Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Feb 12 2026 08:33

17 min

How to invest in gold in 2026: Investing in gold has long been a favored method for building wealth and hedging against economic uncertainty.

CFD Trading Basics: As we look toward 2026, one increasingly popular way to invest in gold is through Contracts for Difference (CFDs). This comprehensive guide will delve into what gold CFDs are, how they work, the advantages and disadvantages, and how to get started with investing in them.

The Appeal of Gold

Gold has been a valuable asset for centuries, often regarded as a refuge during times of economic instability. Here are some reasons why gold continues to capture the attention of investors:

Inflation Hedge: Historically, gold has been seen as a safeguard against inflation. When currency values decrease, gold prices often rise, preserving purchasing power. Many investors look to gold as a way to protect their wealth when fiat currencies weaken.

Market Uncertainty: In times of geopolitical tension or financial downturns, investors flock to gold. Its universal value and liquidity make it an attractive asset. Gold's role as a safe-haven asset becomes particularly pronounced during periods of uncertainty, as it retains value better than many other investments.

Portfolio Diversification: Gold often behaves differently from stocks and bonds, making it an effective tool for diversifying investment portfolios. By including gold in an investment portfolio, investors can reduce overall portfolio volatility and improve long-term returns.

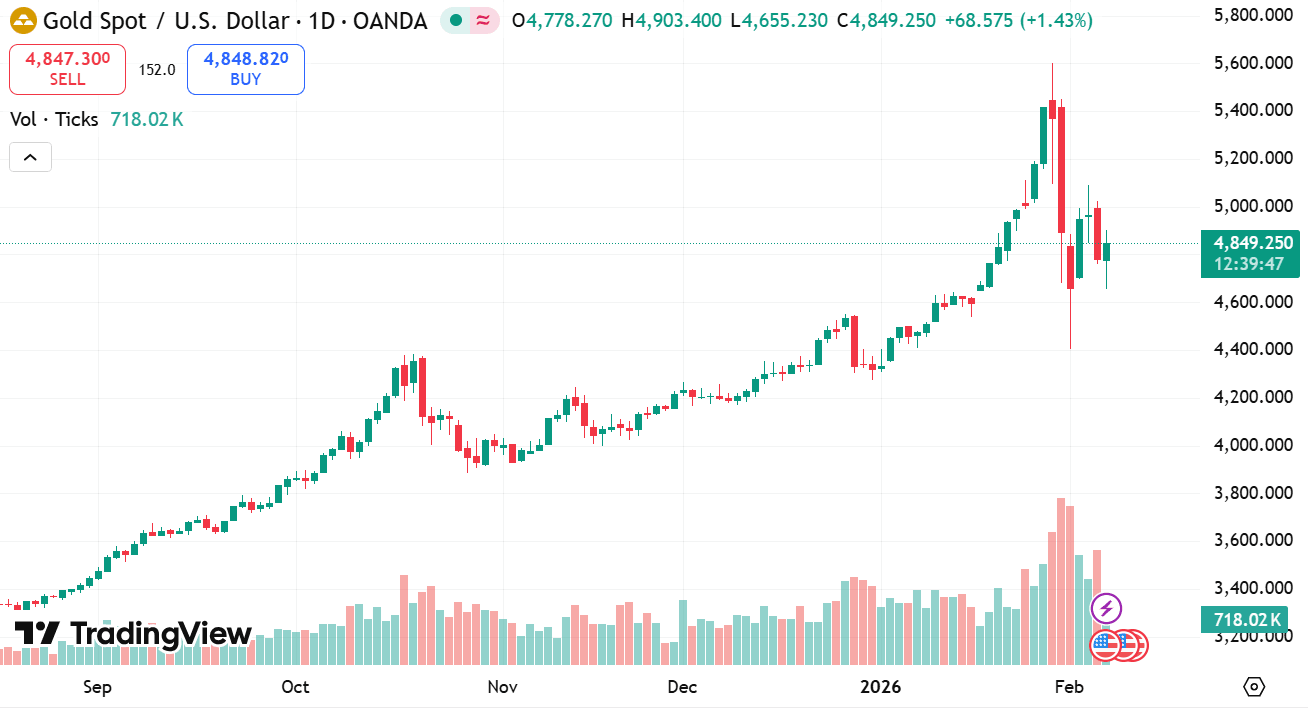

source: tradingview

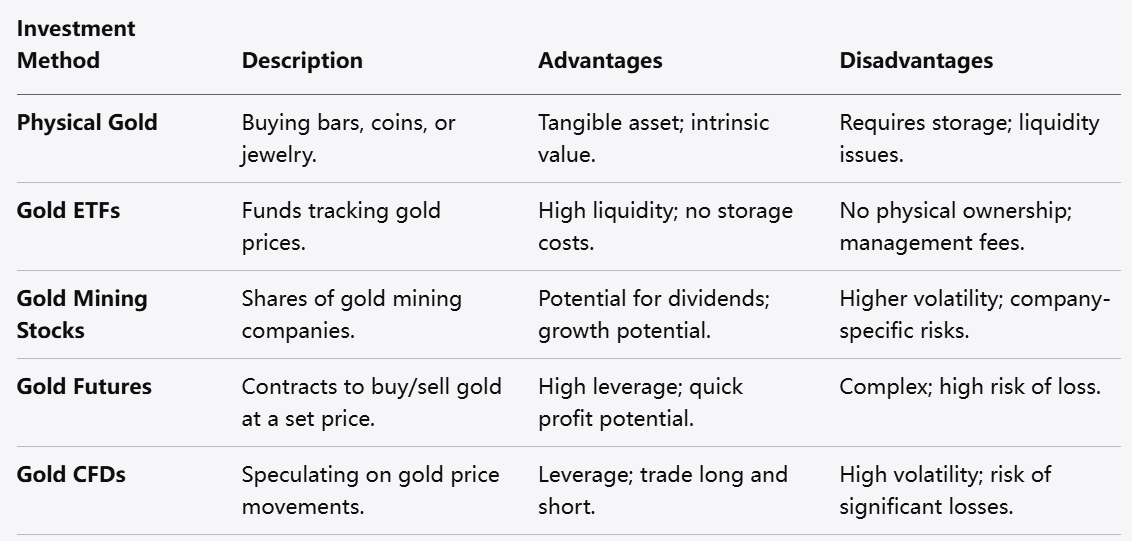

Before diving into gold CFDs, it's essential to understand the various methods of investing in gold:

Physical Gold: This includes buying gold bars, coins, or jewelry. While offering tangible ownership, it comes with storage and insurance considerations. Investing in physical gold requires ensuring proper security and insurance to protect against theft and damage.

Gold ETFs: Exchange-traded funds that track the price of gold. They offer liquidity and ease of trading but do not provide physical ownership. ETFs allow investors to gain exposure to gold prices without the complexities of physical storage.

Gold Mining Stocks: Investing in companies that mine gold can offer exposure to gold prices while also providing dividends and growth potential. Gold mining stocks can be more volatile than the price of gold itself, offering opportunities for higher returns but also increased risk.

Gold Futures: Contracts that obligate the buyer to purchase gold at a predetermined price on a specified date. This method requires a deeper understanding of the commodities market and carries significant risk due to leverage.

Gold CFDs: A derivative instrument allowing traders to speculate on the price of gold without owning the physical asset. CFDs provide a unique way to invest in gold by allowing traders to take advantage of price movements without the need for physical ownership.

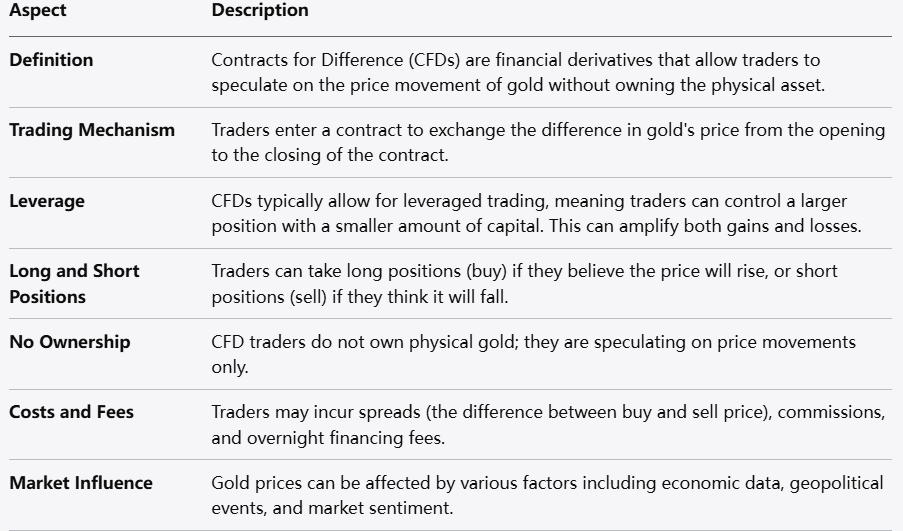

Definition of CFDs

Contracts for Difference (CFDs) are financial derivatives that enable traders to speculate on the price movement of an underlying asset without actually owning it. In the case of gold CFDs, traders can profit from fluctuations in gold prices without having to physically hold the metal.

How Gold CFDs Work

When you trade gold CFDs, you enter into an agreement with a broker to exchange the difference in the price of gold between the opening and closing of the contract. Here’s how it works:

Opening a Position: When you think the price of gold will increase, you can open a "buy" position. Conversely, if you believe prices will fall, you can open a "sell" position. Your decision can be based on market analysis or news events impacting gold prices.

Leverage: CFDs are typically traded on margin, meaning you can control a larger position with a smaller initial investment. Leverage can magnify both potential gains and losses, requiring careful risk management practices to prevent significant losses.

Closing the Position: Your profit or loss is determined by the difference between the opening and closing prices of the CFD. If the price moves in your favor, you realize a profit; if not, you incur a loss. This mechanism allows traders to quickly enter and exit positions based on market conditions.

Leverage: Gold CFDs allow for higher leverage than traditional investments, enabling traders to amplify their exposure with a smaller capital outlay. While this increases potential returns, it also heightens financial risk.

No Physical Ownership: With CFDs, you don’t own the underlying gold asset, eliminating issues related to storage, insurance, and liquidity. This makes gold CFDs more convenient for traders who prefer not to manage physical assets.

Flexibility: Gold CFDs can be traded across various market conditions, allowing for both long and short positions depending on market expectations. This flexibility enables traders to adapt quickly to market changes.

1. Accessibility and Ease of Trading

Gold CFDs have made it easier for investors to trade gold without the need for physical ownership or storage concerns. This accessibility is particularly appealing to beginners, as they can enter the market with smaller amounts of capital.

2. Potential for Profit in Rising and Falling Markets

CFDs allow traders to capitalize on both upward and downward price movements. If you believe that gold prices will decrease, you can open a short position and profit from that decline. This flexibility can enhance trading strategies in various market conditions.

3. Leverage and Increased Exposure

Leverage can significantly amplify potential gains, allowing traders to control larger positions with a smaller initial investment. However, it is crucial to understand the risks associated with leverage, as potential losses can also be magnified.

4. No Storage or Insurance Costs

Investing in physical gold requires considered costs associated with safe storage and insurance. Gold CFDs eliminate these concerns, simplifying the investment process and reducing overall costs.

5. Market Accessibility and Trading Hours

Gold CFDs can be traded on various platforms, often providing access to the market 24 hours a day. This flexibility is advantageous for those looking to respond quickly to market conditions or trade during specific time zones.

1. Risk of High Volatility

The gold market can be highly volatile, leading to rapid price fluctuations. This volatility can lead to significant gains but also increases the risk of substantial losses. Traders should be prepared for sudden market movements that can impact their positions.

2. Potential for Margin Calls

Due to the leveraged nature of CFDs, if your account balance falls below a specific threshold, your broker may issue a margin call, requiring you to deposit additional funds to maintain your position. This could lead to forced liquidation if you are unable to meet the margin requirements.

3. Lack of Ownership

Investors in gold CFDs do not possess any physical gold, meaning they miss out on certain benefits of tangible assets, such as using gold as a haven during extreme inflation or secure emergencies. This lack of ownership may be a disadvantage for those who prefer tangible investments.

4. Broker Fees and Spreads

CFDs often come with associated costs, including spreads (the difference between the buying and selling prices) and potential overnight financing charges, which can affect overall profitability. Understanding the fee structure is essential for effective trading.

5. Complexity of CFD Markets

For beginners, understanding how CFDs work, particularly the intricacies of leverage and margin, can be overwhelming. A solid knowledge base is critical before engaging with these financial instruments to avoid making uninformed decisions.

1. Educate Yourself

Before investing in gold CFDs, take the time to understand how they function:

Market Dynamics: Study how gold prices are influenced by economic factors, geopolitical events, and market sentiment. Familiarizing yourself with these dynamics helps in making predictions about future price movements.

Risk Management: Learn about strategies to protect your capital, including stop-loss orders and position sizing. Understanding how to manage risk is crucial for long-term trading success.

2. Choose a Reliable CFD Broker

Selecting a reputable broker is critical for successful trading. Consider the following aspects:

Regulation: Ensure the broker is regulated by a recognized authority (e.g., the FCA in the UK, ASIC in Australia) to protect your funds and ensure fair trading practices.

Trading Platform: Opt for a user-friendly platform with robust tools for analysis and execution. A good platform should offer real-time quotes, analytical tools, and educational resources for traders.

Fees and Spreads: Compare the costs associated with trading CFDs, including spreads, commissions, and overnight fees. This comparison can help you select a broker that fits your trading style and budget.

Customer Support: Look for brokers that offer reliable customer support to assist you when needed. Responsive customer service can help resolve issues quickly and effectively.

3. Open a Trading Account

Once you’ve selected a broker, you’ll need to open a trading account. This typically involves:

Filling out a registration form with your personal details.

Completing identity verification procedures, which may include submitting documents like a government-issued ID and proof of address.

Funding your account through a bank transfer, credit card, or other methods. Ensure that you understand the funding options available and any associated fees.

4. Develop a Trading Strategy

Having a clear trading strategy is essential for navigating the CFD market. Consider these components:

Market Analysis: Utilize technical and fundamental analysis to inform your trading decisions. Technical analysis involves studying price charts and patterns, while fundamental analysis looks at economic indicators and news.

Risk Management: Determine how much of your capital you are willing to risk on each trade. Many traders recommend risking no more than 1-2% of your total capital on a single trade. This approach is vital in preserving your trading capital.

Entry and Exit Points: Establish criteria for when to enter and exit trades. This could include technical indicators, specific price levels, or market events.

5. Start Trading with a Demo Account

Most reputable brokers offer demo accounts allowing you to practice trading without risking real money. Use this opportunity to:

Familiarize yourself with the trading platform. A solid understanding of the platform's features and tools can enhance your trading efficiency.

Test your trading strategy in a risk-free environment. Experimenting with different strategies allows you to refine your approach before committing real capital.

Understand market behaviors in different scenarios. Observing how gold prices react to various economic indicators can better prepare you for future trading decisions.

6. Begin Trading Gold CFDs

Once you feel confident in your strategy, you can start trading gold CFDs with real capital. Remember to:

Monitor market conditions closely. Regularly checking market news, economic reports, and geopolitical developments can help inform your trading decisions.

Be ready to adapt your strategy based on new information. Flexibility in your trading approach allows you to remain responsive to unexpected events.

Stick to your risk management protocols to protect your capital. Consistently applying risk management strategies is crucial for long-term success and sustainability.

1. Technical Analysis

Many traders use technical analysis to predict future price movements in gold. Here are some common tools:

Support and Resistance Levels: Identify key price levels that historically act as barriers for prices. Support levels indicate where buying interest may emerge, while resistance levels suggest selling pressure. Understanding these levels can aid in determining entry and exit points.

Moving Averages: Traders often use moving averages to identify trends and potential reversal points. The crossover of shorter moving averages above longer ones can indicate bullish momentum, while the opposite can signal bearish conditions.

Relative Strength Index (RSI): The RSI measures the speed and change of price movements, helping traders identify overbought or oversold conditions. Values above 70 may indicate that gold is overbought, while values below 30 suggest it may be oversold. This indicator can provide useful signals for entering or exiting trades.

2. Fundamental Analysis

Understanding the macroeconomic factors influencing gold prices is crucial. Key aspects to consider include:

Interest Rates: When central banks lower interest rates, the attractiveness of holding gold increases as it does not yield interest. Conversely, higher interest rates may lead to lower demand for gold as investors seek better returns in interest-bearing assets.

Economic Data: Monitor economic indicators, such as GDP growth, unemployment figures, and inflation rates. Strong economic performance typically leads to increased demand for commodities, including gold, while economic downturns can decrease demand.

Geopolitical Events: Keep informed about global events that may influence market sentiment. Tensions in key gold-producing regions or significant political developments can lead to price fluctuations. For example, political instability in a major producer country may disrupt supply chains, driving prices higher.

3. Sentiment Analysis

Understanding market sentiment can provide insights into potential price movements. This can involve:

News Monitoring: Follow reputable news sources to stay updated on changes in the economic landscape that could affect gold prices. Price movements often respond to breaking news, making timely information essential for traders.

Investor Sentiment Indicators: Look for sentiment indicators that gauge bullish or bearish perspectives in the market. Surveys, trading volume, and open interest can provide clues about market sentiment.

1. Setting Stop-Loss Orders

One of the most effective ways to manage risk is by using stop-loss orders. These orders automatically close your position when the asset reaches a predetermined price, limiting your potential loss. Determine a suitable level for your stop-loss based on your overall trading strategy and risk tolerance.

2. Diversifying Your Trades

While focusing on gold CFDs, consider diversifying your trading portfolio to include other assets. Diversification can help mitigate risks associated with heavy losses in one position. Explore other commodities, stocks, or financial instruments to complement your gold trading strategy.

3. Continuous Learning and Adaptation

The financial markets are constantly evolving, and so should your trading strategies. Invest time in continuous learning about new trading methods, market analysis techniques, and risk management strategies. Adapt your approach based on changing market conditions and new information.

4. Maintaining an Emotional Discipline

Trading can evoke emotional responses, especially when significant profits or losses are involved. Maintaining emotional discipline is crucial for making rational decisions. Stick to your trading plan, avoid impulsive actions, and keep your focus on long-term objectives.

Investing in gold through CFDs presents a unique set of advantages and challenges. As we approach 2026, understanding the intricacies of gold CFDs can empower beginners to make informed decisions.

From comprehending market dynamics and selecting reliable brokers to developing effective trading strategies, each step is critical to navigating the complexities of gold trading. The potential for high returns, the ability to trade on margin, and the flexibility to profit in both rising and falling markets make gold CFDs appealing, but they also carry inherent risks.

Education and preparation are paramount for anyone considering entering the gold CFD market. By arming yourself with knowledge, setting clear strategies, and investing cautiously, you can enhance your chances of success in this exciting and volatile arena. Through continual learning, adaptation, and disciplined trading, you can navigate the evolving landscape of gold CFDs and potentially achieve your financial goals.

Looking to trade gold CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.