Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Nov 7 2025 09:02

7 min

Xom Stock Forecast: ExxonMobil Corporation, commonly known by its ticker symbol XOM, is a major player in the global energy sector.

As one of the largest integrated oil and gas companies, its stock performance is often seen as a barometer of the energy market’s health. This article delves into the current outlook and future forecast for Exxon stock by exploring multiple facets including its business model, historical performance, price drivers, and longer-term expectations.

The immediate future of Exxon’s stock price is influenced by a range of factors, both internal and external. Market conditions such as crude oil and natural gas prices, global demand for energy, and geopolitical tensions can cause rapid price fluctuations. Additionally, investor sentiment toward the energy transition and regulatory developments can impact near-term movements.

Exxon’s recent operational updates, production forecasts, and financial results also play critical roles in shaping expectations. The company’s ability to manage costs, execute projects efficiently, and respond to market challenges remains essential for its short-term stock trajectory.

ExxonMobil is an integrated energy company with operations spanning upstream and downstream segments. Its upstream activities involve exploration and production of oil and natural gas worldwide. The downstream segment includes refining, marketing, and distribution of petroleum products.

In addition, Exxon is involved in chemical manufacturing and increasingly invests in lower-carbon technologies and energy solutions. This diversified portfolio enables Exxon to mitigate risks associated with commodity price swings and adapt to evolving energy demands.

The company’s scale and global reach provide it with competitive advantages, including access to resources, technological expertise, and a broad customer base.

Trading Exxon stock online is straightforward given its status as a widely listed and liquid asset on major stock exchanges. Investors and traders can access Exxon shares through various brokerage platforms offering stock trading, as well as derivatives like options and CFDs.

The stock’s liquidity ensures tight bid-ask spreads, which benefits active traders. Long-term holders often seek stable dividend payments and exposure to the energy sector’s potential rebound, while short-term traders may focus on price volatility and market news.

Understanding trading costs, platform features, and order types is important for successful participation in Exxon’s stock market.

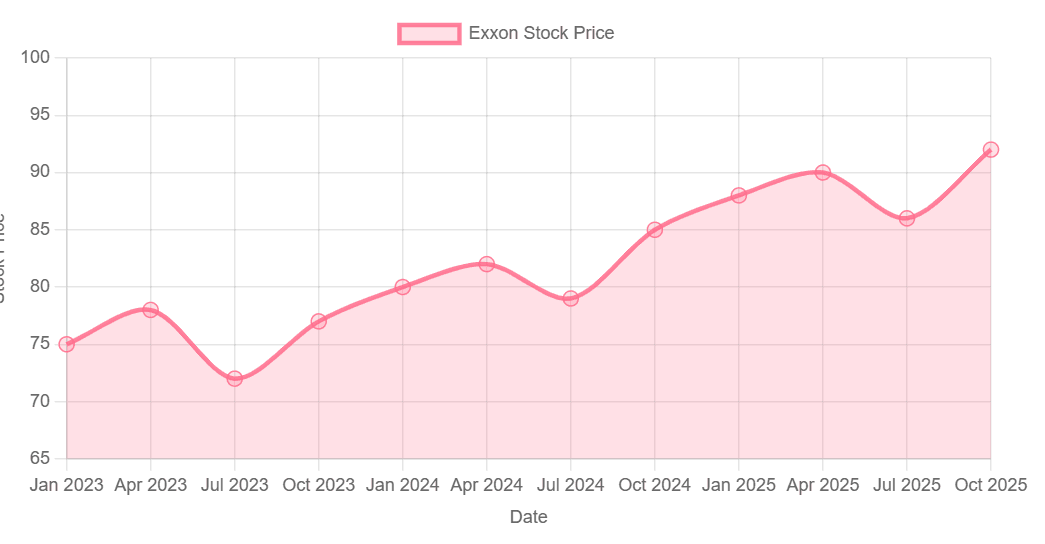

Exxon’s price history reflects decades of navigating the ups and downs of the energy markets. The stock has experienced periods of strong growth during oil booms and faced challenges during downturns caused by oversupply, demand shocks, or geopolitical conflicts.

Historical price trends often correlate with global oil prices and broader economic cycles. External shocks such as financial crises, pandemics, or shifts in energy policy have also left marks on Exxon’s stock performance.

Despite volatility, Exxon’s established position and dividend track record have attracted a loyal shareholder base over time.

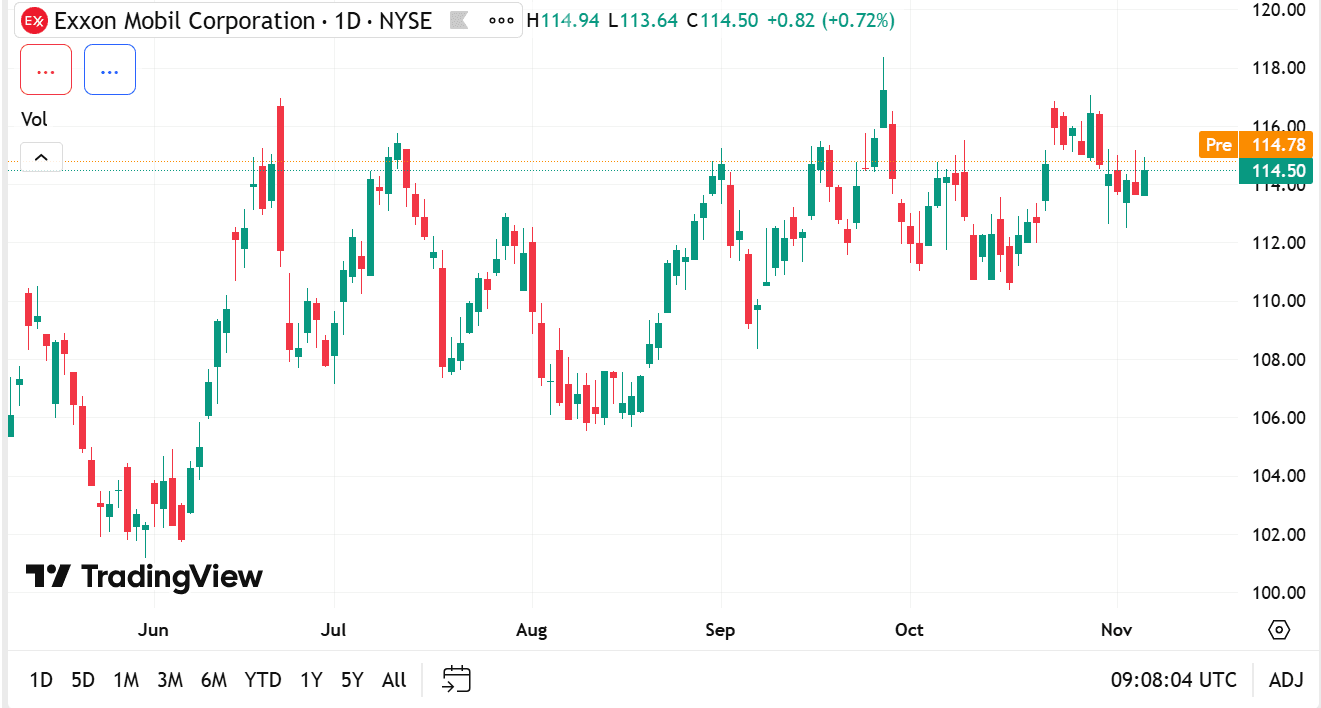

source: tradingview

Several key factors drive Exxon’s stock price:

Exxon’s stock price can exhibit volatility due to factors specific to the energy sector and general market conditions. Sudden shifts in oil prices, unexpected geopolitical events, or changes in regulatory frameworks can cause sharp price swings.

Accounting rules related to asset valuation, reserve reporting, and impairment charges also influence reported earnings and investor perceptions. For example, write-downs of oil reserves or project costs may affect reported financial results, thereby impacting stock prices.

Understanding these elements helps interpret Exxon’s reported financials and market reactions.

Dividend payments are a significant aspect of Exxon’s shareholder appeal. The company has a long history of distributing dividends, which provides steady cash flow for those holding the stock.

Dividend policy is influenced by Exxon’s cash flow generation, capital expenditure needs, and overall financial health. Maintaining or growing dividend payments often reflects management confidence in the company’s earnings prospects.

For many market participants, dividends serve as a key factor in evaluating the attractiveness of Exxon stock, particularly in a sector known for cyclical earnings.

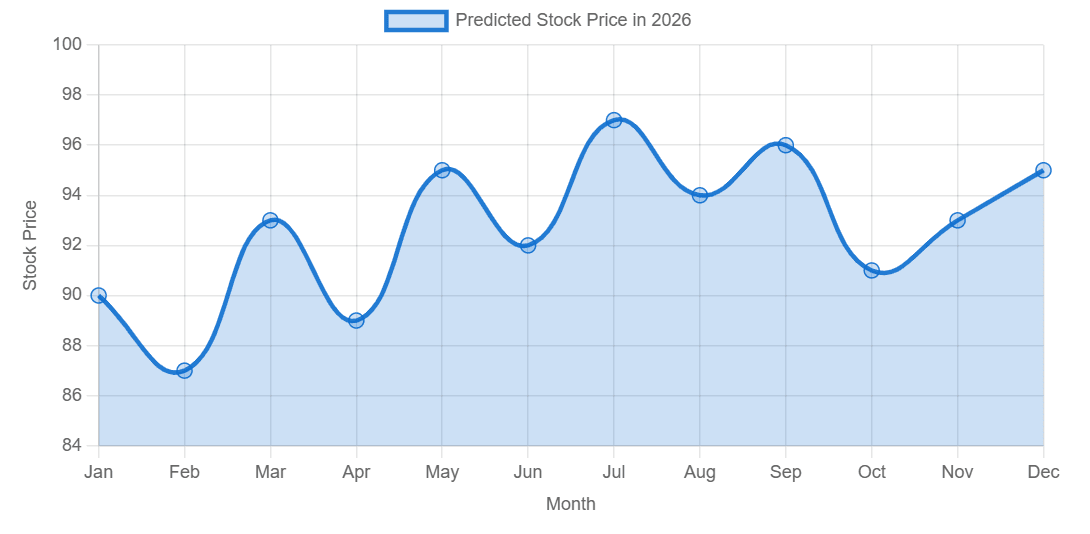

Price predictions for Exxon stock rely on a combination of fundamental analysis, market conditions, and broader energy trends. Expectations vary depending on assumptions about commodity prices, global energy demand, and Exxon’s operational execution.

Some anticipate that as the global economy recovers and energy demand rises, Exxon’s revenues and cash flows will strengthen, supporting upward price trends. Others caution that the increasing push toward renewable energy and climate policies may pressure traditional oil and gas companies over the medium to long term.

Analyses also consider Exxon’s ability to innovate, reduce emissions, and diversify its energy portfolio as critical to sustaining value amid evolving market dynamics.

Looking toward 2026 to 2027, Exxon’s stock price outlook depends on several potential scenarios:

Energy Market Recovery: If global energy demand grows steadily and oil prices remain robust, Exxon could benefit from higher earnings and cash flow, potentially driving stock appreciation.

Energy Transition Impact: Increased adoption of renewable energy and stricter environmental regulations may challenge Exxon’s traditional business model, requiring adaptation and investment in cleaner technologies.

Technological Advances: Breakthroughs in energy efficiency, carbon capture, or alternative fuels cou

ld position Exxon as a leader in the transition, enhancing long-term value.

Geopolitical and Economic Factors: Stability in key oil-producing regions and global economic conditions will continue to influence Exxon’s operational environment and market sentiment.

Overall, the mid-term outlook incorporates both opportunities and risks, with Exxon’s strategic decisions playing a pivotal role in shaping its future stock performance.

ExxonMobil remains a cornerstone of the global energy industry, and its stock reflects the dynamics of one of the most vital sectors worldwide. The immediate and longer-term forecast for Exxon stock hinges on commodity price trends, operational execution, regulatory changes, and the company’s adaptation to the evolving energy landscape.

While historical volatility and market uncertainties persist, Exxon’s integrated business model, dividend history, and global presence provide a foundation for navigating future challenges. Monitoring global energy developments and Exxon’s strategic responses will be key to understanding the stock’s potential trajectory through 2026, 2027, and beyond.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.