Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Tuesday Oct 28 2025 03:32

7 min

What Is the NASDAQ 100 (NAS100) Index: The NASDAQ 100 Index is one of the most widely followed stock market indices globally, representing a select group of companies primarily from the technology sector.

For traders and market participants, understanding this index and the ways to access its price movements is essential. This article explores what the NASDAQ 100 Index is, how it differs from other major indices, and the various methods to trade it.

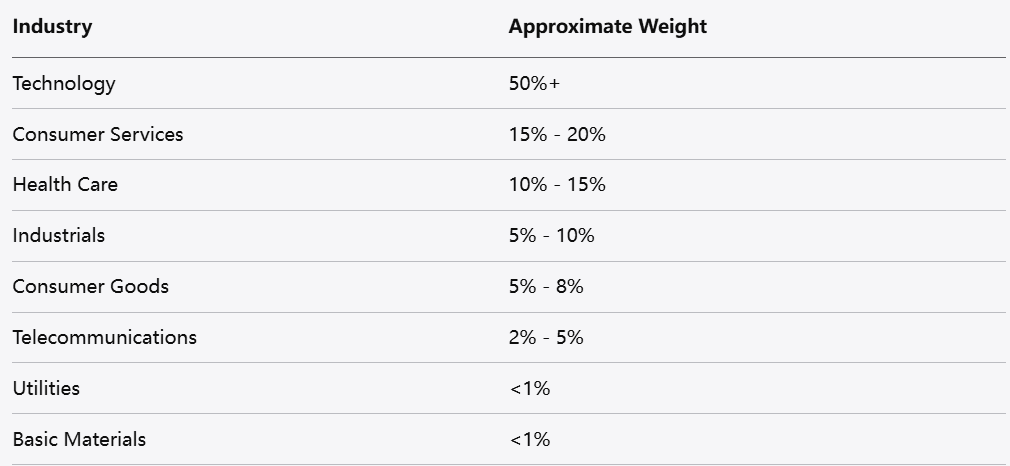

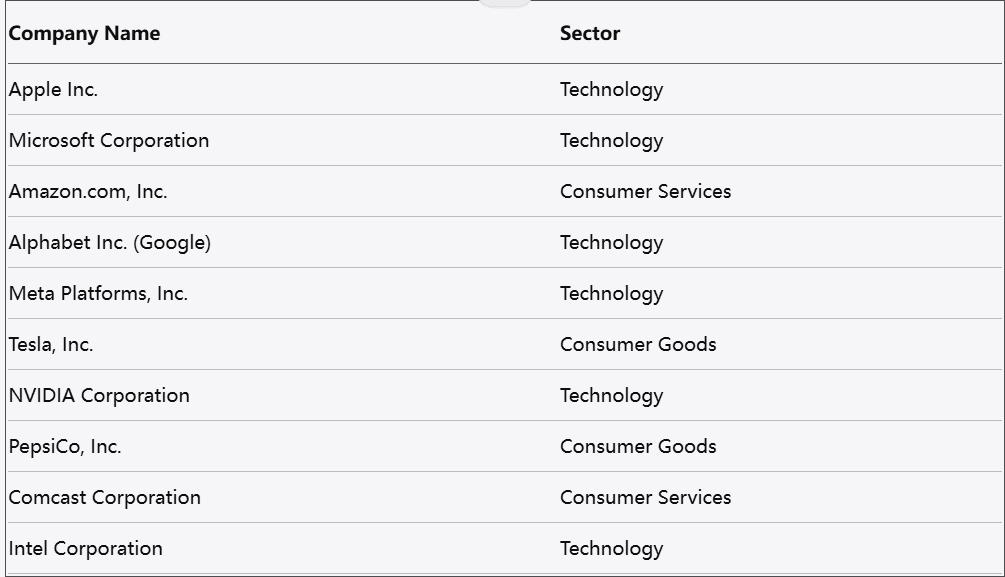

The NASDAQ 100 Index tracks the performance of the 100 largest non-financial companies listed on the NASDAQ stock exchange. It includes firms from sectors such as technology, consumer services, healthcare, and industrials. The index serves as a benchmark for the performance of large-cap growth companies in the United States, with a strong emphasis on innovation-driven enterprises.

This index excludes financial companies, differentiating it from some broader indices. It is weighted based on market capitalization, meaning larger companies have a more substantial influence on the index’s movements.

The index comprises a diverse range of companies, including those involved in software, semiconductors, biotechnology, retail, and more. Many of the world’s most recognizable technology firms are part of this group, reflecting the sector’s dominance in the modern economy.

The inclusion criteria focus on market size, liquidity, and listing requirements, ensuring that the index represents leading companies within their respective fields. Regular rebalancing occurs to maintain its alignment with the evolving market landscape.

While the NASDAQ 100 tracks the top 100 largest non-financial companies on the NASDAQ exchange, the NASDAQ Composite Index is broader and includes thousands of stocks listed on the exchange. The Composite encompasses both financial and non-financial firms, making it a more comprehensive measure of the overall market activity on NASDAQ.

source: tradingview

Because of its narrower focus, the NASDAQ 100 tends to be more concentrated in large-cap technology and growth stocks, while the Composite provides a wider market overview.

The NASDAQ 100, Dow Jones Industrial Average, and S&P 500 are three major U.S. stock indices, each with unique characteristics:

NASDAQ 100: Focuses on the largest non-financial companies listed on NASDAQ, with a strong emphasis on technology and growth sectors.

Dow Jones Industrial Average: Comprises 30 large, blue-chip companies across various industries, weighted by price rather than market cap. It is often seen as a gauge of established industrial and consumer-related companies.

S&P 500: Tracks 500 of the largest companies across all sectors in the U.S., weighted by market capitalization. It is widely regarded as a benchmark for the overall U.S. stock market.

Each index reflects different market segments and investment styles, offering diversified perspectives on market performance.

The current price of the NASDAQ 100 Index fluctuates constantly during market hours, reflecting the real-time performance of its constituent stocks. This price serves as a key reference point for traders and market participants looking to gauge market conditions or execute trades based on index movements.

Accessing up-to-date pricing information requires checking financial platforms or brokerage tools that provide live market data.

The NASDAQ 100 has exhibited various price trends over the years, influenced by technological innovation, economic cycles, and global events. Its history reflects periods of rapid growth driven by advances in technology, as well as corrections aligned with broader market shifts.

Understanding these historical trends can provide context for current market behavior and potential future movements. However, the index’s heavy weighting in technology means it can experience greater volatility compared to more diversified indices.

There are several ways for market participants to gain exposure to the NASDAQ 100 Index, each with different characteristics and risk profiles.

(1) NASDAQ 100 Index Futures

Futures contracts on the NASDAQ 100 allow traders to speculate on the index’s future value. These contracts are standardized agreements to buy or sell the index at a predetermined price on a specific date.

Trading futures offers leverage and liquidity, making it a popular choice for those seeking to participate in index price movements without owning the underlying stocks. However, futures require understanding of contract specifications and risk management.

(2) NASDAQ 100 Stock

Individual stocks within the NASDAQ 100 can be bought and sold through traditional stock trading accounts. Purchasing shares of companies included in the index provides direct exposure to their performance.

This approach allows for tailored portfolio construction but requires careful selection and monitoring of individual companies.

(3) Trade NASDAQ 100 Index CFD with Markets.com

Contract for Difference (CFD) trading provides a way to speculate on the NASDAQ 100 Index without owning the underlying assets. CFDs enable traders to take positions on price movements both upward and downward.

Markets.com offers access to NASDAQ 100 CFDs with flexible trading conditions, including leverage options. CFD trading can provide quick entry and exit, but it carries risks related to leverage and market volatility.

Trading NASDAQ 100 CFDs involves certain considerations:

The NASDAQ 100 Index represents a dynamic and influential segment of the U.S. equity market, dominated by large-cap technology and growth companies. Its focus and composition differentiate it from broader indices, offering unique opportunities for exposure to innovation-driven sectors.

Market participants can access the NASDAQ 100 through various instruments, including futures contracts, individual stocks, and CFDs. Each method offers different advantages and requires an understanding of associated risks.

By staying informed about the index’s characteristics, market environment, and trading options, individuals can better navigate the complexities of trading the NASDAQ 100 and align their strategies with their financial goals.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.