Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Jan 15 2026 09:04

21 min

Beginner's guide to CFD trading: Contract for Difference (CFD) trading has emerged as an attractive option for individuals looking to participate in financial markets without the need to own the underlying asset.

CFDs allow traders to speculate on the price movements of various assets, including stocks, commodities, indices, and currencies. This guide offers a comprehensive overview of how to effectively engage in CFD trading by breaking it down into six essential steps.

Selecting the right CFD broker is a critical first step in your trading journey. A reputable broker will provide the tools, resources, and support necessary for successful trading.

Among the many options available, Markets.com stands out as a strong choice for both beginner and seasoned traders. Below, we’ll explore the key features and advantages that make Markets.com an appealing CFD broker.

Wide Range of Markets

Markets.com provides access to a diverse array of markets, making it suitable for various trading strategies. Traders can engage with multiple asset classes, including:

This broad selection allows traders to diversify their portfolios and explore various opportunities.

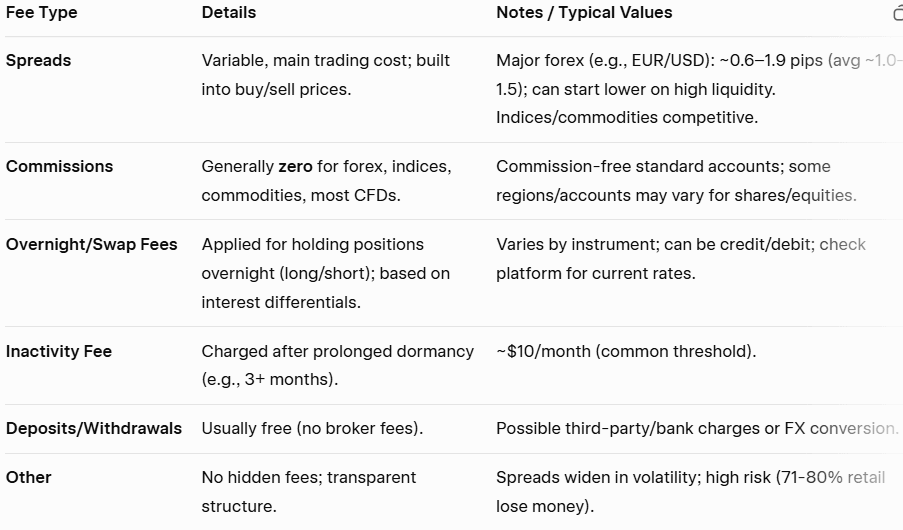

Competitive Costs and Fees

Understanding the cost structure is vital in CFD trading, and Markets.com is known for its competitive pricing. The broker generally offers:

Tight Spreads: Markets.com provides low spreads on a variety of asset classes, reducing trading costs.

Transparent Fees: Traders can expect clear information regarding any commissions or fees associated with their trades.

No Hidden Charges: This transparency contributes to a trustworthy trading environment.

These resources are invaluable for building confidence and knowledge.

Customer Support

Reliable customer support is essential for a seamless trading experience. Markets.com provides robust customer service through multiple channels:

Live Chat: Get immediate assistance during trading hours.

Email and Phone Support: Reach out for help with account-related inquiries or technical issues.

Comprehensive FAQ Section: A well-organized FAQ section addresses common questions, allowing traders to find information quickly.

Selecting a broker is foundational to your success in CFD trading, and Markets.com offers a compelling package for both beginners and experienced traders. With strong regulatory oversight, a user-friendly platform, a wide range of markets, competitive fees, comprehensive educational resources, and excellent customer support, Markets.com is well-equipped to support your trading journey.

In the following steps, we’ll delve deeper into the account setup process, market selection, trade execution, and monitoring strategies, ensuring you are well-prepared to trade CFDs effectively.

After selecting a broker, the next step is to open your CFD trading account. This process, while typically straightforward, requires careful attention to detail.

Completing the Application

Most brokers offer a seamless online application process to set up your account. Expect to provide standard personal information, including:

Full name

Address

Date of birth

You may also encounter questions about your financial background and trading experience. This information helps brokers assess your suitability for trading and ensure compliance with regulations.

Verifying Your Identity

To comply with international regulations aimed at preventing money laundering and fraud, brokers are required to verify your identity. Prepare to upload the following documents:

Identification: A government-issued photo ID, like a passport or driver’s license.

Proof of Residence: This can be a utility bill, bank statement, or lease agreement showing your name and address.

The verification process can take a few hours to a couple of days, depending on the broker.

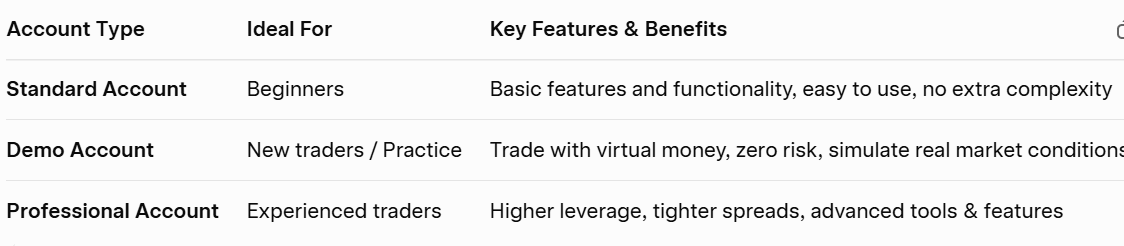

Choosing Account Type

CFD brokers often offer a variety of account types to cater to different trading styles:

Standard Account: Ideal for beginners, offering basic features and functionality.

Demo Account: Allows you to practice trading with virtual money before risking real funds.

Professional Account: For experienced traders, often providing access to higher leverage and additional features.

Select the account type that aligns with your trading goals and experience level.

Deposit Funds

Once your account is set up and verified, you will need to deposit funds to start trading. Review the deposit options available, which often include:

Bank Transfers

Credit/Debit Cards

E-wallets (like PayPal or Neteller)

Make sure to consider any potential fees or delays associated with each deposit method. Familiarizing yourself with the broker's policies regarding deposits and withdrawals will prevent surprises later.

Choosing the appropriate market to trade is fundamental to your overall trading success. The vast array of available markets can be overwhelming, so here are some considerations to make an informed choice:

Types of Markets Available

CFD trading spans multiple asset classes, including:

Forex: Engage with currency pairs such as EUR/USD or GBP/JPY. The forex market operates 24/5 and is known for its liquidity and volatility.

Stocks: Trade CFDs on shares of individual companies. The stock market can be influenced by company performance, industry trends, and economic factors.

Commodities: Speculate on the prices of physical goods, including precious metals (gold, silver), energy (oil, natural gas), and agricultural products. The commodities market can react to supply and demand dynamics influenced by global events.

Indices: Trade CFDs on market indices like the S&P 500 or FTSE 100, reflecting the performance of a collection of stocks. This can provide diversification as it reduces reliance on individual equities.

Cryptocurrencies: Engage in CFD trading for cryptocurrencies such as Bitcoin or Ethereum, capturing the price movements of these digital assets. This offers exposure to the rapidly evolving crypto market, allowing for both potential gains and diversification from traditional assets.

ETFs (Exchange-Traded Funds)

Trade CFDs on ETFs, which represent a basket of assets including stocks, bonds, or commodities. This allows for instant diversification across various sectors or markets, combining the liquidity of stocks with the broad exposure of mutual funds.

Research the Market

Before committing to a market, conduct extensive research. Focus on identifying factors that may impact price movements:

Economic Indicators: Analyze reports such as inflation data, unemployment rates, and GDP growth that influence market sentiment.

Company News: For stock trading, keep abreast of earnings reports, product launches, and significant company developments.

Global Events: Political tensions, changes in trade policies, and natural disasters can all impact commodity prices.

Developing a robust understanding of these factors helps in aligning your trades with market realities.

Consider Volatility

Volatility is a key aspect of trading. Markets can experience sudden price swings, which can either present trading opportunities or increase risk.

High Volatility: Markets like cryptocurrencies or certain commodities may offer greater swings, ideal for aggressive traders.

Low Volatility: More stable markets, such as major currency pairs, may provide lower risk but also fewer opportunities for profit.

Assess your risk tolerance carefully, as high volatility can lead to significant fluctuations in your account balance.

Align with Your Strategy

Your approach to trading should guide your market choices. If you prefer short-term trades, you may benefit more from the liquidity of the forex market. Conversely, if your strategy aims for longer-term positions based on corporate performance, stocks and indices may align better with your goals.

Once you have selected a market, it's time to determine whether to buy or sell. This basic decision is foundational to CFD trading.

Analyzing Market Conditions

Making a confident decision requires thorough analysis. As mentioned earlier, you can utilize both fundamental and technical analysis approaches to guide your choices.

Fundamental Analysis

Focus on economic events and financial reports that influence market movements. Understanding how factors like economic growth, interest rates, and sector performance can shape prices is crucial.

For example, if economic indicators suggest impending inflation, traders may flock to gold as a hedge, potentially driving its price higher.

Technical Analysis

For those inclined to technical analysis, utilize price charts and trading indicators. Various tools, such as:

Moving Averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA) help identify price trends.

Relative Strength Index (RSI): This measures momentum and can indicate overbought or oversold conditions.

Candlestick Patterns: Recognizing patterns in candlestick formations can indicate potential reversals or continuation of trends.

Utilizing these tools can inform entry and exit points, forming a well-rounded trading strategy.

Market Sentiment

Market sentiment involves the collective attitude of traders towards a particular asset. This can be gauged through various channels:

News Reports: Stay updated on current events that could sway trader sentiment.

Social Media: Platforms like Twitter and trading forums can offer insights into prevailing market emotions.

Monitoring sentiment allows you to anticipate potential price movements and adjust your trading plan accordingly.

Making the Decision

Once you have conducted your analysis, it’s time to decide whether to open a buy (long) position or a sell (short) position.

Buy Position: In this case, you're betting that the asset's price will rise. Successful trade examples often stem from strong market fundamentals and positive sentiment.

Sell Position: Here, you're speculating that the asset's price will decrease. This decision may arise from bearish market indicators or negative sentiment.

Ensure that your decision is backed by your analysis to increase the likelihood of a successful trade.

With your decision made, it's time to set up and execute your trade. This involves several stages to ensure that you enter the market effectively.

Choose Your Trade Size

Selecting your position size is crucial. Typically, CFD trading allows you to specify how many contracts you wish to trade, and it’s essential to align this with your risk management practices.

Risk Management: Most traders recommend risking no more than 1-2% of your trading capital on any single trade. This protects your account from substantial losses and allows for longevity in trading.

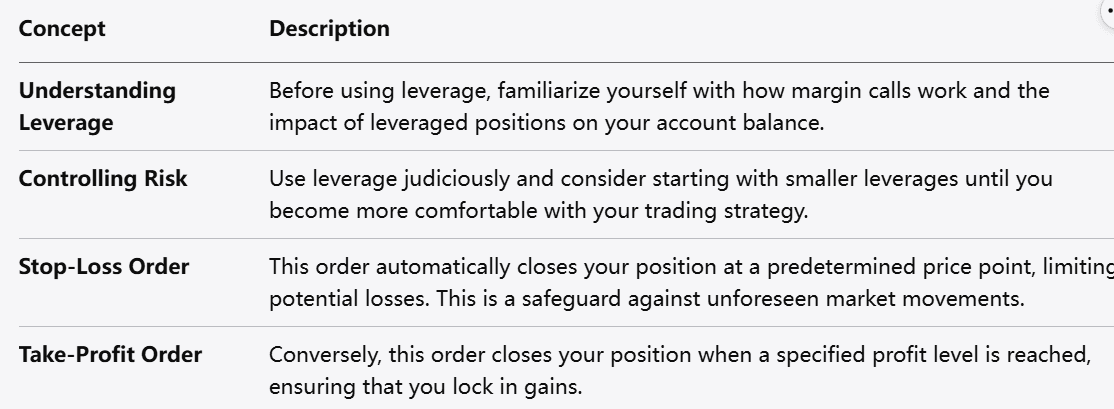

Leverage Considerations

Leverage can significantly affect your trading experience. While it allows you to magnify potential returns, it also heightens risk.

Understanding Leverage: Before using leverage, familiarize yourself with how margin calls work and the impact of leveraged positions on your account balance.

Controlling Risk: Use leverage judiciously and consider starting with smaller leverages until you become more comfortable with your trading strategy.

Setting Stop-Loss and Take-Profit Orders

To manage your risk effectively, it’s wise to set both stop-loss and take-profit orders.

Stop-Loss Order: This order automatically closes your position at a predetermined price point, limiting potential losses. This is a safeguard against unforeseen market movements.

Take-Profit Order: Conversely, this order closes your position when a specified profit level is reached, ensuring that you lock in gains.

These automatic features can help you maintain discipline in your trading strategy and prevent emotional decision-making.

Executing the Trade

When you are ready, proceed to execute your trade. On your broker's trading platform:

Select the Market: Navigate to the chosen market you wish to trade.

Enter Position Size: Specify the number of contracts you want to trade.

Select Trade Direction: Choose whether you are buying or selling.

Review: Make sure all details are accurate before submitting.

Confirm: Once everything is correct, execute your trade. The platform should reflect your open position shortly after.

After executing your trade, continuous monitoring is paramount. Markets can be unpredictable, and vigilance can help you react quickly to changes.

Keeping Track of Market Conditions

Stay informed about factors that could influence your trades:

News Alert: Set up alerts through your trading platform for significant news that affects your market.

Economic Calendar: Use economic calendars to track upcoming releases of economic data likely affecting market conditions.

Analyzing Your Position

Regularly evaluate your open position to determine if it remains aligned with your initial analysis.

Is the market behaving as you expected?

Has any new information emerged that could affect your position?

If your initial thesis is no longer valid, you may need to reconsider your strategy, which could result in closing the position earlier than planned.

Closing Your Trade

When you feel it’s time to exit the trade, the process is straightforward:

Access Open Positions: Navigate to your account and find the open position you wish to close.

Confirm Details: Review the details, including current price, profit/loss status, and any outstanding orders (stop-loss or take-profit).

Close the Trade: Execute the order to close the position. Your broker will reflect the finalized transaction in your account.

Reviewing Your Performance

Once the trade is closed, take the time to analyze its performance. Ask yourself:

What worked well?

What could you have done differently?

Keeping a trading journal can be beneficial. Document your trades, strategies, outcomes, and emotions during trading. Over time, this reflection can help improve your decision-making and trading strategies.

Now that you understand the fundamental steps in CFD trading, consider integrating some advanced tips to enhance your trading journey:

Develop a Trading Plan

A well-thought-out trading plan serves as a roadmap for your trading activities. Include aspects such as:

Trading Goals: What do you hope to achieve?

Risk Management: Define your maximum risk for each trade.

Entry and Exit Strategies: Document the criteria that will prompt buying or selling.

Having a plan helps in maintaining consistency and discipline.

Continuous Education

Financial markets are ever-evolving. Commit to ongoing learning to stay informed about market trends, new trading strategies, and developments in the economy.

Consider webinars, online courses, and trading forums as resources for education.

Practice with a Demo Account

Before trading real funds, spend time practicing on a demo account. This allows you to familiarize yourself with the trading platform without risking money and enables you to refine your strategy in a risk-free environment.

Stay Emotionally Detached

Trading can evoke strong emotions, especially during market volatility. Aim to remain analytical and stick to your trading plan, avoiding impulsive decisions based on fear or greed.

Network with Other Traders

Engaging with a community of traders can provide insights and support. Consider joining trading forums, attending trading meet-ups, or participating in social media groups focused on trading discussions.

CFD trading offers a dynamic and flexible way to engage with financial markets. By following these six comprehensive steps—choosing the right broker, opening an account, selecting your market, deciding on a buy or sell position, executing your trade, and continuously monitoring your positions—you lay the groundwork for a successful trading experience.

Remember that trading carries risk; therefore, maintaining a disciplined approach, educating yourself continuously, and practicing effective risk management will enhance your potential for success. With the insights and guidance provided in this guide, you are better equipped to navigate the exciting world of CFD trading. As you embark on your journey, be patient, stay committed, and enjoy the learning process as you develop your skills and strategies over time.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.