Wednesday Aug 6 2025 08:02

5 min

The U.S. ISM Services PMI stood at 50.8 in June 2025, signalling a modest expansion in the services sector after dipping slightly below the 50-mark in May. This rebound was driven by a rise in business activity and new orders, even though employment remained in contraction territory. Looking ahead, the expected PMI reading for July is 51.5, reflecting growing optimism about service-sector resilience. The data is scheduled to be released today at 14:00 GMT.

This slight uptick is likely based on improving consumer demand, easing supply chain constraints, and strong business activity momentum observed in June. Additionally, the persistent strength in input prices suggests that service providers are still experiencing robust demand, justifying expectations for a continued, if moderate, expansion in July.

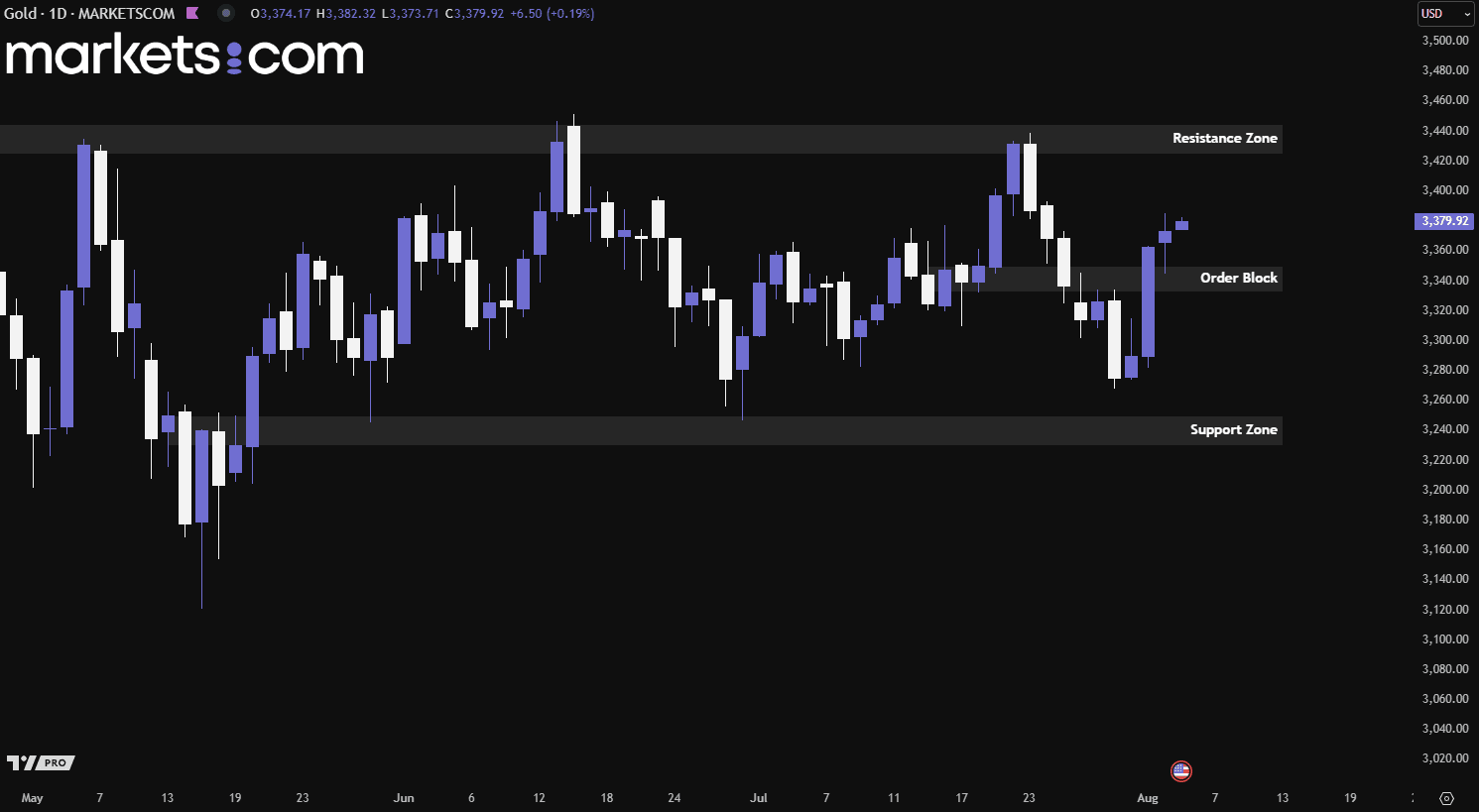

(Gold Daily Price Chart, Source: Trading View)

From a technical analysis perspective, the gold price has been moving in a consolidation phase since late May 2025, as the price can’t break either the resistance zone or support zone. Recently, the price has surged upwards with significant bullish momentum and even broke above the order block of 3,333 – 3,350. This could further give confirmation of the bullish movement, potentially continuing to push the gold price higher.

The U.S. dollar saw a modest rebound on Monday, stabilising after sharp losses triggered by a trio of events on Friday: a disappointing U.S. jobs report, the resignation of a Federal Reserve Governor, and President Donald Trump’s dismissal of a senior statistics official. These developments weighed heavily on the greenback and fueled market expectations of imminent Fed rate cuts.

However, Monday’s recovery may be short-lived, as broader weakness in the dollar could resurface amid growing policy uncertainty and signs of economic softening. The U.S. economy appears to be slowing across multiple sectors, casting doubt on the long-term benefits of shifting production and purchases away from overseas. While some economic indicators still hint at possible support from the Fed, global sentiment remains cautious, with little evidence of renewed optimism.

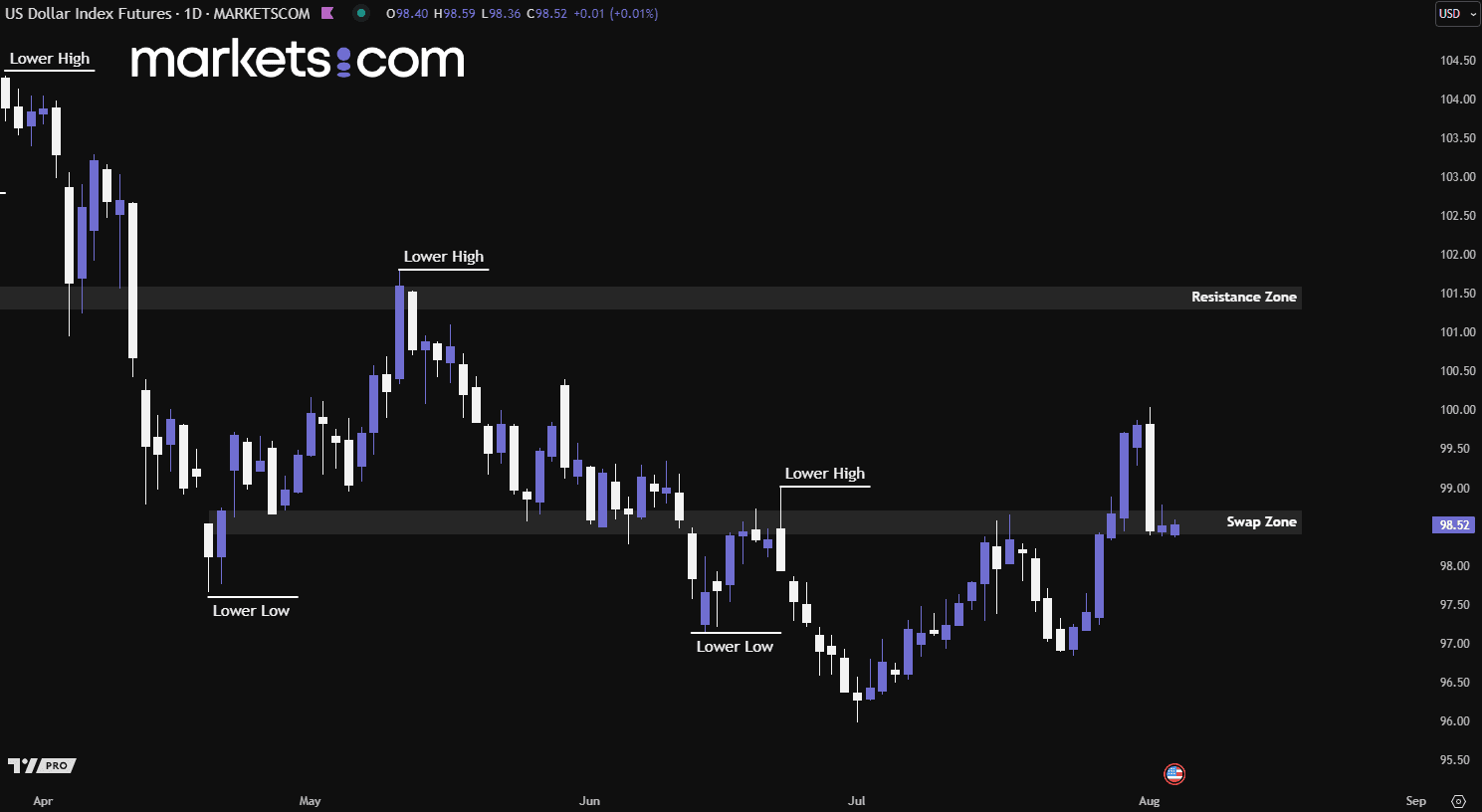

(U.S. Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the U.S. dollar index has been in a bearish trend since mid-January 2025, as reflected by the series of lower highs and lower lows. However, it began gaining bullish momentum and started moving higher in early July 2025.

On 16 July, the index retested the swap zone of 98.40 – 98.70. Then, it pulled back; it formed a higher low rather than a lower low, indicating that the bearish momentum may be weakening. Since then, the index has surged upward again and broken above the swap zone. It then dropped back and is currently retesting the swap zone again. If it managed to find support from this zone, it might continue its bullish movement and surge upward. Conversely, if the bearish forces push the index to break below this zone, it might potentially continue to drive lower.

The Commodity Futures Trading Commission (CFTC) announced on Monday that it will permit the trading of spot crypto asset contracts listed on futures exchanges registered under its oversight. Acting CFTC Chair Caroline Pham said the move aligned with the SEC’s “Project Crypto” and paves the way for immediate federal-level spot crypto trading. The CFTC also invited stakeholders to provide input on listing procedures for these contracts in designated markets.

This coordinated effort between the CFTC and the Securities and Exchange Commission represents a major win for the crypto industry, which has long sought regulatory clarity. SEC Chair Paul Atkins recently introduced several pro-crypto initiatives, including plans to develop clearer guidelines on when tokens qualify as securities, as well as proposals for tailored disclosure rules and exemptions. The joint regulatory approach signals growing institutional support for structured crypto integration.

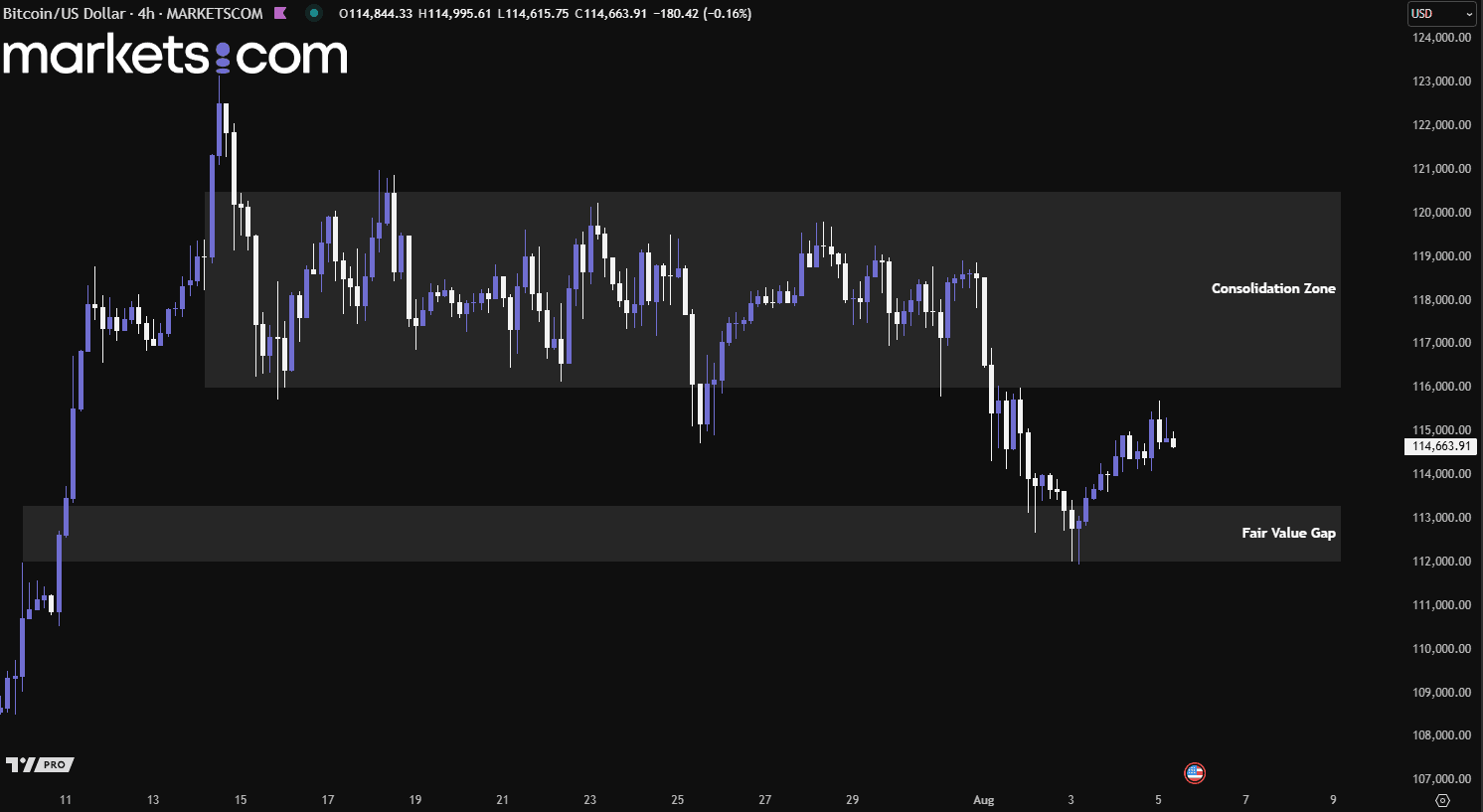

(Bitcoin 4H Price Chart, Source: Trading View)

From a technical analysis perspective, Bitcoin previously broke below the consolidation zone of 116,000–120,500, which triggered further downside movement. However, the price found support at the daily fair value gap of 112,000 – 113,300, gained bullish momentum, and surged upward. This bullish momentum could potentially continue, driving the price higher to retest the consolidation zone before determining its next directional move.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.