Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Dec 3 2025 09:11

12 min

Online Commodity Trading: Trading commodities has increasingly become a popular venture for both seasoned traders and newcomers.

Gold (XAU/USD) Price today: One of the most sought-after commodities is gold, often regarded as a reliable asset for diversification and hedging against economic uncertainty. In this guide, we will explore how to trade gold CFDs, covering essential concepts, strategies, and best practices to maximize your trading experience.

The Historical Significance of Gold

Gold has been valued throughout history for its beauty, rarity, and unique properties. Unlike fiat currencies, which can be printed at will, gold is finite, making it an attractive option for wealth preservation. Throughout the ages, it has symbolized wealth and power, serving not only as currency but also as a store of value.

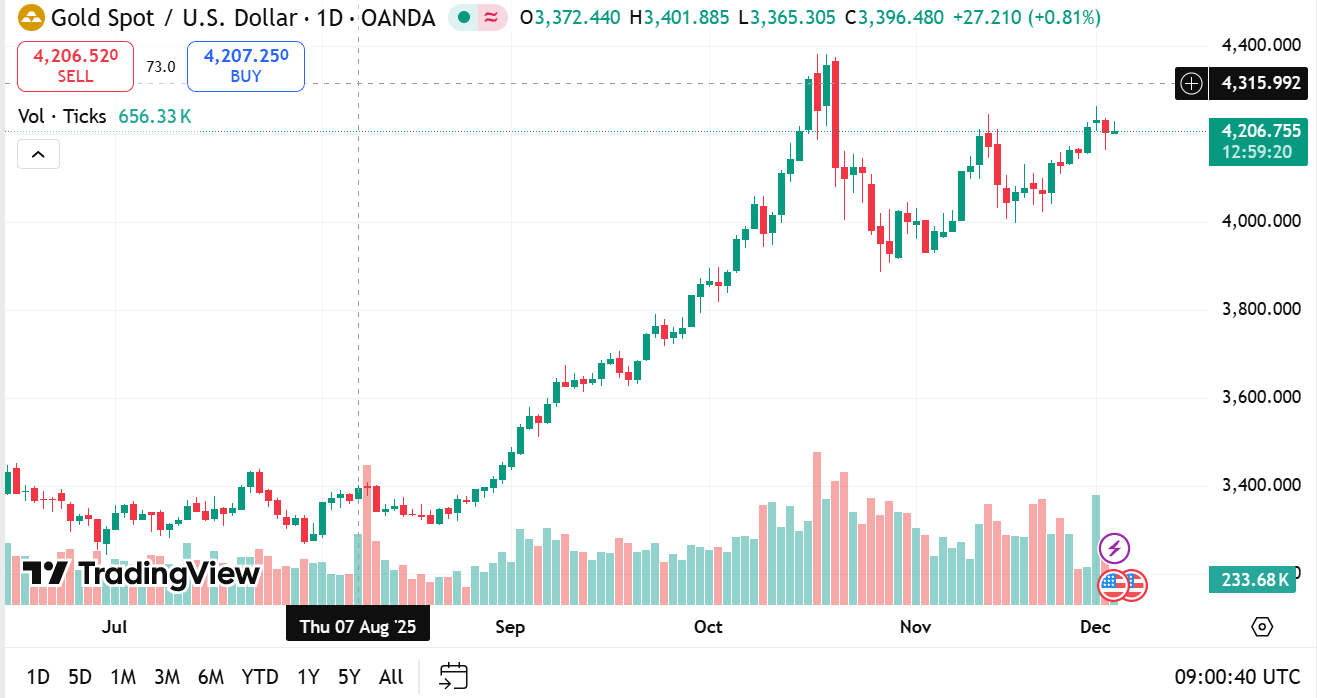

Current Market Dynamics

In the modern era, gold's status has been further solidified as a critical asset in financial markets. With rising inflation, currency fluctuations, and geopolitical tensions, gold remains a popular choice for diversifying portfolios. Understanding the fundamental factors influencing gold prices is crucial for effective trading.

source: tradingview

Definition of Contracts for Difference (CFDs)

A Contract for Difference (CFD) is a financial derivative that allows traders to speculate on the price movements of an underlying asset, such as gold, without actually owning the asset. When trading CFDs, you enter an agreement with a broker to exchange the difference in the asset's price from the moment the contract is opened to when it is closed.

Advantages of Trading CFDs

Risks Associated with CFD Trading

While CFDs offer various advantages, they also come with inherent risks:

Choosing a Reliable Broker

The first step in trading gold CFDs is selecting a reputable broker. Consider the following factors:

Regulation: Choose a broker regulated by a recognized financial authority to ensure that your investments are protected.

Trading Platform: Evaluate the trading platform for usability, features, and access to trading tools.

Fees and Spreads: Compare fees and spreads associated with trading gold CFDs, as these can impact overall profitability.

Customer Support: Adequate customer support can make a difference, especially for new traders requiring assistance.

Opening a Trading Account

Once you've selected a broker, the next step is to open a trading account. This process typically includes:

Registration: Fill out the necessary details, including personal information and trading experience.

Verification: Many brokers require identification verification to comply with regulations. Be prepared to provide documentation, such as a passport or utility bill.

Funding Your Account: After verification, fund your account using a preferred payment method. Ensure you are aware of any deposit minimums and transaction fees.

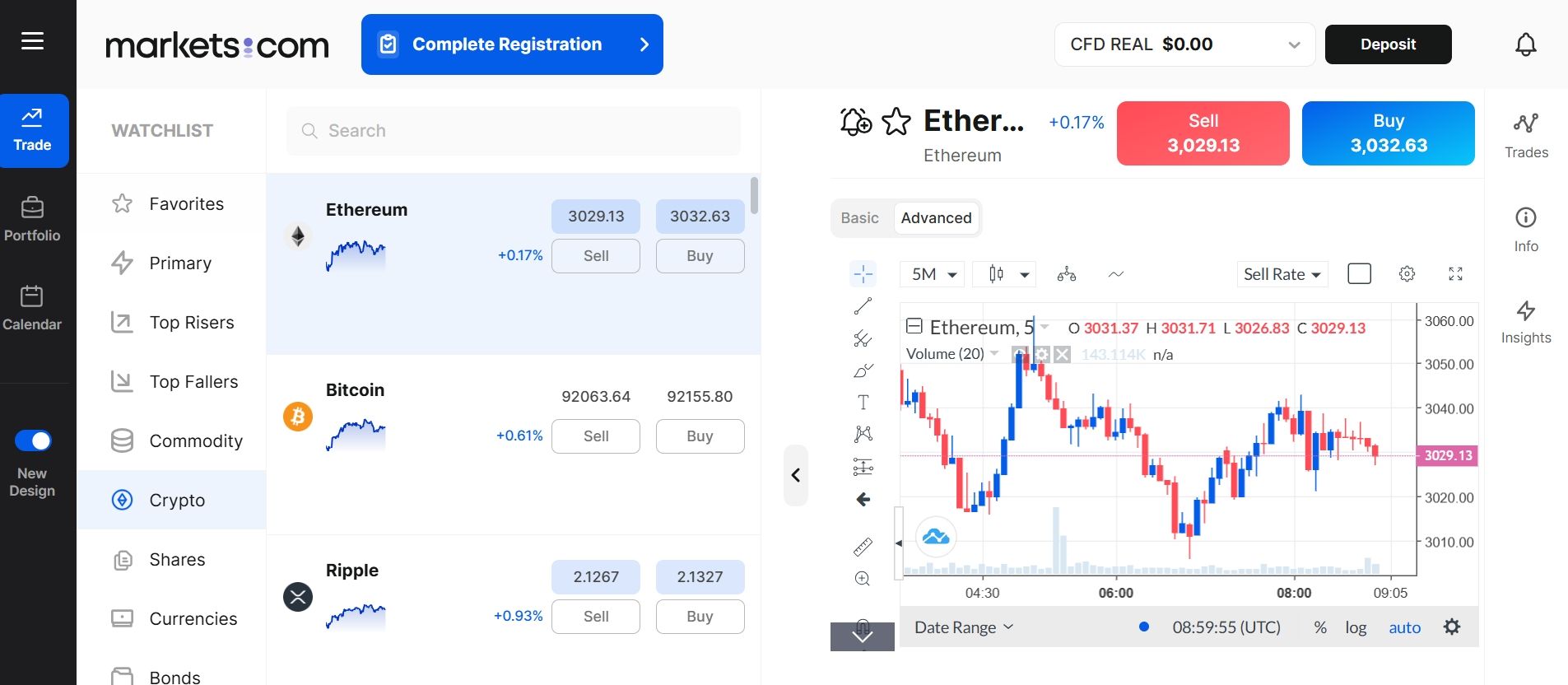

Markets.com offers a user-friendly platform for trading Gold CFDs (XAU/USD), making it an ideal choice for both novice and experienced traders. With 24/5 access to the gold market, you can execute trades at your convenience, capitalizing on price movements whenever they occur.

Whether you are looking to hedge against economic uncertainty or speculate on price moves, trading gold CFDs with Markets.com provides a comprehensive trading experience tailored to your needs.

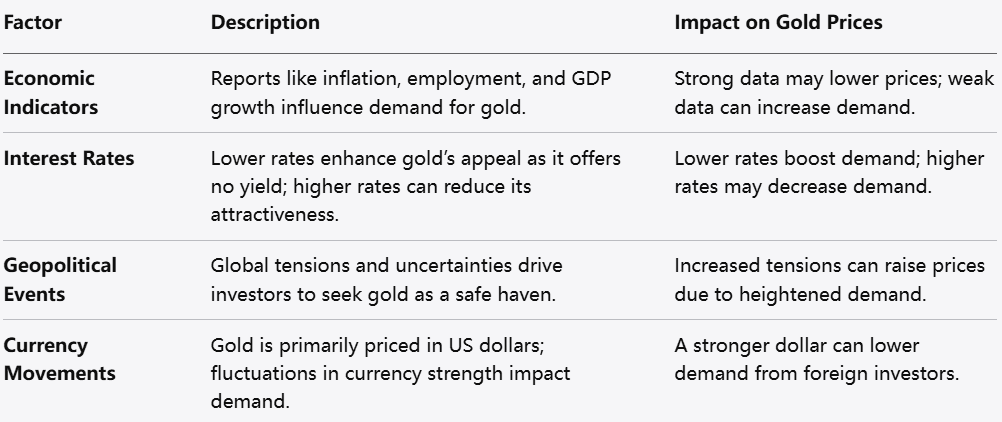

To trade gold effectively, it is essential to grasp the factors affecting its price fluctuations:

Economic Indicators: Economic reports, such as inflation data, employment figures, and GDP growth, can influence gold prices. Strong economic data may result in lower gold prices, while weak data can boost demand.

Interest Rates: Lower interest rates tend to increase gold's appeal as a non-yielding asset. Conversely, rising interest rates may lead to reduced demand for gold.

Geopolitical Events: Tensions and uncertainties in global politics can drive investors toward gold as a safe-haven asset.

Currency Movements: Gold is typically priced in major currencies, primarily the US dollar. A stronger dollar can make gold more expensive for foreign investors, potentially decreasing demand.

Fundamental Analysis

Fundamental analysis involves evaluating economic data and market trends to predict future price movements. Key factors to consider include:

Economic News Releases: Monitor important economic news releases that can affect gold prices, such as labor reports, inflation data, and more.

Interest Rate Decisions: Central bank decisions regarding interest rates should be on your radar, as these can significantly influence gold’s market position.

Geopolitical Developments: Be aware of global events that can drive investment toward gold, such as conflicts or trade disputes.

Technical Analysis

Technical analysis relies on historical price data and trading volume to predict future price movements. Key components include:

Chart Patterns: Familiarize yourself with common chart patterns, such as head and shoulders, triangles, and flags, to identify potential trading signals.

Indicators: Utilize technical indicators, such as moving averages, Relative Strength Index (RSI), and MACD, to gain insights into market trends and momentum.

Candlestick Analysis: Study candlestick patterns to identify potential reversals or continuations in market trends.

Effective risk management is essential in trading to minimize potential losses. Consider these strategies:

Stop-Loss Orders: Set stop-loss orders to automatically close a position once it reaches a certain price level, limiting potential losses.

Position Sizing: Determine the appropriate position size based on your trading strategy and risk tolerance. Avoid risking more than a certain percentage of your trading capital on a single trade.

Diversification: While focusing on gold, consider diversifying your portfolio with other assets to mitigate risks associated with fluctuations in any single market.

Trading Hours and Market Behavior

Understanding the trading hours for gold can enhance your strategy. Gold is typically traded 24 hours a day, five days a week. However, volatility can vary based on the time of day due to overlapping trading sessions among global markets:

Asian Session: The Asian market might see different influences compared to European and US sessions, with varying levels of volatility.

US Market Open: The opening of the US market often brings significant movement in gold prices, influenced by US economic data releases.

Keeping Abreast of Market News

Staying informed about market developments is vital for traders. Use various sources for market news, including:

Economic Calendars: Keep an economic calendar to track upcoming reports and events that may impact gold prices.

Market Analysis Providers: Explore reputable online platforms that provide daily or weekly analysis and insights for commodities and gold specifically.

Social Media and Forums: Engaging with online communities can provide different perspectives and insights from other traders.

Setting Goals and Expectations

Before entering trades, it’s crucial to establish clear trading goals and expectations. Consider the following:

Realistic Targets: Set attainable profit targets based on your trading strategy and risk tolerance.

Time Commitment: Assess how much time you can dedicate to trading. Day trading may require more time and attention than swing trading.

Emotional Discipline: Develop emotional discipline to manage the psychological aspects of trading, such as fear and greed.

Trading gold CFDs can be an enriching experience when approached with the right knowledge and strategies. By understanding the underlying factors affecting gold prices, employing effective trading strategies, and practicing sound risk management, you can navigate the complexities of the gold market more effectively.

Remember, the key to successful trading lies in continuous learning and adaptation to market dynamics. Whether you're a novice looking to explore the world of commodity trading or a seasoned trader seeking to refine your approach, this guide provides the foundational insights necessary to begin trading gold CFDs confidently.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.