Monday Nov 17 2025 09:04

17 min

Day Trading for Beginners: Cryptocurrency markets have captured the attention of both novice and experienced traders worldwide.

Crypto day trading strategy: Among the various trading styles, day trading is one of the most popular approaches due to its potential for quick profits and the dynamic nature of cryptocurrencies. This comprehensive guide will walk you through everything you need to know about day trading cryptocurrencies, specifically focusing on Contracts for Difference (CFDs), a popular financial instrument that allows traders to speculate on price movements without owning the underlying assets.

Crypto day trading refers to the practice of buying and selling cryptocurrencies within the same trading day. The goal is to capitalize on short-term price fluctuations rather than holding assets for the long term. Day traders typically open and close multiple positions during a single day, seeking to profit from small price movements.

Why Day Trade Cryptos and Bitcoin?

High Volatility: Cryptocurrencies like Bitcoin, Ethereum, and others are known for their price volatility. This volatility creates numerous opportunities for profit within short time frames.

24/7 Markets: Unlike traditional stock exchanges, crypto markets operate 24 hours a day, 7 days a week. This allows traders to engage at any time that suits them.

Leverage Opportunities Through CFDs: Crypto CFDs enable traders to use leverage, meaning they can control larger positions with a smaller amount of capital, amplifying potential gains (and risks).

Liquidity: Major cryptocurrencies usually have high liquidity, meaning traders can enter and exit positions easily.

Accessibility: With many platforms offering crypto CFD trading, it’s easier than ever for beginners to start day trading.

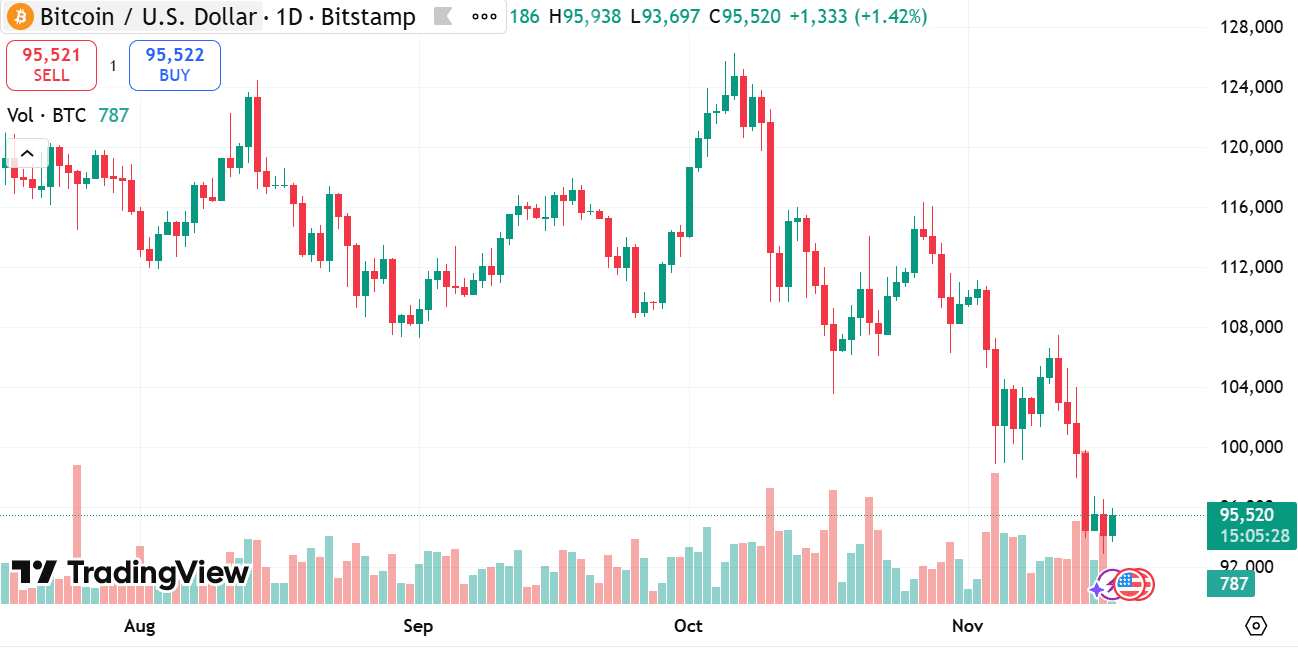

source: tradingview

Successful day trading requires more than just luck. It demands preparation, discipline, and a sound strategy. Let’s explore the key steps involved in becoming a crypto day trader.

2.1 First, You Need a Trading Plan

A trading plan is your roadmap. It helps you stay focused and make objective decisions rather than impulsive ones driven by emotions.

Key components of a trading plan include:

2.2 Understand How to Read Charts

Chart reading is fundamental to day trading. Most day traders rely heavily on technical analysis, which involves studying price charts to predict future market movements.

Basic chart types:

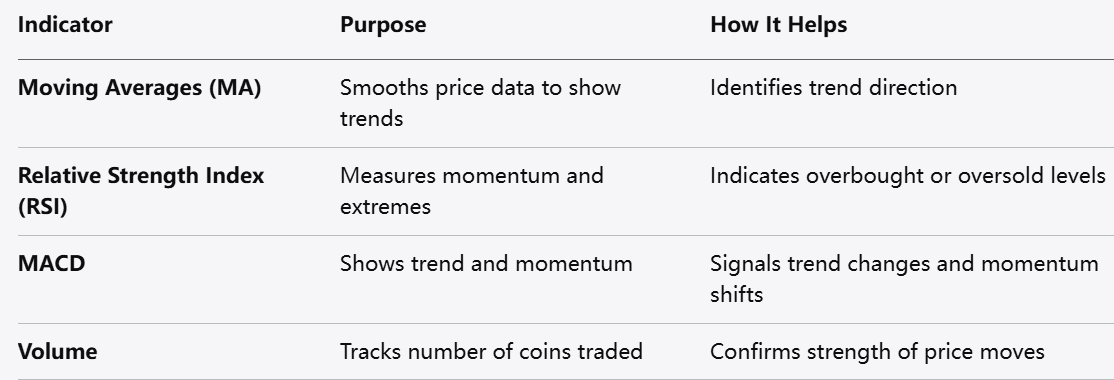

Popular technical indicators for crypto day trading:

Moving Averages (MA): Smooth price data to identify trends.

Relative Strength Index (RSI): Measures momentum and identifies overbought/oversold conditions.

MACD (Moving Average Convergence Divergence): Shows trend direction and momentum.

Volume: Indicates the number of coins traded; high volume often confirms trends.

Understanding chart patterns such as support and resistance levels, trend lines, and common patterns like flags, triangles, and head and shoulders is also crucial.

2.3 Create an Account and Get Familiar with the Platforms

To start day trading crypto CFDs, you’ll need to open an account on a reliable trading platform that offers CFD trading on cryptocurrencies. Some popular platforms include Markets.com, eToro, and Plus500.

Steps to get started:

Registration: Provide your personal details and complete the know-your-customer (KYC) process.

Demo Account: Use a demo account to practice trading without risking real money.

Explore the Interface: Familiarize yourself with the trading dashboard, charting tools, order types, and risk management features.

Fund Your Account: Once you’re comfortable, deposit funds to start live trading.

2.4 Explore Cryptocurrencies for Day Trading

While Bitcoin is the most well-known cryptocurrency, many others offer exciting day trading opportunities. Popular choices include:

Diversifying across multiple cryptocurrencies can reduce risk and increase opportunities, but it’s important not to overextend and to understand each asset’s behavior.

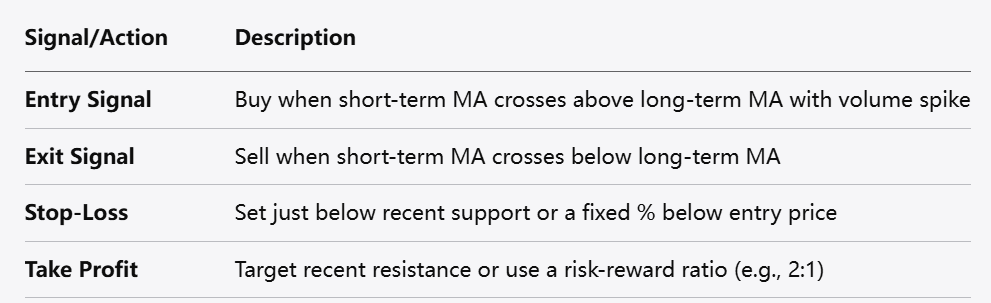

For beginners, a straightforward approach can be the best foundation. Here is a simple day trading strategy based on moving averages and volume:

Setup:

Use a 5-minute or 15-minute candlestick chart.

Apply two moving averages: a short-term (e.g., 9-period) and a longer-term (e.g., 21-period).

Watch volume spikes for confirmation.

How it works:

Entry Signal: Buy when the short-term moving average crosses above the longer-term moving average, especially if accompanied by increased volume.

Exit Signal: Sell when the short-term moving average crosses back below the longer-term moving average.

Stop-Loss: Place a stop-loss just below a recent support level or a fixed percentage below your entry price.

Take Profit: Set a target based on recent resistance levels or a risk-reward ratio (e.g., 2:1).

This strategy helps you trade with the trend and uses volume to confirm strength, reducing false signals.

Day trading can be exciting and potentially profitable, but it’s not without challenges:

Emotional Discipline: The fast pace can lead to stress and impulsive decisions.

Risk of Loss: High volatility means large losses can occur quickly.

Time Commitment: Successful day trading often requires constant market monitoring.

Costs: Frequent trading leads to higher fees and spreads, impacting profitability.

It’s essential to approach day trading as a skill that requires learning, patience, and ongoing practice. Avoid chasing hype or unrealistic profits and always manage your risk.

Treating your trading like a business can elevate your chances of success. Platforms like Markets.com provide tools and support to help you operate professionally:

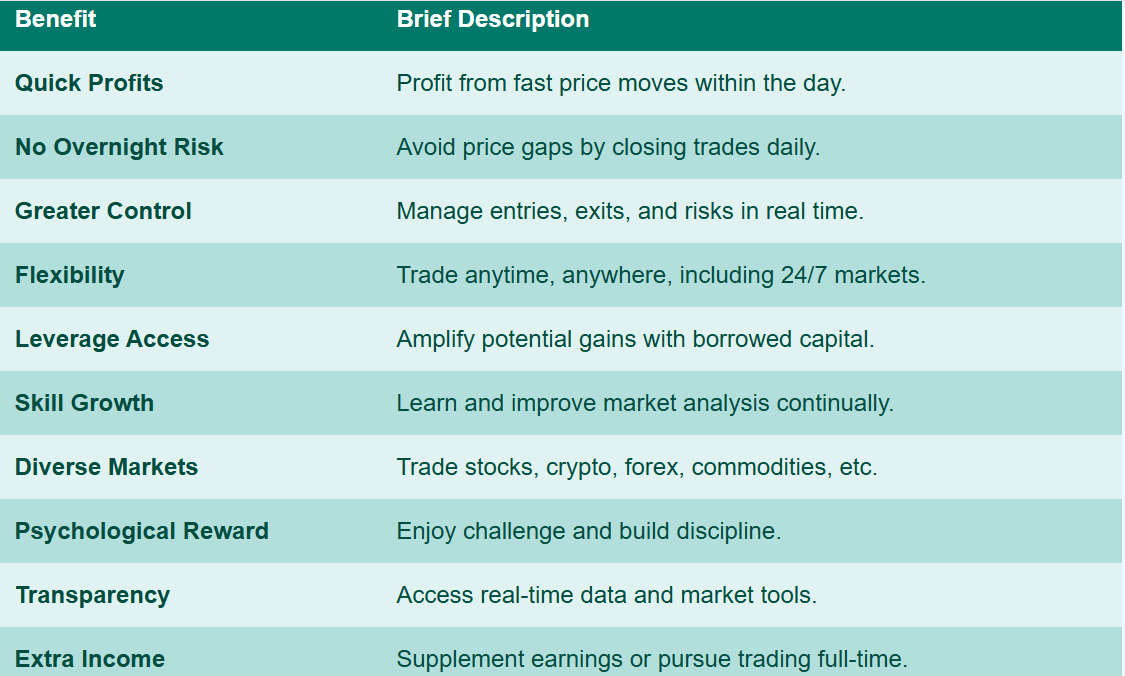

Day trading has become an increasingly popular approach to financial markets, especially with the rise of cryptocurrencies and online trading platforms. Unlike long-term investing, day trading involves buying and selling financial instruments within the same trading day, aiming to profit from short-term price movements. While it is often viewed as a challenging and high-risk activity, day trading offers several key benefits that attract many traders around the world. This article explores the main advantages of day trading and why it may be a suitable strategy for certain market participants.

(1) Potential for Quick Profits

One of the primary benefits of day trading is the opportunity to make profits quickly. Because day traders open and close positions within a single day, they can capitalize on short-term price fluctuations that occur in volatile markets. This rapid turnover means that profits can accumulate more frequently compared to long-term investing, where gains depend on larger, slower market trends.

The ability to react swiftly to market news, technical signals, or sudden price movements allows day traders to seize multiple trading opportunities throughout the day. For those who develop effective strategies and maintain discipline, this can translate into consistent income streams.

(2) No Overnight Risk Exposure

Day trading avoids the risk associated with holding positions overnight. Markets can react unpredictably to after-hours news, geopolitical events, or economic data releases, which may cause gaps in price when the market reopens. Such gaps can result in significant losses if a trader is caught on the wrong side of the position.

By closing all trades before the market closes, day traders eliminate overnight exposure and reduce the risk of unexpected price swings affecting their portfolios. This control over exposure is particularly beneficial in highly volatile markets, such as cryptocurrencies or certain stocks, where prices can swing dramatically outside regular trading hours.

(3) Greater Control Over Trades

Day traders have direct control over every trade they make. Unlike investors who buy and hold assets for months or years, day traders make deliberate decisions on entry and exit points based on real-time data. This hands-on approach allows traders to adapt quickly to changing market conditions and adjust their strategies immediately.

This high level of control also means that day traders can implement strict risk management rules, such as setting stop-loss orders and take-profit levels, to protect their capital. With careful planning, traders can limit losses and lock in profits more effectively than in longer-term investing.

(4) Flexibility and Independence

Day trading offers flexibility in terms of working hours and location. Since many financial markets operate electronically, traders can work from anywhere with an internet connection. This independence appeals to people who want to escape traditional office environments or pursue trading as a side activity alongside other commitments.

Additionally, markets such as cryptocurrencies operate 24/7, allowing traders to choose times that best fit their schedules. This flexibility enables individuals to customize their trading routines according to their personal preferences and lifestyle.

(5) Access to Leverage

Many day trading platforms offer leverage, which allows traders to control larger positions with a smaller amount of capital. Leverage can amplify profits by increasing the exposure a trader has to price movements. For example, with leverage, a relatively small price change can result in a significant gain relative to the trader’s invested capital.

While leverage increases potential profits, it also magnifies losses, so it must be used cautiously. Nevertheless, access to leverage is a powerful tool that can enhance the effectiveness of day trading strategies when combined with sound risk management.

(6) Continuous Learning and Skill Development

Day trading is not just about luck; it requires knowledge, skill, and discipline. Traders constantly analyze price charts, news, and economic indicators, which helps them develop a deep understanding of market behavior. This ongoing learning process can be intellectually stimulating and rewarding.

Over time, traders improve their ability to read technical indicators, recognize patterns, and refine their strategies. The skills gained through day trading are transferable and can be applied to other areas of financial markets or investment approaches.

(7) Opportunities in Various Markets

Day trading is not limited to stocks or cryptocurrencies. It can be applied across a wide range of financial instruments including forex, commodities, indices, and bonds. This diversity allows traders to explore different markets and find the ones that best suit their trading style and risk tolerance.

For example, forex markets are known for their high liquidity and volatility during certain times, while commodities can be influenced by geopolitical events and supply-demand dynamics. Having multiple markets to choose from increases the number of trading opportunities available.

(8) Psychological Benefits

For many, day trading offers psychological satisfaction through the challenge and excitement of the markets. Making quick decisions, solving problems, and competing against the market can be engaging and motivating. The immediate feedback from trades—whether wins or losses—can help traders develop resilience and emotional discipline.

Moreover, day trading can foster a sense of independence and accomplishment as traders learn to rely on their own analysis and judgment. This empowerment can be fulfilling for individuals who enjoy taking responsibility for their financial outcomes.

(9) Transparency and Access to Information

Modern day trading benefits from the transparency and accessibility of market data. Real-time price feeds, news updates, and analytical tools are widely available to retail traders. This democratization of information levels the playing field, allowing individual traders to compete more effectively with institutional participants.

Access to advanced charting software, economic calendars, and social sentiment analysis helps traders make more informed decisions. This wealth of information supports technical and fundamental analysis, improving the quality of trade entries and exits.

(10) Possibility of Supplementing Income or Full-Time Career

Day trading can serve as a supplementary source of income or even a full-time career for those who master it. Many traders start part-time, learning the ropes while maintaining other jobs, and gradually increase their commitment as their skills and confidence grow.

While day trading is not guaranteed to be profitable, disciplined traders who develop robust strategies can achieve consistent earnings. For some, it offers the freedom to replace traditional employment and pursue financial independence.

Q: What is the difference between trading crypto CFDs and buying cryptocurrencies?

A: Trading CFDs means you speculate on price movements without owning the actual cryptocurrency. This allows for leverage and short-selling but means you don’t own the underlying asset.

Q: How much capital do I need to start day trading crypto?

A: The amount varies by platform and personal risk tolerance. Many brokers allow opening positions with small amounts, but it’s advisable to start with money you can afford to lose.

Q: Can I day trade crypto on weekends?

A: Yes. Cryptocurrency markets operate 24/7, including weekends and holidays, making it possible to trade anytime.

Q: Is day trading crypto profitable?

A: It can be, but it requires skill, discipline, and a solid strategy. Many traders also experience losses, especially early on.

Q: What are the risks of day trading crypto CFDs?

A: Risks include market volatility, leverage magnifying losses, liquidity issues in smaller coins, and emotional decision-making.

Q: How can I minimize risks in day trading?

A: Use strict risk management rules, including stop losses, limit your leverage, trade only liquid assets, and continually educate yourself.

In summary, crypto day trading via CFDs offers a dynamic opportunity to profit from the fast-moving cryptocurrency markets. By developing a solid trading plan, learning to read charts, practicing on demo accounts, and using simple yet effective strategies, beginners can build a foundation for successful trading. Most importantly, treat your trading like a business—manage risks carefully and continuously improve your skills. With patience and discipline, day trading cryptocurrencies can become a rewarding endeavor.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.