Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Nov 5 2025 07:46

7 min

What does margin mean in trading: Margin trading is a method used by many market participants to increase their exposure to financial markets beyond the limits of their available capital.

It involves borrowing funds from a broker to open larger positions, which can amplify both potential gains and losses. This article explains the concept of margin in trading, its key components, and provides an example to clarify how margin trading works in practice.

In trading, margin refers to the amount of money a trader must deposit and keep in their account as collateral to open and maintain a leveraged position. When using margin, a trader borrows funds from the brokerage to control a larger position than the cash they have on hand.

The margin system is designed to protect both the trader and the brokerage. It ensures that the trader has enough funds to cover potential losses, and that the broker does not face excessive risk when lending capital for trading activities.

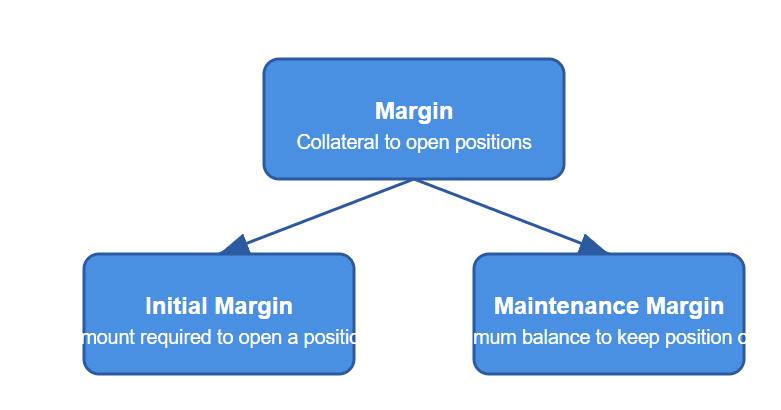

There are two main types of margin involved in trading:

By using margin, traders can enhance their market exposure, but it also requires careful management to avoid margin-related risks.

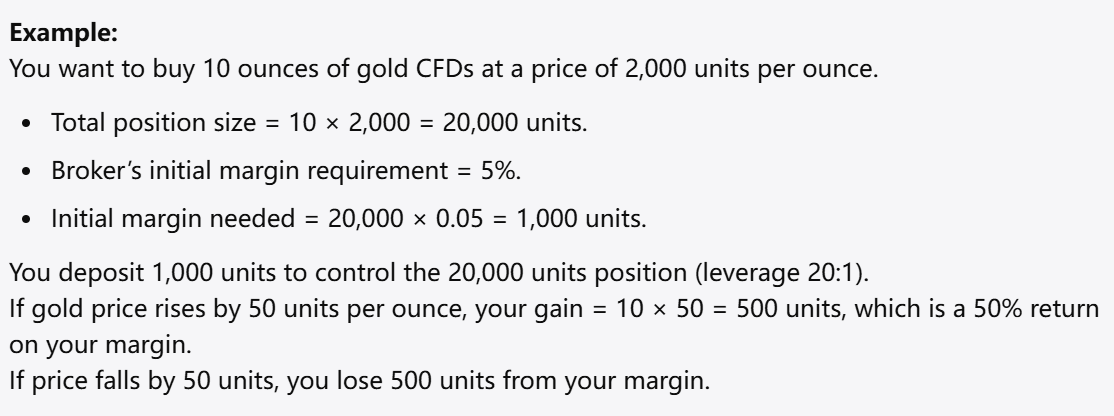

The initial margin is the amount of money a trader must put forward to open a new position using borrowed funds. It acts as a security deposit that allows the trader to access a larger market position than their available cash.

The calculation of the initial margin depends on the broker’s margin requirements and the size of the position the trader wants to open. It is usually expressed as a percentage of the total position value.

Example of Initial Margin Calculation (Conceptual):

If a trader wants to open a position controlling a certain value of an asset, the broker requires a fraction of that value as an initial margin. The trader must have this amount available in their trading account before the position can be executed.

This margin requirement varies by market and asset class. For instance, different rules apply to stocks, commodities, forex, and cryptocurrencies. Regulatory bodies and brokers often set minimum margin requirements to ensure market stability.

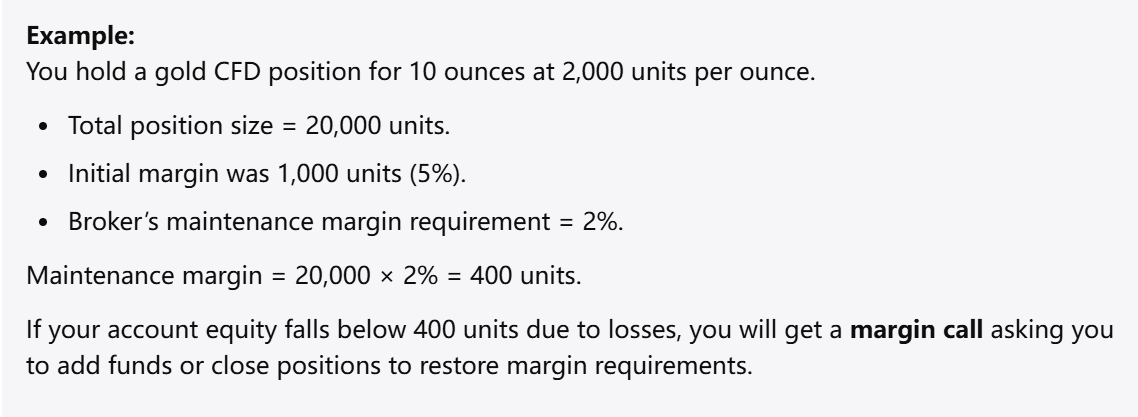

The maintenance margin is the minimum amount of equity that a trader must maintain in their account to keep a leveraged position open. It serves as a threshold to prevent accounts from falling into negative equity.

If the trader's account equity falls below this level due to adverse price movements, the broker may ask the trader to deposit additional funds or close positions to reduce exposure.

Example of Maintenance Margin:

Maintenance margin is typically set at a lower percentage than the initial margin. This difference allows some room for the position to fluctuate in value without immediate liquidation.

The exact percentage required as maintenance margin depends on the broker’s policies and the asset traded. Brokers notify traders if their equity falls below this level, prompting action to restore the required margin.

A margin call occurs when the equity in a trader’s account falls below the maintenance margin requirement. This situation happens when market movements go against the trader’s position, reducing the account balance.

When a margin call is triggered, the broker requires the trader to either deposit additional funds or close part or all of the position to bring the account equity back to the minimum required level.

How to Avoid a Margin Call

How to Fix a Margin Call

Margin trading allows traders to control positions larger than their available capital by borrowing funds from brokers. It requires a deposit known as initial margin to open new positions and a maintenance margin to keep them open.

While margin trading can amplify exposure to markets, it introduces risks such as margin calls, where traders must act quickly to restore account equity. Proper risk management, including regular monitoring and use of protective orders, is essential to navigate margin trading effectively.

Through a clear understanding of margin requirements and margin calls, traders can better manage leveraged positions and the risks involved.

Q: Is margin trading available for all asset types?

Margin availability depends on the asset class and broker policies. Common markets offering margin include stocks, forex, commodities, and cryptocurrencies.

Q: Can I lose more than my initial deposit when trading on margin?

Yes, because margin trading involves leverage, losses can exceed the initial margin if market moves are unfavorable.

Q: What happens if I ignore a margin call?

Ignoring a margin call may lead to the broker closing your positions to limit losses, which could result in realized losses beyond your deposited funds.

Q: How does leverage relate to margin?

Leverage is the ratio of the total position size to the margin deposited. Higher leverage means controlling a larger position with less capital.

Q: Are margin requirements fixed or variable?

Margin requirements can vary depending on market conditions, broker policies, and regulatory changes. They may also differ between asset classes.

Margin is a powerful tool in trading that allows greater market exposure but requires careful management. Understanding the mechanics behind initial and maintenance margin, as well as how to respond to margin calls, is essential for anyone engaging in leveraged trading.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.