Monday Nov 17 2025 10:25

12 min

Cheapest ways to buy bitcoin in 2026 for beginners: Bitcoin remains one of the most popular cryptocurrencies to own and trade, attracting millions of new users every year.

As we move further into 2026, buying Bitcoin has become simpler and more accessible than ever before, but it also comes with a variety of options that differ widely in fees, ease of use, and security. For beginners, minimizing costs while ensuring safety and convenience is paramount.

This article explores the cheapest ways to buy Bitcoin in 2026, focusing especially on brokers and platforms that offer low fees. We will also examine how to trade Bitcoin CFDs with some of the best brokers and what critical factors beginners should watch out for when starting their crypto journey.

When it comes to buying Bitcoin, beginners have several avenues:

1.1 Cryptocurrency Exchanges

The most common way to buy Bitcoin is through cryptocurrency exchanges. These platforms allow users to purchase Bitcoin using fiat currencies like USD, EUR, or GBP.

Centralized Exchanges (CEX): These include platforms like Binance, Coinbase, Kraken, and Bitstamp. They typically provide high liquidity and easy access to Bitcoin but charge trading fees, deposit fees, and sometimes withdrawal fees.

Decentralized Exchanges (DEX): While DEXs generally focus on token swaps rather than direct fiat-to-Bitcoin purchases, they can be cheaper for some transactions but may require more technical knowledge.

1.2 Peer-to-Peer (P2P) Platforms

P2P platforms connect buyers and sellers directly, often allowing for negotiation of fees and payment methods, sometimes resulting in lower costs. However, P2P trading requires caution to avoid scams.

1.3 Bitcoin ATMs

Bitcoin ATMs allow users to buy Bitcoin in person, often using cash. They provide convenience but tend to have higher fees than online exchanges.

1.4 Brokers Offering Bitcoin CFDs

Contracts for Difference (CFDs) allow traders to speculate on Bitcoin’s price movements without owning the underlying asset. CFD brokers typically charge spreads and commissions but can offer lower fees overall, especially when leveraged trading is involved.

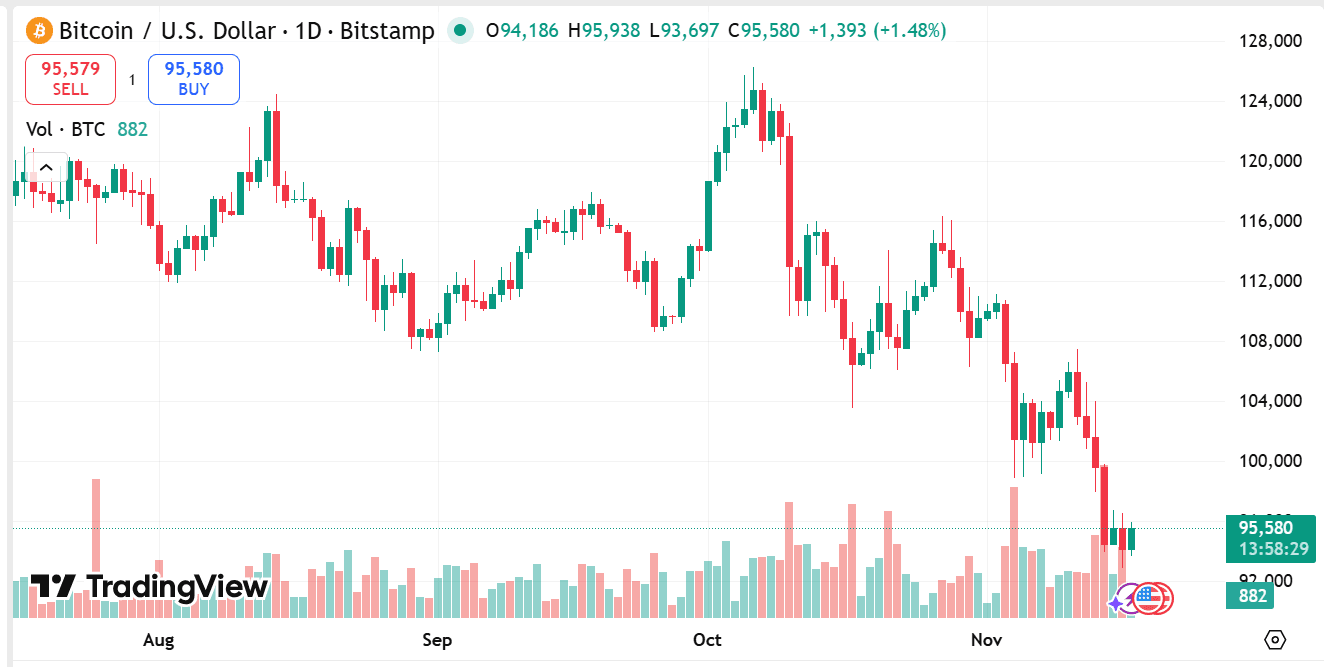

source: tradingview

For beginners looking for cost-effective ways to buy Bitcoin, choosing the right exchange can save a significant amount in fees. Here are some of the cheapest exchanges as of 2026:

2.1 Binance

Binance remains one of the most popular exchanges globally, known for very competitive trading fees starting as low as 0.1%. Binance also offers discounts for using its native token (BNB) to pay fees.

Pros: Low trading fees, high liquidity, multiple fiat onramps.

Cons: Regulatory scrutiny in some countries.

2.2 Kraken

Kraken is well-regarded for security and relatively low fees. It offers a tiered fee structure that rewards high-volume traders.

Pros: Secure, user-friendly, moderate fees.

Cons: Slightly higher fees for low-volume traders.

2.3 Coinbase Pro

The advanced platform from Coinbase offers much lower fees than its basic service, with fees as low as 0.5% per trade.

Pros: Trusted brand, easy to use.

Cons: Fees still higher than Binance or Kraken for small trades.

2.4 Bitstamp

Bitstamp has a straightforward fee model starting at 0.5% and decreasing with volume.

Pros: Reliable, easy for beginners.

Cons: Fees not the lowest, limited altcoin selection.

For those interested in trading rather than owning Bitcoin, CFD brokers can be a very cost-effective route. They allow trading Bitcoin price movements with leverage, often combined with low spreads and no commissions.

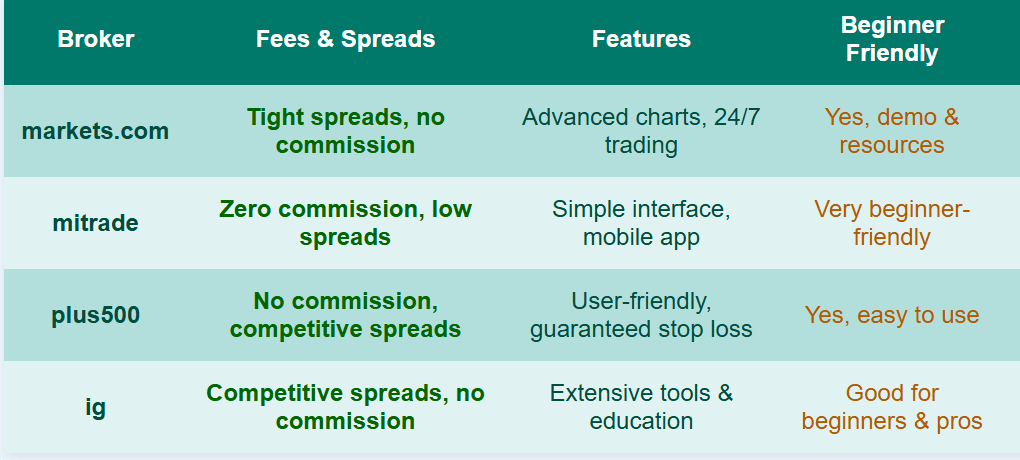

Here are some of the top brokers offering Bitcoin CFDs with competitive fees:

3.1 Markets.com

Overview: Markets.com is a well-regulated broker offering Bitcoin CFDs with tight spreads and user-friendly platforms.

Fees: Competitive spreads on BTC/USD, no commission on crypto CFDs.

Features: Advanced charting tools, risk management options, and 24/7 crypto trading.

Advantages for Beginners: Demo accounts, educational resources, easy deposits and withdrawals.

3.2 Mitrade

Overview: Mitrade offers zero commission trading and tight spreads on Bitcoin CFDs.

Fees: No deposit fees, low overnight fees for leveraged positions.

Features: Simple interface, mobile app, and risk management tools.

Advantages: Good for beginners due to intuitive design.

3.3 Plus500

Overview: Plus500 is a popular CFD broker with a straightforward fee model and tight spreads.

Fees: No commissions, spreads vary by market conditions.

Features: User-friendly platform, risk management features, and guaranteed stop losses.

Advantages: Suitable for beginners wanting to avoid complex fee structures.

3.4 IG

Overview: IG is a veteran broker with a strong reputation and wide range of crypto CFDs.

Fees: Competitive spreads, no commissions on crypto CFDs.

Features: Extensive educational content, advanced tools.

Advantages: Trusted global presence and good beginner support.

Markets.com offers a straightforward way for beginners to trade Bitcoin CFDs with minimal costs. Here’s a step-by-step overview of how to start:

4.1 Open an Account

Register on the Markets.com website.

Complete the verification process to comply with regulations.

Deposit funds using supported payment methods.

4.2 Use Demo Account

Practice trading Bitcoin CFDs in a risk-free environment.

Learn how spreads and leverage affect your trades.

4.3 Analyze the Market

Use the platform’s advanced charting tools and indicators.

Follow news and events that impact Bitcoin prices.

4.4 Place a Trade

Select Bitcoin CFD from the crypto section.

Choose your trade size and leverage level (use leverage carefully).

Set stop-loss and take-profit orders to manage risk.

4.5 Monitor and Close Trades

Track your position and adjust stop-loss or take-profit if needed.

Close the trade manually or let it close automatically upon reaching your targets.

4.6 Benefit From Low Fees

Markets.com charges tight spreads without extra commissions.

No fees on deposits or withdrawals.

Overnight fees apply only if you hold leveraged positions overnight.

While buying or trading Bitcoin cheaply is attractive, beginners must be cautious. Here are critical points to consider:

5.1 Hidden Fees and Spreads

Some platforms advertise low commissions but have wider spreads.

Always check the total cost of trading, including spreads, commissions, deposit, and withdrawal fees.

5.2 Security and Regulation

Use well-regulated and reputable platforms to avoid scams and protect your funds.

Check if the broker or exchange offers insurance or fund protection schemes.

5.3 Leverage Risks

Trading Bitcoin CFDs with leverage can magnify losses.

Beginners should start with low leverage or none at all to manage risk effectively.

5.4 Withdrawal Limits and Delays

Some platforms impose withdrawal limits or delays that can be inconvenient.

Understand the withdrawal policies before committing funds.

5.5 Market Volatility

Bitcoin is highly volatile; prices can change rapidly.

Use stop-loss orders and risk management strategies to protect your capital.

5.6 Customer Support

Responsive customer support is vital for beginners.

Choose platforms known for good customer service.

Q1: What is the smallest amount of Bitcoin I can buy?

You don't have to buy a whole Bitcoin. You can buy fractions of a Bitcoin. The smallest unit is called a Satoshi (one hundred millionth of a Bitcoin). Most exchanges allow you to buy as little as $5 or $10.

Q2: Do I need to report my Bitcoin to the government?

Yes. In most countries, including the US, buying and holding Bitcoin is generally not a taxable event. However, selling, trading, or using it to buy goods or services is typically considered a taxable event and must be reported on your taxes. Keep detailed records of all your transactions.

Q3: What is a Bitcoin ETF? Is that an easier option?

A Bitcoin Exchange-Traded Fund (ETF) is a regulated financial product that allows you to gain exposure to Bitcoin's price movements without actually holding the cryptocurrency.

Pros: Easy to buy and sell in traditional brokerage accounts, regulated by financial authorities, no need to worry about wallets/security.

Cons: You don't own the actual Bitcoin (no "not your keys"), and you may pay annual management fees. For some beginners, buying a spot Bitcoin ETF through a traditional broker might be an easier, regulated first step, but it is fundamentally different from owning the coin itself.

Q4: What is the "Bitcoin Halving," and why is it important in 2026?

The Halving is a programmed event that occurs roughly every four years, which cuts the reward miners receive for validating transactions by half.

The last Halving occurred in 2024.

It is a key event because it reduces the supply of new Bitcoin entering the market, making the asset scarcer. Historically, Halvings have preceded significant bull runs, but past performance is not a guarantee of future results.

Q5: Should I use a Decentralized Exchange (DEX)?

DEXs (like Uniswap or Bisq) allow you to trade directly from your wallet, offering more privacy and control. However, they are more technically complex and carry a higher risk of user error. For a beginner in 2026, a well-regulated Centralized Exchange (CEX) is the recommended starting point.

Buying Bitcoin cheaply in 2026 is entirely feasible with the right knowledge and platform choice. Beginners should consider low-fee exchanges like Binance and Kraken for direct Bitcoin purchases. For those interested in trading rather than owning, CFD brokers such as Markets.com, Mitrade, Plus500, and IG offer low-cost Bitcoin trading with additional benefits like leverage and risk management tools.

It’s essential to carefully evaluate fees, security, and support before starting. Practicing with demo accounts and using proper risk controls can help beginners trade Bitcoin successfully without getting overwhelmed by costs or risks.

By following these guidelines, buying or trading Bitcoin with minimal fees can be a smooth and cost-effective experience, paving the way for a successful crypto journey in 2026.

Looking to trade Bitcoin (BTC/USD) CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.