Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Nov 5 2025 10:16

7 min

Why trade forex: The foreign exchange (forex) market is one of the largest and most liquid financial markets globally.

It involves the buying and selling of currency pairs, and many participants engage in trading for various reasons. This guide explores the motivations behind trading forex, the difference between speculation and hedging, and provides beginner-friendly advice to start trading. Additionally, it offers a brief overview of popular forex CFD trading platforms for newcomers.

Forex trading attracts a wide range of market participants due to several unique characteristics. One reason is the sheer size and liquidity of the market, which means currencies can be bought and sold quickly with minimal price disruption. This high liquidity allows for smooth entry and exit from trades.

Another factor is the accessibility of the forex market. It operates 24 hours a day across global financial centers, enabling traders to participate at almost any time. This around-the-clock availability suits people with different schedules and trading preferences.

Moreover, forex trading offers a broad selection of currency pairs from major economies to emerging markets. This variety allows traders to focus on markets they understand or wish to explore. Many currencies react differently to global economic events, providing a dynamic environment.

Lastly, forex trading generally requires relatively low capital to start compared to some other financial markets. This lower barrier attracts beginners and those interested in learning market behavior without committing large sums initially.

Speculation involves buying or selling currencies with the expectation that their value will change favorably. Traders speculate to benefit from price fluctuations in currency pairs. For example, if a trader believes one currency will strengthen against another, they may buy that currency pair to gain from the anticipated movement.

Speculative trading in forex often relies on analyzing market conditions, economic indicators, and geopolitical events that influence currency values. While speculation can lead to gains, it also carries risk, as markets can move unpredictably.

Many traders use leverage in forex to control larger positions with smaller amounts of capital, amplifying both potential rewards and risks. Because of this, managing risk and understanding market dynamics is crucial when speculating.

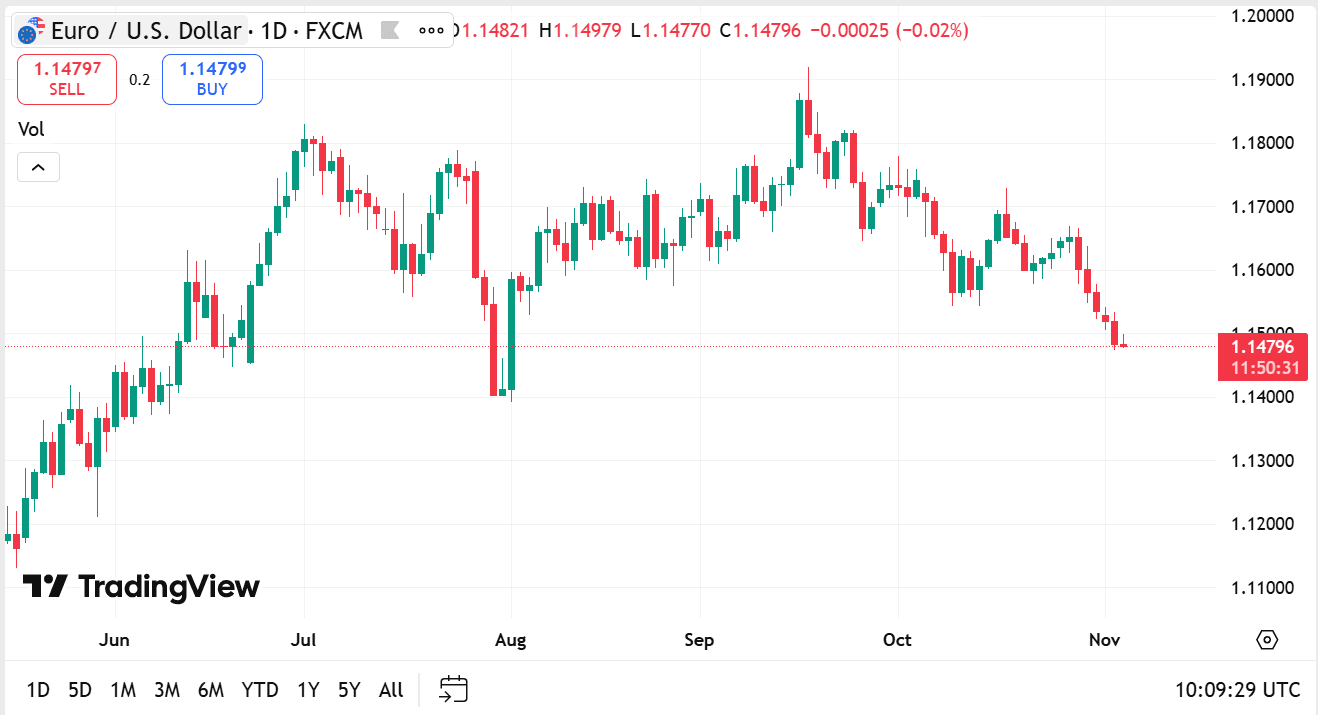

source: tradingview

Hedging in forex is a strategy used to reduce or offset potential losses from adverse currency movements. Instead of seeking to gain from price changes, hedging aims to protect an existing position or exposure.

For instance, a company expecting to receive payment in a foreign currency might hedge against the risk that the currency weakens before the payment arrives. By locking in an exchange rate through a forex contract, the company reduces uncertainty about its future cash flow.

Similarly, traders or portfolio managers may use forex hedging to safeguard against currency risks associated with international assets. Hedging strategies can involve taking opposite positions in the forex market or using derivatives like options or futures.

Speculation vs. Hedging

While both speculation and hedging involve trading currencies, their objectives differ significantly. Speculation seeks to capitalize on expected price movements to increase capital. Hedging prioritizes protection against unfavorable currency shifts to minimize losses or preserve value.

Traders focused on speculation often take on more risk, embracing market volatility to enhance returns. In contrast, hedgers typically accept smaller, more controlled outcomes, aiming for stability rather than growth.

Understanding the distinction helps traders and businesses choose appropriate strategies based on their goals and risk tolerance.

Getting started with forex trading requires a foundation of knowledge and a thoughtful approach. Here are some essential steps for beginners:

1. Learn the Basics

Familiarize yourself with fundamental concepts such as currency pairs, bid and ask prices, spreads, leverage, and margin. Understanding how these elements interact is critical for effective trading.

2. Choose a Reliable Broker

Select a forex CFD trading platform that offers transparent conditions, strong regulation, and user-friendly tools. A good broker provides access to a variety of currency pairs and offers educational resources for beginners.

3. Practice with a Demo Account

Most platforms provide demo accounts where beginners can trade using virtual funds. This practice helps in gaining experience with platform features and testing strategies without financial risk.

4. Develop a Trading Plan

Create a clear plan outlining your trading style, risk management rules, and goals. Decide how much capital you will risk per trade and set limits to protect your account.

5. Start Small and Manage Risk

Begin trading with small amounts to build confidence and avoid large losses. Use stop-loss orders to limit downside risk and practice discipline in following your plan.

6. Keep Learning and Adapting

The forex market is influenced by many factors, so continuous learning is essential. Stay informed about economic news, market trends, and refine your approach based on experience.

Choosing the right platform enhances your trading experience and supports your learning process. Here are five forex CFD platforms that are popular among traders, known for their features and accessibility:

Trading forex can be an engaging and dynamic activity with the right preparation and mindset. Understanding why participants trade forex, the difference between speculation and hedging, and following practical steps to begin trading will help beginners navigate the market more confidently.

Choosing a reputable trading platform that fits your needs and offers supportive tools is an important part of the journey. With patience, discipline, and continuous learning, trading forex can be a valuable skill to develop.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.