Tuesday Nov 11 2025 09:00

14 min

How to invest in gold now: Gold has established itself as a reliable investment option over centuries, serving not only as a financial asset but also as a symbol of wealth and prosperity.

With its multifaceted appeal, gold remains an important consideration for both novice and seasoned investors. This comprehensive guide will address the best ways to invest in gold, the reasons behind its enduring popularity, what influences its price, and practical strategies for entering the gold market.

Gold prices are influenced by a variety of factors, making them complex and dynamic. Understanding these factors can help investors make informed decisions.

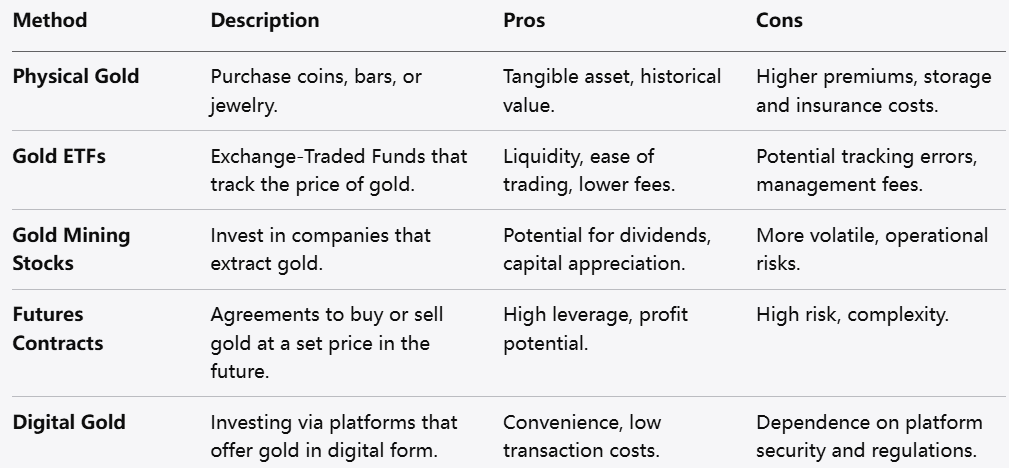

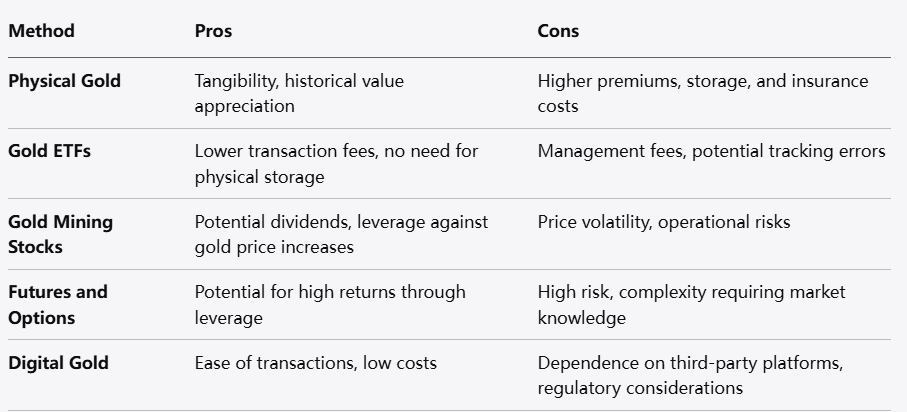

Entering the gold investment arena requires careful consideration of various methods. Each method comes with its own set of pros and cons.

1. Physical Gold

Investors can choose to buy physical gold in the form of coins, bars, or jewelry. When buying physical gold, it's essential to consider authenticity, storage, and insurance.

Gold Bullion: Includes gold bars and coins, typically produced by government mints or reputable private mints. Ensure certified authenticity from recognized dealers.

Gold Jewelry: While many cultures value jewelry as an investment, it’s crucial to note that its resale value may not equal the original purchase price due to craftsmanship costs.

2. Gold ETFs (Exchange-Traded Funds)

Gold ETFs allow investors to buy shares that represent a stake in gold assets without the complexities of storing physical gold. They trade on major stock exchanges, and their prices fluctuate throughout the trading day based on the price of gold.

Advantages: Liquidity, ease of trading, and lower management fees compared to mutual funds.

Disadvantages: Potential tracking errors where the ETF may not perfectly follow gold prices and management fees that can affect returns.

3. Gold Mining Stocks

Investing in companies that mine for gold is another way to gain exposure to gold prices. Gold mining stocks tend to be more volatile than gold itself, but they can offer significant returns during rising gold markets.

Advantages: Potential for dividends and capital appreciation as mining companies can benefit from rising gold prices.

Disadvantages: Operational risks, management issues, and fluctuations in mining output can increase volatility.

4. Futures and Options

For those with more experience, gold futures and options can provide opportunities for leveraging investments. These contracts allow investors to buy or sell gold at a predetermined price at a future date.

Advantages: High leverage allows for significant profit potential.

Disadvantages: High risk due to leveraged positions and complex market dynamics that can lead to substantial losses.

5. Digital Gold Investments

Emerging financial technology now allows investors to purchase gold digitally. Some platforms offer digital gold where investors can buy, sell, or trade gold securely without needing physical possession.

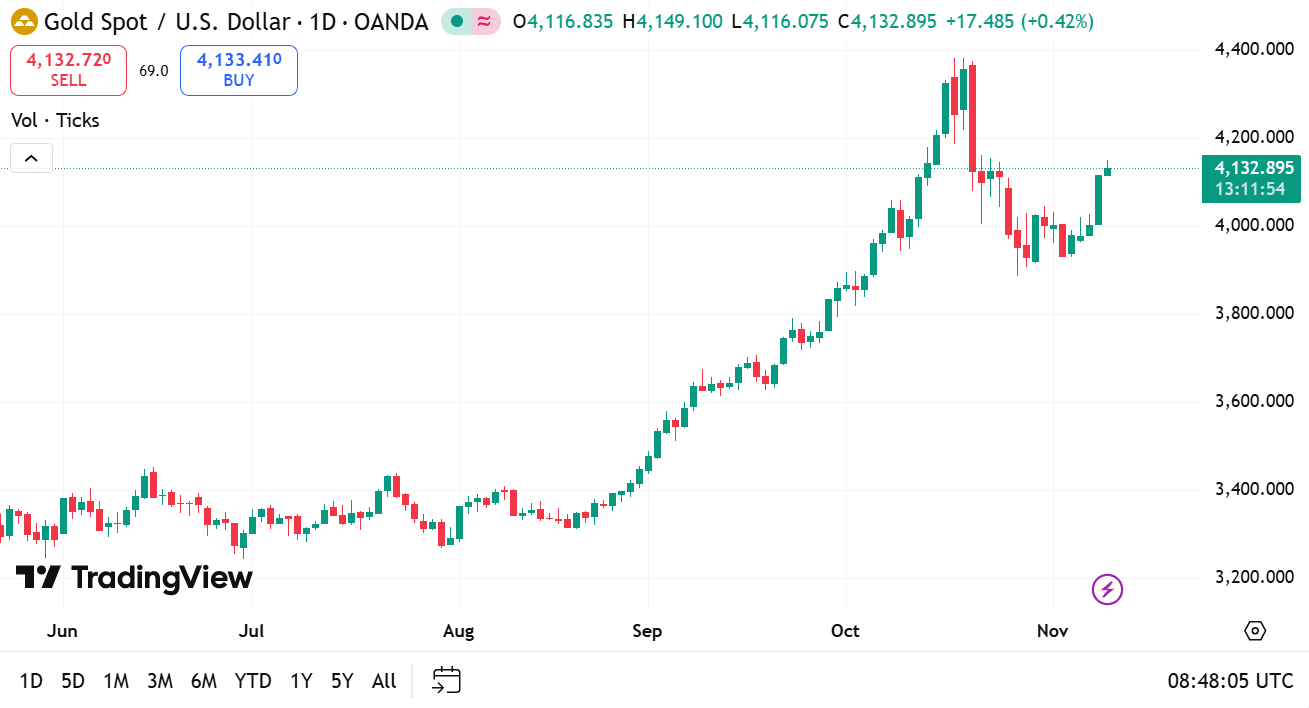

source: tradingview

Advantages: Convenience and the possibility of low fees.

Disadvantages: Reliance on the platform's security and regulatory risks.

Understanding the costs associated with trading gold is crucial for maximizing profits and making informed decisions. These costs can vary widely based on the method of investment.

1. Purchase Costs

When buying physical gold, you’ll often pay a premium over the spot price, which reflects the cost of production, distribution, and dealer margins. The premium may vary depending on the size of the purchase and the type of gold.

2. Storage Fees

If you choose to hold physical gold, secure storage is paramount. Many investors opt for safety deposit boxes at banks or use third-party vault services, which typically charge annual fees based on the amount being stored.

3. Transaction Fees

Investments in ETFs or stocks may incur brokerage fees. These fees can vary widely between brokerage firms, so it’s advisable to shop around for low-cost options.

4. Tax Implications

Different forms of gold investments may be subject to various tax treatments. Selling physical gold could incur capital gains taxes based on the profit made. Understanding the tax implications relevant to your jurisdiction is essential for effective financial planning.

5. Market Spread

The spread—defined as the difference between the buying price and the selling price—can significantly impact your returns. Gold that has high liquidity tends to have tighter spreads, which is favorable for investors looking to enter and exit positions quickly.

The method chosen for gold investment can significantly affect the overall cost structure. Here’s an overview of how different investment options compare:

1. Physical Gold

Pros: Tangibility, historical value appreciation.

Cons: Higher premiums, storage, and insurance costs.

2. Gold ETFs

Pros: Lower transaction fees, no need for physical storage.

Cons: Management fees and potential tracking errors.

3. Gold Mining Stocks

Pros: Potential dividends and leverage against gold price increases.

Cons: Price volatility and operational risks associated with mining companies.

4. Futures and Options

Pros: Potential for high returns through leverage.

Cons: High risk and complexity, requiring substantial market knowledge.

5. Digital Gold

Pros: Ease of transactions and low costs.

Cons: Dependence on third-party platforms and regulatory considerations.

As economic conditions evolve, the question arises: is gold still a sound investment?

1. Long-Term Value

Gold has historically proven to retain its value over the long term. While it may not offer the high short-term returns seen in stocks, its stability makes it a reliable hedge against market volatility and inflation.

2. Market Conditions

Economic downturns typically lead to increased demand for gold. The current economic climate (characterized by inflation, high debt levels, and geopolitical tensions) often prompts investors to consider gold as a protective measure.

3. Affordability and Accessibility

With various ways to invest, from physical gold to ETFs, even modest budgets can access gold investments. This accessibility makes it a viable option for a wide range of investors.

4. Smart Investment Strategy

Investors should consider their financial goals before investing in gold. Allocating a portion of a diversified portfolio to gold can enhance resilience against market shocks.

5. Market Timing and Trends

Investors should stay aware of market trends and timing. Generally, entering the market during dips in gold prices can maximize potential returns.

To maximize the benefits of gold investment, consider the following strategies:

1. Research and Education

Successful investing starts with knowledge. Understand market trends, economic indicators, and investment options. Continuous learning will empower informed decision-making.

2. Diversification

Avoid concentrating your investments solely in gold. While it can protect against inflation and economic uncertainty, diversification across various asset classes (like stocks, bonds, and real estate) can enhance overall portfolio performance.

3. Leverage Expert Insights

Consulting financial advisors or investment professionals can provide valuable insights tailored to your individual circumstances, including risk tolerance and financial goals.

4. Long-Term Focus

Investing in gold should generally be approached with a long-term perspective. Short-term volatility may be unsettling, but patience can often result in favorable outcomes.

5. Regular Portfolio Assessment

Periodically review your investment portfolio to ensure alignment with evolving financial goals and market conditions. This review may warrant rebalancing your gold holdings based on current economic realities.

Investing in gold can offer significant benefits, including wealth preservation, diversification, and potential capital appreciation. To navigate the complexities of the gold market successfully, investors must understand the various methods available, the associated costs, and the factors that influence gold prices.

Making informed investment decisions while staying abreast of market trends will ultimately help investors leverage gold as a viable component of their overall financial strategy. Through research, careful planning, and consistent review, individuals can effectively harness the power of gold to secure their financial future.

Looking to trade gold CFDs right now? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.