Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Jan 22 2026 09:22

19 min

Crypto day trading: Day trading cryptocurrency can be a lucrative endeavor, but it requires a solid understanding of the market, risk management strategies, and the technical aspects of trading.

Crypto day trading strategy: This article provides an extensive overview of how to day trade crypto Contracts for Difference (CFDs) using Markets.com as your trading platform.

Day trading involves buying and selling financial instruments within a single trading day. In the cryptocurrency market, this strategy aims to capitalize on short-term price movements, making it crucial for traders to adopt a proactive approach to market analysis and strategy development.

The Appeal of Day Trading

The appeal of day trading can be attributed to several factors:

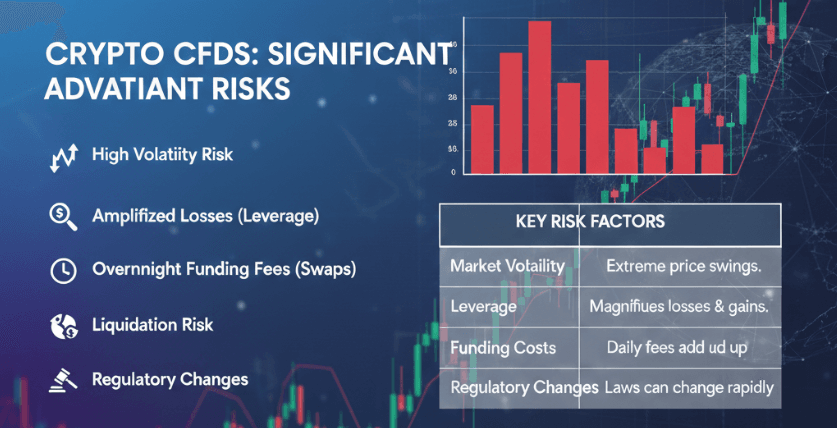

Given the volatility of cryptocurrencies, day trading can be particularly rewarding, although it also comes with significant risks. Successful day traders often rely on technical analysis and market sentiment to make informed decisions.

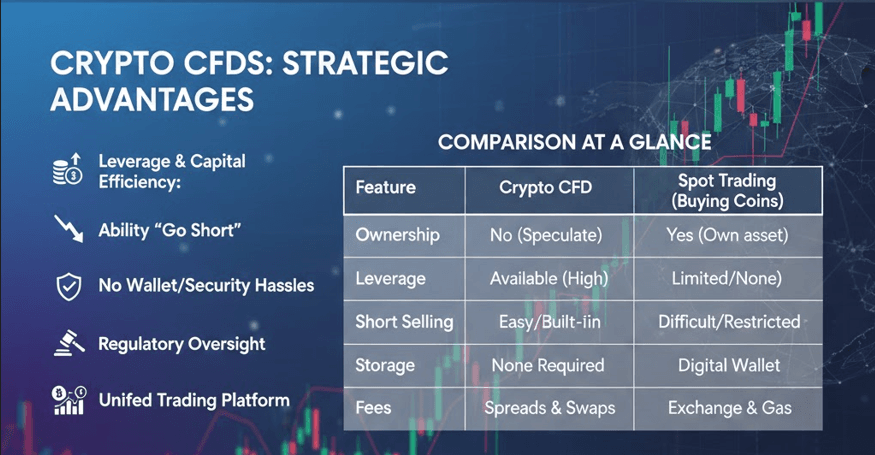

Contracts for Difference (CFDs) allow traders to speculate on the price movement of cryptocurrencies without actually owning the underlying asset. When trading crypto CFDs, you enter into a contract with a broker, such as Markets.com, agreeing to pay the difference between the opening and closing prices.

Advantages of Trading Crypto CFDs

Risks of Trading Crypto CFDs

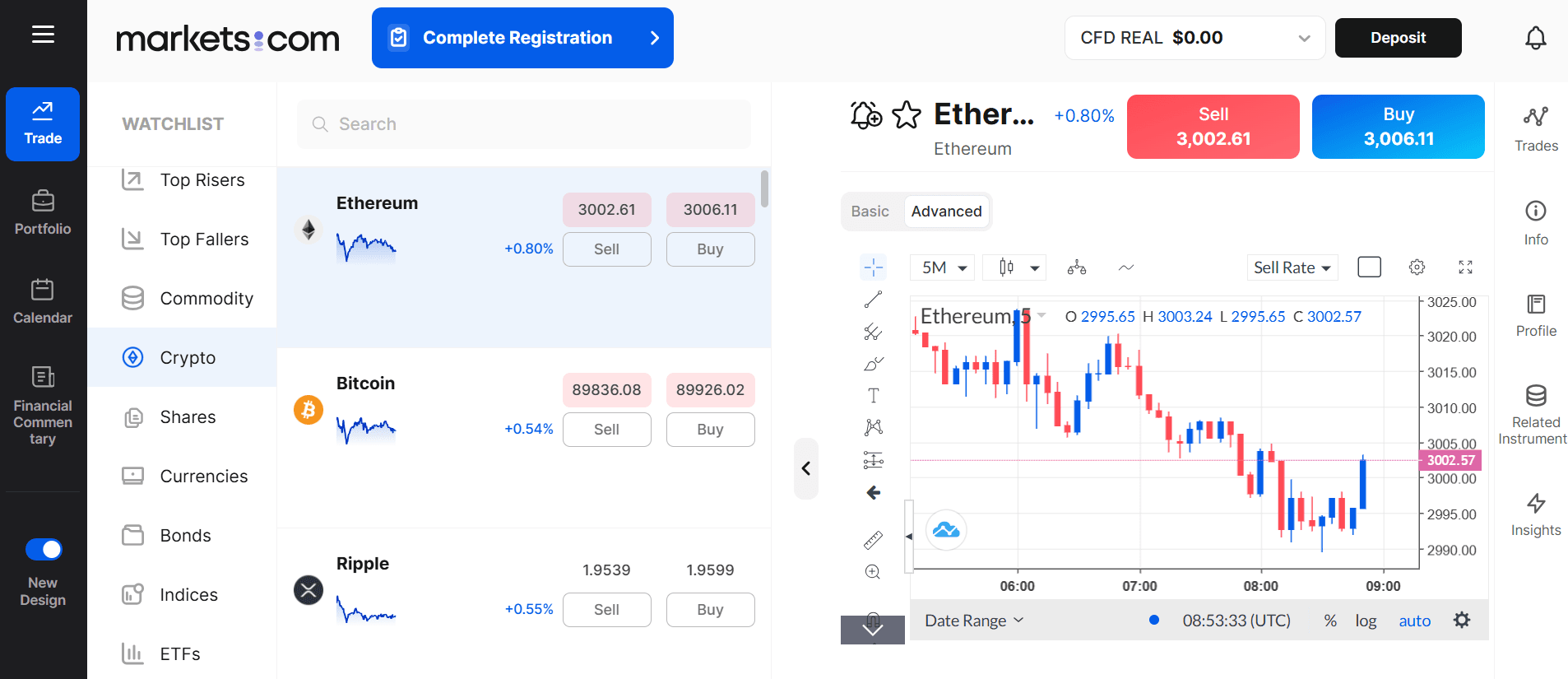

Markets.com is a popular trading platform that specializes in offering a wide range of financial instruments, including cryptocurrency CFDs. Understanding how to navigate this platform is crucial for day trading success.

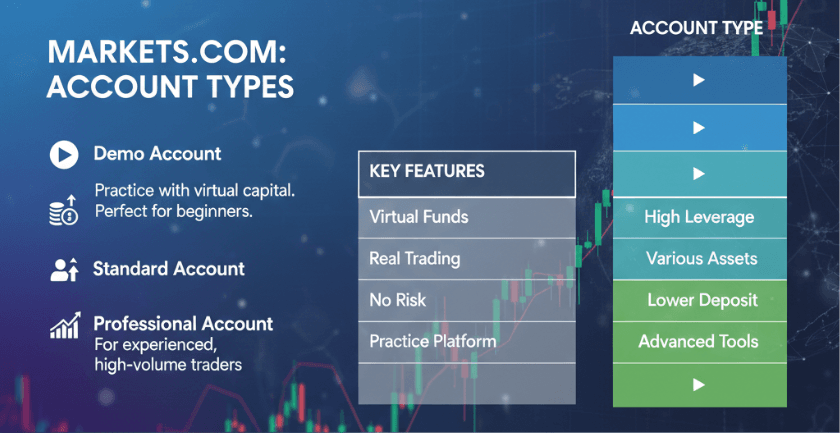

3.1 Account Types

Markets.com offers several account types tailored to different trading styles and preferences:

Demo Account: Ideal for beginners, this allows you to practice trading without risking real capital. This account mimics live trading conditions and is perfect for honing your skills and strategies.

Standard Account: Aimed at most traders, providing access to various cryptocurrencies and other financial instruments. This account typically requires a lower minimum deposit.

Professional Account: For more experienced traders, this account offers higher leverage options and increased trading limits. This account can be particularly suitable for active or high-volume traders.

3.2 User Interface and Features

The Markets.com platform comes equipped with various features to facilitate trading:

Real-Time Charts: Access to live price charts helps traders analyze market movements in real time. Customizable chart settings allow for various time frames, enabling traders to focus on specific patterns.

Research and Analysis Tools: The platform offers market insights, news articles, and analysis that can inform trading decisions. Data analytics tools help identify trends and forecast future price movements.

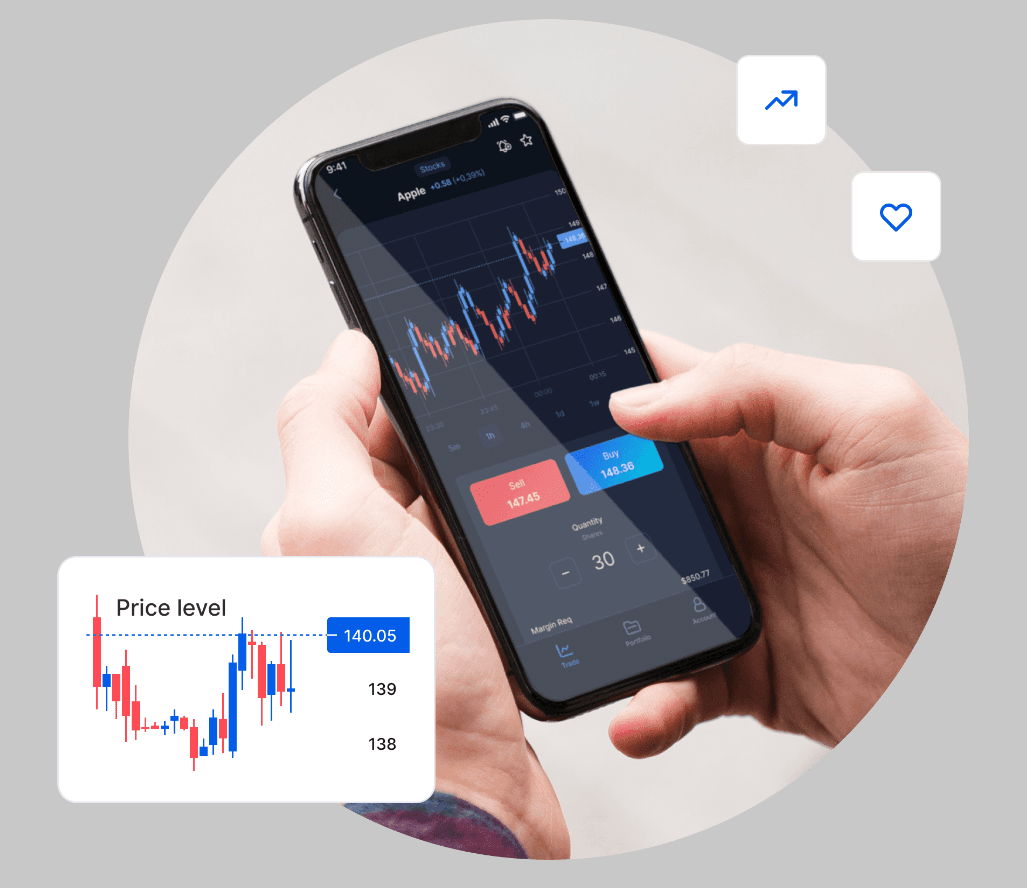

Mobile Application: For on-the-go trading, Markets.com provides a mobile app that extends platform functionalities to smartphones and tablets, ensuring traders can keep track of their positions at all times.

Additional Features

Technical Alerts: Traders can set up alerts based on specific price thresholds or technical indicators, ensuring they don’t miss critical trading opportunities.

Educational Resources: Markets.com offers tutorials, webinars, and articles covering various trading topics to help users improve their understanding of trading strategies and market dynamics.

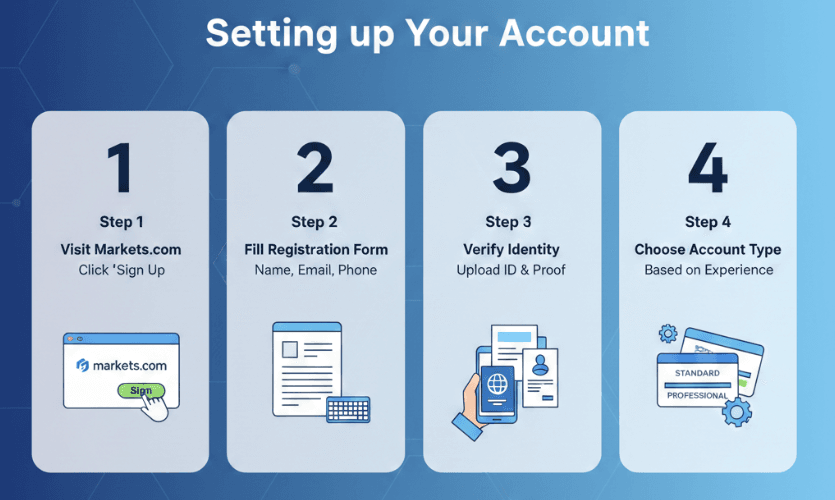

4.1 Setting up Your Account

To start day trading crypto CFDs on Markets.com, follow these steps:

Visit the Markets.com website and click on the “Sign Up” button.

Complete the registration form with your personal details, including name, email, and phone number.

Verify your identity by uploading the necessary documents, such as a government-issued ID and proof of address. This process is required to comply with regulations and ensure account security.

Choose your account type based on your trading experience and needs. Each account type offers different features and leverage options.

4.2 Funding Your Account

Once your account is set up, the next step is funding:

Select your preferred payment method: Markets.com typically accepts various methods, including credit/debit cards, bank transfers, and e-wallets. Check for any transaction fees associated with your chosen method.

Deposit funds: Follow the instructions to deposit a minimum amount required to start trading. It's wise to start with an amount you're comfortable risking as you learn.

4.3 Choosing Your Crypto Asset

Markets.com offers a selection of cryptocurrencies. Some popular options include Bitcoin, Ethereum, Litecoin, and Ripple. Conduct thorough research to choose assets that align with your trading strategy and market interests.

Researching Cryptocurrencies

Market Capitalization: Look for cryptocurrencies with a significant market cap, indicating a more stable price and consistent trading volume.

Historical Performance: Analyze past price movements to gauge potential future performance based on cyclical trends.

Community and Development Activity: Active communities and ongoing development can indicate a cryptocurrency's potential for growth.

Technical analysis is a fundamental skill for day traders. It involves analyzing price charts and patterns to forecast future price movements.

5.1 Chart Patterns

Recognizing chart patterns can provide insights into market behavior. Some common patterns include:

Head and Shoulders: This pattern can indicate a reversal in trend.

Double Tops and Bottoms: These patterns signal potential trend reversals, with double tops suggesting a bearish reversal and double bottoms indicating bullish sentiment.

Flags and Pennants: Often indicate continuation of the current trend, allowing traders to anticipate price movements in the same direction.

5.2 Indicators and Tools

Several technical indicators can assist in your analysis:

Moving Averages: Help identify trends by smoothing out price data. The crossover between a short-term and a long-term moving average can suggest potential buy or sell signals.

Relative Strength Index (RSI): Measures the speed and change of price movements, indicating overbought or oversold conditions. An RSI above 70 often indicates overbought conditions, while below 30 suggests oversold conditions.

MACD (Moving Average Convergence Divergence): Provides insights into momentum and trend strength, helping traders identify potential buy and sell signals.

Combining Indicators for Effective Strategy

Utilizing multiple indicators in conjunction can lead to more informed trading decisions. For example, combining RSI with moving averages can provide confirmation of signals before executing trades.

While technical analysis focuses on price movements, fundamental analysis considers the underlying factors affecting a cryptocurrency’s value. This broader perspective can enhance trading strategies.

Key Factors to Consider

Market News: Significant news events can dramatically impact prices. Staying updated on the latest developments in the crypto market, such as regulations, technological innovations, and partnerships, is crucial.

Regulatory Changes: Changes in legislation or regulatory policies can create volatility. Understanding the regulatory environment can help anticipate price movements.

Technological Developments: Innovations or issues in a cryptocurrency's underlying technology can influence market sentiment. Monitoring development roadmaps and community updates can provide insights into potential future movements.

The Role of Market Sentiment

Market sentiment often drives price movements in cryptocurrencies. Understanding how news and events influence trader psychology can lead to better entry and exit points. Tools like sentiment analysis can help gauge overall market mood and potential price movements.

A well-defined trading strategy is essential for success in day trading.

7.1 Day Trading Strategies

Here are a few approaches to consider:

Scalping: This strategy involves making numerous trades throughout the day to capture small price movements. Scalpers benefit from tight spreads, making Markets.com an ideal platform for this approach.

Momentum Trading: Traders buy assets that show strong price trends, riding the momentum until there are signs of a reversal. Identifying the right entry and exit points is crucial for this strategy.

Breakout Trading: Entering a position when the price breaks out of a defined resistance or support level enables traders to capitalize on rapid price movements.

The Scenario: ETH Breakout

Imagine you are monitoring Ethereum on a 15-minute chart. You notice it has been hitting a "resistance" ceiling at $3,500 three times but failing to cross it. Suddenly, the price breaks above $3,500 with a massive spike in trading volume.

(1) The Setup (Entry)

You decide to enter a "Long" position (betting the price goes up) once the breakout is confirmed.

• Starting Capital: $10,000

• Entry Price: $3,510 per ETH

• Trading Fee (0.1%): $10.00

• Net Investment: $9,990 used to buy ETH

• Amount of ETH Bought: $2.846$ ETH ($9,990 / 3,510$)

(2) The Management (Stop-Loss)3

To protect yourself, you set a Stop-Loss at $3,475 (just below the old resistance). If the price drops here, the exchange automatically sells to prevent further loss.

• Risk per ETH: $35 ($3,510 - $3,475$)

• Total Risk: $99.61 ($35 \times 2.846$ ETH) — This is roughly 1% of your total capital.

(3) The Exit (Take-Profit)

Two hours later, ETH rallies to $3,600. You notice the RSI (Relative Strength Index) is over 70, signaling it might be "overbought," so you sell.4

• Exit Price: $3,600 per ETH

• Gross Sale Proceeds: $10,245.60 ($2.846 \text{ ETH} \times 3,600$)

• Trading Fee (0.1%): $10.25

• Net Sale Proceeds: $10,235.35

Testing and Refining Your Strategy

Before implementing a new strategy in real-time trading, consider testing it within a demo account. This will allow you to refine your approach without the risk of capital loss.

7.2 Risk Management Techniques

Effective risk management is crucial to protect your capital:

Set Stop-Loss Orders: Limit potential losses by automatically selling your position if the price drops to a pre-defined level. Adjusting stop-loss levels as trades progress can secure profits.

Diversification: Spread your investments across multiple cryptocurrencies to mitigate risk. Avoid putting all your capital into one asset to minimize exposure.

Position Sizing: Determine the appropriate amount to invest in each trade based on your risk tolerance. Typically, it’s advisable to risk no more than 1-2% of your total trading capital on a single trade.

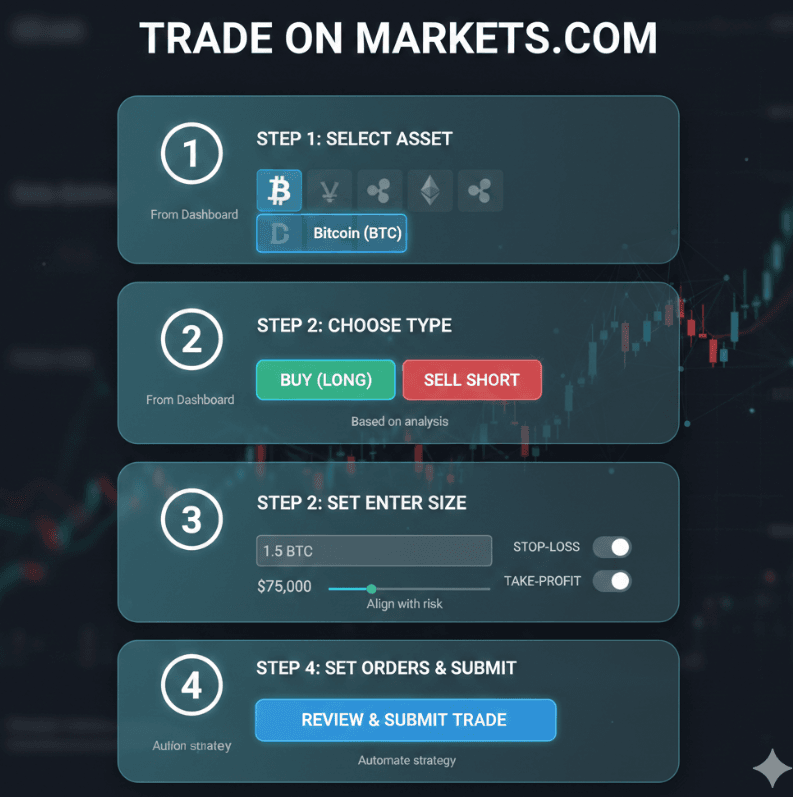

8.1 Executing a Trade

To place a trade on Markets.com:

Select the cryptocurrency you wish to trade from the dashboard.

Choose your trade type: Decide if you want to go long (buy) or short (sell), depending on your market analysis.

Enter the trade size: Specify the amount you wish to invest. Ensure it aligns with your risk management strategy.

Set stop-loss and take-profit orders if desired to automate your trading strategy.

Click “Submit” to execute the trade, ensuring to review your parameters before finalizing the order.

8.2 Monitoring Your Trades

After placing your trades, actively monitor their performance. The Markets.com platform provides tools and notifications to stay updated on price movements and market conditions.

Adjusting Your Strategy

As market conditions evolve, be prepared to adjust your strategy accordingly. This may involve shifting your stop-loss orders or exiting positions based on RSI signals or other indicators. Regularly reviewing your trades helps inform future decisions.

Day trading can be emotionally taxing, making discipline essential for success. Here are some tips:

Stick to Your Plan: Follow your trading strategy without allowing emotions to interfere. Clearly defined rules can guide your actions during volatile market conditions.

Take Breaks: Avoid burnout and emotional decision-making by taking regular breaks, especially during periods of high market volatility. Stepping back can provide clarity for future trades.

Reflect on Your Trades: Regularly review your performance to identify mistakes, patterns of behavior, and areas for improvement. This self-reflection is vital for developing as a trader.

To succeed in day trading, be mindful of common pitfalls:

Overleveraging: While leverage can enhance gains, it can also amplify losses. Use it cautiously and understand the risks involved.

Ignoring Market Conditions: Always stay aware of broader market trends and shifts that may impact your trades. Adjust strategies based on overall market sentiment.

Failing to Plan: Trading without a strategy can lead to impulsive decisions and financial losses. Invest time in planning and research before executing trades.

11.1 Algorithmic Trading

Algorithmic trading utilizes computer programs to execute trades based on pre-defined criteria. While this approach requires programming knowledge and understanding of trading systems, it can offer several advantages:

Speed: Algorithms can execute trades faster than human traders, capitalizing on opportunities in real time.

Emotionless Trading: Automated systems eliminate emotional biases, adhering strictly to your strategy without hesitation.

11.2 Arbitrage Opportunities

Arbitrage involves taking advantage of price differences across different exchanges. By buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another, traders can secure risk-free profits. Successful arbitrage trading requires:

Quick Execution: Speed is crucial, as price discrepancies can close rapidly.

Monitoring Multiple Exchanges: Keeping track of various exchanges and their pricing can help identify potential arbitrage opportunities.

Successful day trading requires constant engagement with market news and analysis. Here are some useful resources:

Cryptocurrency News Websites

CoinDesk: Offers news, analysis, and educational resources on cryptocurrencies and blockchain technology.

CoinTelegraph: Provides timely updates and market insights, along with in-depth articles about the crypto space.

Social Media and Forums

Twitter: Following key figures in the crypto community can provide real-time insights and trends.

Reddit: Subreddits like r/CryptoCurrency offer discussions, latest news, and trader experiences, providing valuable peer feedback.

Continuing Education

Consider investing in trading courses or webinars that focus on advanced strategies, risk management, and market analysis. Continuous learning can enhance your trading skills and adaptability.

Day trading crypto CFDs with Markets.com can be an exciting and profitable venture if approached with the right strategies and mindset. Understanding both the technical and fundamental aspects of the market, developing a solid trading plan, and remaining disciplined are crucial components of success.

As you embark on your trading journey, continuous learning and adaptation will help you navigate this dynamic landscape effectively. By investing time and effort into understanding the nuances of trading, you can enhance your chances of achieving your financial goals in the ever-evolving world of cryptocurrency.

With persistence and dedication, day trading can offer a fulfilling and profitable experience, allowing you to take part in the thrilling world of cryptocurrencies while managing your financial risks responsibly.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.