Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Nov 14 2025 09:49

10 min

Which broker is best for bitcoin trading: The cheapest option often depends on your trading volume, frequency, and whether you want to own the underlying asset or simply speculate on its price.

Crypto market today: Acquiring Bitcoin can be done through several channels, with the total cost being a combination of trading fees, deposit/withdrawal fees, and the price spread (the difference between the highest buy and lowest sell price).

The landscape of purchasing and trading Bitcoin (BTC) is complex, with numerous options, each carrying a different fee structure. For investors and traders aiming to maximize their returns, minimizing costs is paramount. This extensive guide will explore the cheapest ways to acquire Bitcoin, analyze the fee structures of popular exchanges, detail the world of Bitcoin CFDs (Contracts for Difference), and highlight crucial watch-outs to protect your capital.

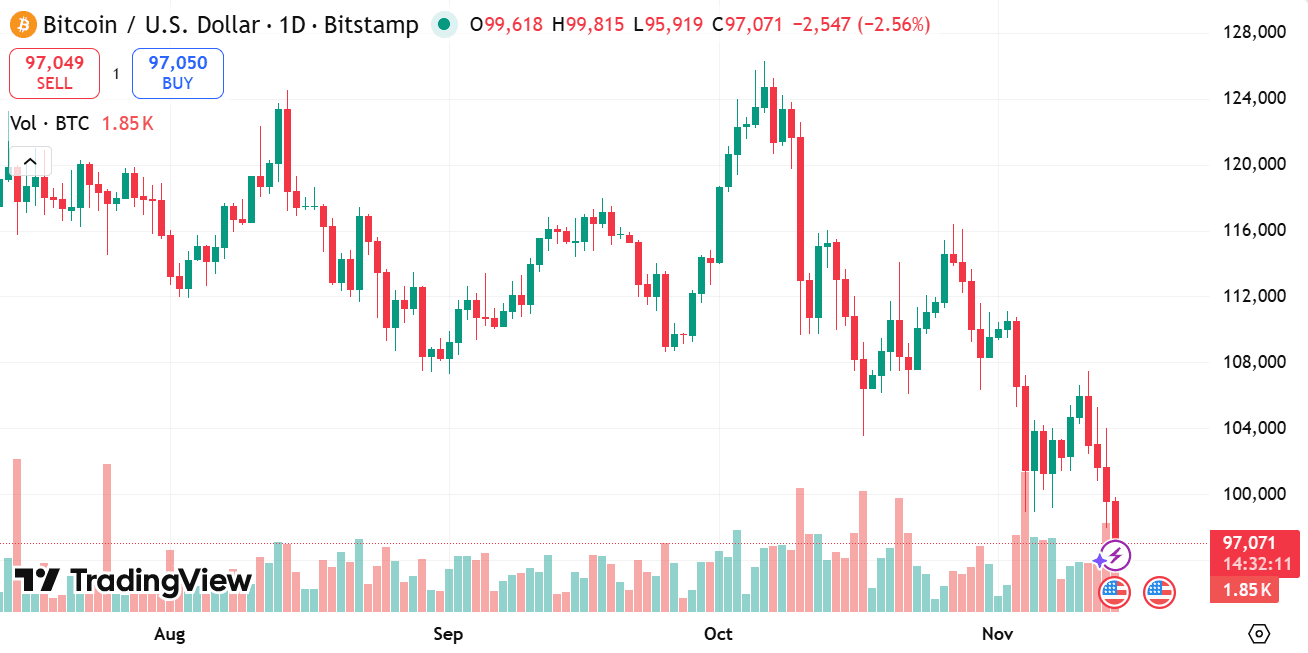

source: tradingview

Acquiring Bitcoin can be done through several channels, with the total cost being a combination of trading fees, deposit/withdrawal fees, and the price spread (the difference between the highest buy and lowest sell price). The cheapest option often depends on your trading volume, frequency, and whether you want to own the underlying asset or simply speculate on its price.

The primary division is between platforms that allow you to own and withdraw the actual Bitcoin (Exchanges) and platforms that offer instruments to speculate on its price movement (Brokers offering CFDs).

The most common way to purchase Bitcoin is through a centralized cryptocurrency exchange. The key to minimizing fees here is to use their "Advanced" or "Pro" trading platforms, which charge lower Maker/Taker fees based on your trading volume, as opposed to the simplified but more expensive "Instant Buy" options.

A Maker order is a limit order that adds liquidity to the order book (e.g., placing an order to buy BTC at a price lower than the current market price). A Taker order is a market order that instantly fills an existing order, removing liquidity (e.g., buying BTC at the current market price). Makers pay lower fees, sometimes even zero.

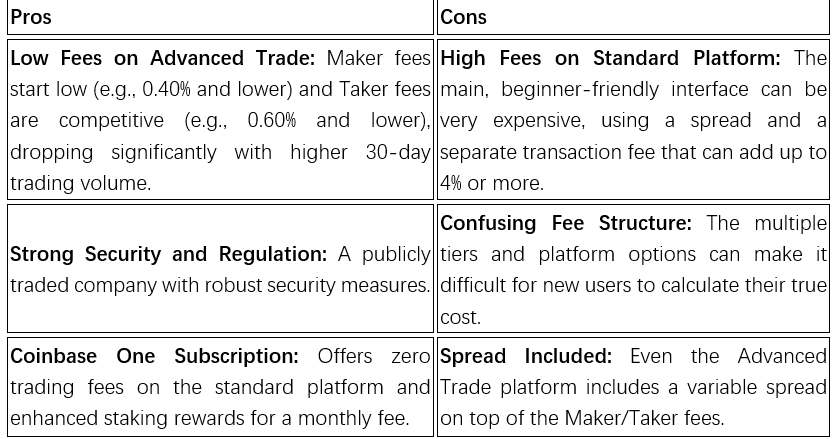

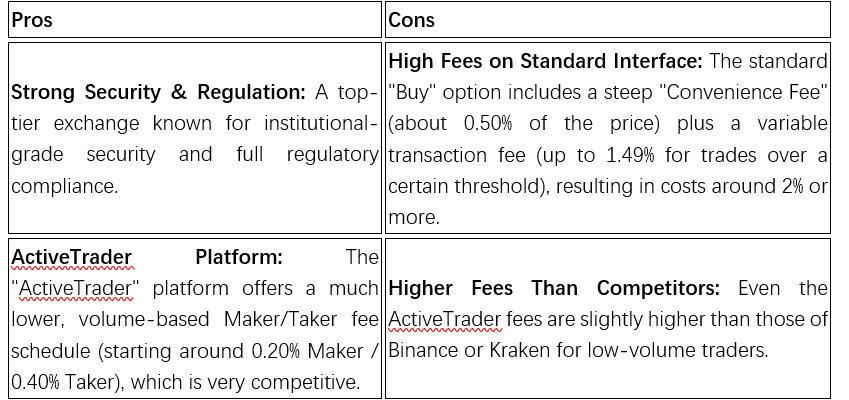

1. Coinbase

Coinbase is known for its regulatory compliance and ease of use, particularly in the United States.

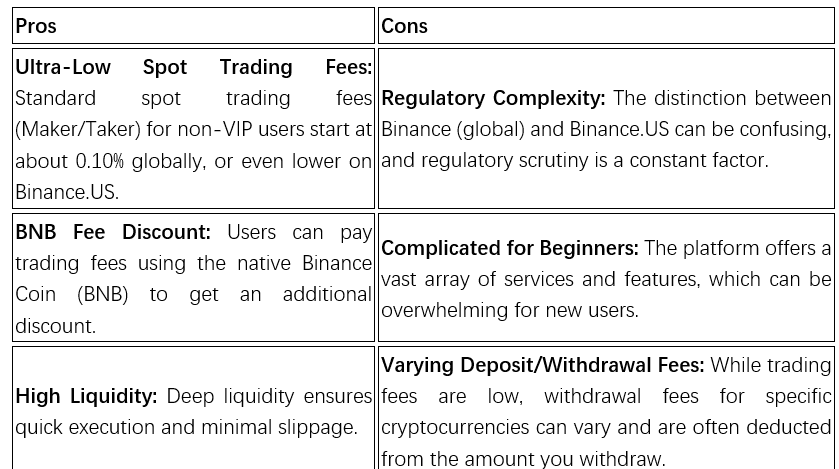

2. Binance (Binance and Binance.US)

Binance is the world's largest exchange by volume and is known for its extremely low fees, particularly on its global platform. Note the distinction between the global Binance platform and the separate, US-regulated entity, Binance.US, which has different fees and asset availability.

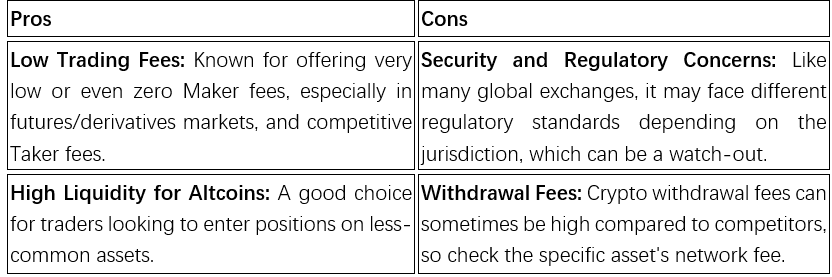

3. MEXC

MEXC is a global exchange often recognized for its wide selection of smaller, more volatile altcoins and has historically offered competitive, even promotional, fee structures, particularly in futures trading.

Fee Minimization Tip: Focus on using Limit Orders (Maker) to potentially benefit from zero-fee or near-zero-fee trading promotions that the exchange frequently offers to attract liquidity.

4. Gemini

Gemini is a highly regulated exchange known for its focus on security and compliance, especially within the US.

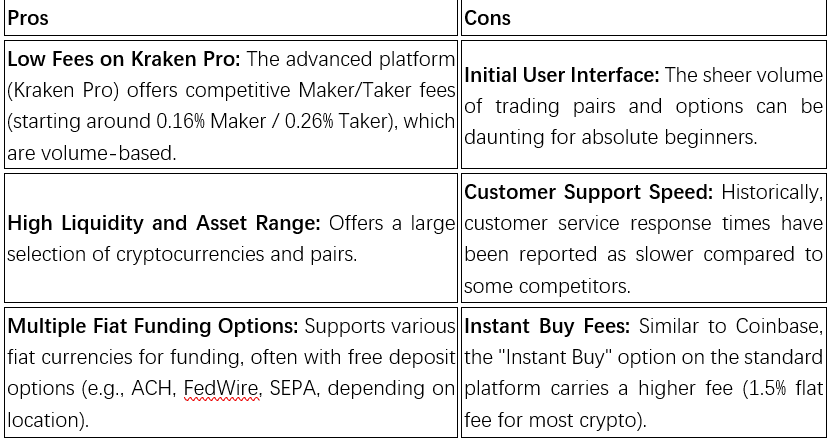

5. Kraken

Kraken is a veteran crypto exchange known for its wide range of services, strong security, and generally low fees.

Bitcoin CFDs (Contracts for Difference) allow you to speculate on the price movement of Bitcoin without actually owning the underlying asset. This approach is popular among short-term traders and can be cost-effective as it bypasses cryptocurrency network withdrawal fees. However, it introduces overnight financing (swap) fees if you hold the position past the trading day.

The primary cost in CFD trading is the spread (the difference between the buy and sell price) and the aforementioned financing fees.

1. Mitrade

Mitrade is a broker offering CFD trading on various assets, including Bitcoin.

• Fee Structure: Primarily relies on a competitive spread for its fee, often offering commission-free trading.

• Leverage: Offers leverage, which can amplify both profits and losses.

• Watch-out: Focus on minimizing overnight financing fees by avoiding holding positions for too long, as these can quickly outweigh the low spread cost.

2. markets.com

markets.com is a global CFD and financial trading platform known for its competitive spreads and educational resources.

• Fee Structure: Low-to-zero commission with a primary focus on competitive spreads on Bitcoin CFDs.

• Platform: Offers trading on popular platforms like MetaTrader 4/5 and its proprietary platform.

• Watch-out: Ensure you understand the specific spread and overnight swap rates for the Bitcoin/US Dollar (BTC/USD) CFD pair before trading.

3. Plus500

Plus500 is a well-known CFD trading provider offering a wide range of markets, including cryptocurrencies.

• Fee Structure: Zero commission on trades, with the main cost being the spread (often quite tight) and the overnight financing rate.

• Platform: Uses a proprietary, user-friendly platform.

• Watch-out: Their model is purely CFD, meaning you cannot withdraw Bitcoin. It is solely for speculation. The overnight funding fee is a significant cost for long-term positions.

Trading Bitcoin CFDs on a platform like markets.com with minimal fees requires a strategic approach focused on minimizing the two main costs: the spread and overnight financing fees.

1. Master the Spread

• Trade High Liquidity Times: The spread is the difference between the buy and sell price. It typically narrows during periods of high trading volume and liquidity, which often coincides with the overlap of major financial market hours (e.g., London and New York sessions). Trading during these times can ensure you get the tightest possible spread.

• Monitor the Bid/Ask: Always check the current bid (sell) and ask (buy) price before executing a market order to assess the immediate cost of the trade.

2. Strategically Manage Overnight Fees (Swaps)

• Understand the Swap Rate: markets.com, like all CFD brokers, charges a small fee (or sometimes pays a credit) for holding a leveraged position open past a certain cut-off time (usually 5 PM New York Time). This is called the overnight financing or swap fee. This is typically the biggest hidden fee for CFD traders.

• Avoid Long-Term Holds: If your trading strategy is short-term (day trading or scalping), ensure you close your position before the daily swap cut-off time to avoid the overnight charge.

• Adjust Leverage: The overnight financing fee is calculated based on the total notional value of your position, which is multiplied by the leverage you use. Lowering your leverage will reduce the total overnight fee you pay, especially if you plan to hold the position for several days or weeks.

3. Utilize Zero-Commission Trading

• markets.com typically offers zero commission on crypto CFD trades. This means the spread and the overnight fee are your only main costs. This contrasts with some exchanges that have a separate commission and a spread.

By focusing on narrow spreads during peak liquidity and diligently closing positions before the overnight financing period (or managing leverage appropriately for longer-term speculation), you can significantly reduce your trading costs on markets.com.

4. Regulatory and Tax Implications

• KYC (Know Your Customer) Requirements: Reputable, low-fee exchanges often require comprehensive KYC verification (ID, proof of address) to comply with anti-money laundering regulations. Be prepared to provide this information.

• Taxation: Buying or trading Bitcoin, even with low fees, has tax consequences. In many jurisdictions, selling or swapping Bitcoin is a taxable event. Consult with a tax professional to understand your local obligations; tax compliance costs are an essential part of the overall "cost" of investing.

By combining the use of advanced trading platforms with Maker limit orders, leveraging free bank transfers, and prioritizing the security of a reputable exchange, you can achieve the goal of purchasing Bitcoin with truly minimal fees.

Looking to trade bitcoin CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.