Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Dec 25 2025 08:41

19 min

How to Choose CFD Trading Platform: Contract for Difference (CFD) trading has become increasingly popular among retail investors due to its flexibility and potential for profit from both rising and falling markets.

Best CFD Trading Platform for 2026: However, the choice of a CFD trading platform significantly impacts your trading experience, costs, and ultimately your success. With numerous platforms available, each offering different features and services, selecting the right one can be daunting. This comprehensive guide walks you through the essential factors to consider when choosing a CFD trading platform, elaborating on each critical aspect to help you make an informed decision.

Why Regulation Matters

One of the most important criteria when selecting a CFD platform is regulation and supervision. Trading CFDs involves financial risk, and ensuring your broker is regulated by a reputable authority can provide a layer of security and peace of mind. A regulated platform adheres to standards designed to protect investors, including segregation of client funds, transparent business practices, and dispute resolution mechanisms.

Major Regulatory Bodies

Look for platforms supervised by well-known financial regulators such as:

Platforms regulated by these authorities are subject to regular audits, capital requirements, and compliance checks.

Risks of Unregulated Platforms

Unregulated brokers may offer attractive features but pose significant risks, including the potential for fraud, lack of fund protection, and unreliable trading conditions. Avoid platforms without transparent regulation or those regulated by obscure authorities.

Verifying a Platform’s Regulation

Before opening an account, verify the broker’s regulatory status by checking official regulator websites. Look for the broker’s license number and read up on their compliance history.

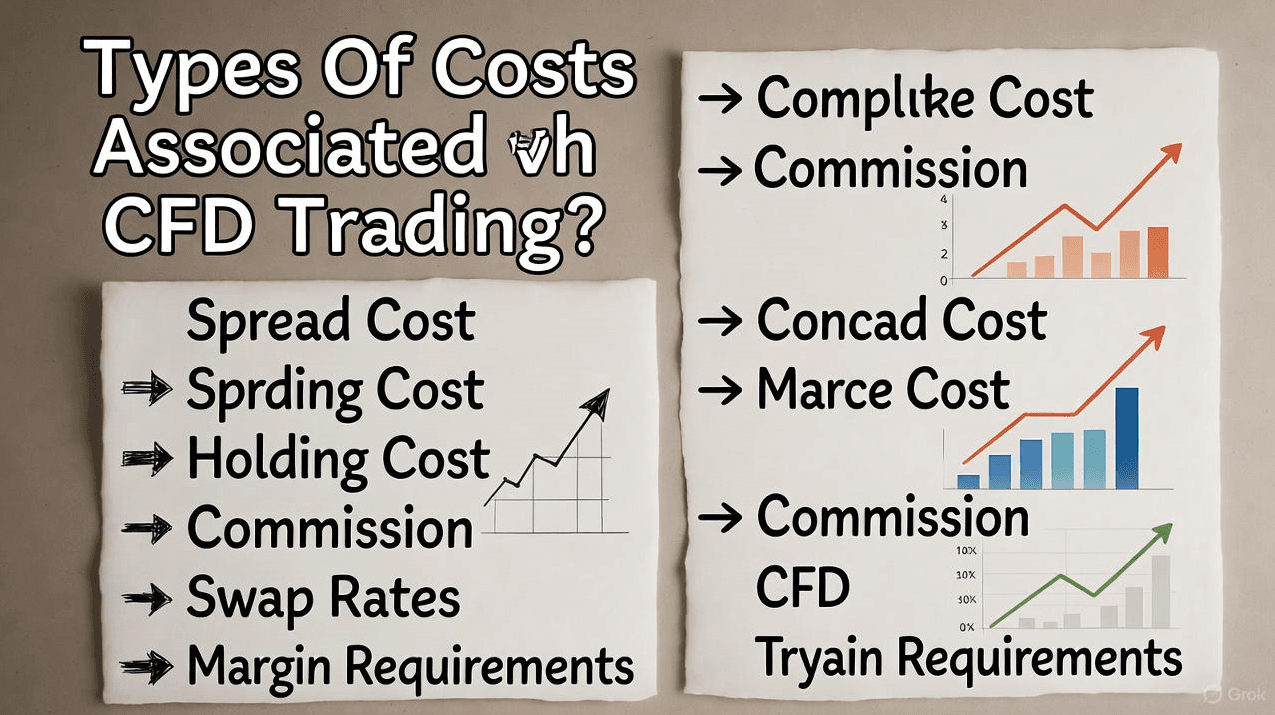

Types of Costs in CFD Trading

Trading costs directly affect your profitability. It’s essential to understand the various fees involved, which typically include:

Spreads: The difference between the buy (ask) and sell (bid) price. A tighter spread means lower cost for entering and exiting trades.

Commissions: Some brokers charge a commission per trade, either fixed or based on trade size.

Overnight Financing Fees (Swap Rates): CFDs are leveraged products, and positions held overnight usually incur financing fees.

Inactivity Fees: Charges levied if the account remains dormant for a specified period.

Deposit and Withdrawal Fees: Some platforms charge fees when moving money in or out.

Comparing Spreads and Commissions

Some platforms offer commission-free trading but charge wider spreads, while others charge a commission but provide tighter spreads. Depending on your trading style (scalping, day trading, or long-term positions), one structure may suit you better.

Hidden Costs to Watch For

Be cautious of platforms that advertise “zero commissions” but compensate by imposing high spreads or hidden fees. Always read the fine print and use demo accounts to gauge actual trading costs.

Cost Transparency

Good CFD platforms openly disclose their fees upfront. Avoid brokers that are vague or inconsistent about their charges.

What Is Order Execution Speed?

Order execution speed is the time it takes from placing a trade to the broker executing it in the market. In CFD trading, where prices can move rapidly, execution speed can be the difference between profit and loss, especially for short-term traders.

Why Fast Execution Matters

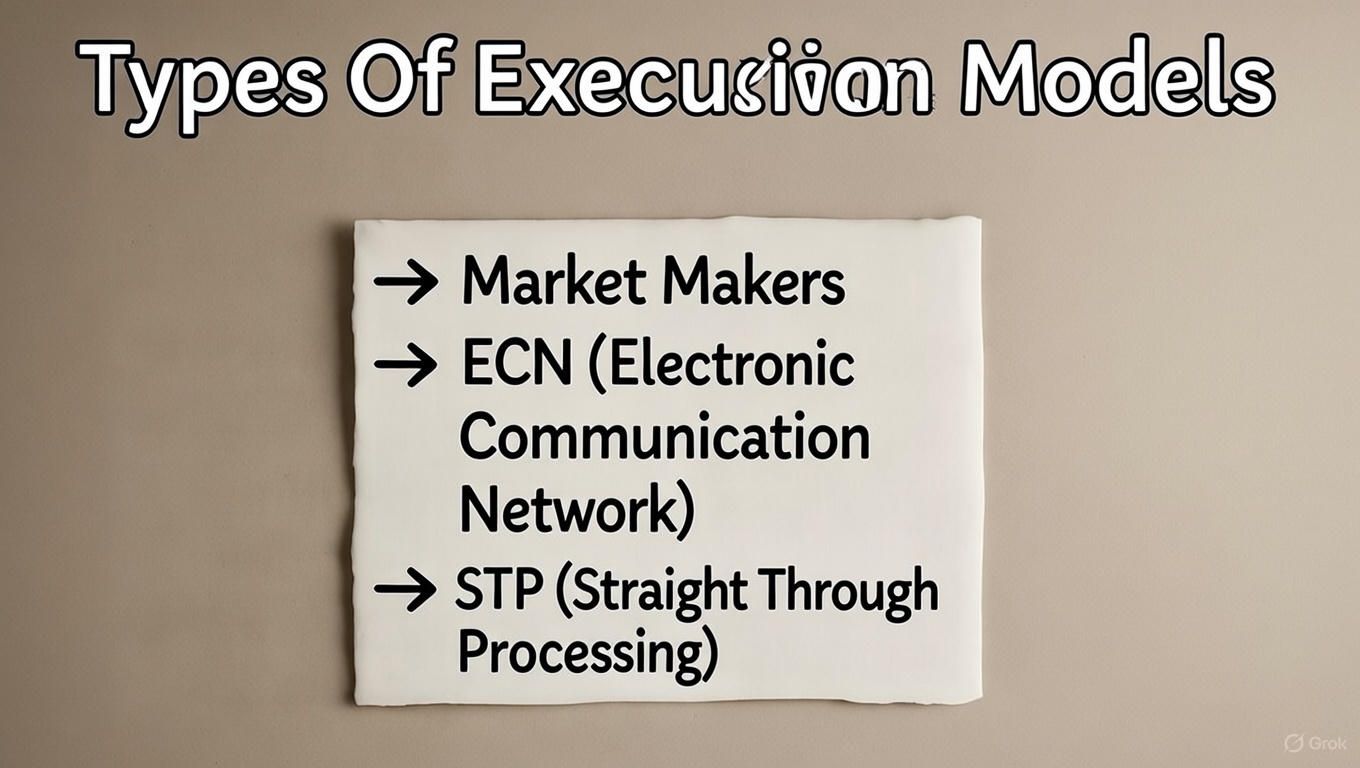

Types of Execution Models

Market Makers: The broker acts as the counterparty to your trade. Execution speed depends on their systems but may involve wider spreads or requotes.

ECN (Electronic Communication Network): Orders are matched with other market participants, often providing faster execution and tighter spreads.

STP (Straight Through Processing): Orders are sent directly to liquidity providers, aiming for rapid execution without requotes.

Checking Execution Speed

Look for platforms with proven execution speed, often measured in milliseconds. Many brokers publish their average execution times or allow you to test via demo accounts. Reading user reviews and performance reports can also help.

Why User Experience Is Crucial

For new traders, a complicated or unintuitive platform can be a major barrier to learning and success. A user-friendly platform reduces mistakes, helps you understand market mechanics, and improves decision-making.

Key Features for Beginners

Additional Tools

Some platforms provide built-in analytical tools, trading signals, and social trading features that allow beginners to follow experienced traders. These can enhance learning and confidence.

Avoiding Overwhelm

While advanced features are attractive, beginners should start with platforms that offer simplicity before moving to more complex tools.

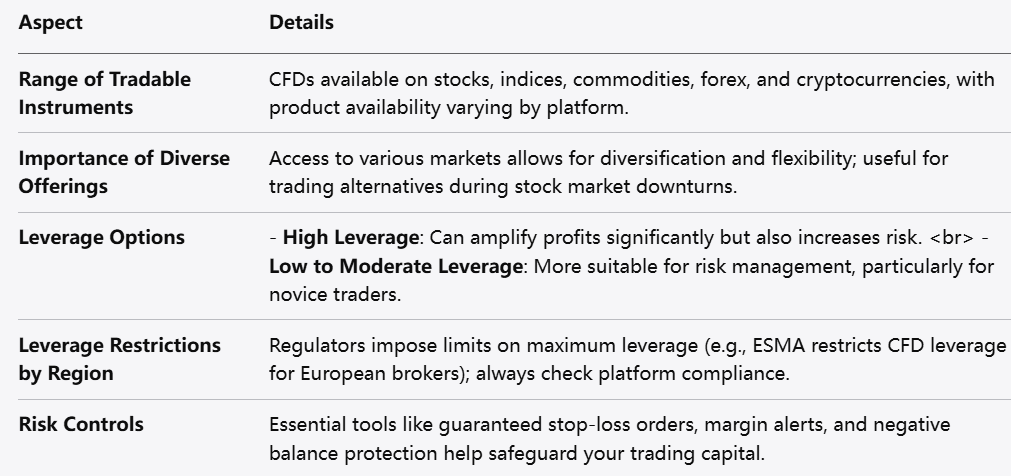

Range of Tradable Instruments

While CFDs allow trading on stocks, indices, commodities, forex, and cryptocurrencies, not all platforms offer the same product range. Consider your trading interests and whether the platform covers the assets you want to trade.

Importance of Diverse Offerings

Access to various markets allows diversification and flexibility. For example, during stock market downturns, you might want to trade commodities or currencies.

Leverage Options and Risks

Leverage amplifies both gains and losses. Different platforms offer varying maximum leverage levels depending on regulatory constraints and internal policies.

High leverage: Can boost profits but increases risk substantially.

Low to moderate leverage: Better suited for risk management, especially for beginners.

Leverage Restrictions by Region

Regulators often limit maximum leverage. For instance, European brokers regulated by ESMA restrict leverage on CFDs to protect retail traders. Check the platform’s leverage offerings and ensure they comply with your local regulations.

Risk Controls

Some platforms provide built-in risk management tools such as guaranteed stop-loss orders, margin alerts, and negative balance protection. These features are essential to protect your capital.

The Role of Customer Support in Trading

Trading involves technical and financial complexities, and issues can arise at any time. Responsive and competent customer service can resolve problems quickly, minimizing disruptions.

Channels of Support

Support Hours and Language

Ensure the platform offers customer support during your trading hours and in a language you understand clearly.

Quality of Support

Look for reviews or testimonials about the broker’s customer service. Poor support can result in missed opportunities or unresolved issues.

Choosing the right CFD trading platform is a crucial step toward successful trading. Consider the following checklist:

When it comes to trading Contracts for Difference (CFDs), selecting the right platform is critical for both beginner and experienced traders. This comprehensive article delves into three of the top CFD trading platforms: Markets.com, IG, and Pepperstone. We'll explore their features, benefits, and drawbacks to help you determine which platform may best suit your trading needs.

CFD trading allows investors to speculate on price movements without owning the underlying asset. It provides opportunities to profit from both rising and falling markets. With leverage, traders can control larger positions with a smaller initial capital outlay, increasing potential profits and risks. However, the choice of a trading platform can significantly influence the trading experience, from execution speed to available instruments.

Markets.com is known for offering a robust trading environment and a wide range of financial instruments. The platform is well-regarded for its user-friendly interface and comprehensive educational resources.

Trading Instruments

Markets.com provides access to a vast array of markets, including:

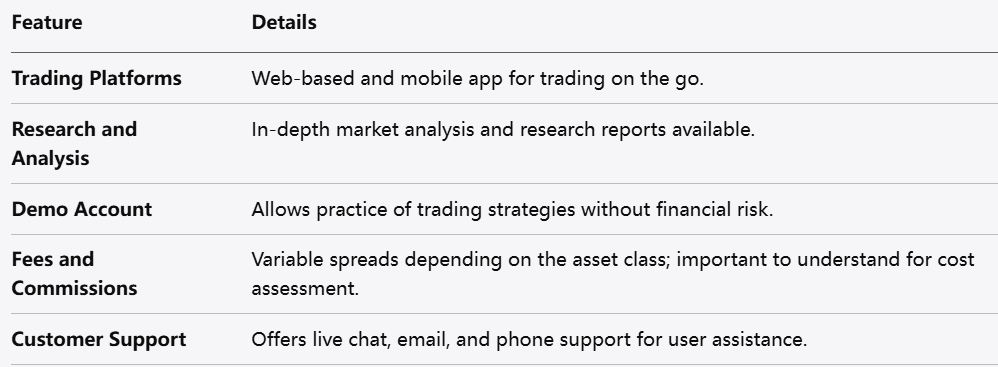

Features and Tools

Markets.com offers various tools designed to enhance the trading experience, including:

Web and Mobile Platforms: A mobile app alongside a web-based platform allows for trading on the go.

Research and Analysis: In-depth market analysis and research reports are available to aid traders in making informed decisions.

Demo Account: A demo account allows users to practice trading strategies without financial risk.

Fees and Commissions

Markets.com charges spreads that can vary depending on the asset class. Understanding the cost structure is essential for assessing long-term trading costs.

Customer Support

A reliable customer support system is crucial in trading. Markets.com offers various support options, including live chat, email, and phone support.

IG Overview

IG Group is one of the oldest and most reputable online trading platforms, founded in 1974. It is known for its extensive range of offerings and robust regulatory framework, which builds trust among traders.

Trading Instruments

IG provides access to a wide range of instruments:

Stocks

Indices

Commodities

Forex

Cryptocurrencies

Features and Tools

IG offers numerous features, such as:

ProRealTime Charts: Advanced charting tools for performing technical analysis.

News and Analysis: Daily market news and insights help inform trading decisions.

Education Resources: A wealth of educational materials, webinars, and articles available for all experience levels.

Fees and Commissions

IG operates with competitive spreads among many markets, and customers should review fees related to various instruments. Understanding these costs helps traders plan their strategies more effectively.

Customer Support

IG provides extensive customer service, with support available via live chat, email, and phone. Their website also features a comprehensive FAQ section.

Pepperstone Overview

Founded in 2010, Pepperstone has quickly emerged as a leading forex and CFD broker known for low spreads and fast execution speeds, catering primarily to forex traders.

Trading Instruments

Pepperstone offers a diverse selection of assets, including:

Forex

Indices

Commodities

Cryptocurrencies

Features and Tools

Key features offered by Pepperstone include:

MetaTrader Platforms: Access to both MetaTrader 4 and MetaTrader 5 for advanced trading.

Research and Education: Includes market analysis and educational materials.

Social Trading Options: Allows users to follow and copy the trades of experienced traders.

Fees and Commissions

Pepperstone is noted for its low-cost trading environment. Its pricing model includes spreads and commissions that vary based on account type.

Customer Support

Pepperstone offers customer support through multiple channels, including live chat and telephone, ensuring traders can get help when needed.

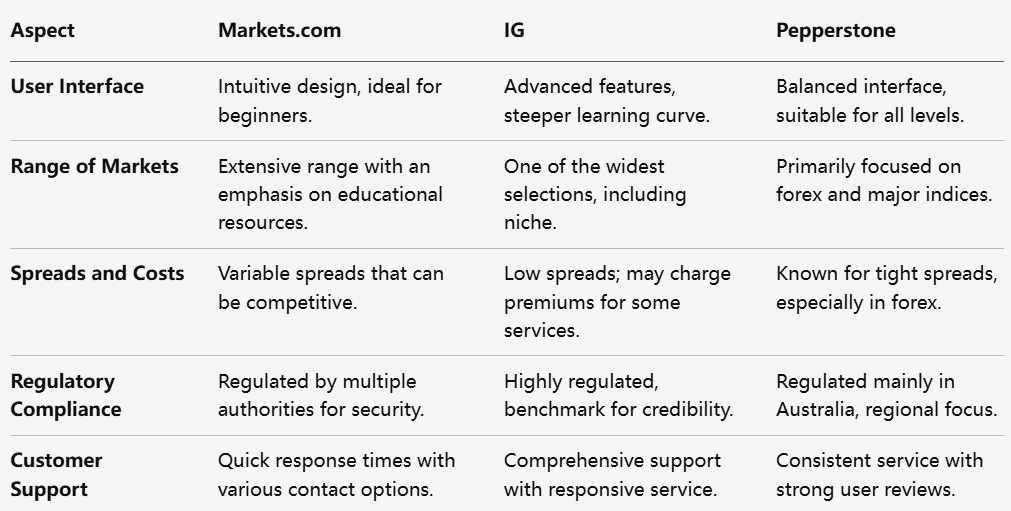

Comparative Analysis

User Interface and Experience

All three platforms provide user-friendly interfaces, but there are nuances to consider:

Range of Markets

While all three platforms offer CFDs on key asset classes, the depth of offerings varies:

Markets.com: Extensive range with a strong emphasis on educational resources.

IG: One of the widest selections, including niche markets.

Pepperstone: Focused primarily on forex and major indices, which may limit options for those interested in other asset classes.

Spreads and Costs

Cost structure is a significant factor in CFD trading:

Markets.com: Variable spreads that can be competitive but vary significantly.

IG: Offers low spreads; may charge a premium for certain services.

Pepperstone: Known for tight spreads, particularly in forex trading, attractive to high-frequency traders.

Regulatory Compliance

All three platforms have regulatory oversight, but their jurisdictions vary:

Customer Support

Customer support is critical, especially during volatile trading periods. All three platforms offer multiple support channels:

Markets.com: Quick response times with various contact options.

IG: Comprehensive support; users report responsive service.

Pepperstone: Consistent service with strong user reviews regarding response efficiency.

Pros and Cons

Markets.com

Pros

Accessible for beginner traders.

Comprehensive educational materials.

Broad range of instruments.

Cons

Variable spreads may not be the lowest.

Platform may lack advanced tools for seasoned traders.

IG

Pros

Extensive range of instruments and markets.

Well-regarded for regulatory compliance.

Advanced trading tools and analysis.

Cons

Complexity may overwhelm beginners.

Pricing may include higher costs for certain services.

Pepperstone

Pros

Low-cost trading environment.

Fast execution speeds suitable for active traders.

Strong focus on forex.

Cons

Limited range of non-forex instruments.

Customer support may vary based on the region.

No single platform suits everyone. Your choice depends on your trading style, experience level, budget, and personal preferences. Take advantage of demo accounts offered by most brokers to test platforms before committing real funds. Remember that a good platform complements your trading strategy but does not guarantee success—sound trading practices and risk management remain essential.

Invest time in researching and comparing platforms based on these criteria to ensure you select a trusted, cost-effective, and user-friendly CFD trading environment tailored to your needs.

Choosing the best CFD trading platform ultimately depends on your trading style, preferences, and experience level. Markets.com stands out for its educational resources and user-friendly approach. IG excels in providing a broad selection of markets and advanced trading tools, making it suitable for experienced traders. Pepperstone appeals to cost-sensitive forex traders who value execution speed.

Investors should conduct thorough research and consider demo accounts to test each platform before committing real capital. Understanding the strengths and limitations of each option will help align trading goals with the right platform, enhancing the overall trading experience.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.