Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Jan 7 2026 10:51

14 min

What Is a Full Body Candle: Candlestick charts are a popular tool among traders and investors for analyzing price movements in various markets, including stocks, forex, and cryptocurrencies.

Start investing in 2026: Among the various candlestick patterns, the full body candle holds particular significance. This article delves into what a full body candle is, how to read candlestick charts effectively, and the strategies that can be employed using this method of analysis.

Candlestick charts originated in Japan over 300 years ago and were initially used to track rice prices. Today, they have become a standard tool for technical analysis in financial markets across the globe. Unlike traditional line charts, which only plot closing prices, candlestick charts provide more information by displaying the open, high, low, and close prices within a specific time frame.

Why Use Candlestick Charts?

Visual Representation: Candlestick charts provide a visual representation of price movements, making it easier to identify trends, reversal points, and market sentiment.

Comprehensive Data: Each candle provides four key data points, allowing for a deeper understanding of price dynamics in the given timeframe.

Variety of Patterns: Traders can use a wide array of candlestick patterns to derive market signals, making them versatile tools in trading strategies.

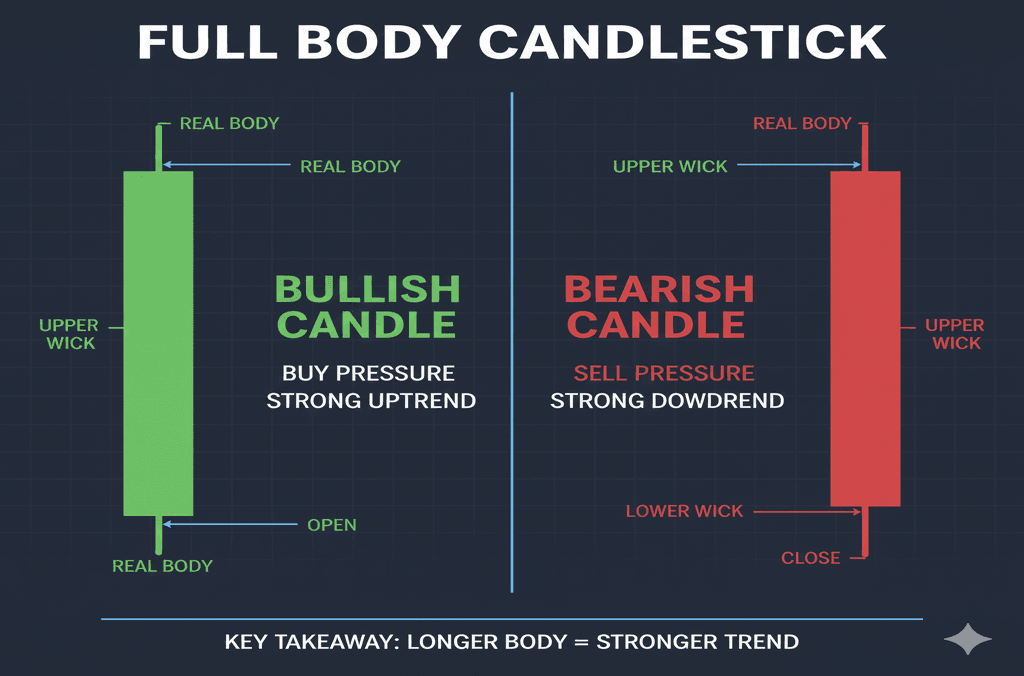

Understanding the anatomy of a candlestick is essential for effective analysis. Each candlestick consists of several components:

Visual Understanding

A candlestick is typically depicted in two colors:

Usually shown in red (or black), indicating that the closing price was lower than the opening price.

A full body candle is a candlestick with a large body and little or no wicks. This indicates strong buying or selling pressure within that time frame.

Characteristics of Full Body Candles

Market Sentiment:

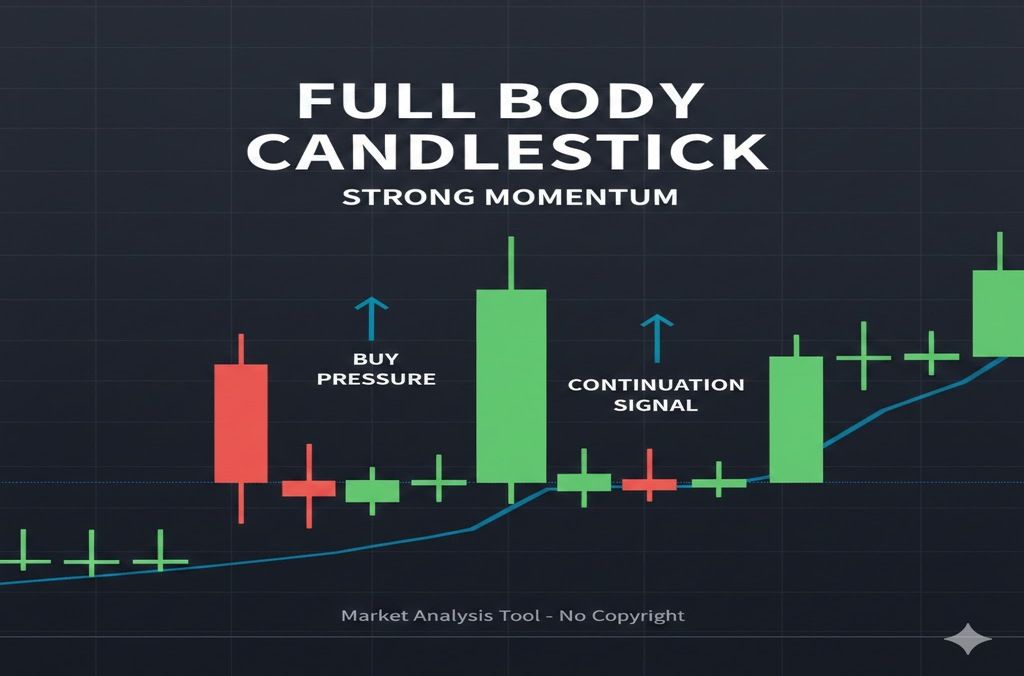

A full body candle serves as a powerful indicator of market sentiment, reflecting the prevailing emotions and actions among traders.

Trend Confirmation:

Traders often utilize full body candles for trend confirmation and anticipating potential reversals.

Understanding how to read full body candles can significantly enhance trading strategies and decision-making processes, allowing for more effective navigation of the market landscape. Traders may use full body candles to confirm ongoing trends or to anticipate reversals.

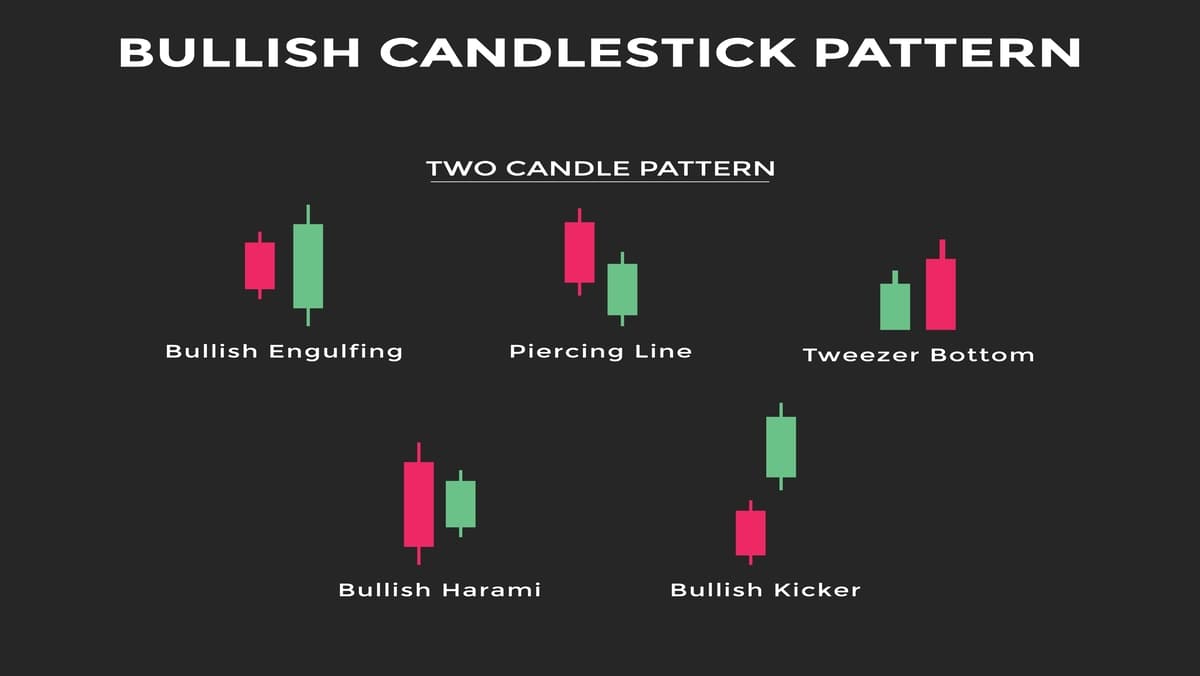

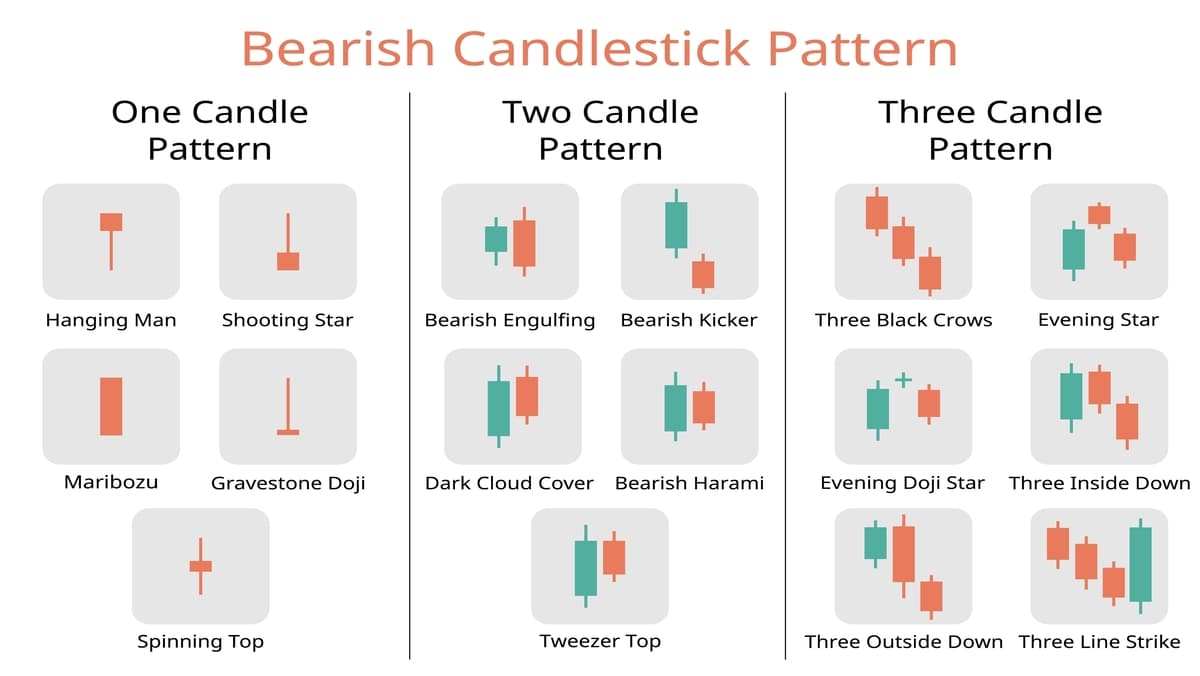

Candlestick patterns can be classified into various categories based on their implications for market movements. Below are some of the primary types:

Bullish Candlesticks

These patterns generally signal a potential upward price movement.

Full Body Bullish Candle: Indicates strong buying interest.

Hammer: A candlestick that has a small body and a long lower wick, formed after a downtrend, suggesting potential reversal.

Bearish Candlesticks

These patterns indicate a potential downward price movement.

Full Body Bearish Candle: Signals strong selling pressure.

Shooting Star: A candlestick with a small body and a long upper wick, typically formed after an uptrend, indicating potential reversal.

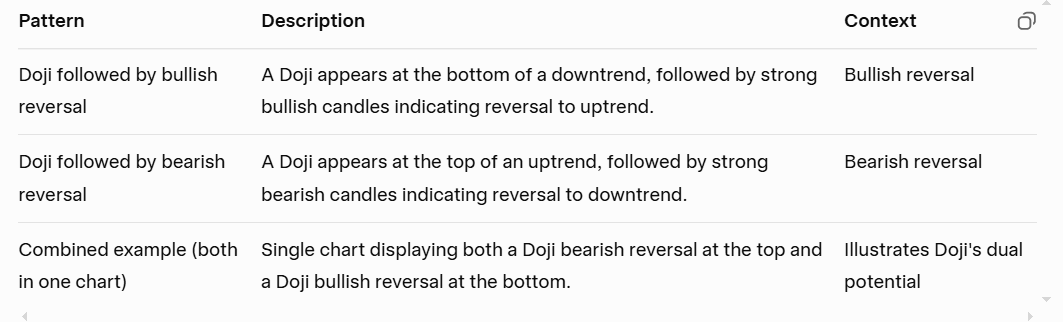

Neutral Candlesticks

These patterns indicate indecision in the market.

Doji: A candle where the opening and closing prices are virtually the same, suggesting a balance between buying and selling pressures.

Spinning Top: A candle with a small body but longer wicks, indicating indecision.

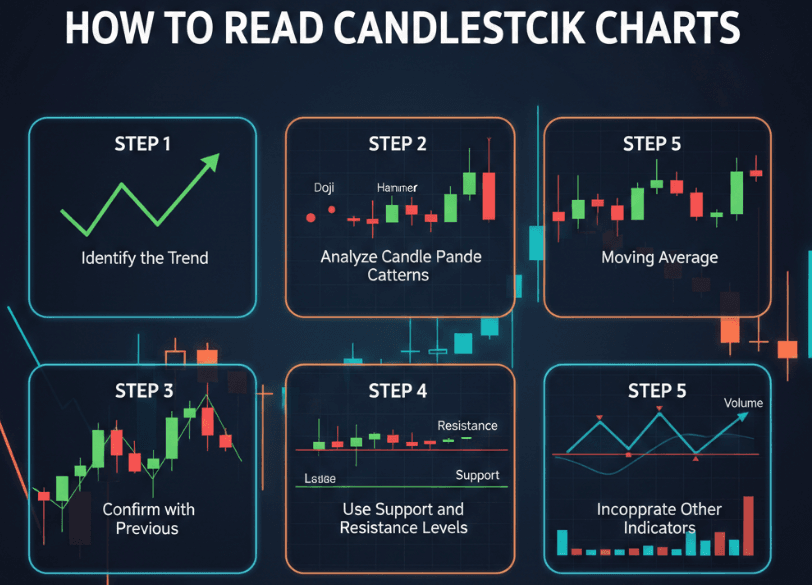

Reading candlestick charts requires an understanding of the context in which candles appear. Here are some basic steps to follow:

Step 1: Identify the Trend

Determine whether the market is in an uptrend, downtrend, or sideways. This context is crucial for interpreting individual candles.

Step 2: Analyze Candle Patterns

Look for single or multiple candlestick patterns. A single full body candle can indicate strong sentiment, while patterns such as hammers or shooting stars can offer signals for potential reversals.

Step 3: Confirm with Previous Candles

It’s essential to analyze prior candlesticks to confirm the signals given by full body candles. For instance, a full body bullish candle following several bearish candles might suggest a reversal.

Step 4: Use Support and Resistance Levels

Align candlestick readings with key support and resistance levels. This can help validate signals generated by full body candles.

Step 5: Incorporate Other Indicators

Using additional technical indicators, such as moving averages or RSI, alongside candlestick analysis can bolster your decision-making process and enhance the reliability of the signals.

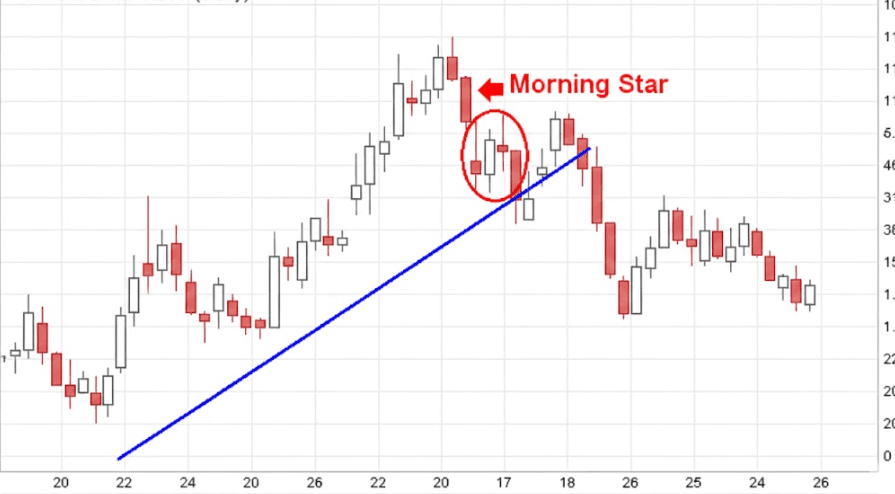

Trend Reversal Strategy

A trend reversal strategy involves identifying full body candlesticks at potential turning points in the market. Here are steps to consider:

Identify a Trend: Look for an established trend—up or down.

Spot Reversal Patterns: Look for full body candles that suggest continuation or reversal at trend extremes. For instance, a full body bearish candle in an uptrend may indicate a trend reversal.

Confirmation: Wait for confirmation signals, such as subsequent candles that align with your analysis.

Set Stop Losses: Place stop losses to limit potential losses when the market does not behave as anticipated.

Continuation Pattern Strategy

A continuation pattern strategy focuses on using full body candles to identify potential breakout points.

Identify Consolidation: Look for periods where price movements are confined to a narrow range.

Identify Breakout Candles: A full body candle breaking out of this range can indicate a continuation of the previous trend.

Volume Confirmation: Confirm the breakout with increased trading volume, indicating strong market interest.

Set Profit Targets: Determine levels where profits can be taken based on previous price action.

Volume plays a critical role in confirming the strength of candlestick patterns. Higher trading volume during the formation of a full body candle can indicate stronger sentiment and increase the likelihood of a price move continuing in the suggested direction.

How to Use Volume Effectively

Confirm Breakouts: A full body candle that breaks through resistance or support with high volume has a stronger chance of sustaining that movement.

Divergence: If candlestick patterns are forming while volume is declining, this may indicate weakening momentum and result in a failed breakout.

Even experienced traders can fall prey to common mistakes when analyzing candlestick charts. Here are some pitfalls to avoid:

Ignoring Context: Reading a full body candle without considering the broader market context may lead to incorrect interpretations.

Focusing on Single Candles: Relying too heavily on single candlesticks without considering their sequence can skew analysis.

Neglecting Volume: Ignoring volume while reading candlestick signals can result in misleading conclusions about market strength.

Overtrading: Infrequently confirming signals can lead to entering trades prematurely or against prevailing trends.

Full body candles are powerful indicators that can provide significant insights into market sentiment and price movement. By understanding how to read candlestick charts and incorporating various trading strategies, traders can harness the potential of these analytical tools. However, it is crucial to avoid common mistakes and remain aware of the broader market context.

Implementing effective practices around candlestick analysis, including a consideration of volume, will enhance trading success. Remember that no method is foolproof, and continuous learning and adaptation to changing market conditions are essential in navigating the world of trading successfully. As with any trading strategy, risk management remains paramount to sustaining long-term profitability.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.