We use cookies to do things like offer live chat support and show you content we think you’ll be interested in. If you’re happy with the use of cookies by markets.com, click accept.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Thursday Aug 22 2024 12:30

5 min

It seems a given now that the Federal Reserve will cut interest rates next month. This, to be fair, has been well understood by markets for a fair while. But minutes from the Fed’s last meeting in July confirmed the “vast majority” of policymakers are behind cutting in September. Meanwhile the US labour market may not be in such great shape as thought, following a data release from the Bureau of Labour Statistics (BLS).

The FOMC believes that "if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting”. The minutes also noted how "many" Federal Reserve officials viewed the stance of rates to be restrictive and "a few participants" backed a cut in July.

BLS figures for the labour market showed sharply lower jobs growth, with an adjustment to March 2024 total nonfarm employment of -818,000 (-0.5%). That was a steep correction considering the average of the last 10 years is about –0.1%.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

So, a cut coming next month and perhaps as much as 100 basis points (bps) of cuts expected by the end of the year. Federal Reserve Chair Jay Powell should confirm the first part of this (a September cut) with his speech in Jackson Hole tomorrow. However, he’s hardly going to nail his colours to the mast with the second part (100bps of cuts this year). Caution on cuts could sound like hawkishness; declaring victory over inflation would stoke the fire again.

The narrative is plausible, the market behaved as you might expect — Treasury yields are down, the US dollar extended its run lower towards the Dec ‘23 trough, equities firmed up. Smalls caps rose the most, with the Russell 2000 index up 1% and the broad S&P 500 adding 0.42%.

The S&P 500 is about 1% off its all-time high and the equal weighted index is at it — is the peak in? Via BofA equity guru Savita Subramanian, half of BofA's market peak signals have been triggered — prior market peaks typically saw an average of 70% of signals triggered.

European stock markets also rallied yesterday and are a bit firmer again today amid some mixed PMI data. France’s CAC 40 index added 0.25% on a hot services PMI, whilst Germany’s DAX trimmed gains after a mixed PMI with the manufacturing index down to 42.1 from 43.2, though services were much better. The FTSE 100 struggled to break 8,300 with similar gains. Tokyo led Asian stock markets on a strong services PMI.

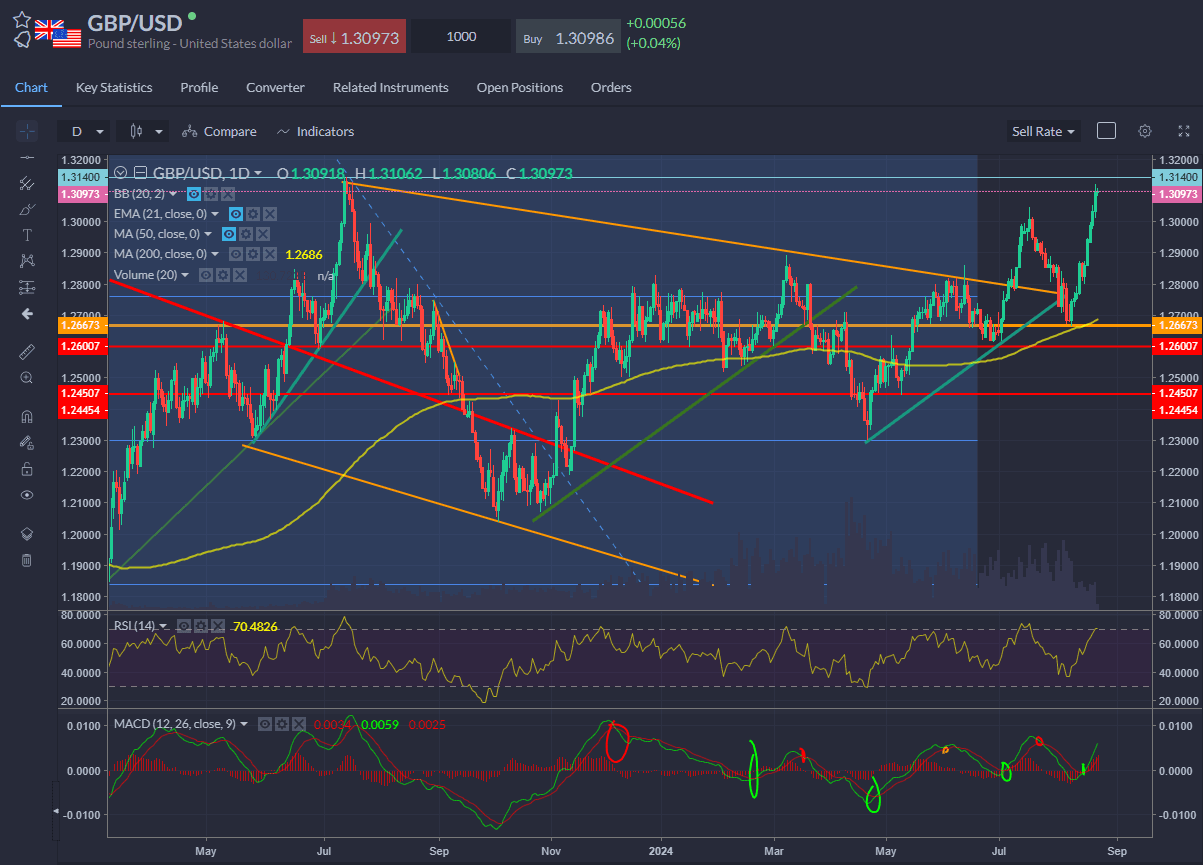

The softer dollar saw sterling rise on an air pocket. GBPUSD eased back a touch after breaching 1.31 but bulls look determined to push on through the July ‘23 peak at 1.3140. Watch for flows reversal should Powell sound more hawkish tomorrow. US PMIs and weekly unemployment figures are due later.

EURUSD also broken free and eyeing the Jul ‘23 high at 1.1275 to take out 1.13 eventually — the ECB today publishes accounts of its last monetary policy meeting in July, when it cut rates by 25bps to 3.75%.

WTI front month futures fell despite bullish EIA inventory data, slipping to the lowest level since February. Crude inventories fell by 4.6 million barrels, but this big draw did little to assuage concerns that the US and Chinese economies are in a funk. Meanwhile more oil is coming on the market.

BofA suggests non-OPEC+ oil production, particularly from Brazil, Guyana, Canada, and the US, is expected to rise by 1 million barrels per day (bpd) in 2024 and a further 1.6m bpd day in 2025. With OPEC+ also looking to reintroduce barrels to the market and lacklustre demand growth of about 1 million bpd, the BofA's report suggests that the market could see a surplus of 700,000 bpd in 2025, leading to a significant build-up in both commercial and strategic oil inventories.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Tuesday, 24 June 2025

5 min

Tuesday, 24 June 2025

5 min

Monday, 23 June 2025

7 min