Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Monday Nov 3 2025 07:55

8 min

Walmart (WMT) stock analysis: Walmart, as one of the largest retail chains globally, remains a key player in the retail sector.

Its earnings reports often serve as a barometer for broader consumer trends and retail health. As the company approaches its next earnings announcement, understanding what factors could influence its performance is essential. This analysis explores Walmart's current positioning, the retail environment, and potential drivers shaping its upcoming earnings results.

Walmart operates a vast network of stores, including supercenters, discount stores, and e-commerce platforms. Its business model focuses on providing a wide range of products at competitive prices, targeting a broad customer base. This diversified approach helps Walmart maintain resilience amid changing consumer behaviors.

In recent years, Walmart has embraced digital transformation, investing heavily in online sales channels and integrating technology to enhance the shopping experience. This blend of physical and digital presence positions the company to adapt to evolving retail trends.

Consumer spending patterns play a crucial role in Walmart’s performance. Economic conditions such as wage growth, employment rates, and inflation impact shoppers’ purchasing power. When consumers tighten their budgets, discount retailers like Walmart often see increased traffic, as shoppers seek value for their money.

However, rising costs for goods and supply chain challenges may affect Walmart’s margins and pricing strategies. The company’s ability to manage these factors while maintaining competitive prices will be closely watched during the earnings period.

E-commerce and Digital Growth

Walmart’s expansion in e-commerce has been a major strategic focus. The company’s online sales growth contributes significantly to overall revenue, driven by convenience and changing shopping habits. Investments in delivery services, curbside pickup, and digital advertising support this growth.

The upcoming earnings report will likely highlight the progress of digital initiatives and their contribution to total sales. Continued growth in this area is essential for Walmart to compete with other retail giants and meet consumer expectations.

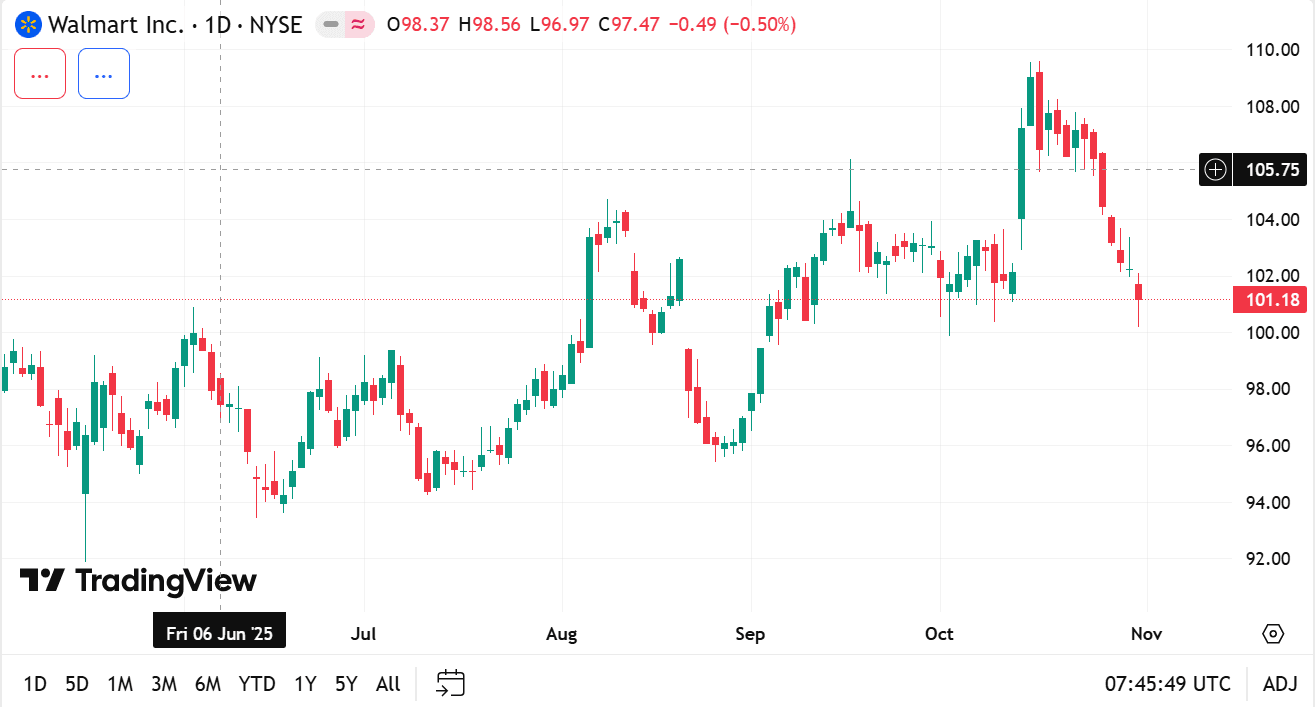

source: tradingview

Inventory and Supply Chain Management

Supply chain efficiency remains a critical factor for Walmart. The company’s ability to maintain sufficient inventory levels without excessive overstock influences both sales and costs. Recent disruptions in global supply chains have posed challenges for many retailers, affecting product availability and shipping times.

Walmart’s scale and logistics capabilities provide advantages in navigating these challenges. Insights into how the company is handling current supply chain issues will offer clues about future operational performance.

Pricing Strategies and Competitive Landscape

Price competitiveness is central to Walmart’s market strategy. The company’s approach to pricing, including discounts, promotions, and price matching, helps attract price-conscious shoppers. Balancing low prices with margin management will be a focus area during earnings discussions.

Competition from other retailers, both brick-and-mortar and online, continues to intensify. Walmart’s ability to differentiate itself through pricing, product assortment, and customer service will influence sales trends and market share.

Impact of Inflation and Cost Pressures

Inflationary pressures affect both consumers and retailers. For Walmart, rising costs for goods, labor, and transportation can squeeze margins if not managed carefully. The company’s pricing power and operational efficiencies will be tested in this environment.

Earnings updates may reveal how Walmart is adjusting to these pressures, including any changes in cost structures or shifts in product mix to maintain overall performance.

International Operations

While Walmart’s core business is in the domestic market, its international operations contribute to overall results. The company operates stores in various countries, each with unique market dynamics and consumer behaviors.

Performance in these international markets will be part of the earnings narrative, especially regarding growth initiatives, regulatory environments, and competitive positioning.

Walmart continues to invest in technology to enhance supply chain logistics, customer experience, and store operations. Innovations such as automation, artificial intelligence, and data analytics support efficiency and responsiveness.

Updates on technology-driven improvements and their impact on operational costs and sales could feature in the earnings commentary, providing insight into Walmart’s long-term strategic direction.

Labor Market and Workforce Management

Labor costs and workforce management are significant factors for Walmart, given its large employee base. Wage trends, hiring challenges, and employee retention efforts influence operational expenses and service quality.

Details on workforce initiatives, including training programs, wage adjustments, and employee benefits, may be discussed as part of the company’s efforts to maintain a productive and motivated workforce.

Environmental and Social Governance (ESG) Initiatives

Walmart has made commitments toward sustainability and social responsibility, which are increasingly important to consumers and the broader community. ESG initiatives around reducing carbon footprint, responsible sourcing, and community engagement shape the company’s public image and consumer loyalty.

Any progress or new commitments on these fronts could be highlighted during earnings, reflecting Walmart’s focus on sustainable growth.

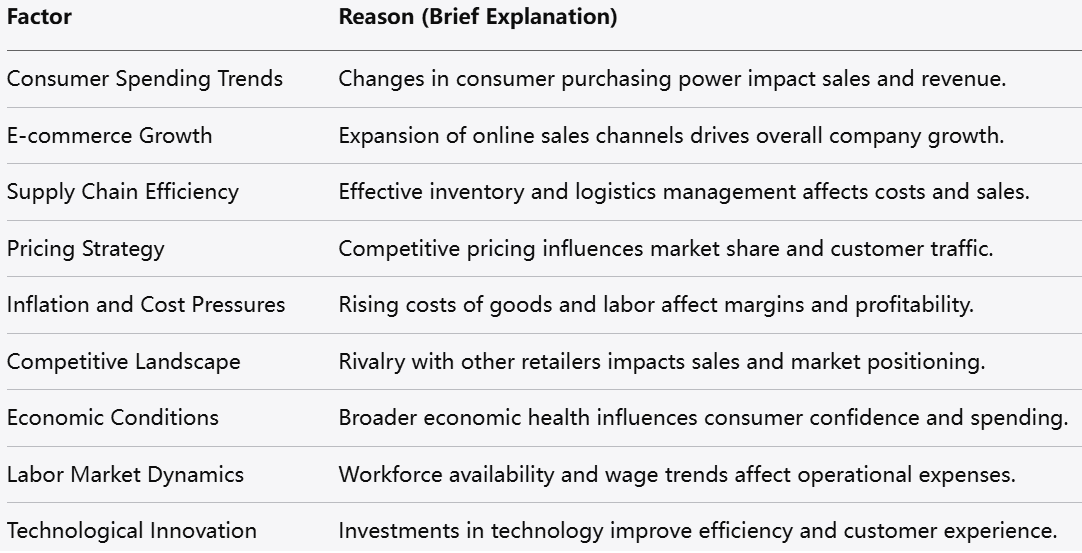

Key areas of focus for Walmart’s upcoming earnings include:

Looking to trade Walmart (WMT) stock CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Walmart’s earnings report will provide valuable insights into how the company is navigating a challenging retail environment marked by economic uncertainty, evolving consumer behaviors, and intensified competition. Its blend of physical stores and growing digital presence positions it to remain a dominant force in retail.

Monitoring the company’s approach to pricing, supply chain management, and technological innovation will be key to understanding its outlook. As Walmart continues to adapt and execute its strategies, the upcoming earnings announcement will be an important indicator of its trajectory in the changing retail landscape.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.