Wednesday Aug 6 2025 07:27

5 min

The U.S. dollar strengthened against the euro and yen on Monday after the United States and European Union reached a trade agreement, easing fears of a global trade war. The deal, announced Sunday by President Trump and European Commission President Ursula von der Leyen, imposes a 15% tariff on EU goods—half the 30% rate previously threatened to take effect on August 1. This follows a separate U.S. trade agreement with Japan last week. Meanwhile, U.S. and Chinese officials resumed economic talks in Stockholm, seeking to extend their trade truce and prevent the return of steep tariffs.

The dollar also gained 0.59% against the yen, reaching 148.535. With trade tensions easing, investor focus is shifting to upcoming corporate earnings and central bank meetings. Both the Federal Reserve and the Bank of Japan are widely expected to hold interest rates steady this week. Still, markets will closely analyse their forward guidance for signals on future policy shifts.

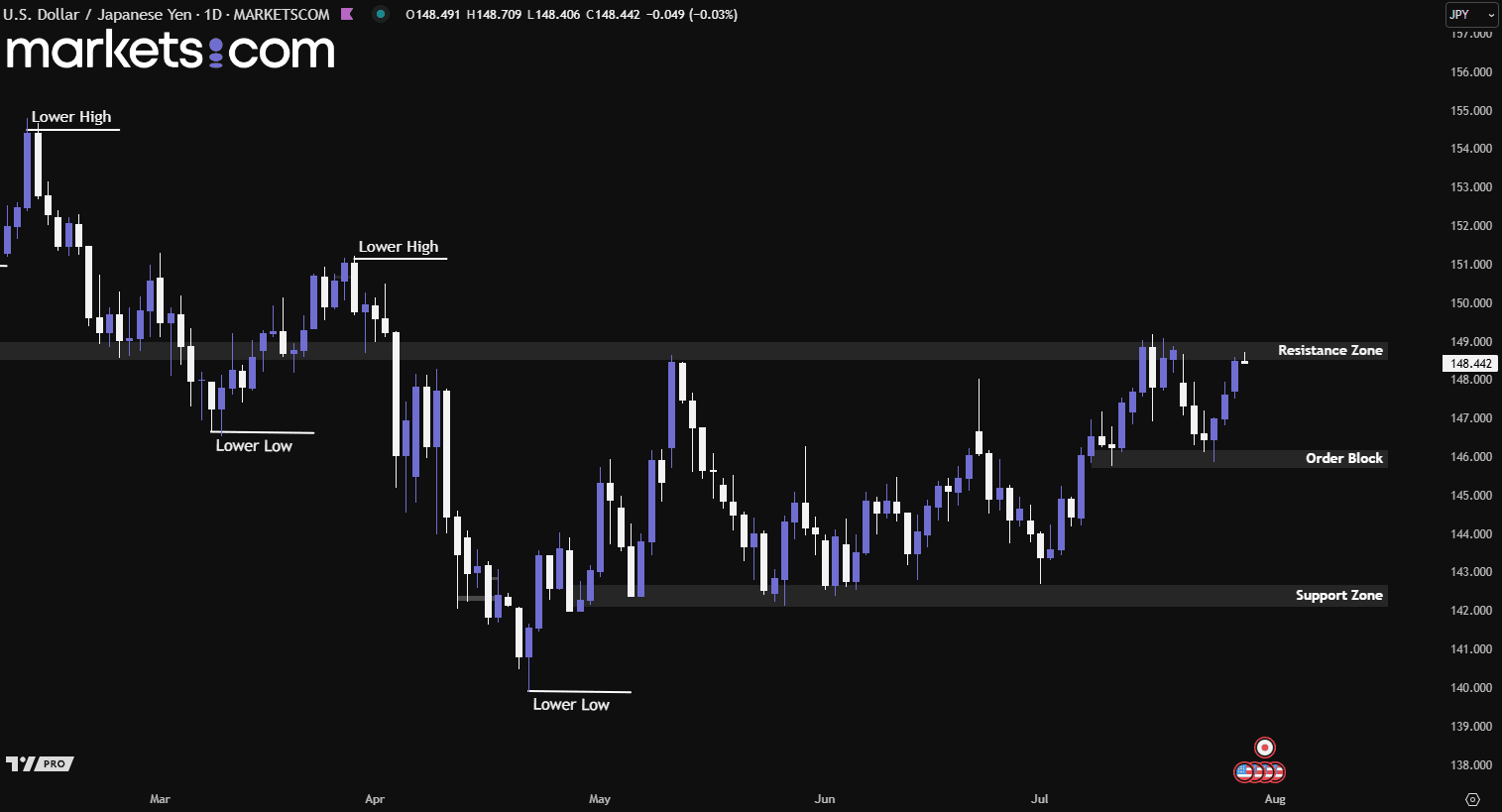

(USD/JPY Daily Chart, Source: Trading View)

From a technical analysis perspective, the USD/JPY currency pair rebounded from the support zone of 142.10 – 142.70 and was later rejected from the resistance zone of 148.50 – 149.00. It then pulled back to retest the order block at 145.70 – 146.20, found support there, and surged upward to once again test the resistance zone. If the pair manages to break above this resistance area, it could signal a continuation of the bullish trend, potentially pushing the pair higher. Conversely, if bearish pressure holds, the pair may drop back to retest the order block.

The British pound briefly touched a two-year low against the euro on Monday before rebounding, while also slipping slightly against the U.S. dollar. Its moves were largely driven by broader market reactions to the newly announced EU-U.S. trade deal. At last check, sterling was down 0.2% to $1.34185, its lowest level in a week, after being weighed down by weaker-than-expected UK retail sales and business activity late last week.

While recent economic data has been soft, it hasn't been weak enough to force aggressive easing. Some analysts believe continued modest data could drive sterling to fresh lows against the euro, especially as the European Central Bank is expected to stay on hold. With little UK economic data on deck this week, attention turns to next week’s BoE meeting, where markets are nearly fully pricing in a 25-basis point rate cut, one of only two cuts anticipated this year.

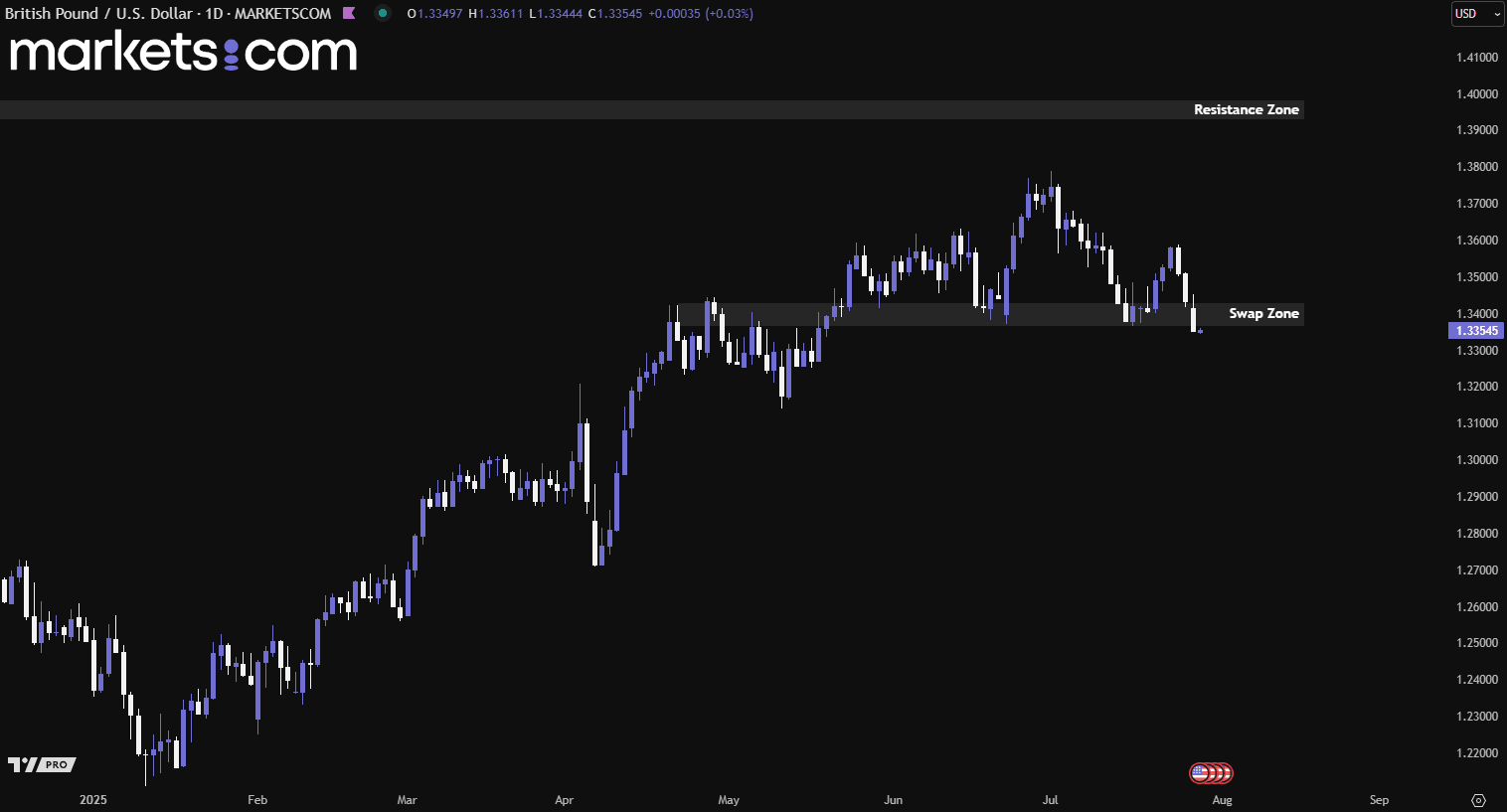

(GBP/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the GBP/USD currency pair has been moving in a bullish trend since early January 2025, as indicated by the higher highs and higher lows. The pair has retested the swap zone of 1.3365 – 1.3430 twice previously, with the second retest failing to form a higher high, indicating the bullish momentum has started to diminish. Yesterday, the pair completely broke below this swap zone, which suggests the bearish momentum might regain control, potentially driving the pair further downwards.

Tesla shares rose over 2.5% on Monday after Elon Musk confirmed a major chip supply agreement with Samsung Electronics. A recent Samsung filing disclosed a $16.5 billion deal running from July 26, 2024, through December 31, 2033. Under the agreement, Samsung’s Texas facility will manufacture Tesla’s next-generation AI6 processors. Musk highlighted the strategic importance of the partnership, noting that Samsung already produces the AI4 chips, while TSMC handles the AI5 chips. He also mentioned that Tesla engineers will work closely on-site and praised the plant’s convenient location, near his home

The deal strengthens Tesla’s long-term AI roadmap, particularly for its upcoming Robotaxi and Autopilot projects. As chip supply constraints ease, this extended contract may help stabilise production costs and ensure chip availability for future vehicle launches. The agreement marks another step in Tesla’s bid to integrate and secure critical tech components vertically.

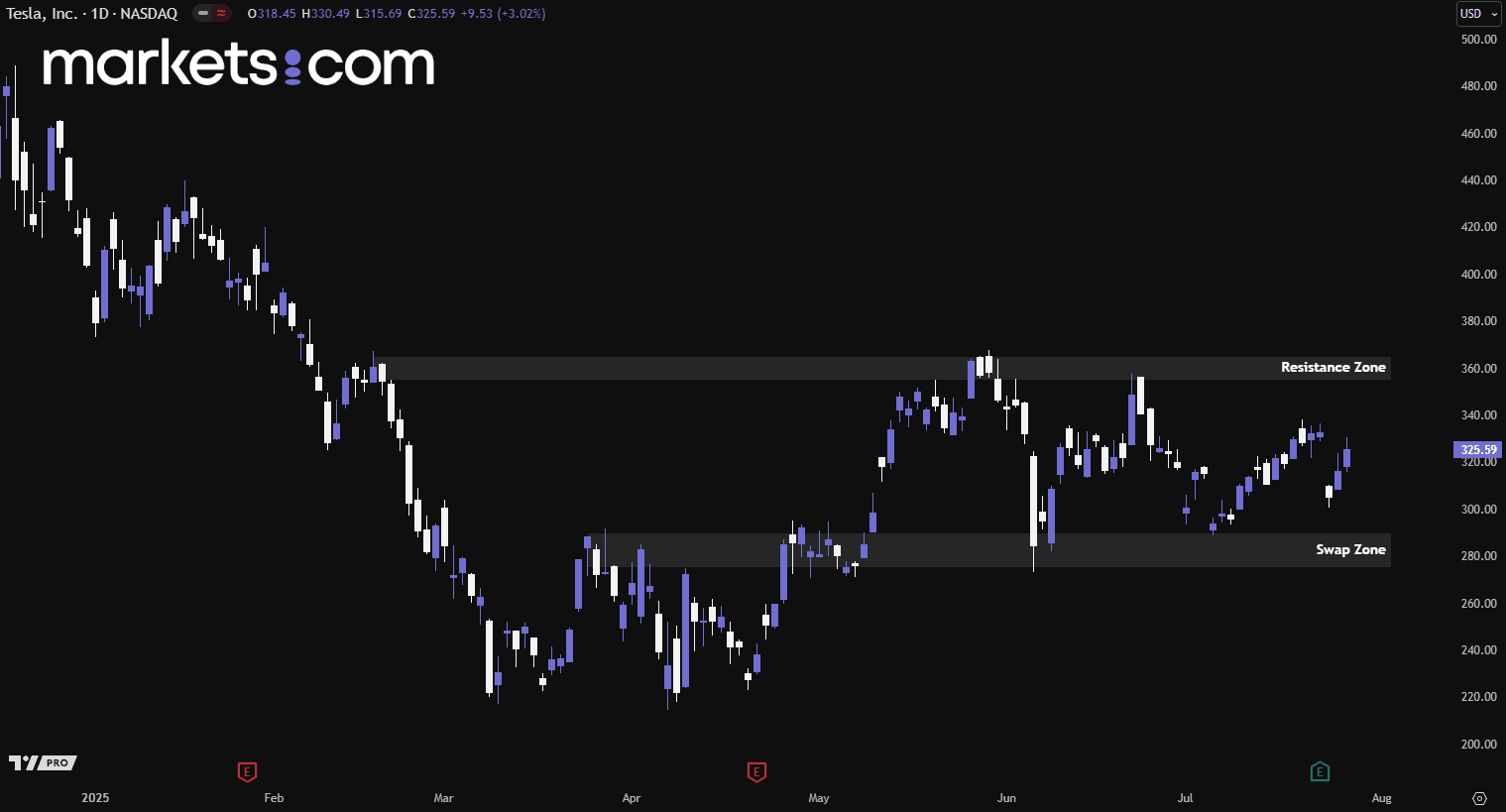

(Tesla Daily Share Price Chart, Source: Trading View)

From a technical analysis perspective, Tesla's share price has rebounded from the swap zone of $275 – $295, reinforcing this area as a solid support zone after multiple past reactions. This valid bullish movement could potentially drive the price higher to retest the resistance zone of $355 – $365. If the price breaks above this resistance, a further surge may follow. Conversely, failure to break through could result in a pullback and a period of consolidation.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.