Monday Nov 10 2025 10:25

11 min

Gold price forecast 2025/2026/2027: Gold remains one of the most closely watched commodities worldwide, often regarded as a safe haven during times of economic uncertainty.

As global economic, political, and social landscapes evolve, understanding the trajectory of gold prices becomes essential for investors, traders, and policymakers alike. This comprehensive analysis explores the current state of gold prices, forecasts for the coming years, and methodologies to analyze gold price movements effectively.

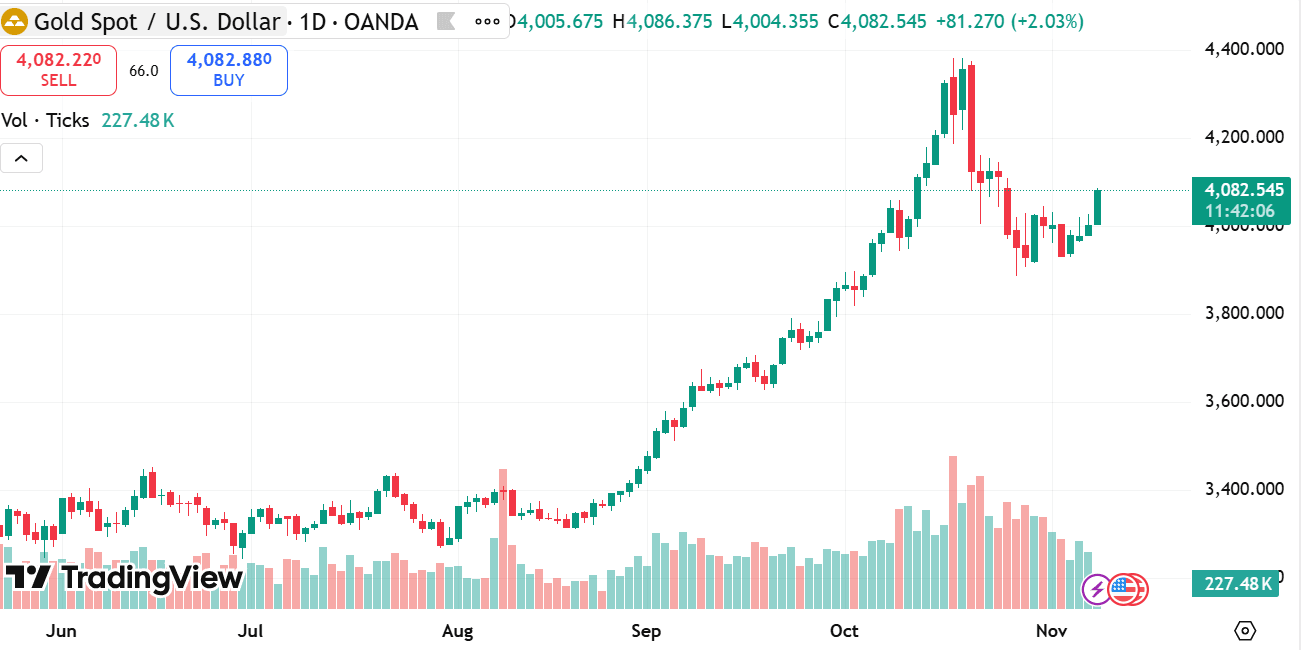

Current Gold Price Overview

As of mid-2024, gold prices remain a focal point of the global financial markets. Several factors contribute to the current valuation of gold, including inflation concerns, geopolitical tensions, monetary policies, and market sentiment. After navigating a volatile period marked by pandemic-related economic disruptions, inflationary pressures, and shifts in central bank policies, gold’s price has demonstrated resilience.

source: tradingview

Gold prices are influenced heavily by the US dollar's strength, interest rate expectations, and investor appetite for safe-haven assets. The metal’s current valuation reflects a balance between inflation hedging demand and the cost of holding non-yielding assets amid rising interest rates.

Gold Price Forecast for 2025

Forecasting gold prices for 2025 requires a careful examination of underlying economic variables. Most analysts expect gold to maintain or increase its value due to ongoing inflation concerns and geopolitical risks, though the pace of growth may moderate depending on global economic recovery and central bank policies.

Key drivers for 2025 include:

Given these factors, the price of gold in 2025 is projected to hover within a range influenced by these competing forces rather than exhibit extreme volatility seen in past crisis periods.

Importance of Gold Price Analysis

Understanding gold price trends is vital for several reasons:

Avoiding Emotional Investing

Markets are often driven by sentiment, rumors, and speculation that can lead to overreaction. By learning to analyze gold price trends objectively, investors avoid emotional decisions based on short-term market noise.

Long-term Financial Planning

For individuals planning retirement, wealth preservation, or legacy, comprehending gold price dynamics over the long term is crucial to aligning investment goals with market realities.

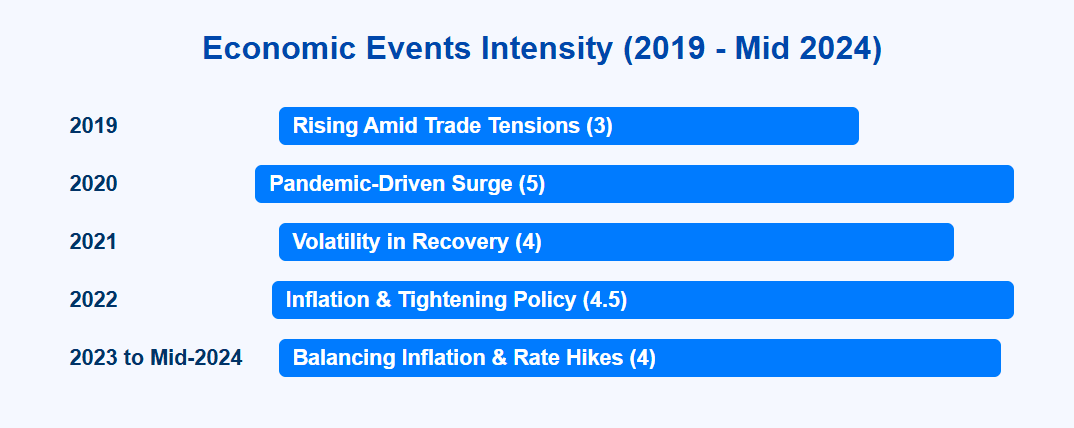

2019: Rising Amid Trade Tensions

In 2019, gold prices rose steadily, supported by escalating trade tensions between major economies, notably the United States and China. Investors sought safety amid uncertainty, pushing gold higher. The Federal Reserve’s pivot toward accommodative monetary policy also bolstered gold’s appeal.

2020: Pandemic-Driven Surge

The outbreak of COVID-19 in early 2020 triggered unprecedented economic upheaval. Central banks worldwide slashed interest rates and launched massive stimulus packages, flooding markets with liquidity. Gold surged to record highs as investors flocked to safe-haven assets amid uncertainty and fears of inflation.

2021: Volatility in Recovery

While vaccine rollouts and economic reopening fueled optimism, inflation fears and sporadic COVID variants created mixed signals. Gold prices experienced volatility but remained generally elevated, reflecting a tug-of-war between growth optimism and inflation hedging.

2022: Inflation and Tightening Monetary Policy

Inflation accelerated markedly, prompting central banks, especially the US Federal Reserve, to raise interest rates aggressively. Higher rates increased the opportunity cost of holding gold, leading to downward pressure on prices. However, geopolitical conflicts, such as the Russian invasion of Ukraine, intermittently supported gold as a safe haven.

2023 to Mid-2024: Balancing Inflation and Rate Hikes

In the latest period, gold prices have been influenced by the ongoing tension between persistent inflation and continued monetary tightening. While rising rates generally weigh on gold, ongoing geopolitical and economic uncertainties have sustained demand.

Key Takeaway

The past five years underscore gold’s sensitivity to macroeconomic shifts and crisis events. Price trends reflect a complex interplay of monetary policy, global economic health, and geopolitical tensions.

Longer-Term Structural Factors

By 2026, structural changes such as evolving energy policies, demand from emerging markets, and technological advances in mining and recycling may influence supply and demand fundamentals for gold.

Summary Forecast

Gold prices in 2025 and 2026 are expected to fluctuate within a moderate upward trend, shaped by inflation dynamics, geopolitical uncertainties, and central bank actions. Sharp deviations are possible if unexpected economic or political shocks occur.

Fundamental Analysis

Macroeconomic Indicators

Supply and Demand Factors

Geopolitical and Market Sentiment

Political instability, trade tensions, and financial crises trigger safe-haven buying of gold.

Technical Analysis

Price Patterns and Trends

Indicators and Oscillators

Volume Analysis

Rising volume during price increases supports bullish trends, while declining volume during price rises may signal weakening momentum.

Combining Both Approaches

For reliable forecasts, combining fundamental insights with technical confirmations provides a more comprehensive view of gold price dynamics.

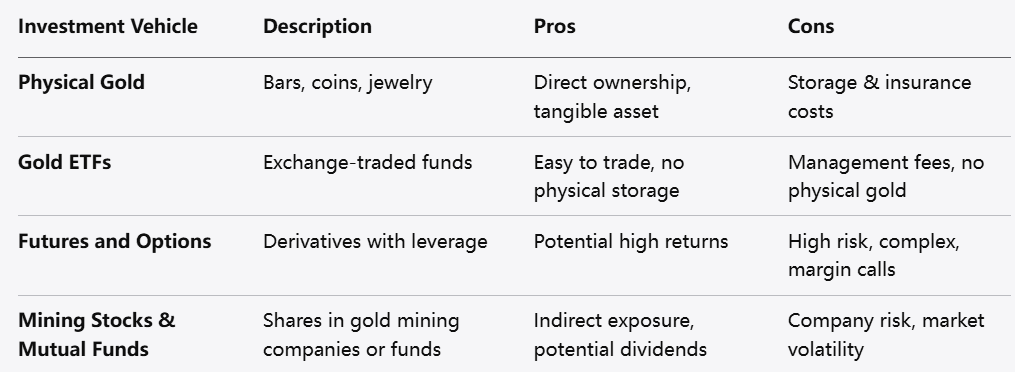

Investment Vehicles for Gold

Physical Gold: Bars, coins, and jewelry offer direct ownership but involve storage and insurance costs.

Gold ETFs: Exchange-traded funds provide exposure without physical handling.

Futures and Options: Offer leverage but come with higher risk.

Mining Stocks and Mutual Funds: Indirect exposure to gold prices with company-specific risks.

Seasoned investors stress the importance of viewing gold not as a get-rich-quick asset but as a strategic portfolio component for risk mitigation and wealth preservation.

Forecasting gold prices through 2025, 2026, and beyond requires a nuanced understanding of diverse economic and geopolitical factors. While inflation and geopolitical tensions are likely to support gold prices, monetary policy tightening and economic recovery may exert downward pressure.

Analyzing gold prices effectively combines fundamental macroeconomic research and technical chart analysis, enabling investors to navigate a complex and often volatile market. Gold’s enduring appeal as a safe haven and inflation hedge ensures its continued relevance in global financial markets.

For investors, adopting disciplined strategies, staying informed, and maintaining a balanced portfolio will be key to leveraging gold’s potential benefits in the coming years.

Looking to trade gold CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.