Friday Nov 7 2025 09:28

7 min

Top Australian Shares: Investing in the stock market can be an effective way to build wealth over time.

For those new to investing, starting with established and well-known companies can provide a more stable entry point. Australia’s share market offers a range of blue-chip companies with strong track records, making them attractive options for beginners. This guide explores ten of the top Australian shares for new investors and offers practical tips for buying stocks.

BHP Group is a global leader in mining and resources. It operates across a variety of commodities including iron ore, coal, copper, and petroleum. As one of the world’s largest mining companies, BHP benefits from diversified operations and global demand for raw materials. Its strong balance sheet and consistent dividend payments make it a popular choice for investors seeking exposure to the materials sector.

The Commonwealth Bank of Australia is one of the country’s largest banks, offering a wide range of financial services such as retail, business, and institutional banking. Known for its technological innovation and market presence, CBA has a solid history of profitability and dividend distributions. For beginners, investing in a major bank like CBA offers exposure to the financial sector with relatively stable earnings.

CSL Limited is a global biotechnology company specializing in the development of innovative biotherapies and vaccines. With a strong presence in the healthcare sector, CSL has demonstrated consistent growth driven by product development and global demand for medical treatments. Its defensive nature makes it attractive during economic uncertainty, providing steady performance irrespective of market cycles.

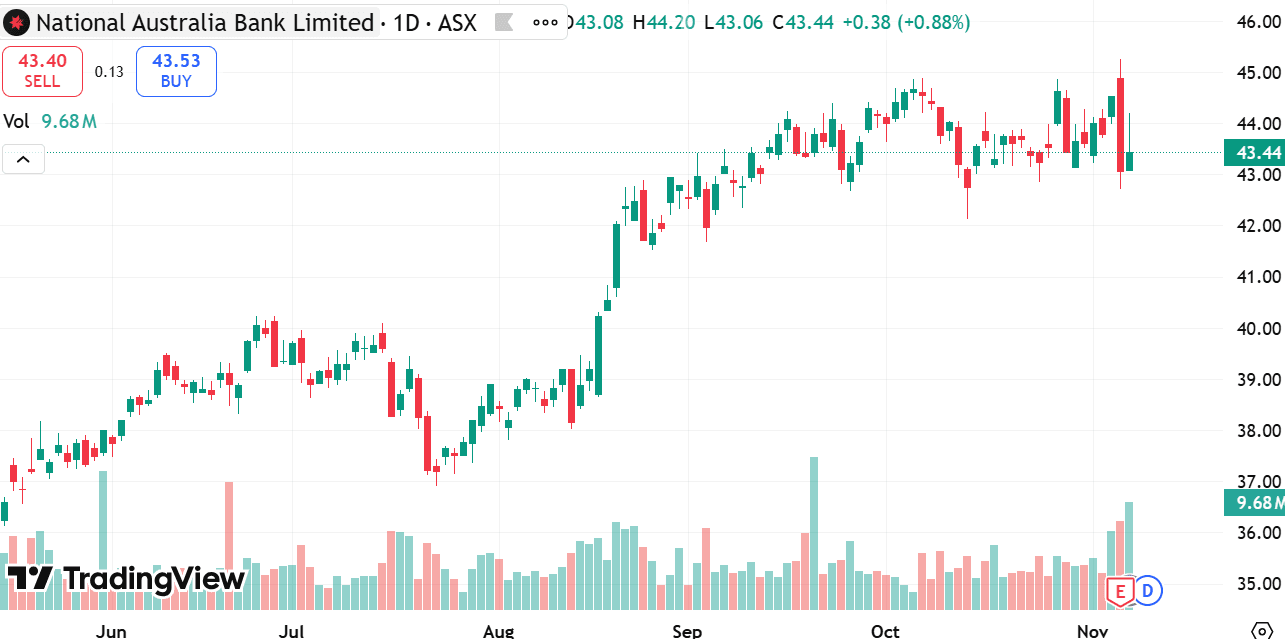

source: tradingview

National Australia Bank is another of Australia’s major banks, with a focus on retail banking, business services, and wealth management. NAB has a broad customer base and operates extensively across Australia and New Zealand. The company’s commitment to digital transformation and improving customer experience supports its long-term growth prospects.

Westpac is one of the oldest banks in Australia, offering a comprehensive range of banking and financial services. It serves millions of customers and has a significant presence in the mortgage market. Despite facing some regulatory challenges in recent years, Westpac remains a key player in the banking industry, offering potential for stable returns through dividends and capital growth.

ANZ is a major bank with a strong presence not only in Australia but also in Asia and the Pacific region. It provides retail, commercial, and institutional banking services. ANZ’s international exposure can offer diversification benefits within a portfolio, and its focus on sustainability initiatives aligns with evolving market preferences.

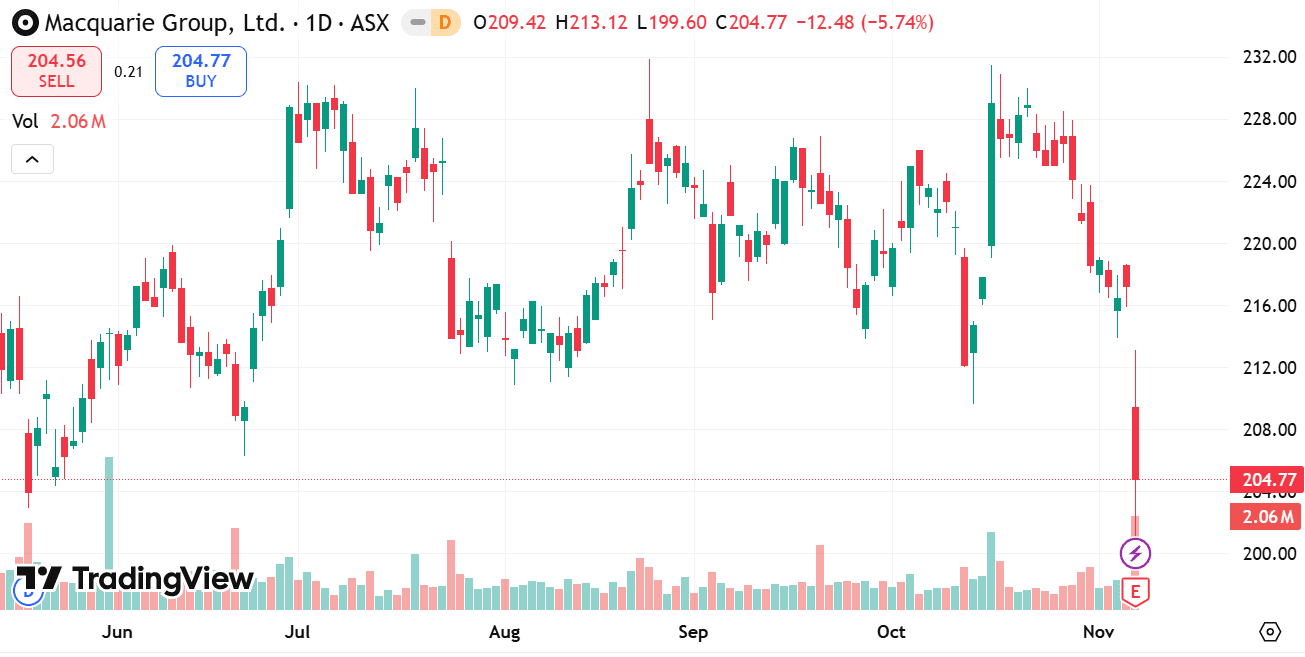

source: tradingview

Macquarie Group is a global financial services provider known for its asset management, investment banking, and advisory services. The firm has a diverse business model that includes infrastructure investments and funds management. Macquarie’s growth-oriented approach and exposure to various financial markets create opportunities for capital appreciation.

Fortescue Metals Group is an iron ore producer with a growing presence in renewable energy projects. The company has expanded rapidly in recent years, benefiting from strong demand from global markets. Its focus on cost efficiency and sustainability initiatives positions it well for future growth in the resources sector.

Woodside is a leading Australian energy company specializing in oil and natural gas production. It is involved in large-scale projects and has begun transitioning towards renewable energy ventures. Woodside’s strategic investments and operational scale make it a significant player in the energy sector, appealing to investors seeking exposure to traditional and emerging energy markets.

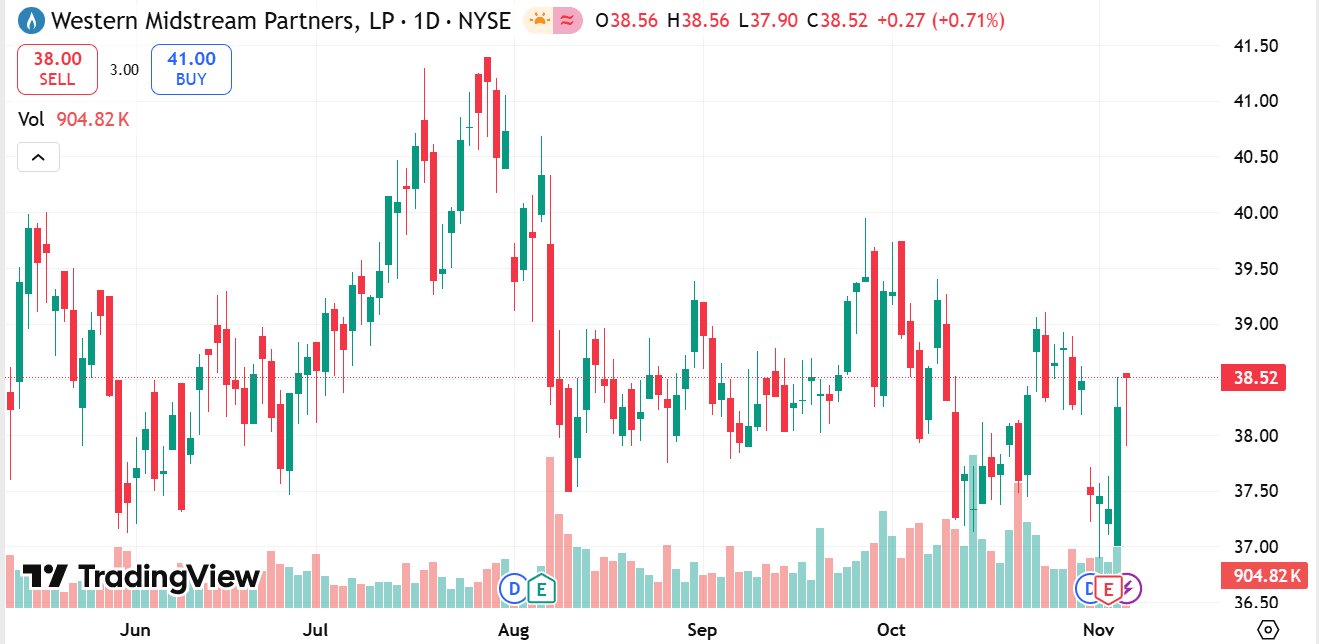

source: tradingview

Wesfarmers is a diversified conglomerate with interests in retail, chemicals, fertilisers, and industrial products. It owns well-known brands and retail chains, including supermarkets and home improvement stores. Wesfarmers’ diversified business model provides stability and potential for steady growth, making it a solid option for beginners.

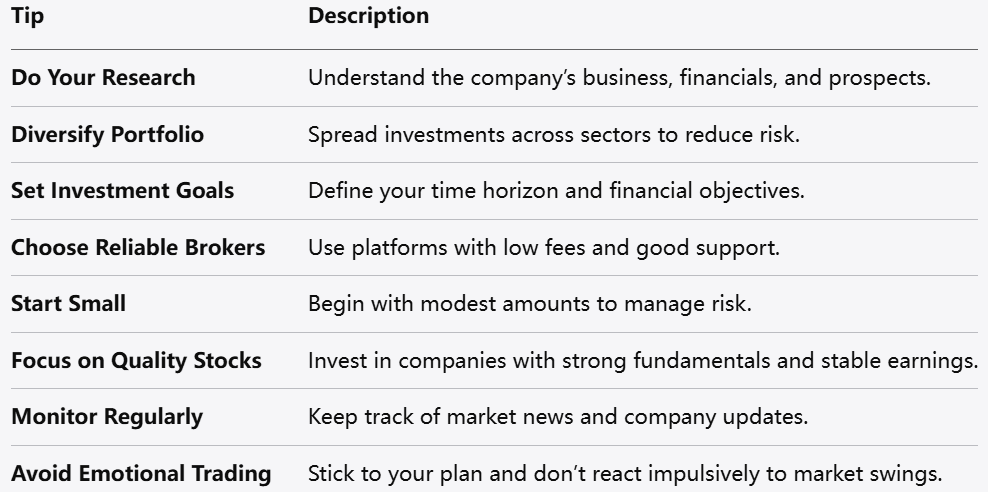

Investing in shares requires thoughtful planning and understanding of the market. Here are some practical tips for beginners:

1. Do Your Research

Before buying any stock, study the company’s business model, financial health, competitive position, and growth prospects. Understanding what the company does and how it makes money is crucial.

2. Diversify Your Portfolio

Avoid putting all your money into one stock or sector. Spreading investments across different industries can reduce risk and improve the chances of steady returns.

3. Consider Your Investment Horizon

Determine whether you are investing for the short term or long term. Stocks can be volatile in the short term but tend to provide better returns over longer periods.

4. Use Reliable Brokerage Platforms

Choose a brokerage with low fees, good customer service, and easy-to-use trading tools. Many platforms offer educational resources and demo accounts.

5. Start Small

Begin with modest investments and increase your exposure as you gain confidence and knowledge. This approach limits potential losses while you learn.

6. Focus on Quality Stocks

Prioritize companies with strong fundamentals, stable earnings, and good management. Blue-chip stocks often provide resilience during market downturns.

7. Monitor Your Investments

Keep track of your portfolio regularly to stay informed about company news, earnings reports, and market conditions. Adjust your holdings if necessary.

8. Avoid Emotional Decisions

Markets fluctuate, and it’s important not to react impulsively to short-term price changes. Stick to your investment plan and maintain discipline.

For beginners entering the Australian share market, investing in well-established companies like BHP Group, Commonwealth Bank, and CSL Limited offers a solid foundation. These companies are leaders in their respective sectors and provide a combination of growth potential and relative stability.

Building a diversified portfolio with a mix of industries and companies helps manage risk and smooth out volatility. Coupled with thorough research, a clear investment plan, and prudent decision-making, investing in Australian shares can be an effective way to grow capital over time.

Remember, investing is a journey that rewards patience and continuous learning. Starting with these top Australian shares and following sound investing principles can help beginners navigate the stock market with greater confidence.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.