invest in gold.

Investing in gold provides a unique opportunity to enhance your financial portfolio. With various types available, including physical gold, paper gold, and innovative digital formats, investors can tailor their strategies to suit their individual needs and goals. Understanding how gold is priced and the factors influencing its value can help you make informed investment decisions.

Whether you are looking to diversify your portfolio, hedge against inflation, or preserve wealth, gold holds significant potential as a strategic investment. As you navigate the complexities of gold investing, remember to evaluate your risk tolerance and financial objectives to create a well-rounded investment plan.

In summary, building a profitable gold investment portfolio requires careful analysis of gold performance and an understanding of various investment avenues. Whether you choose to invest in physical gold, ETFs, mining stocks, or CFDs, a well-rounded approach considering your financial goals and risk tolerance can lead to successful outcomes in the gold market.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.