We use cookies to do things like offer live chat support and show you content we think you’ll be interested in. If you’re happy with the use of cookies by markets.com, click accept.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Tuesday May 19 2020 09:27

2 min

Moderna shares jumped another 20% and the S&P 500 rallied over 3% after the US drug maker reported positive results from its early stage trials of its potential Covid-19 vaccine. The news sent risk assets higher as a vaccine would help economies get back to a true normal far quicker than any other measure. But has Moderna really got the goods?

What we know so far:

“These interim Phase 1 data, while early, demonstrate that vaccination with mRNA-1273 elicits an immune response of the magnitude caused by natural infection starting with a dose as low as 25 [micrograms],” Moderna chief medical officer Dr Tal Zaks said in a statement.

“When combined with the success in preventing viral replication in the lungs of a pre-clinical challenge model at a dose that elicited similar levels of neutralizing antibodies, these data substantiate our belief that mRNA-1273 has the potential to prevent COVID-19 disease and advance our ability to select a dose for pivotal trials,” he added.

Moderna is just one of many drug companies racing to be the first to develop a vaccine against Covid-19.

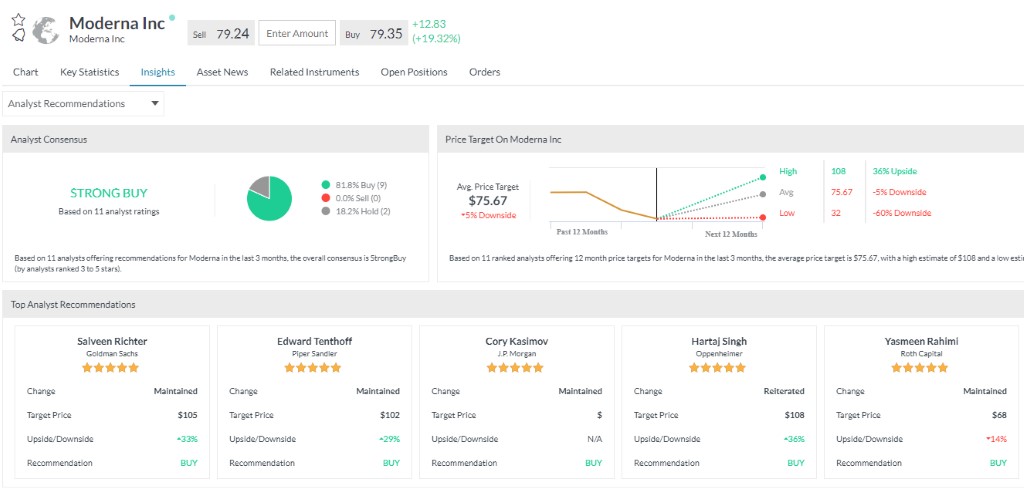

Shares in Moderna have soared this year by at least 300% to $80 by Monday’s close. It has just announced a new placing to raise $1.3bn at $76, yet shares keep rising and Wall Street still has a strong buy rating on the stock.

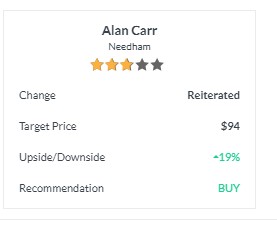

Needham recently upgraded its price target on the stock to $94 from $58.

“Based on these data, we believe the vaccine is likely to be found effective for prevention of infection in a Phase 3 trial,” said Needham analyst Alan Carr. “We expect Moderna to have meaningful supply by 4Q20. We have therefore added an mRNA-1273 revenue stream to our model and are raising our price target to $94.”

Asset List

View Full ListLatest

View all

Tuesday, 13 May 2025

4 min

Monday, 12 May 2025

6 min

Monday, 12 May 2025

5 min

Thursday, 15 May 2025

Indices

The Future of CFD Trading: Forex CFDs, Commodity CFDs, Crypto CFDs and more

Thursday, 15 May 2025

Indices

Can you trade CFDs on cryptocurrencies: Ethereum CFDs, SUI CFDs, Solana CFDs