Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Nov 21 2025 10:02

11 min

What Are Privacy Coins: Cryptocurrencies have revolutionized the way people think about money and transactions, offering decentralized, peer-to-peer alternatives to traditional financial systems.

Crypto market today: However, while many cryptocurrencies provide transparency by design, this transparency can compromise user privacy. This has led to the development of a unique category of cryptocurrencies known as privacy coins. These coins aim to shield transaction details, protect user identities, and enhance confidentiality in a digital world where privacy is increasingly scarce.

This article explores what privacy coins are, how they work, the top three privacy coins in the market today, and the prospects of privacy coins in the future amid regulatory and technological challenges.

What Are Privacy Coins?

Privacy coins are cryptocurrencies specifically designed to ensure anonymity and confidentiality for users during transactions. Unlike public blockchains such as Bitcoin and Ethereum, where transaction data is transparent and traceable by anyone, privacy coins obscure critical transaction information including sender and receiver identities, transaction amounts, and other metadata.

This enhanced privacy is achieved through advanced cryptographic techniques that mask or encrypt transaction details. Privacy coins are often used by individuals seeking to maintain financial confidentiality, protect business secrets, or avoid surveillance and censorship.

Why Is Privacy Important in Cryptocurrency?

The original vision behind cryptocurrencies was to create a decentralized system free from intermediaries and censorship. However, the transparent nature of many blockchains introduces privacy vulnerabilities:

Privacy coins address these concerns by enabling users to transact without revealing sensitive information, thus protecting personal privacy and promoting financial freedom.

How Do Privacy Coins Work?

Privacy coins employ various cryptographic tools to hide transaction data. Some of the common techniques include:

Several privacy-focused cryptocurrencies exist today, but three stand out due to their technology, adoption, and community support.

1. Monero

Monero is widely regarded as the leading privacy coin, known for its strong privacy by default. It was launched in 2014 with a mission to offer fully anonymous and untraceable transactions.

Key Technologies

Ring Signatures: Mask sender identities by mixing their transaction with others.

Stealth Addresses: Hide recipient addresses by generating one-time use addresses.

Ring Confidential Transactions (RingCT): Conceal transaction amounts.

Monero’s privacy features are turned on by default for every transaction, making it impossible to see who sent or received funds or how much was transferred.

Adoption and Use Cases

Monero is popular among users who require strong privacy protections, including activists, journalists, and those living under oppressive regimes. It has also gained attention in less savory contexts due to its untraceability, but developers emphasize legitimate privacy rights.

Challenges

Monero faces regulatory scrutiny and has been delisted from some exchanges due to concerns over illicit use. Its privacy features also make forensic analysis very difficult, causing tension with law enforcement.

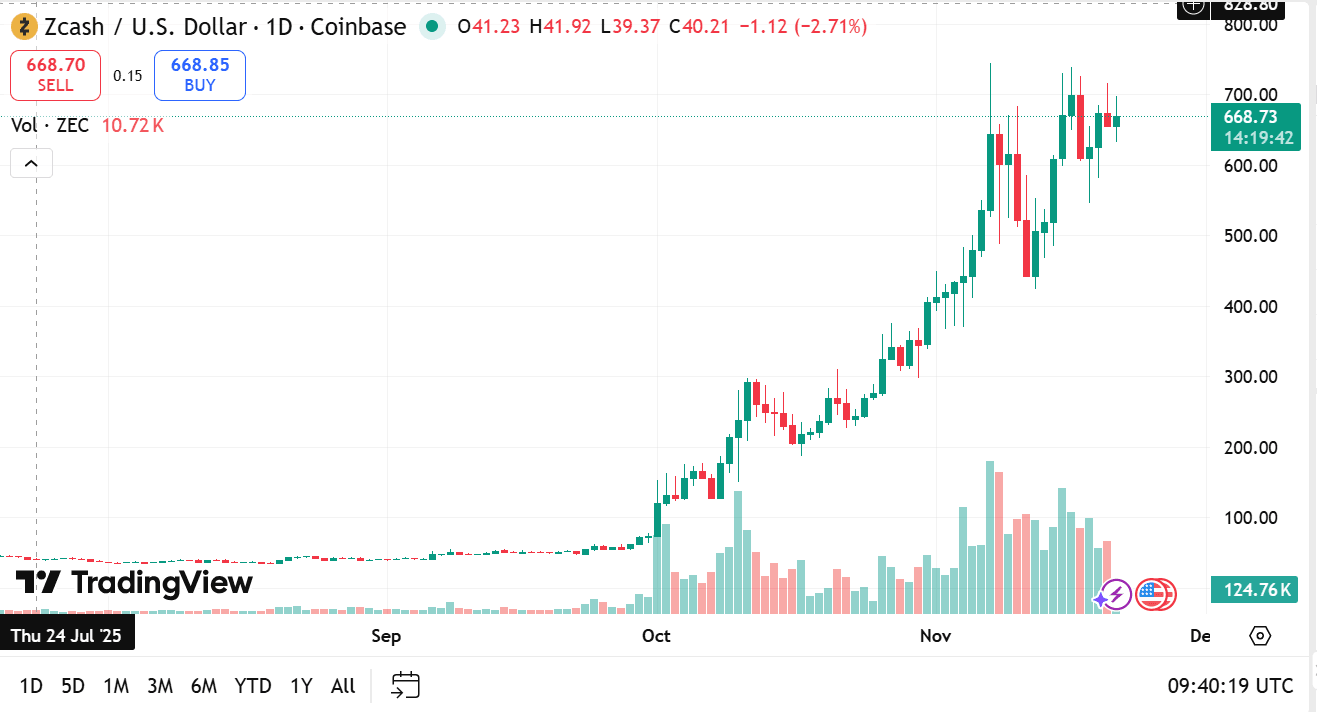

source: tradingview

2. Zcash

Zcash is a privacy coin launched in 2016 that offers optional privacy features using zero-knowledge proofs called zk-SNARKs.

Key Technologies

zk-SNARKs: Allow shielded transactions that hide sender, receiver, and amount while ensuring transaction validity.

Transparent Transactions: Users can choose between transparent (public) and shielded (private) transactions.

Zcash provides flexibility by allowing users to send either fully private or transparent transactions, appealing to both privacy advocates and those who need regulatory compliance.

Adoption and Use Cases

Zcash is used in privacy-sensitive applications and by institutions that require auditability along with privacy, thanks to its selective disclosure capability. It has partnerships exploring privacy in financial services.

Challenges

The optional privacy means many transactions remain transparent, limiting overall anonymity. The complex cryptography also demands more computing resources.

source: tradingview

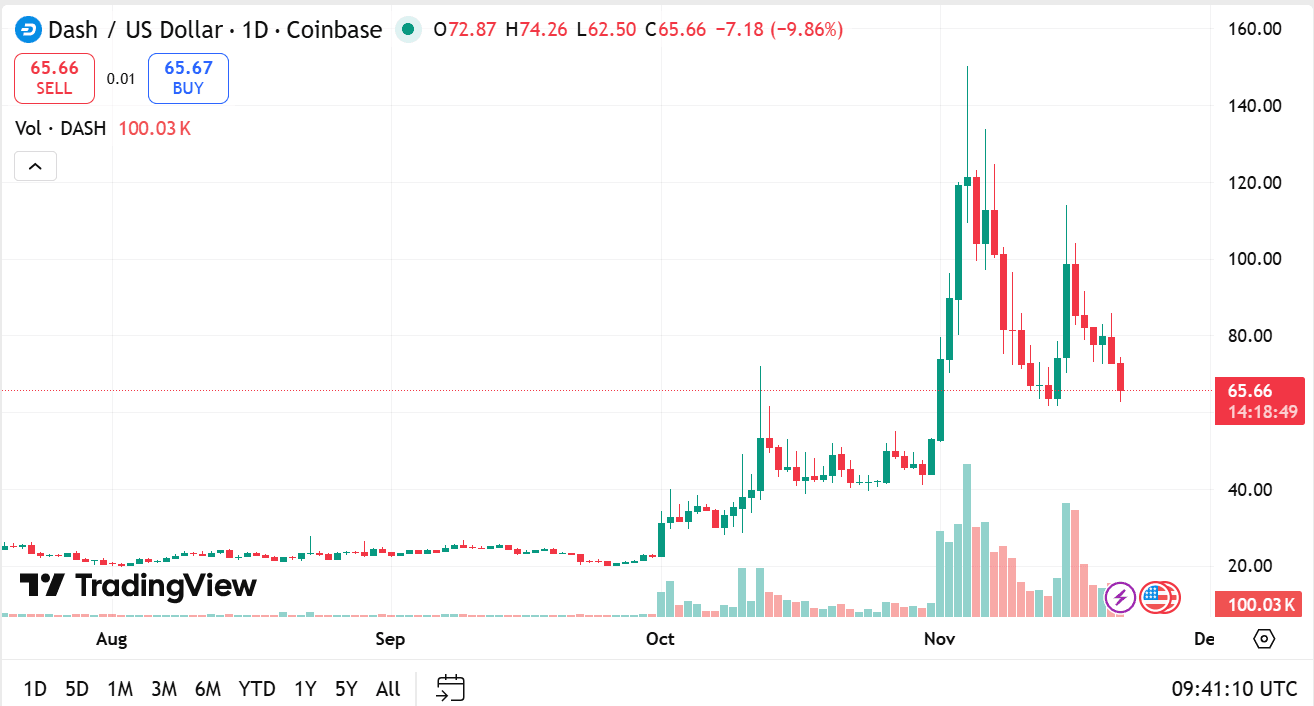

3. Dash

Dash started as a Bitcoin fork but has incorporated privacy-focused features over time, including PrivateSend.

Key Technologies

PrivateSend: A coin mixing service that anonymizes transactions by pooling and redistributing funds.

InstantSend: Allows near-instant transaction confirmations.

Dash combines privacy with usability and speed, aiming for practical everyday use as digital cash.

Adoption and Use Cases

Dash has been adopted by merchants and businesses as a payment method, especially in regions with unstable currencies. Its privacy features are optional but enhance user confidentiality.

Challenges

Compared to Monero and Zcash, Dash’s privacy is less robust because mixing is optional and can be circumvented by sophisticated analysis.

source: tradingview

Regulatory Environment

The biggest challenge facing privacy coins is regulatory. Governments and regulatory agencies are concerned about the potential misuse of privacy coins for money laundering, terrorism financing, tax evasion, and other illicit activities.

Growing Demand for Privacy

On the other hand, the increasing awareness of digital privacy and data security fuels demand for privacy-enhancing technologies. With data breaches, pervasive surveillance, and cybercrime on the rise, more users seek ways to protect their financial information.

Privacy coins serve not only individuals but also businesses requiring confidentiality, such as healthcare, legal services, and private contracts.

Technological Advancements

Privacy coin projects continue innovating:

Wider adoption depends on:

Legal Risks: Depending on jurisdiction, using privacy coins might attract scrutiny or be restricted.

Volatility: Like all cryptocurrencies, privacy coins are subject to price volatility.

Reputation: Privacy coins are sometimes associated with illegal activities, potentially affecting user perception.

Security: Users must ensure wallets and keys are secure to prevent loss or theft.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Privacy coins represent a critical evolution in the cryptocurrency space, addressing fundamental concerns about privacy, anonymity, and financial freedom. Monero, Zcash, and Dash each offer distinct approaches to privacy, balancing anonymity, usability, and regulatory considerations.

While privacy coins face significant regulatory challenges, the global trend toward enhanced data protection and digital privacy suggests they will continue to play an important role. Innovations in technology, compliance, and adoption may help privacy coins thrive in a future where privacy is increasingly valued and protected.

For anyone interested in cryptocurrency, understanding privacy coins is essential to grasp the full spectrum of opportunities and risks in the digital asset landscape.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.