Monday May 18 2020 10:12

1 min

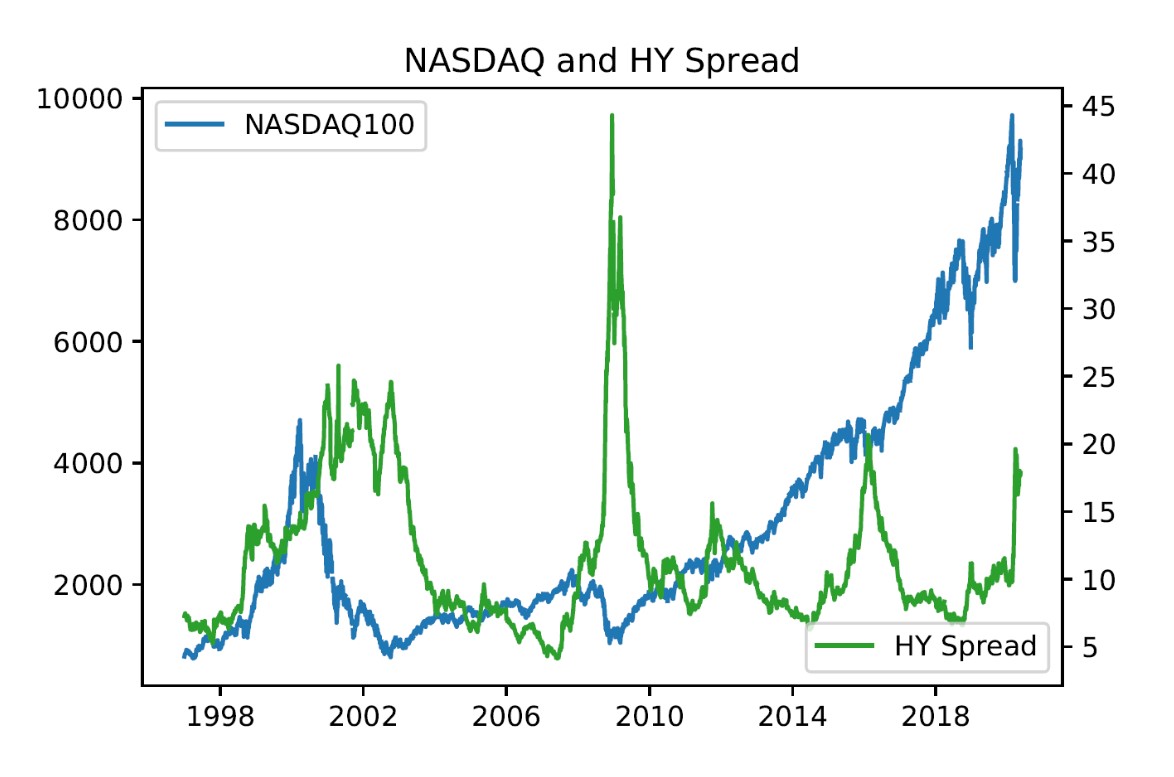

Over the last 8 weeks, the NASDAQ has rallied as much as 40%, from its lows on 23 March to a swing high at the beginning of last week.

However, an analysis of the performance of high-yield corporate debt during the current equity market rally, as compared to how high-yield debt has performed in past bear markets, may indicate to traders that continued caution is warranted.

This is because, while the NASDAQ rallied from lows at 6,633 to highs above 9,353, the high-yield spread has only tightened from a recent high of 19.62% to 17.85% on Friday.

The high-yield spread we have considered is the difference between corporate debt below investment grade and government debt.

Historically, we have seen a seen a much greater tightening of spreads when looking at the end of bear markets, such as those that originated during the dotcom bubble crash and the 2008 global financial crisis, compared to what we have seen now.

Instead, what we are seeing now, with spreads remaining high, may look more like a bear market rally rather than the sustained equity bull market uptrend seen when credit spreads have moved markedly lower.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.

Asset List

View Full ListLatest

View all

Sunday, 17 August 2025

5 min

Sunday, 17 August 2025

5 min

Sunday, 17 August 2025

5 min