Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Dec 4 2025 08:57

14 min

Start investing in 2026: Investing in CFDs offers traders significant opportunities to profit from price movements in various financial markets, including stocks, indices, commodities, and cryptocurrencies.

CFD Trading Explained: As the investment landscape evolves, knowing how to find the best CFD broker becomes crucial for success. This trader's guide will provide insights into various aspects of CFD trading and essential factors to consider when selecting a broker, ensuring you are well-prepared to start investing in 2026. One highly recommended platform for trading CFDs is Markets.com, known for its user-friendly interface and robust trading tools.

Definition of CFDs

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of various assets without owning the underlying asset. When you trade CFDs, you enter into a contract with a broker, agreeing to pay the difference between the opening and closing prices of an asset. If the price moves in your favor, you profit, but if it goes against you, you incur losses.

How CFDs Work?

CFDs enable traders to enter positions based on whether they believe the asset's price will rise or fall. By going "long" (buying), traders profit from rising prices, whereas going "short" (selling) allows them to profit from declining prices. This flexibility adds to the appeal of CFDs, as it provides opportunities in both bullish and bearish markets.

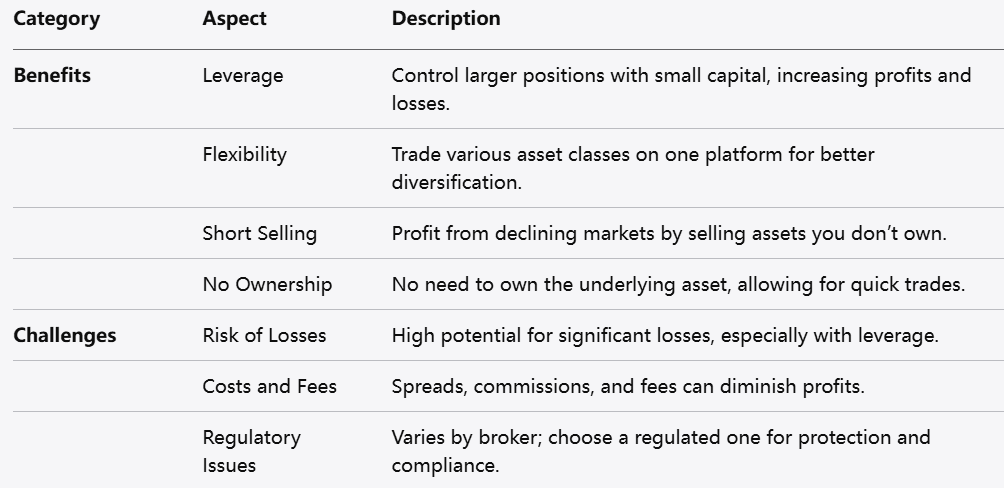

1. Leverage

One of the primary benefits of CFD trading is the ability to use leverage, which allows traders to control a larger position with a relatively small amount of capital. This means that even small price movements can lead to significant profits. However, it's essential to note that while leverage amplifies gains, it also increases the potential for losses.

2. Flexibility

CFDs provide traders with the flexibility to trade various asset classes, including equities, indices, commodities, and more, all from a single platform. This diversification can help mitigate risk and improve overall portfolio performance.

3. Short Selling

CFD trading allows for short selling, enabling traders to profit from declining markets. This means you can sell an asset you do not own, buying it back later at a lower price. This capability is particularly advantageous during market downturns.

4. No Ownership of Assets

CFDs do not require you to own the underlying asset, which simplifies the trading process. You do not need to worry about taking delivery of physical shares or commodities, making it easier to enter and exit positions quickly.

1. Risk of Losses

While the potential for profits is high, trading CFDs carries inherent risks. Price fluctuations can lead to substantial losses, especially when using leverage. Therefore, effective risk management strategies are crucial.

2. Costs and Fees

Most CFD brokers charge spreads, commissions, or overnight fees, which can eat into profits. It's important to understand the fee structure of your chosen broker to ensure that trading costs do not outweigh potential gains.

3. Regulatory Considerations

CFD trading is subject to different regulations depending on the broker's location. Ensure that you choose a regulated broker to protect your investments and maintain compliance with local laws.

1. Define Your Trading Goals

Before entering the CFD market, it's crucial to establish your trading goals. Consider your financial objectives, risk tolerance, and time commitment. Are you looking for short-term gains, long-term growth, or something in between? Your goals will influence your trading strategy and choice of broker.

2. Understand Market Conditions

Familiarize yourself with the current market conditions and trends, as they can impact your trading decisions. Analyzing economic indicators, geopolitical events, and market sentiment can provide valuable insights into potential price movements.

3. Develop a Trading Strategy

A well-defined trading strategy is essential for success. Determine your approach to technical and fundamental analysis, position sizing, and risk management. Consistency in adhering to your strategy will enhance your chances of success in the CFD market.

Selecting the right CFD broker is pivotal to your trading success. Here are several key factors to consider when evaluating potential brokers:

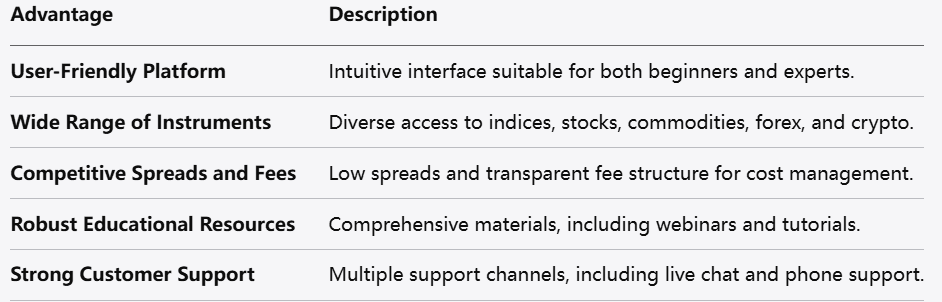

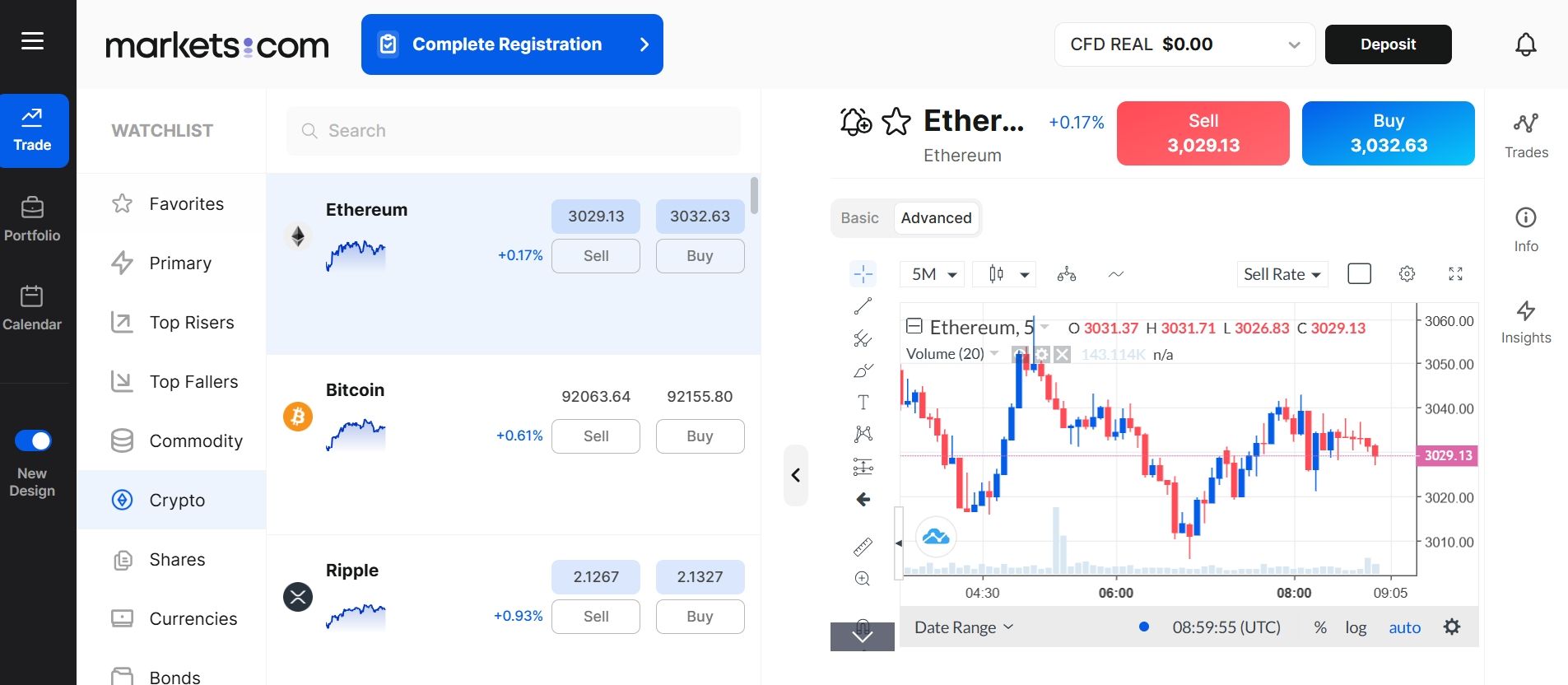

User-Friendly Platform

Markets.com provides an intuitive trading platform that is easy to navigate, catering to both beginners and experienced traders.

Wide Range of Instruments

The broker offers access to a diverse array of financial instruments, including indices, stocks, commodities, forex, and cryptocurrencies, allowing for effective portfolio diversification.

Competitive Spreads and Fees

Markets.com features low spreads and a transparent fee structure, maximizing potential profits and helping traders manage costs effectively.

Robust Educational Resources

The platform provides a wealth of educational materials, including webinars and tutorials, which help traders enhance their skills and market knowledge.

Strong Customer Support

Markets.com offers multiple support channels, including live chat and phone support, ensuring that assistance is readily available whenever needed.

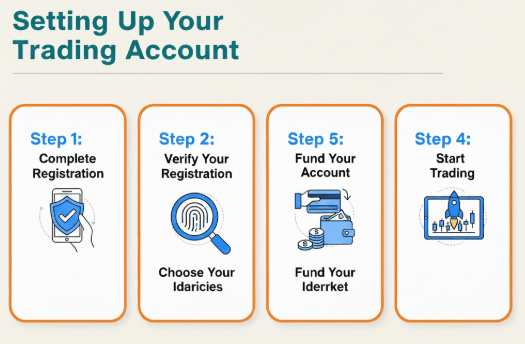

Once you have chosen a broker, the next step is to set up your trading account. Here’s how to get started:

By following these steps, you can efficiently set up your trading account with Markets.com and start your trading journey.

1. Keep a Trading Journal

Maintaining a trading journal is an excellent way to track your trades, learn from your successes and mistakes, and refine your trading strategy. Document your entries, exits, and the rationale behind each trade.

2. Analyze Your Performance

Regularly review your trading performance to identify strengths and weaknesses. Assess your winning and losing trades, paying attention to factors such as market conditions and your emotional state during trades.

3. Adjust Your Strategy

As you gain experience and insights, be open to adjusting your trading strategy. The markets are constantly evolving, and flexibility can improve your adaptability to changing conditions.

Online Communities

Engaging with online trading communities can provide valuable insights and support. Forums and social media groups often share market analysis, trading strategies, and personal experiences, helping you stay informed and connected to other traders.

Books and Courses

Consider investing time in trading education through books and online courses. Numerous resources are available that cover various aspects of trading, including technical and fundamental analysis, risk management, and trading psychology.

Market News and Analysis

Stay updated with market news and analysis from reputable financial news sources. Proactive awareness of global economic events, central bank announcements, and geopolitical developments can enhance your understanding of market movements.

Starting to invest in CFDs in 2026 presents exciting opportunities for traders willing to learn and adapt to the evolving market landscape. By understanding the fundamental aspects of CFD trading, setting clear goals, and meticulously selecting the right broker, such as Markets.com, you can position yourself for success.

Markets.com stands out for its user-friendly platform, extensive educational resources, and robust customer support, making it an excellent choice for both novice and experienced traders alike. Stay informed about market developments, continuously enhance your trading skills, and apply effective risk management strategies to minimize losses.

With the right approach and a solid understanding of the markets, you will be well-equipped to navigate the world of CFD trading and achieve your investment goals. As you prepare for this journey, remember that patience, discipline, and ongoing education are key components of becoming a successful trader.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.