Sunday Aug 17 2025 04:42

5 min

In June, the U.S. Producer Price Index (PPI) and Core PPI (excluding food, energy, and trade services) were both unchanged at 0.0% month-over-month, indicating a balance between rising goods costs and softer services prices. For July, economists expect both measures to rise by 0.2%, signalling a mild rebound in wholesale inflation after the stagnant June figures.

The modest upward forecast reflects several factors, including the base effect from June’s flat reading, slight increases in energy and commodity prices, recovering demand in certain service sectors, and the gradual pass-through of tariff-related costs. Seasonal adjustments also tend to produce small mid-year price increases. Together, these factors suggest that while inflation pressures remain subdued, underlying producer costs are firm enough to push July’s PPI and core PPI modestly higher.

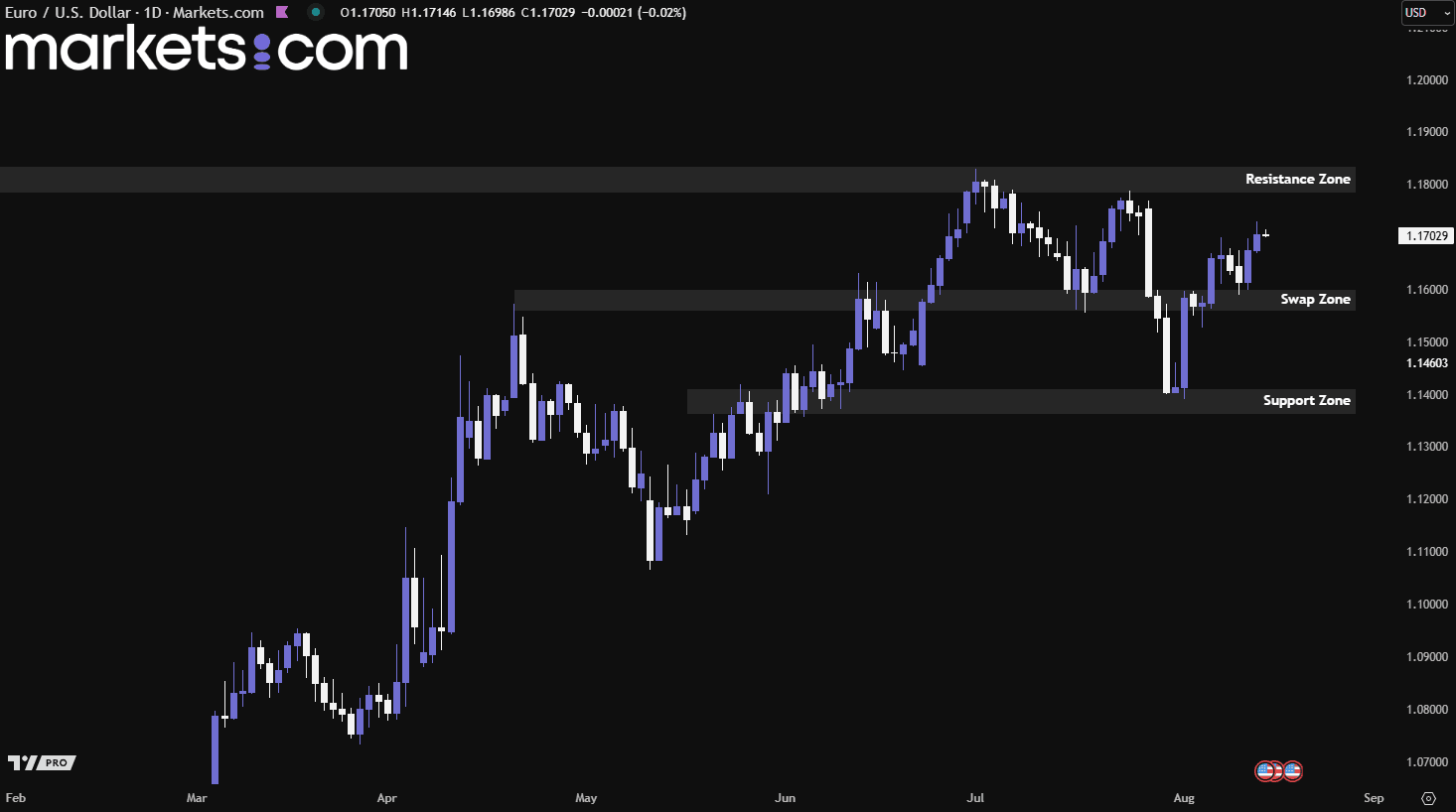

(EUR/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the EUR/USD currency pair has been in a bullish trend since mid-January 2025, as indicated by the formation of higher highs and higher lows. Recently, it experienced a pullback after being rejected from the resistance zone of 1.1785 – 1.1835. It then found support at the 1.1360 – 1.1410 zone, regained bullish momentum, and surged upward, breaking above the swap zone of 1.1560 – 1.1600. This valid bullish movement could potentially continue, driving the pair higher to retest the 1.1785 – 1.1835 resistance zone.

Coinbase has launched its second Stablecoin Bootstrap Fund, nearly six years after the first in 2019, to boost stablecoin liquidity across decentralised finance (DeFi) protocols. Managed by Coinbase Asset Management, the program will initially provide liquidity to platforms including Aave, Morpho, Kamino, and Jupiter, aiming to expand stablecoin accessibility and maintain stable rates across the DeFi ecosystem.

The move comes as Coinbase intensifies its push into DeFi amid a reported drop in spot trading volumes and Q2 revenue. Last week, the exchange unveiled plans to integrate a decentralised exchange, granting users access to millions of digital assets previously unavailable on its platform. The company has also outlined ambitions to become an “everything exchange,” offering tokenised stocks, prediction markets, and early-stage token sales.

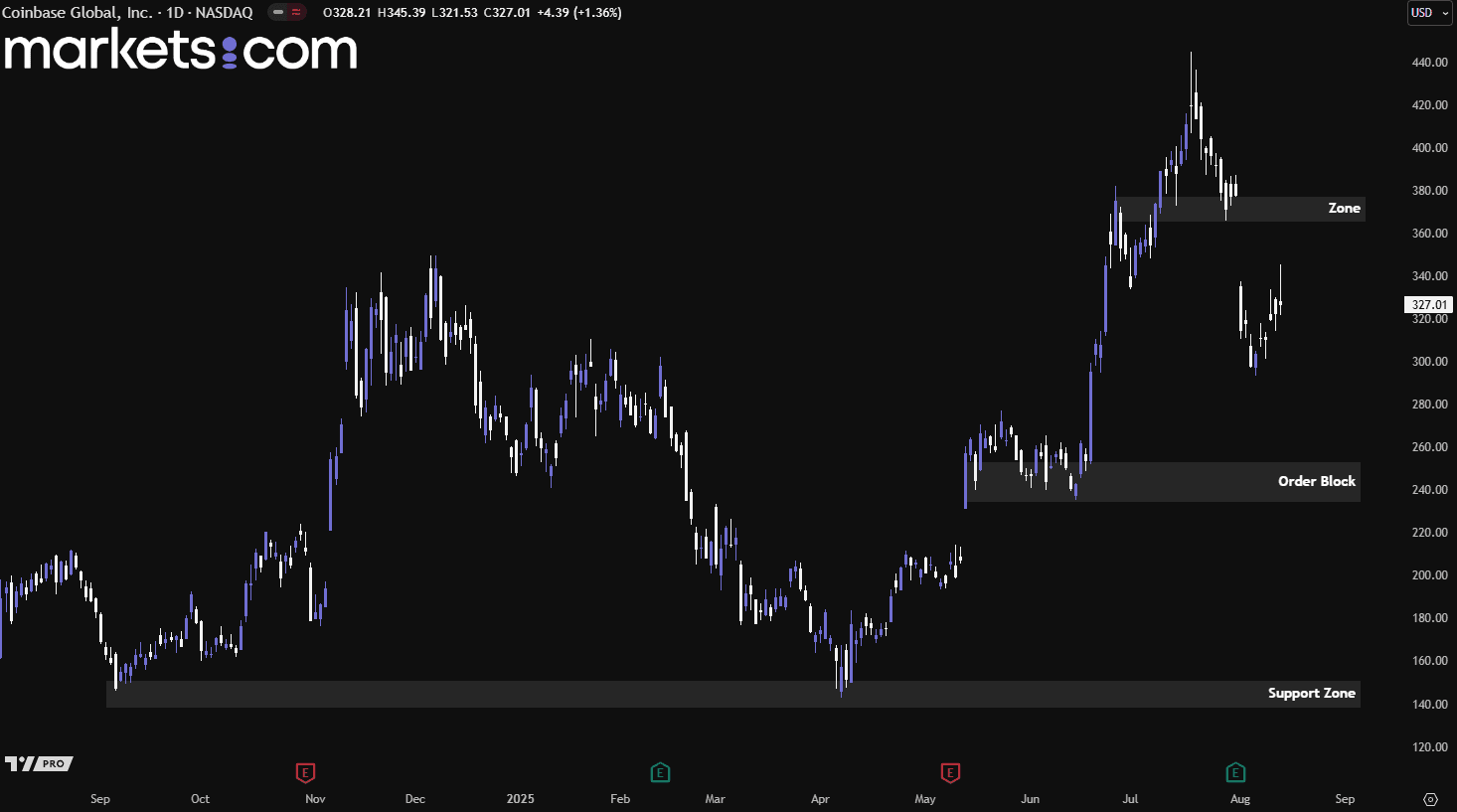

(Coinbase Daily Share Price Chart, Source: Trading View)

From a technical analysis perspective, the Coinbase daily chart has been in a bullish trend since early April 2025, rebounding from the support zone of 138 – 150, as indicated by the formation of higher highs and higher lows. Recently, it experienced a significant pullback, even dropping below the 365 – 377 zone. This indicates that bearish momentum remains intact and could potentially drive the price lower to retest the order block of 234 – 254 before determining its next directional move.

Tesla (TSLA) will launch its Austin-based robotaxi service to the public in September, CEO Elon Musk announced on social media. The rollout follows an invite-only trial phase that began in June with a small fleet of driverless vehicles and a limited user base. The company has secured all required permits from the Texas Department of Licensing and Regulation to operate statewide as a licensed Transportation Network Company through August 2026.

Guggenheim analyst Ronald Jewsikow said the earlier-than-expected launch signals Tesla’s confidence in its technology and positive feedback from early riders. He believes the expanded full self-driving model could strengthen the bull case for Tesla’s eventual fleet-wide robotaxi transition. While safety drivers will remain on board and no removal date has been set, he does not expect that to dampen investor optimism.

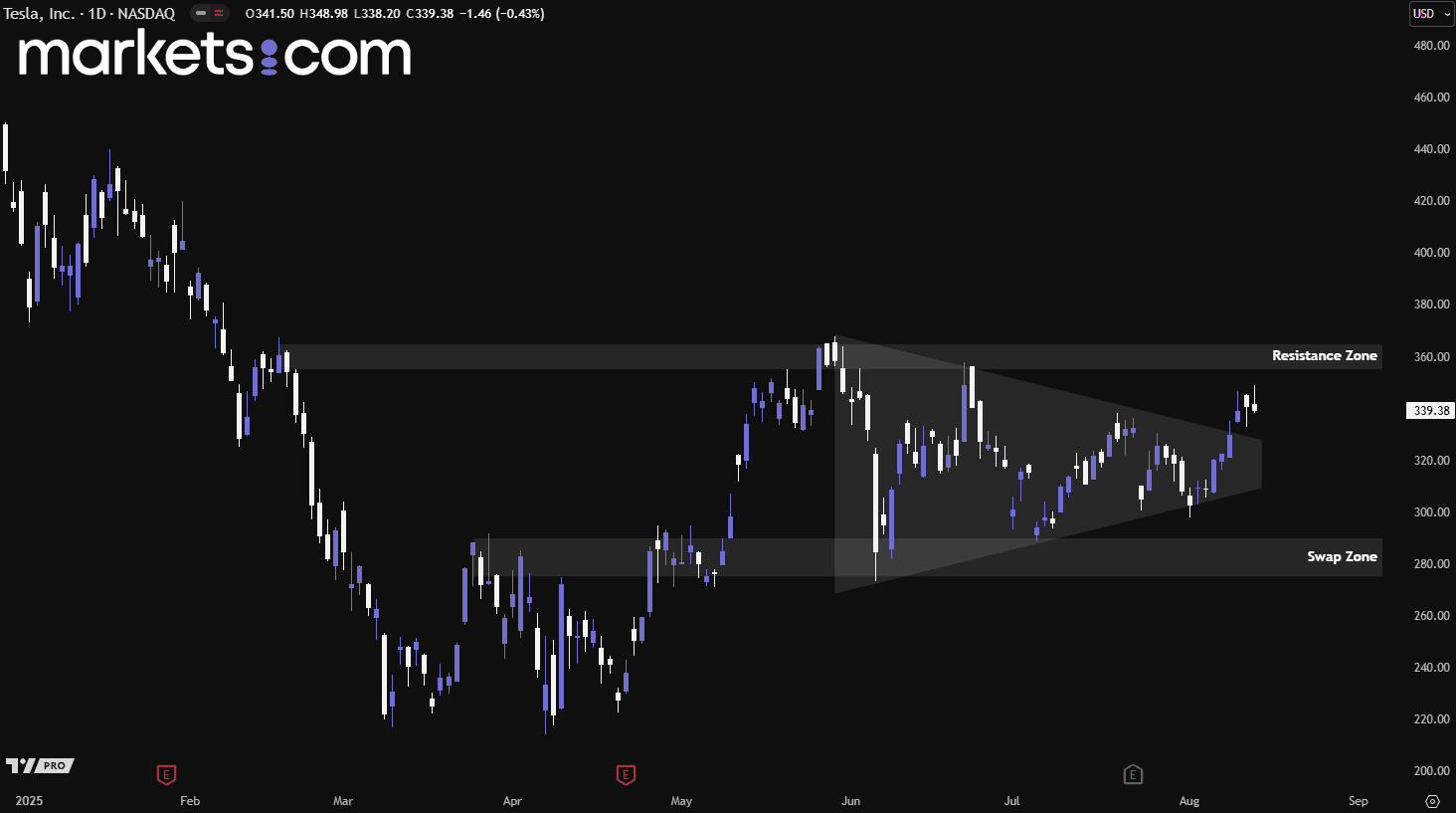

(Tesla Daily Share Price Chart, Source: Trading View)

From a technical analysis perspective, the Tesla share price has broken above the descending triangle, indicating that bullish forces have prevailed over bearish forces in this battle. This could potentially push the price higher to retest the resistance zone of 355 – 365. If it can break above this zone, further upside movement is likely.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.