Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Tuesday Dec 23 2025 09:16

20 min

Gold trading basics: Gold has long been considered a valuable asset, both as a store of wealth and as a hedge against economic uncertainties.

Gold Investing Guide: Whether you are a beginner looking to enter the world of gold trading or an experienced trader seeking to diversify your portfolio, understanding the fundamentals of gold trading and investment is essential. This comprehensive guide will walk you through where to buy gold, the different methods of trading or investing in gold, and why gold CFD trading can be an effective approach. Additionally, we will highlight markets.com as a reputable broker for gold CFD trading.

Gold has been treasured for thousands of years due to its rarity, durability, and intrinsic value. Today, it remains a popular asset for various reasons:

Hedge Against Inflation: Gold tends to retain its value during inflationary periods, helping protect purchasing power.

Safe-Haven Asset: In times of economic uncertainty or geopolitical tensions, gold often attracts investors seeking stability.

Portfolio Diversification: Adding gold to an investment portfolio can reduce overall risk due to its low correlation with stocks and bonds.

Liquidity: Gold is highly liquid, easily bought or sold in global markets.

Speculation and Trading Opportunities: Its price volatility offers opportunities for traders to profit from short-term price movements.

Understanding these reasons helps clarify why gold remains an important asset in personal finance and trading strategies.

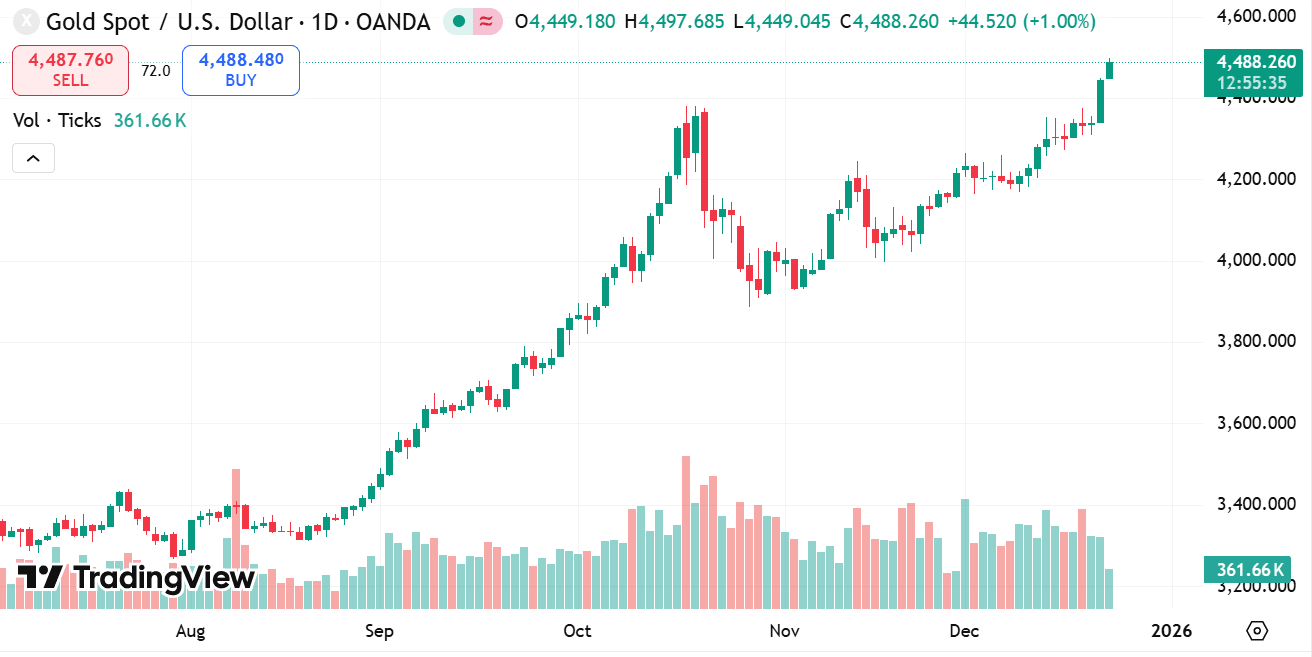

source: tradingview

There are multiple methods to invest or trade gold, each with unique features, risks, and advantages. These include:

Buying Physical Gold: Bars, Coins, and Jewelry

Physical gold is the most traditional form of gold investment. It involves purchasing tangible gold in the form of bars, coins, or jewelry. Gold bars are typically sold by weight and purity, offering a straightforward way to accumulate gold bullion. Coins such as the American Gold Eagle, Canadian Maple Leaf, or South African Krugerrand are popular among collectors and investors alike, combining value with often collectible appeal.

Jewelry, while often attractive and wearable, usually carries additional costs beyond the gold content, including craftsmanship and design premiums. Owning physical gold can provide a sense of security and direct ownership, but it also requires considerations such as safe storage, insurance, and liquidity when it comes time to sell.

Gold Exchange-Traded Funds (ETFs) and Mutual Funds: Indirect Gold Investment

For investors who want exposure to gold without handling physical bullion, gold ETFs and mutual funds provide a practical alternative. Gold ETFs track the price of gold by holding physical gold or gold-related assets, and their shares are traded on stock exchanges just like regular stocks. This allows investors to buy and sell gold exposure conveniently, with the added benefit of easy portfolio diversification.

Mutual funds focused on gold typically invest in a mix of physical gold and gold mining companies. Both ETFs and mutual funds offer lower entry costs and avoid the complications of storage and security associated with physical gold. However, investors do not own the physical metal directly, and management fees apply.

Gold Futures and Options: Derivative Contracts Based on Gold Prices

Gold futures and options are standardized contracts traded on commodity exchanges that allow investors to speculate on the future price of gold. A gold futures contract obligates the buyer to purchase gold (or the seller to deliver gold) at a predetermined price on a specific future date.

Options on gold futures provide the right, but not the obligation, to buy or sell gold at a set price within a certain timeframe. These derivatives are often used by hedgers and speculators alike to manage risk or profit from price movements.

While futures and options provide leverage and the potential for substantial returns, they are complex instruments that involve significant risk and require a solid understanding of the market and contract mechanics. They are generally better suited for experienced traders.

Gold Stocks: Shares in Gold Mining Companies

Another way to gain exposure to gold is by investing in the stocks of gold mining companies. These companies operate mines, explore for new deposits, and extract gold from the earth. The value of gold stocks is influenced not only by the price of gold but also by company-specific factors such as operational costs, management efficiency, and geopolitical risks related to mining locations.

Gold stocks can offer dividends and the potential for capital appreciation, sometimes amplifying gains when gold prices rise and suffering more during downturns. Investing in gold stocks carries additional risks compared to physical gold, as company performance plays a significant role alongside commodity prices.

Gold Contracts for Difference (CFDs): Speculating Without Owning Physical Gold

Gold CFDs are financial derivatives that allow traders to speculate on gold price movements without owning the physical asset. When trading gold CFDs, you enter a contract with a broker to exchange the difference in gold’s price between the opening and closing of a trade.

CFDs offer the advantage of leverage, enabling traders to control larger positions with less capital. They also allow easy access to both rising and falling markets through long and short positions. The trading process is simple, with no need to worry about storage or delivery.

However, CFDs carry risks, especially due to leverage, which can magnify losses as well as gains. They are typically suited for those with active trading strategies and a good understanding of market dynamics.

Selecting the best way to invest or trade gold depends on your individual goals, risk appetite, and experience. Physical gold appeals to those seeking tangible assets and long-term stability. ETFs and mutual funds offer convenience and liquidity for investors looking for easier access and diversification. Futures, options, and CFDs are geared toward traders comfortable with higher risk and complexity, aiming to capitalize on short-term price movements.

Gold stocks provide exposure to the mining sector and can complement broader equity portfolios but come with company-specific risks. Ultimately, the choice should align with your financial objectives, investment horizon, and how actively you wish to manage your gold exposure.

Buying Physical Gold

Purchasing physical gold means acquiring tangible assets such as gold bars, coins, or jewelry. This traditional form of gold investment appeals to those who want direct ownership.

Gold Bars: Available in various weights, bars offer a cost-effective way to own significant amounts of gold.

Gold Coins: Popular coins include the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand.

Jewelry: While beautiful and wearable, jewelry often carries premiums and manufacturing costs above gold’s spot price.

Where to Buy Physical Gold

You can purchase physical gold from:

Authorized Dealers: Reputable gold dealers and bullion shops.

Banks: Some financial institutions offer gold coins and bars.

Online Dealers: Trusted online platforms selling physical gold with delivery services.

Auctions and Private Sellers: Less common, but an option for unique or collectible items.

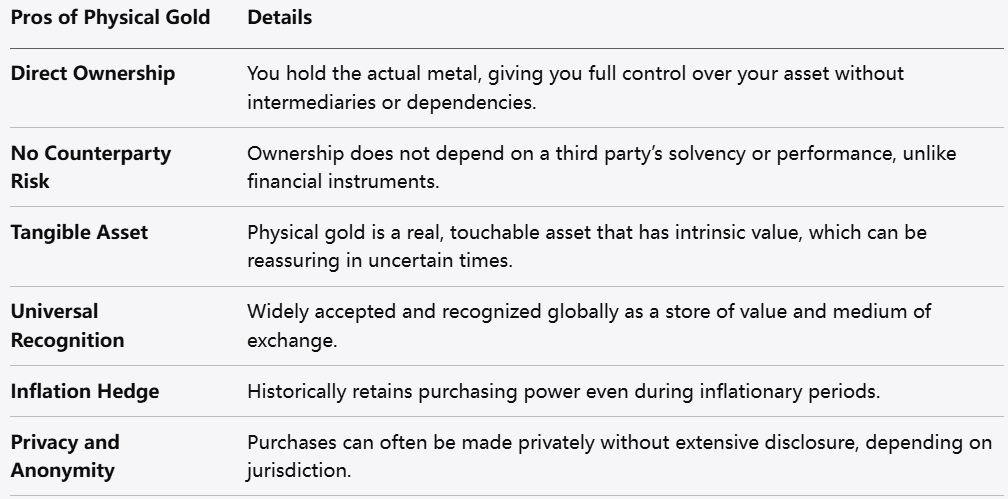

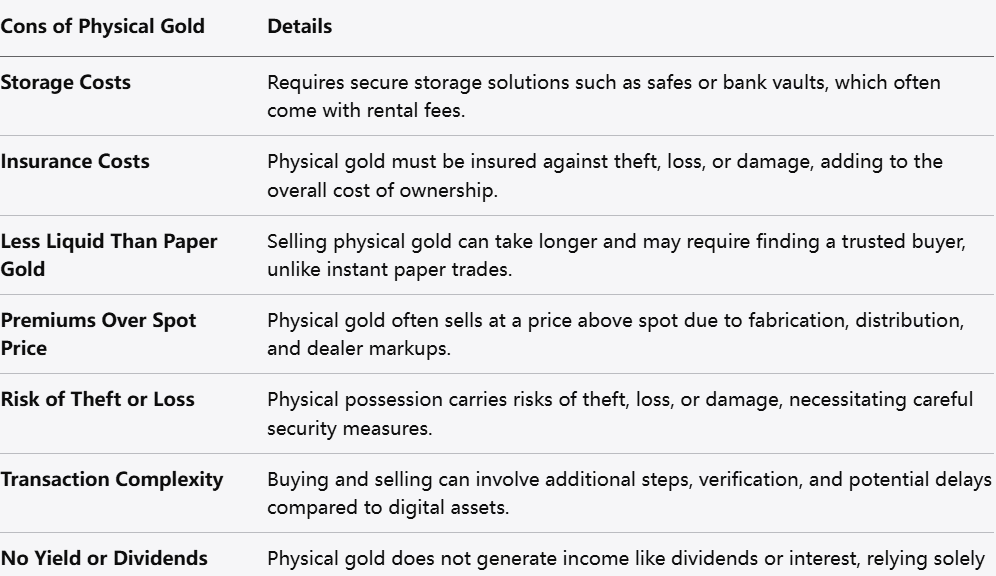

Pros and Cons of Physical Gold

Pros: Direct ownership, no counterparty risk, tangible asset.

Cons: Storage and insurance costs, less liquid than paper gold, premiums over spot price.

What Are Gold ETFs?

Gold ETFs are exchange-traded funds that track the price of gold. They provide exposure to gold prices without the need for physical storage.

How Gold ETFs Work

ETFs hold physical gold or gold futures contracts.

Shares of the ETF trade on stock exchanges.

Investors can buy or sell shares throughout the trading day.

Gold Mutual Funds

These funds invest in a basket of gold-related assets such as mining stocks or physical gold.

Advantages of ETFs and Mutual Funds

Easy to buy and sell.

Lower costs compared to physical gold.

No need for storage or insurance.

Suitable for smaller investors.

Considerations

Investors do not own physical gold.

Fund management fees apply.

Subject to market risks similar to other securities.

What Are Gold Futures?

Gold futures are standardized contracts to buy or sell a specific amount of gold at a predetermined price on a future date.

What Are Gold Options?

Options give the right, but not the obligation, to buy or sell gold futures at a set price within a specific timeframe.

Trading Futures and Options

Typically traded on commodity exchanges.

Require margin accounts.

Offer leverage but involve high risk.

Pros and Cons

Allow speculation on gold price movements.

Can hedge physical gold holdings.

Complex and may not suit beginners.

Risk of substantial losses if the market moves against you.

Investing in gold stocks means buying shares in companies engaged in gold mining, exploration, and production.

Why Invest in Gold Stocks?

Potential for dividends.

Leverage to gold price – stocks may rise more than gold itself.

Exposure to company-specific factors such as management and production costs.

Risks

Company operational risks.

Stock market volatility.

Gold price fluctuations impact profitability.

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movement of gold without owning the physical asset.

How Gold CFDs Work

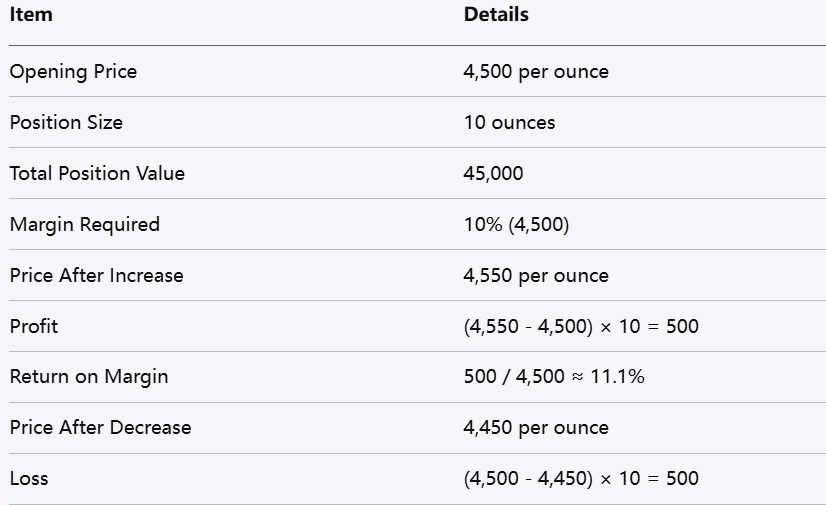

Gold Contracts for Difference (CFDs) offer a flexible way to trade gold price movements without owning the physical metal. When you trade gold CFDs, you enter into an agreement with a broker to exchange the difference in the gold price between the moment you open your position and when you close it. This method allows you to speculate on price fluctuations without the need to manage storage or security concerns associated with physical gold.

One of the key advantages of gold CFDs is the ability to trade on both rising and falling markets. If you expect the price of gold to increase, you can open a long position (buy). Conversely, if you anticipate a price decline, you can open a short position (sell). This two-way trading capability enables you to potentially profit regardless of gold’s direction, provided your market predictions are correct.

CFDs are typically leveraged products, meaning you only need to deposit a fraction of the total trade value, known as the margin, to control a larger position. Leverage amplifies your exposure to gold price movements, which can increase potential gains. However, it also magnifies potential losses, so managing risk through careful position sizing and stop-loss orders is essential.

Because you do not take ownership of physical gold, trading CFDs is often faster and more cost-efficient than buying bullion or gold ETFs. The process involves lower transaction costs and allows for quick entry and exit from positions, making CFDs suitable for short-term trading strategies such as day trading or swing trading.

Gold CFDs provide a way to participate in the gold market with flexibility, leverage, and the ability to benefit from both upward and downward price changes—all without dealing with the complexities of physical ownership. However, due to leverage and market volatility, it is important to approach gold CFD trading with a well-defined strategy and disciplined risk management.

Leverage: Trade larger positions with a smaller amount of capital.

No Physical Ownership: Avoid storage and insurance concerns.

Access to Both Markets: Profit from gold price increases and decreases.

Lower Transaction Costs: Often cheaper than futures contracts.

Fast Execution: Suitable for day trading and short-term strategies.

24-Hour Trading: Access gold markets nearly round the clock.

Leverage: Amplify Your Trading Power

One of the most attractive features of gold CFD trading is leverage. This allows you to control a larger position with a smaller amount of capital by using margin. Instead of paying the full value of your gold trade upfront, you only need to deposit a fraction of it. This amplifies your exposure to price movements, offering the potential for higher returns. However, leverage also increases risk, so it’s crucial to manage your trades carefully to avoid large losses.

No Physical Ownership: Simplify Your Investment

Trading gold CFDs means you never take possession of physical gold. This eliminates the need to worry about storage, insurance, or security concerns that come with owning gold bars or coins. Without the hassle and costs related to physical ownership, trading CFDs can be more straightforward and convenient, especially for active traders.

Access to Both Rising and Falling Markets

Gold CFDs enable you to profit in both upward and downward markets. If you anticipate the price of gold will rise, you can open a long position (buy). Conversely, if you expect prices to decline, you can open a short position (sell). This flexibility offers trading opportunities regardless of market conditions, unlike traditional gold investment that only benefits from price appreciation.

Lower Transaction Costs

Compared to futures contracts or buying physical gold, CFDs often have lower transaction costs. Brokers typically offer tighter spreads and fewer commissions, reducing the overall cost of trading. This cost efficiency makes CFDs especially attractive for traders who engage in frequent buying and selling.

Fast Execution for Active Trading

Gold CFDs trade on highly liquid markets, which means orders are executed quickly. This fast execution is essential for short-term strategies such as day trading or swing trading, where timing can significantly impact profitability. The ability to enter and exit positions swiftly allows traders to take advantage of rapid price movements.

24-Hour Trading Access

Many brokers offer 24-hour trading on gold CFDs, reflecting the global nature of the gold market. This continuous access lets you respond immediately to economic news, geopolitical events, or market developments that affect gold prices, no matter the time zone. Such flexibility is valuable for traders seeking opportunities around the clock.

Step 1: Choose a Reliable Broker

Selecting a trustworthy broker is critical. Look for:

Regulation by reputable authorities.

Transparent fees.

Robust trading platforms.

Strong customer support.

Step 2: Open and Fund Your Trading Account

Complete the registration process and deposit funds.

Step 3: Learn the Trading Platform

Familiarize yourself with order types, charting tools, and risk management features.

Step 4: Develop a Trading Plan

Define your strategy, risk tolerance, and trading goals.

Step 5: Practice with a Demo Account

Many brokers offer demo accounts to practice without risking real money.

Step 6: Start Trading

Begin with smaller trades, apply stop-loss orders, and monitor your positions.

markets.com is a global broker known for its comprehensive offering tailored to CFD traders, including gold CFDs.

Key Features of markets.com

markets.com combines security, ease of use, and powerful tools, making it ideal for those interested in gold CFD trading whether beginners or experienced.

Gold remains a timeless asset with diverse trading and investment options. Whether you prefer owning physical bars, investing through ETFs, speculating with futures, or trading CFDs, gold offers opportunities to fit various goals and risk profiles.

For those interested in active trading, gold CFD trading presents a flexible, cost-effective way to engage with gold price movements without the complications of physical ownership. Choosing a reputable broker like markets.com can provide the tools, security, and support needed to navigate the gold markets confidently.

By educating yourself on gold trading basics, carefully selecting your method, and practicing disciplined risk management, you can incorporate gold into your financial strategy effectively.

Looking to trade gold CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.