Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Jan 8 2026 10:42

19 min

Candlestick Patterns Explained: Candlestick patterns are a crucial aspect of technical analysis in trading, and they provide insights into price movements and potential future trends based on historical data.

How to Read Candlestick Charts: Among the various candlestick patterns, the Morning Star has gained attention for its reliability in signaling bullish reversals. This article delves deeply into the Morning Star candlestick pattern, explaining its structure, significance, variations, and how to effectively use it in trading strategies.

Candlestick charts originated in Japan over 300 years ago and were used by rice traders to analyze market prices. The method was later adopted by traders worldwide due to its effectiveness in visually representing price movements. Each candlestick represents a specific period of trading (like a day, hour, or minute) and provides information about the opening, closing, high, and low prices.

Candlestick patterns are a fundamental tool in technical analysis, originating from Japanese rice traders in the 18th century and later popularized in the West by Steve Nison. Each candlestick represents price action over a specific timeframe, displaying the open, high, low, and close prices.

The body shows the range between open and close, while upper and lower shadows (wicks) indicate the highs and lows. Bullish candles typically have a larger body when the close is higher than the open, signaling buying pressure, whereas bearish candles show the opposite.

These patterns powerfully illustrate market sentiment and the ongoing psychological tug-of-war between buyers (bulls) and sellers (bears). They capture intrabar dynamics that simpler charts overlook, helping traders spot potential trend reversals, continuations, or periods of indecision. Mastering candlesticks improves timing, risk assessment, and overall strategy robustness across markets like stocks, forex, and cryptocurrencies.

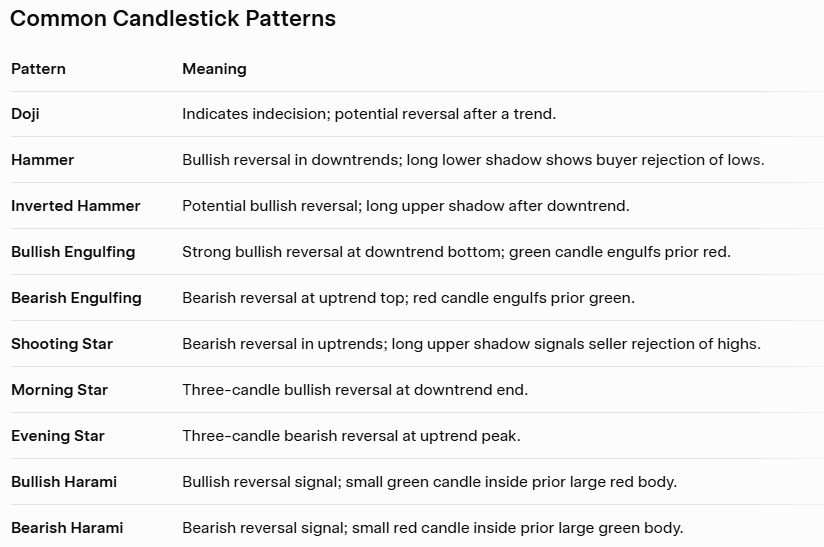

Common Patterns and Their Meanings

Doji: Open and close are virtually equal, forming a cross-like shape. Indicates indecision and equilibrium between bulls and bears; often signals potential reversal when appearing after a strong trend.

Hammer and Inverted Hammer: Hammer has a small upper body with a long lower shadow (at least twice the body length), appearing in downtrends as a bullish reversal—buyers rejected lower prices. Inverted Hammer has a long upper shadow, suggesting potential upside after sellers fail to hold lows.

Bullish and Bearish Engulfing: A two-candle pattern where the second candle's body completely engulfs the prior one's. Bullish Engulfing (green engulfing red) at downtrend bottoms signals strong buying reversal. Bearish Engulfing (red engulfing green) at uptrend tops indicates selling takeover.

Other Notable Patterns: Shooting Star (bearish reversal with long upper shadow), Morning/Evening Star (three-candle reversal setups), and Harami (smaller candle inside prior large one, showing indecision).

Limitations and Practical Considerations

Candlestick patterns are not infallible. Backtests and studies often reveal success rates around 50-65% in isolation, with many patterns performing near random without contextual filters. They excel in discretionary trading when aligned with the prevailing trend, higher volume, or key levels. Over-reliance can lead to false signals in ranging or manipulated markets.

In conclusion, candlestick patterns remain essential for decoding market psychology and refining trading decisions. They empower traders to anticipate shifts in sentiment, but true effectiveness comes from integration with other tools, strict risk management, and real-world experience. No single pattern guarantees outcomes—discipline and context are key.

Definition of the Morning Star

The Morning Star is a bullish reversal pattern that typically appears at the end of a downtrend. It consists of three distinct candlesticks:

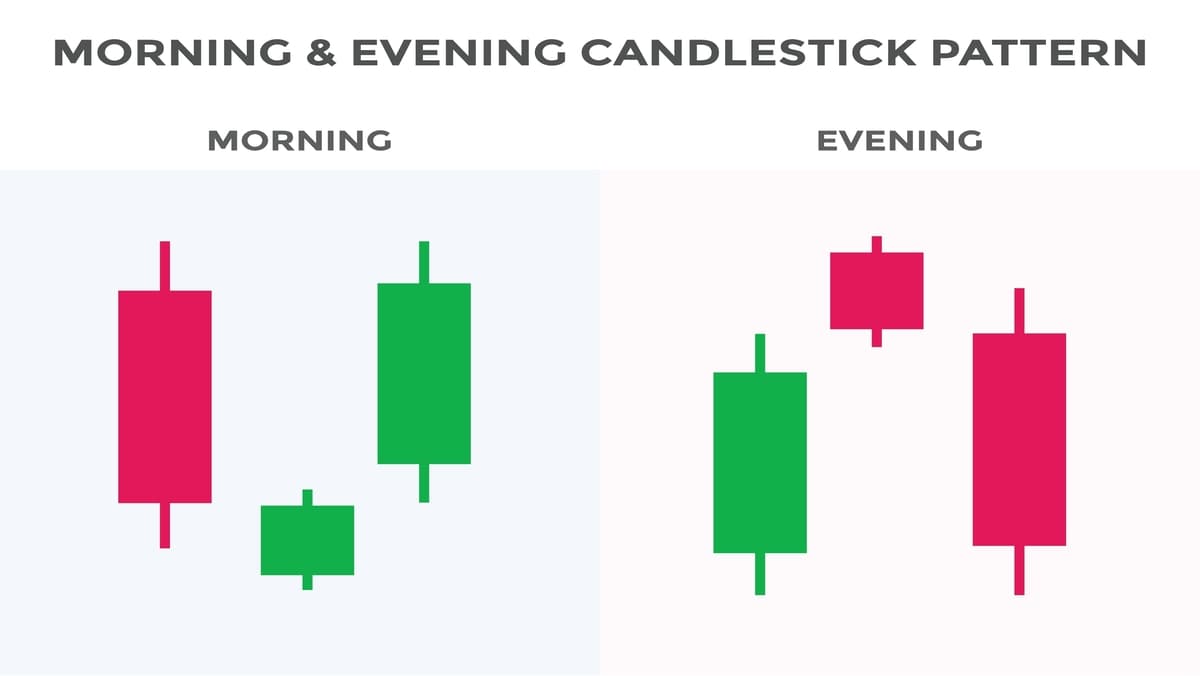

Visual Representation of the Morning Star

To fully comprehend the Morning Star pattern, having a visual reference is helpful. A typical formation looks as follows:

The Significance of the Morning Star Pattern

Market Psychology Behind the Morning Star

The Morning Star reflects a shift in market sentiment from bearish to bullish. The first candle establishes the downtrend, indicating strong selling pressure. The second candle signifies indecision, as buyers and sellers are in a standoff. Finally, the third candle shows that buyers have gained control, suggesting a reversal is taking place.

The Morning Star is a powerful three-candle bullish reversal pattern that typically appears at the end of a downtrend, signaling a potential shift from bearish to bullish control. It derives its name from resembling the "morning star" (Venus) that appears before sunrise, symbolizing the end of darkness.

The pattern consists of three distinct candles:

Key characteristics that enhance reliability include:

Identifying the Morning Star in Different Timeframes

Entry Points

Confirmation: The best entry point is after the third candle closes, indicating the potential continuation of the bullish trend. Some traders may look for additional confirmation through other indicators or patterns.

Stop Loss: Placing a stop loss below the low of the second candle can protect against unfavorable moves. It's essential to determine an appropriate level based on your risk tolerance.

Target Levels: Traders should establish realistic target levels based on previous resistance areas or measured moves. A risk-to-reward ratio of at least 1:2 is often considered ideal.

Additional Confirmation Indicators

Volume Analysis: Increased volume during the third candle can confirm strong buying interest.

Moving Averages: A bullish crossover of short-term moving averages over long-term averages can support the bullish outlook.

Momentum Indicators: Tools like the Relative Strength Index (RSI) can help gauge whether the asset is overbought or oversold, providing additional context to the trade.

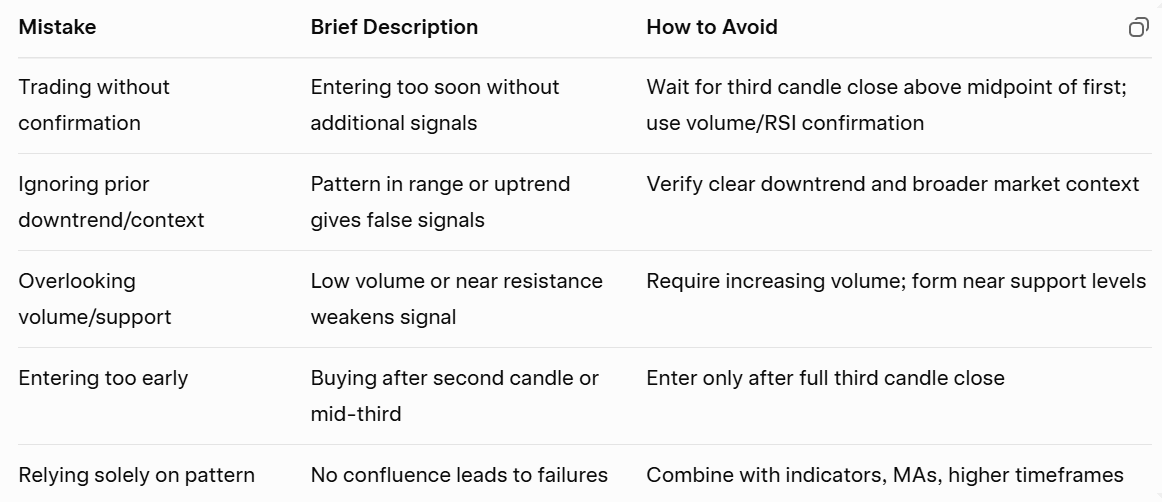

Ignoring Context

Failing to consider the broader market context can lead to poor trading decisions. The Morning Star’s reliability increases when it aligns with other technical indicators or market trends.

Overtrading

Identifying multiple Morning Star patterns may tempt traders to enter numerous trades. Overtrading can worsen risk management and lead to significant losses. It’s crucial to remain selective and disciplined.

Lack of Risk Management

Every trade carries inherent risks. Failing to use stop-loss orders or not diversifying can expose traders unnecessarily. Always implement robust risk management strategies.

Combining with Other Patterns

Using the Morning Star in conjunction with other patterns like head and shoulders, flags, or pennants can enhance overall reliability. A confluence of patterns often leads to more confirmed trade setups.

Trend Continuation

Once a Morning Star reversal is confirmed, traders can look for continuation patterns to capitalize on the broader trend. This could involve identifying flags or channels within the new bullish trend.

Adjusting Position Size

Adapting position sizes based on market volatility and the strength of the Morning Star signal is essential. A well-structured approach to position sizing can help optimize profitability while mitigating risks.

Example 1: A Stock Reversing Near Support

A classic real-world case occurred with Broadcom (AVGO, formerly BRCM) in the mid-2010s. After a sharp decline from above $180 to below $120 amid broader market pressures, a clear Morning Star pattern formed directly at a major horizontal support level around $120.

In recent years, the Nifty 50 (India's benchmark index) displayed a textbook Morning Star on the daily timeframe during a correction phase. Following a sustained downtrend, the pattern emerged near a psychological and Fibonacci support level.

The third candle showed strong buying pressure, with a close above the midpoint of the first bearish candle and elevated volume.

Example 2: A Forex Pair at a Key Support Level

A strong real-world example occurred with the EUR/USD pair on the daily timeframe. After a prolonged downtrend, the pair approached a major support level around 1.1700, which had acted as strong support multiple times in prior months.

Here, a textbook Morning Star pattern formed directly at this key level:

First: A long bearish red candle continuing the downtrend

Second: A small-bodied candle (showing indecision and gapping lower)

Third: A strong bullish green candle closing well above the midpoint of the first candle, with increased volume

This confluence of the pattern with historical support signaled exhausted selling pressure and incoming buyers.

Outcome: The pair reversed sharply, bouncing strongly higher and rallying several hundred pips in the following weeks, confirming the bullish reversal.

In forex, the Morning Star gains extra power when it appears at established support zones (horizontal, trendline, or Fibonacci). Combine with volume spikes and oversold indicators for high-probability entries, and always protect with a stop-loss below the pattern's low.

These examples (stock and forex) show the pattern's versatility across markets when proper context is present.

False Signals

Like any technical tool, the Morning Star pattern is not foolproof. False signals can occur, and traders must remain vigilant. Conditions that lead to invalid signals often include high volatility and lack of context within the broader market.

Dependence on Market Conditions

The effectiveness of the Morning Star can be influenced by broader economic events or news that create market turbulence. Traders should stay informed about economic indicators and relevant news that could impact their trades.

Emotional Decision-Making

Traders often let emotions dictate their actions based on short-term fluctuations rather than adhering strictly to technical setups. Discipline and a solid trading plan are essential for managing emotions.

Increasing volume on the third candle strengthens conviction. A downward gap between the first and second candles, and/or an upward gap before the third, adds significant weight.

Historical studies suggest properly filtered Morning Star patterns achieve success rates of 60–75%, far better than random entries. However, false signals can occur in strongly trending bear markets or during low-volume periods. Never risk more than 1–2% of trading capital per setup. Thorough backtesting on your chosen markets and timeframes is essential.

This strategy performs best on daily charts for swing trading but can be adapted to 4-hour or hourly charts for shorter-term trades. Patience and discipline are critical—always wait for the full three-candle formation and required confirmations.

The Morning Star pattern remains one of the most reliable candlestick reversal signals when traded with strict criteria and confluence from supporting factors like volume, support levels, and technical indicators. While no pattern guarantees success, incorporating proper risk management, avoiding overtrading, and focusing on high-probability setups can significantly tilt the odds in your favor over time. Consistent profitability comes from treating it as part of a complete trading plan rather than a standalone signal.

The Morning Star candlestick pattern is a powerful tool for traders seeking to identify bullish reversals. Understanding its structure, market psychology, and application can significantly enhance trading decisions. However, like any pattern, it is most effective when used in conjunction with robust risk management and a broader market analysis. By recognizing the nuances of the Morning Star and integrating it into a comprehensive trading strategy, traders can improve their chances of successful trades in various market conditions.

In summary, mastery of candlestick patterns like the Morning Star can provide traders with a competitive edge in the markets. Patience, practice, and a commitment to continual learning are essential to becoming adept at utilizing this powerful pattern. Always remember to stay adaptable, as the markets are ever-changing, and strategies must evolve accordingly.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.