Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Dec 3 2025 06:56

15 min

How to start day trading as a beginner: Day trading is a popular trading strategy that involves buying and selling assets within the same trading day.

CFD trading tutorials: This fast-paced approach aims to capitalize on short-term price movements and requires quick decision-making, technical analysis skills, and effective risk management. While day trading can offer substantial profits, it is also fraught with risks, especially for beginners. In this article, we will discuss how to start day trading and explore whether Contracts for Difference (CFDs) are a good choice for this trading style.

So, you're looking into day trading and keep hearing about CFDs. What exactly are these things? Basically, a Contract for Difference, or CFD, is a financial agreement between you and a broker. You're agreeing to exchange the difference in the price of an asset from when you open a trade to when you close it. You're not actually buying or selling the asset itself. Think of it like betting on the price movement. If you're right, you profit from the difference; if you're wrong, you pay the difference. It's a way to speculate on price changes without owning the actual thing, whether that's a stock, an index, or a commodity. This allows for trading on price fluctuations in markets you might not otherwise have access to. You can find out more about CFD trading basics.

A CFD is a type of derivative. Its value is derived from an underlying asset, but you never take ownership of it. It's a contract between two parties – you and the broker – to settle the difference in price. This means you can trade on price movements without the hassle of actually owning and storing the asset. It's a popular tool because it lets you participate in market movements, both up and down.

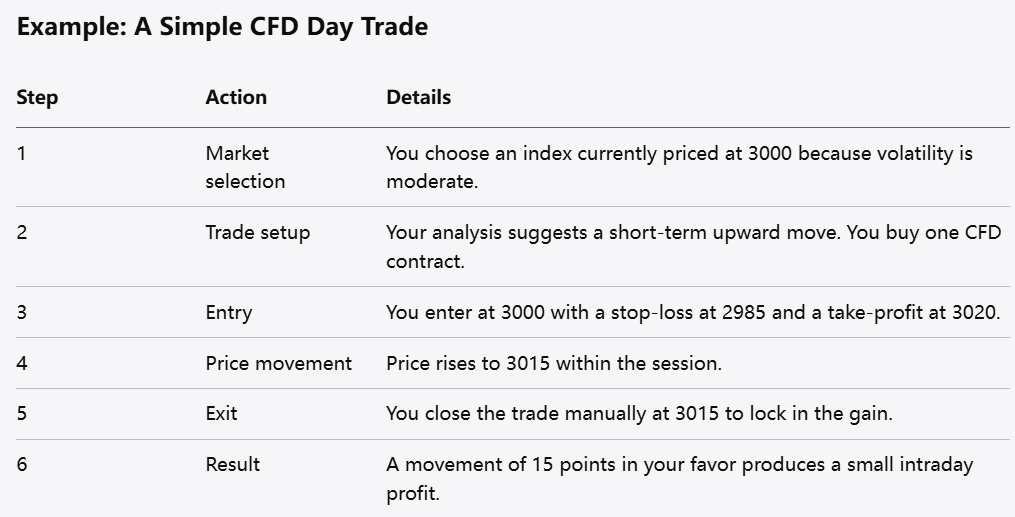

CFD trading works by mirroring the price of the underlying market. You can choose to go 'long' if you think the price will rise, or 'short' if you believe it will fall. Let's say you think Apple stock, currently trading at $150, is going to go up. You could buy a CFD at $150. If the price rises to $160 and you close your position, you profit $10 per contract. If it drops to $140 and you close, you lose $10 per contract. The broker provides the prices, which usually track the real market very closely, with a small difference called a spread. Here's a quick look at the mechanics:

CFD trading allows you to speculate on the price movements of various financial instruments without the need to own the underlying asset. This flexibility means you can potentially profit from both rising and falling markets, but it also means losses can accumulate quickly if not managed properly.

This is a really important point to get straight. When you trade a CFD, you're not buying shares of a company or barrels of oil. You're entering into a contract that's based on the price of those things. So, if you trade a CFD on gold, you're betting on the price of gold, not actually owning any gold. This distinction is key because it means you don't have the rights or responsibilities of a shareholder, for example. You're purely focused on the price difference between when you enter and exit your trade.

Alright, so you've got a handle on what a CFD actually is. Now comes the part where you actually start setting things up to trade them. It’s not just about picking a market and hitting buy or sell; there are a few important steps to get through first. Think of it like getting your tools ready before you start building something.

This is a big one. You can't just trade CFDs with anyone. You need to find a broker that's regulated and trustworthy. What does that mean? Well, it means they follow rules set by financial authorities, which offers you some protection. Look into where they are regulated and what licenses they hold. Also, check out the markets they offer – do they have the stocks, indices, or commodities you're interested in? Don't forget to compare their fees, especially overnight charges if you plan to hold trades longer than a day. Some brokers also offer better risk protections, like negative balance protection, which is a good thing to have.

Opening And Funding Your Trading Account

Once you've picked a broker, you'll need to open an account. This usually involves filling out some forms and verifying your identity. It might seem like a bit of a hassle, but it's standard procedure. After your account is approved, you'll need to deposit some funds to start trading. Think about how much you're comfortable putting in – remember, you should only trade with money you can afford to lose. This is where you can start to get a feel for the platform itself, seeing how it all works before you commit real money.

The Importance Of A Demo Trading Account

Seriously, don't skip this. Most good brokers offer a demo account. It's basically a practice account where you trade with virtual money. You get to see real market prices and charts, but there's no risk to your actual cash. It's the perfect place to test out different order types, practice setting stop-losses, and get a feel for how your chosen trading strategy plays out. You can even try out different platforms, like Margex, to see how their interface works for placing orders and managing trades. Making mistakes on a demo account is free and a really smart way to learn the ropes before you put your own money on the line. It lets you make those early errors when nothing is actually at stake.

Trading CFDs involves significant risk. While they offer flexibility and access to many markets, leverage can magnify both profits and losses. It's vital to understand these risks and implement strong risk management strategies from the outset. Many retail traders lose money, often due to excessive leverage or unexpected market volatility.

Choosing the right broker and practicing on a demo account are the first practical steps in getting started with CFDs. They lay the groundwork for a more informed and less risky trading journey.

If you prefer a regulated, user‑friendly platform to learn on, Markets.com is a well‑known broker that offers CFDs on stocks, forex, indices, and commodities along with educational tools, but you should still compare fees, spreads, and regional regulations before choosing any provider, and never trade money you cannot afford to lose. Day trading demands caution and continuous learning.

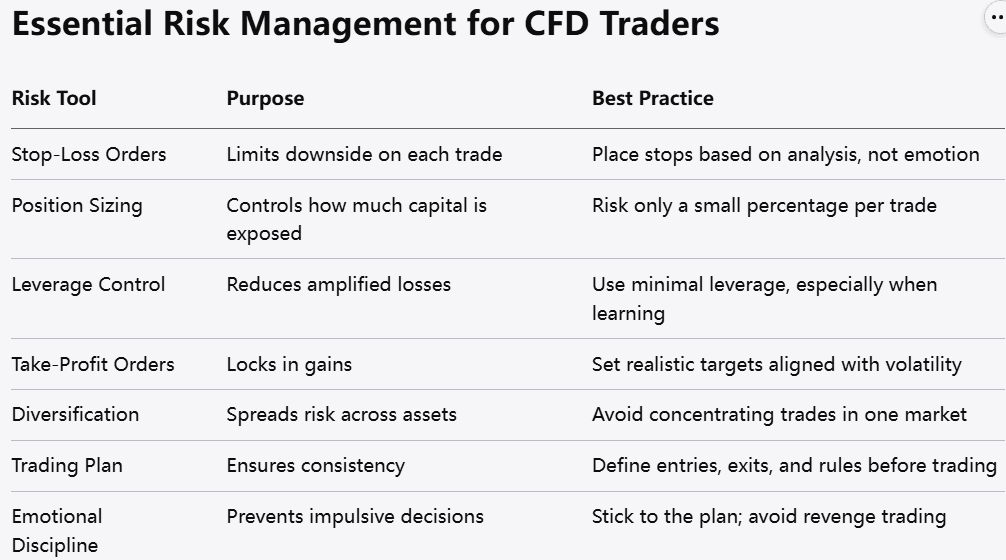

Alright, so you're thinking about diving into CFD trading. It can seem pretty exciting, right? But before you jump in, we really need to talk about managing the risks. It's not the most glamorous part, but honestly, it's probably the most important if you want to stick around.

First off, you've got to figure out how much you're okay with losing on any single trade. This isn't about guessing; it's about setting a limit before you even look at a chart. Think about your total trading capital. A common rule of thumb is to risk only a small percentage, maybe 1% to 2%, of that total on any one trade. So, if you have $10,000 in your account, you might decide that losing $100 or $200 on a single trade is your absolute maximum. This helps prevent one bad trade from wiping out a huge chunk of your money. It’s about survival, not just making a quick buck.

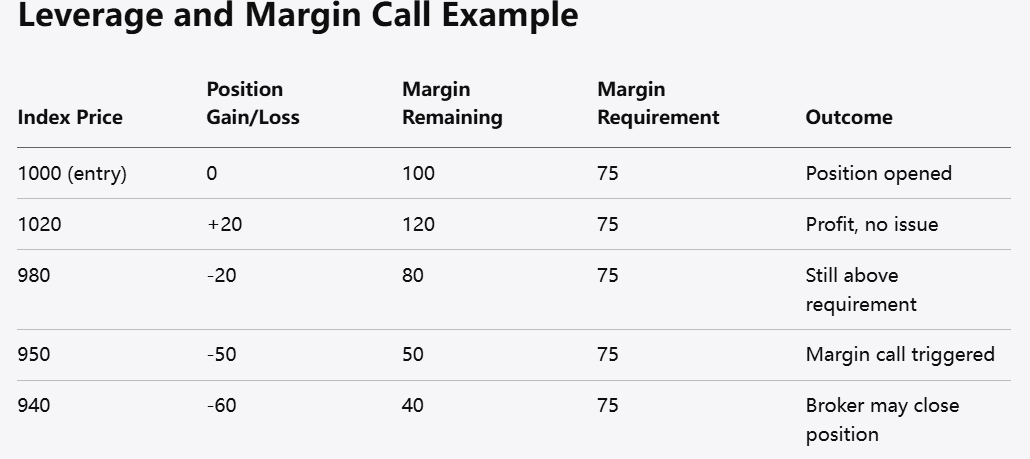

Understanding Leverage And Margin Calls

Leverage is like a double-edged sword. It lets you control a larger position with a smaller amount of your own money, which can boost profits. But, and this is a big 'but', it also magnifies losses. If you use too much leverage, a small move against your position can lead to a margin call. This is when your broker tells you that you need to deposit more funds to cover potential losses, or they'll close your position, often at a loss. It's a serious situation, and understanding how much margin you're using is key. You can check out how margin works on a CFD broker's site.

Implementing Stop-Loss And Take-Profit Orders

These are your best friends when it comes to managing risk automatically. A stop-loss order is set to close your trade if the price moves against you to a certain point, limiting your potential loss. A take-profit order does the opposite; it closes your trade when it reaches a profit target you've set. Using both helps you stick to your plan and avoid making emotional decisions when the market gets wild. They're not foolproof, especially in fast-moving markets, but they provide a vital safety net.

Remember, CFD trading involves a high level of risk. You can lose more than your initial deposit, and it's not suitable for everyone. Always make sure you understand the risks involved and consider seeking independent advice.

Day trading can seem exciting, but it is also one of the most challenging forms of trading because it involves making rapid decisions in fast‑moving markets. As a beginner, your first step is education. Learn how financial markets work, including concepts like liquidity, volatility, bid‑ask spreads, market orders, limit orders, and slippage. Study basic technical analysis tools such as support and resistance, trendlines, candlestick patterns, and common indicators.

Equally important is learning risk management: never risk more than a small percentage of your capital on a single trade, always use stop‑loss orders, and understand that losses are part of the process. Before risking real money, open a demo account with a reputable, regulated broker so you can practice strategies in a simulated environment. This helps you develop discipline, emotional control, and a trading routine without financial pressure. Building a written trading plan that defines when you enter, exit, and avoid trades will also help you stay consistent. Remember that day trading is a skill built over time, not a quick path to wealth.

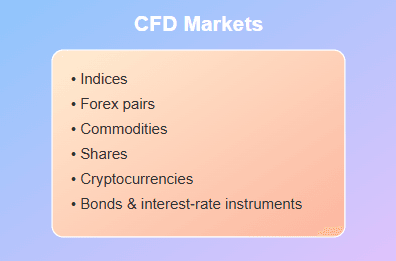

Contracts for difference (CFDs) are popular among day traders because they allow you to speculate on price movements without owning the underlying asset. They offer access to many markets, including indices, commodities, forex pairs, and individual shares, all from a single trading platform. One major advantage for day traders is the ability to go long or short with ease, letting you trade in both rising and falling markets. CFDs also provide leverage, meaning you can open larger positions with a smaller initial deposit.

However, leverage is a double‑edged sword: it magnifies both gains and losses, and for beginners, this often leads to account depletion if not managed carefully. High leverage can cause a small adverse price movement to wipe out a significant portion of your funds, so new traders must be extremely cautious and use the lowest leverage available.

For beginners, CFDs can be suitable only if you fully understand how they work and are prepared for the heightened risk. They are complex instruments, and regulatory bodies often warn that a high percentage of retail accounts lose money when trading CFDs. If you choose to use them, start small, use strict stop‑losses, and avoid trading during highly volatile market events until you are more experienced. Also ensure that your broker is well regulated, transparent with pricing, and offers strong risk‑management tools.

Ultimately, CFDs can be effective for active traders who value flexibility and short‑term speculation, but they require discipline, education, and a realistic mindset. Beginners should approach them with caution and focus on building a solid foundation before trading with significant capital.

First off, you need to decide what you want to trade. CFDs are available on a ton of different things – stocks, major currency pairs, commodities like gold or oil, even big stock market indexes. As a beginner, it's usually best to stick to markets you know something about or that are generally pretty stable. Think about trading CFDs on a major index like the S&P 500, or maybe a popular currency pair like EUR/USD. These tend to have a lot of information available and are usually less wild than, say, some obscure cryptocurrency or a single penny stock. You want markets that are liquid, meaning there are plenty of buyers and sellers, so you can get in and out of trades easily without huge price swings just because of your own order.

Once you've picked your market, you need to decide if you think the price is going to go up or down. This is your trading direction. Are you feeling bullish (expecting prices to rise) or bearish (expecting prices to fall)? Your strategy will dictate this. Some traders only go long, others only go short, and many do both. It's important to have a clear reason for your direction. Don't just guess. Look at charts, read news, and try to form an educated opinion. Remember, with CFDs, you can profit from both rising and falling markets, which is a big deal.

Day trading can be an exciting and potentially profitable venture for beginners willing to invest time and effort into understanding the markets. CFDs offer unique advantages and considerable flexibility for day trading, but they also come with significant risks that require careful management. By creating a solid trading plan, choosing the right platform, and continuing to educate yourself, you can navigate the complexities of day trading successfully. Always remember to practice responsible trading strategies and continuously refine your skills as you progress in your day trading journey.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.