Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Monday Dec 29 2025 09:53

19 min

Beginner's guide to CFD trading: CFD trading has gained popularity among retail investors due to its unique benefits, including the ability to trade on margin and access various global markets.

Start investing in 2026: This guide will provide a comprehensive overview of CFD trading, focusing on how to trade stock CFDs on Markets.com.

Definition of CFD

A Contract for Difference (CFD) is a financial derivative that allows traders to speculate on the price movement of an underlying asset without actually owning it. Instead of buying or selling the asset itself, traders enter into an agreement with a broker to exchange the difference in the asset's price from the time the contract opens to when it closes.

Key Features of CFDs

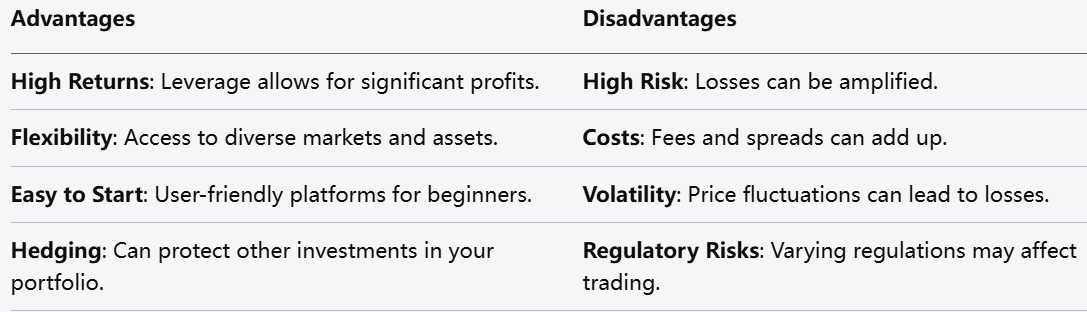

Advantages

Potential for High Returns: Due to leverage, there is the potential for significant returns on investment if trades are successful.

Flexibility: CFDs give you the ability to trade a wide range of markets and asset classes, offering diverse trading opportunities.

Easy to Start: Platforms like Markets.com provide user-friendly environments for new traders, making it easier to learn and trade.

Hedging Opportunities: CFDs can be used to hedge other investments in your portfolio, providing a safety net during market downturns.

Disadvantages

High Risk: Leverage can amplify losses as well as profits, making CFD trading risky, especially for inexperienced traders.

Costs and Fees: While trading CFDs can be cost-effective, spread costs, overnight financing fees, and commissions can add up, affecting overall profitability.

Market Volatility: CFD prices can be highly volatile, and the risks associated with sudden price movements can lead to significant losses.

Regulatory Risks: CFD trading is subject to regulatory practices that may vary by country, impacting trading conditions and availability.

Overview of Markets.com

Markets.com is an online trading platform that offers a wide range of trading instruments, including forex, stocks, commodities, indices, and cryptocurrencies. The platform is designed to cater to both beginner and experienced traders, providing access to advanced trading tools and educational resources.

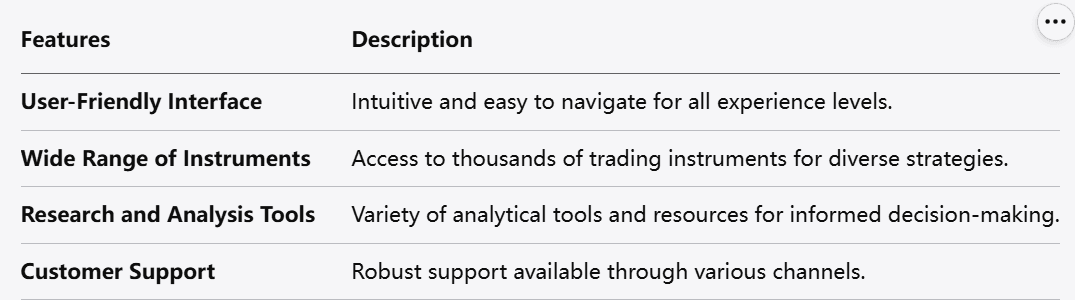

Key Features of Markets.com

User-Friendly Interface: The platform is intuitive and easy to navigate, making it accessible for traders of all experience levels.

Wide Range of Instruments: Markets.com provides access to thousands of trading instruments, allowing for diversity in trading strategies.

Research and Analysis Tools: The platform offers a variety of analytical tools and resources to help traders make informed decisions.

Customer Support: Markets.com provides robust customer support through various channels, ensuring traders can obtain assistance when needed.

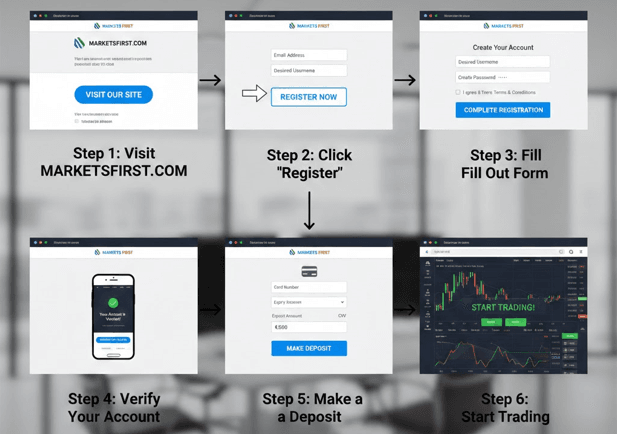

Setting Up a Trading Account on Markets.com

Step-by-Step Guide

Follow these steps to set up your trading account on Markets.com:

Visit the Markets.com Website: Navigate to the Markets.com homepage to begin the registration process.

Click on the "Register" Button: Locate the "Register" button, usually found at the top of the homepage.

Fill Out the Registration Form: Complete the registration form by providing your personal information, such as your name, email address, and phone number.

Create a Password: Choose a strong password for your account. Ensure that it meets the site's security requirements.

Agree to Terms and Conditions: Read and accept the terms and conditions before proceeding.

Verify Your Account: Markets.com may require you to verify your identity by providing documentation, such as a government-issued ID and proof of address.

Make a Deposit: Once your account is verified, you can fund your account using various payment methods, including credit/debit cards, bank transfers, and e-wallets.

Start Trading: After funding your account, you can access the trading platform and begin trading CFDs.

Once you log into your Markets.com account, you’re welcomed by a comprehensive dashboard that serves as the central hub for your trading activities. This user-friendly interface is designed to provide traders with all the necessary information and tools to make informed decisions quickly. Let’s take a closer look at the key sections of the dashboard.

Key Sections of the Dashboard

Account Overview:

At the top of your dashboard, the Account Overview section displays vital information, including your current account balance, equity, and margin level. This data is crucial for understanding your trading capacity, as it reflects the amount of capital you have available for trading and how much leverage you are using. Monitoring this section ensures that you stay aware of your financial standing and can make adjustments as necessary to manage risk effectively.

Market Watch:

The Market Watch section lists various trading instruments available on the platform, including stock CFDs. This area provides real-time price data, allowing traders to track market movements as they happen. You can customize your Market Watch list by adding or removing instruments based on your interests and trading strategies. This personalization helps you focus on the assets you plan to trade, enhancing your responsiveness to market changes.

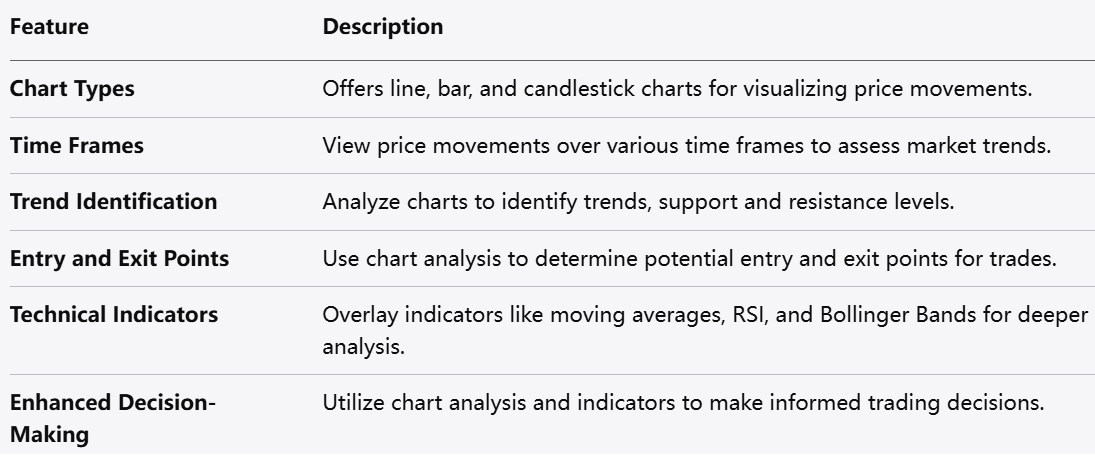

Trading Chart:

The Trading Chart feature is a critical tool for technical analysis. Markets.com provides a variety of chart types, including line, bar, and candlestick charts, to visualize price movements over different time frames. By analyzing these charts, traders can identify trends, support and resistance levels, and potential entry and exit points. The ability to overlay technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands allows for more in-depth analysis, improving trading decisions.

Order Entry Form:

This section is where the actual trading action takes place. The Order Entry Form allows you to place trades quickly, adjust position sizes, and set crucial risk management parameters like stop-loss and take-profit levels. The intuitive layout simplifies the trading process, which is especially beneficial for beginners. Additionally, you can review the associated costs of your trades in this section, providing transparency about spreads and potential commissions.

Customizing Your Workspace

Markets.com recognizes the diverse trading styles of its users, allowing for substantial customization of the trading environment. Customizing your workspace enhances your trading experience and enables you to focus on what matters most.

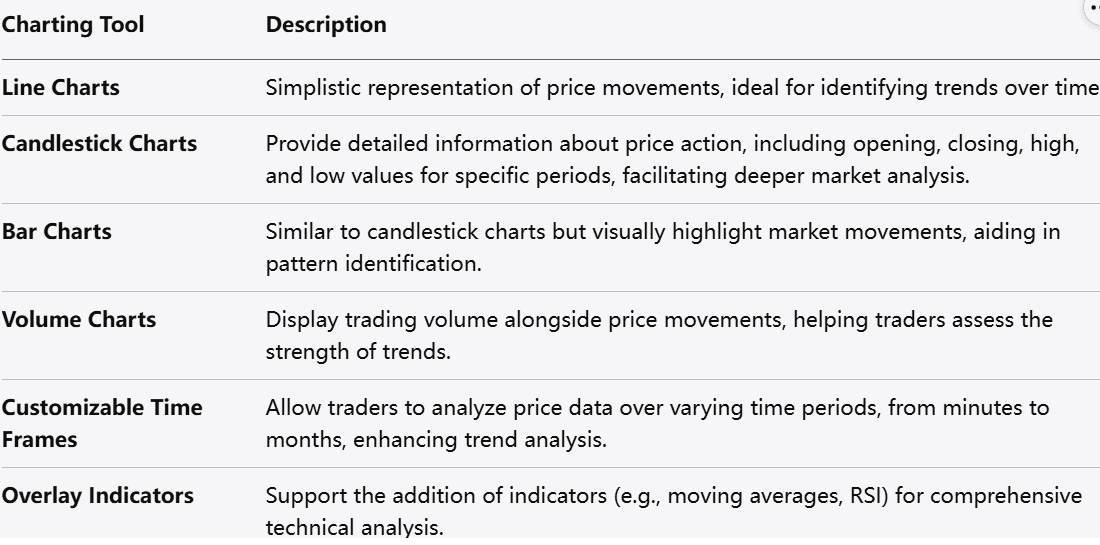

Charting Tools

The platform offers versatile Charting Tools that enable effective technical analysis. Traders can choose from various chart styles, including:

Traders can also add technical indicators to these charts, such as moving averages, RSI, and Fibonacci retracements. These indicators help to identify trends, potential reversals, and market momentum.

Watchlists

The Watchlist feature is a powerful tool that allows you to monitor specific instruments and track their performance closely. By creating custom watchlists, you can curate a selection of stocks or other assets relevant to your trading strategy. This functionality enhances your ability to respond quickly to market movements and developments in the instruments you care about most.

Alerts

Another useful feature on Markets.com is the alert system. You can set price alerts for specific assets, notifying you when they reach predetermined price points. This means you can stay focused on other tasks or trades while still being informed of price changes that might affect your strategy. Alerts can be sent via email or push notifications, ensuring you never miss a trading opportunity.

The dashboard on Markets.com is designed to empower traders by providing all necessary tools and information in an intuitive layout. Understanding each section—from the Account Overview to the Order Entry Form—ensures that you can navigate the platform efficiently and make informed trading decisions.

Furthermore, the customization options available, such as personalized watchlists, versatile charting tools, and alert systems, allow for a tailored trading experience. By leveraging these features, traders can optimize their workflows, react swiftly to market changes, and ultimately enhance their trading outcomes. As you continue to explore and get comfortable with the Markets.com platform, mastering the dashboard and its customizable aspects will serve as a foundation for your trading journey.

Step-by-Step Trading Process

1. Choosing the Right Stock

Before placing a trade, conduct research to identify potential stock CFDs to trade. Consider factors such as:

Market Trends: Analyze market conditions and trends that may impact stock prices.

Company Performance: Review earnings reports, news releases, and analyst recommendations to gauge the financial health of companies.

Technical Analysis: Use technical indicators to identify entry and exit points based on price movements.

2. Placing a Trade

Once you've selected a stock CFD to trade, follow these steps:

Access the Trading Platform: Log in to your Markets.com account, and navigate to the stock you wish to trade.

Select "Trade": Click on the desired stock CFD to open the order entry form.

Choose Your Position Type:

Buy (Go Long): If you expect the stock price to rise, select the “buy” option.

Sell (Go Short): If you anticipate a decline in the stock price, select the “sell” option.

Set Your Position Size: Determine the number of contracts you wish to trade. Remember that leverage allows you to control more significant positions, but assess your risk tolerance carefully.

Use Stop-Loss and Take-Profit Orders: It's essential to manage risk when trading. Set a stop-loss order to limit potential losses and a take-profit order to secure profits when the stock reaches a favorable price.

Review Your Order: Double-check all the details before confirming your trade. Ensure that the position type, size, and orders are accurate.

Confirm the Trade: Click on the “place order” button to execute your trade.

3. Monitoring Your Trade

After placing a trade, actively monitor its performance. Keep an eye on market developments, news related to the stock, and any technical indicator signals that may influence your position.

Adjust Stop-Loss and Take-Profit Orders: If market conditions change, consider adjusting your stop-loss and take-profit levels to align with your trading strategy.

Consider Closing the Position Early: If a trade is not performing as expected, don’t hesitate to close the position early to minimize losses.

4. Closing Your Trade

Once you are satisfied with your trade outcome or reach your predetermined stop-loss or take-profit levels, you can close your position.

Navigate to Your Open Trades: Go to the trading section of Markets.com and locate your open trades.

Select the Trade: Click on the trade you wish to close to access the order management options.

Close the Position: Confirm the closing of the position. The profit or loss will be calculated and reflected in your account balance.

Importance of Risk Management

Risk management is crucial in CFD trading due to the inherent risks associated with leverage and market volatility. Proper risk management can protect your capital and ensure long-term success.

Essential Strategies

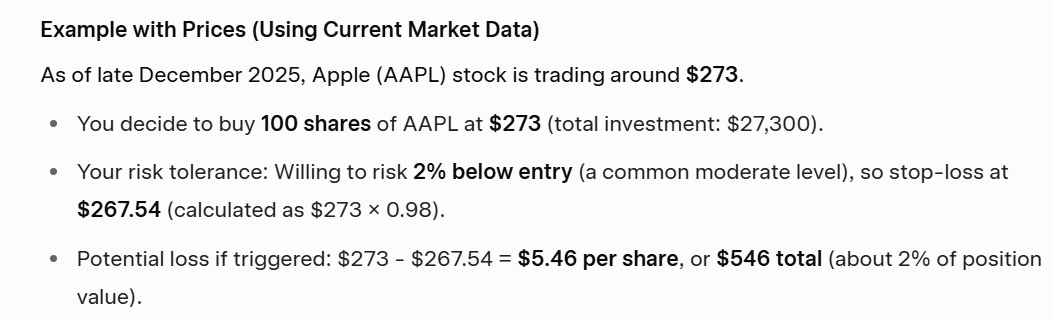

Set Stop-Loss Orders: Always set stop-loss orders to limit potential losses. Determine your risk tolerance and position size to calculate appropriate stop-loss levels.

Diversify Your Portfolio: Avoid concentrating your investments in a single asset. Diversifying your portfolio across different markets and instruments can help mitigate risks.

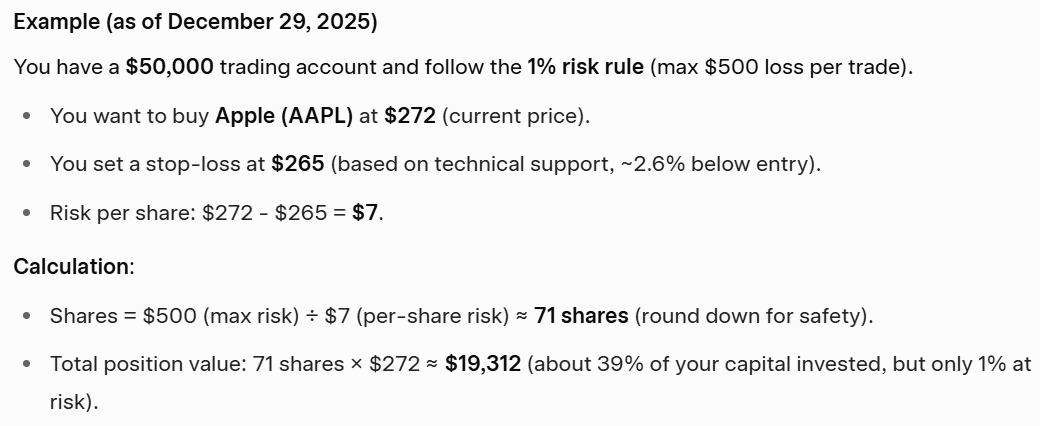

Limit Position Size: Never risk more than a small percentage of your trading capital on a single trade. This approach can help prevent significant capital loss.

Stay Informed: Keep up-to-date with market news, economic events, and developments that could impact your trades. Staying informed can help you make better trading decisions.

Use Leverage Cautiously: While leverage can amplify profits, it also magnifies losses. Use leverage cautiously, and avoid using the maximum available leverage.

1. Technical Analysis

Technical analysis involves studying historical price movements and volume patterns to forecast future price trends. Key tools include:

Charts: Line, bar, and candlestick charts show price movements over different time frames.

Indicators: Use indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify trends and potential reversal points.

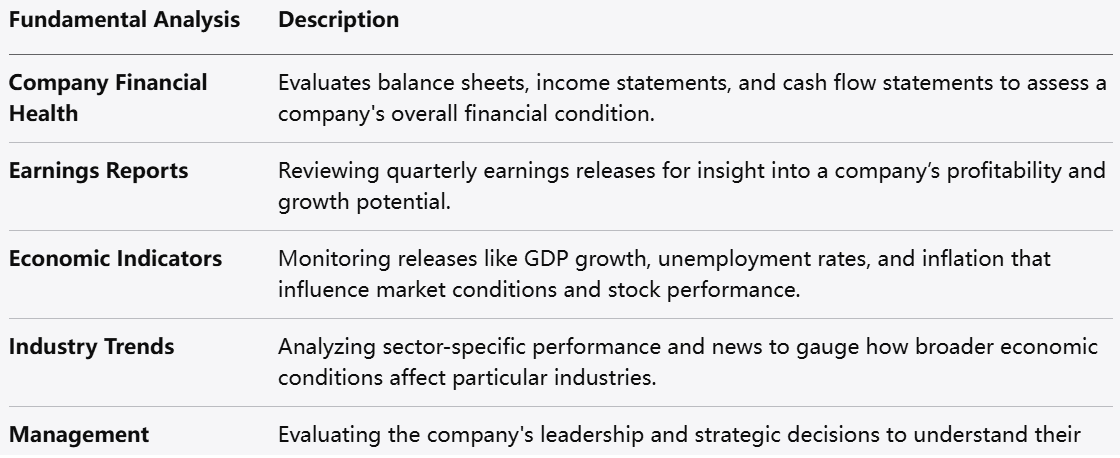

2. Fundamental Analysis

Fundamental analysis involves evaluating a company's financial health, market conditions, and external factors to determine its value. Important factors include:

Earnings Reports: Review quarterly earnings releases for insight into a company’s financial performance.

Economic Indicators: Monitor economic data releases, such as GDP growth, unemployment rates, and inflation, which may impact stock performance.

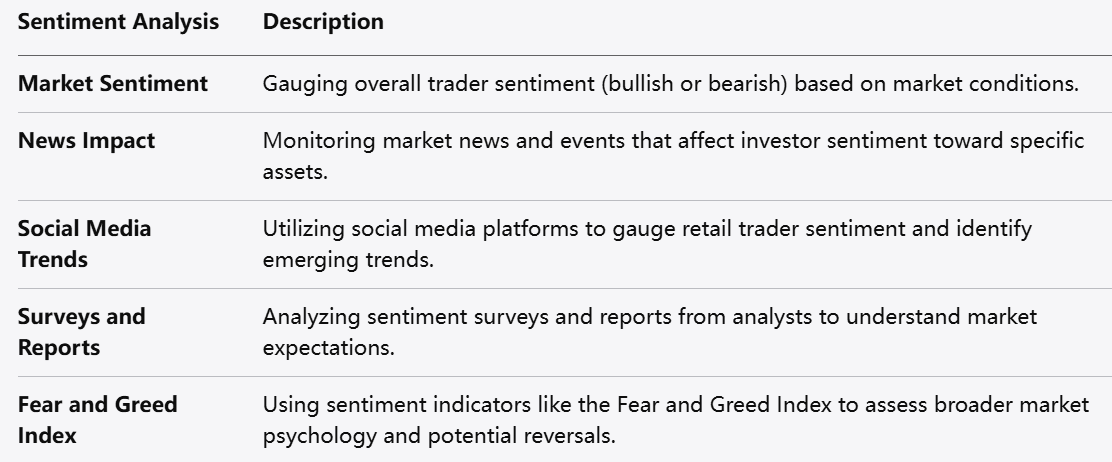

3. Sentiment Analysis

Sentiment analysis gauges how traders and investors feel about a particular asset. Market sentiment can influence price movements, making it essential to consider:

News: Monitor market news and events that may impact sentiment.

Social Media: Social media platforms can provide insight into retail trader sentiment and trends.

Education and Training Resources

CFD trading requires continuous learning. Markets.com offers various educational resources, including:

Keeping a Trading Journal

Maintaining a trading journal can help you track performance, analyze decisions, and identify areas for improvement. Include details such as:

Trading stock CFDs on Markets.com offers an exciting opportunity to participate in financial markets with the potential for high returns. By understanding the fundamentals of CFD trading, setting up an account, and employing effective strategies, you can navigate this dynamic environment confidently.

As a beginner, it’s crucial to approach CFD trading with a solid understanding of the associated risks and rewards. Utilize educational resources, practice with a demo account if available, and develop a disciplined trading plan to enhance your chances of success.

With the right knowledge and approach, CFD trading can be a rewarding venture, allowing you to engage with global markets and capitalize on price movements. Whether you’re looking to trade stocks, indices, commodities, or other instruments, Markets.com provides the tools and resources you need to start your trading journey.

Looking to trade stock CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.