Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Dec 5 2025 09:12

12 min

How to trade gold: Gold has long been regarded as a valuable asset and a safe haven during economic uncertainty. Trading gold can be a profitable endeavor, particularly through CFDs.

Learn How to Trade Gold (XAU/USD) CFDs: This article will delve into the intricacies of trading gold CFDs, offering insights, strategies, and tips for both novice and experienced traders.

The Historical Significance of Gold

Gold has been used as a form of currency and a store of value for thousands of years. Its allure is rooted in its rarity, malleability, and resistance to corrosion. Historically, gold has been a benchmark for wealth, especially during times of economic instability.

Why Trade Gold?

These factors collectively underscore why gold remains a compelling choice for traders looking to capitalize on various market conditions.

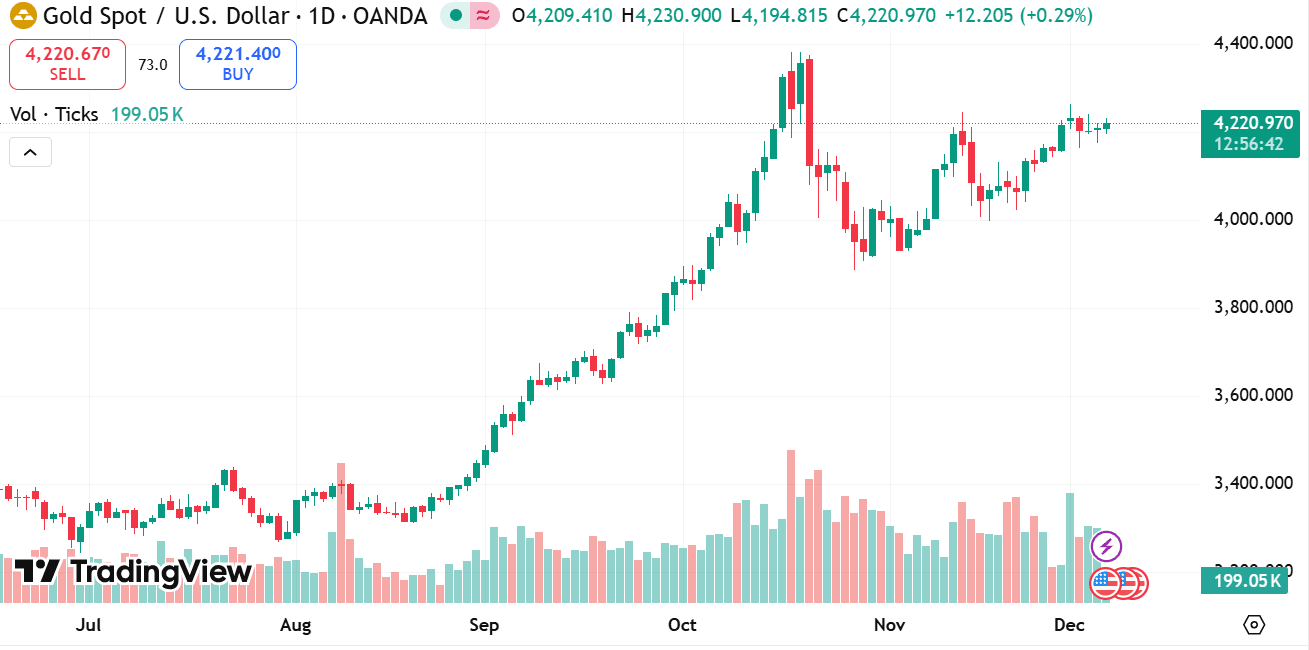

source: tradingview

Definition of Contract for Difference (CFD)

A CFD is a financial derivative that allows traders to speculate on the price movement of an asset without owning the underlying asset. In the case of gold CFDs, traders can profit from the fluctuations in gold prices.

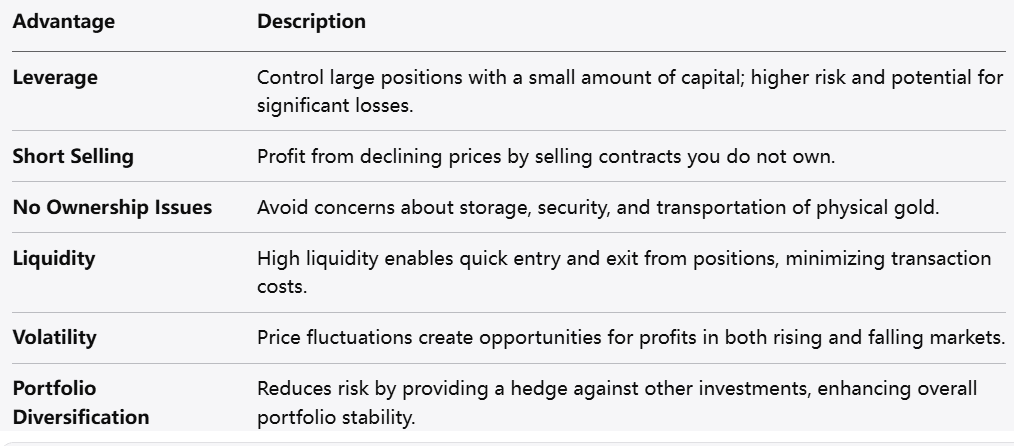

Benefits of Trading Gold CFDs

1. Leverage

Traders can control large positions with a relatively small amount of capital, allowing for potentially higher returns on investment. However, it’s important to note that while leverage amplifies profits, it also increases risk, potentially leading to significant losses.

2. Short Selling

Gold CFDs enable traders to profit from declining prices through short selling. This means traders can sell gold contracts they do not own, taking advantage of downward price movements to generate profits.

3. No Ownership Issues

Traders do not have to deal with the logistics of storing, securing, or transporting physical gold. This convenience allows them to focus on trading strategies without the complications of managing physical assets.

4. Liquidity

Gold markets are highly liquid, allowing traders to enter and exit positions swiftly. This liquidity helps minimize transaction costs and prevents price slippage during trades.

5. Volatility

The fluctuations in gold prices create opportunities for traders to capitalize on short-term price movements. Skilled traders can profit from both rising and falling markets due to gold's inherent volatility.

6. Portfolio Diversification

Trading gold CFDs can provide a hedge against risks in other investments. Gold typically has a low correlation with stocks and bonds, allowing for better risk management and overall portfolio stability.

These factors illustrate the appeal of trading gold CFDs, combining the potential for profit with practical trading benefits.

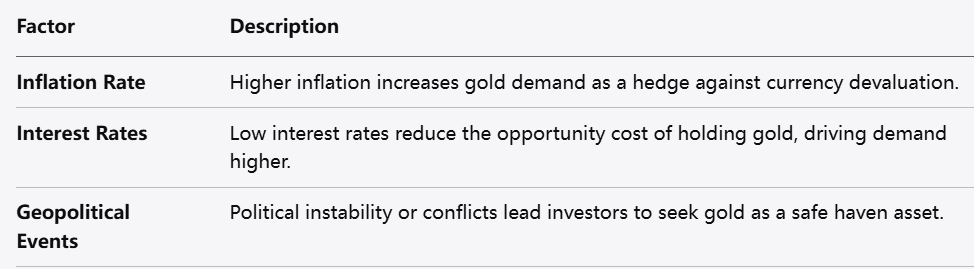

Fundamental Analysis

Fundamental analysis involves examining the factors that influence gold prices, including:

Economic Indicators

Inflation Rate: Higher inflation often leads to increased gold demand as a hedge against currency devaluation.

Interest Rates: When interest rates are low, the opportunity cost of holding gold decreases, often driving demand.

Geopolitical Events: Political instability or conflicts can push investors toward gold as a safe haven.

Supply and Demand Dynamics

Gold supply is influenced by mining production, recycling, and central bank policies. Understanding these factors can provide insight into future price movements.

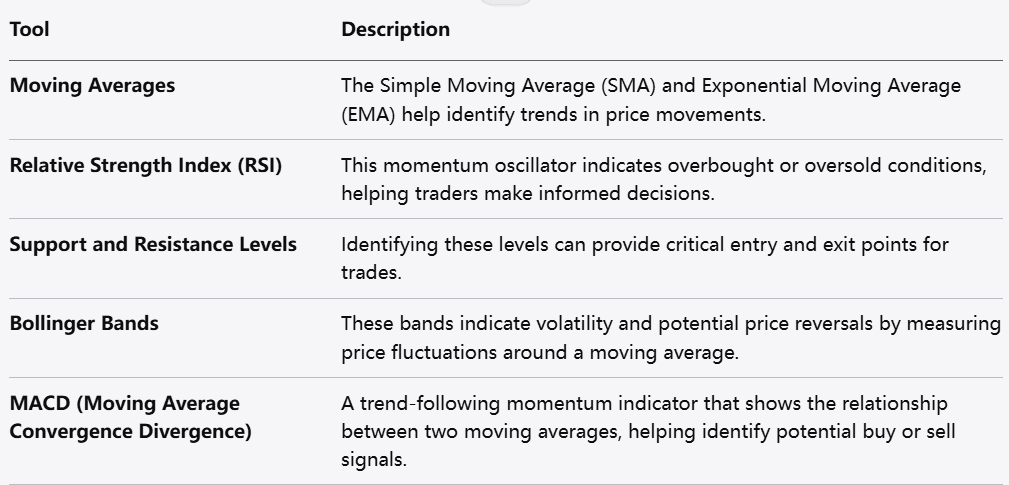

Technical Analysis

Technical analysis focuses on historical price movements to forecast future trends. Key components include:

Chart Patterns

Support and Resistance Levels: Identifying these can help traders make informed entry and exit points.

Trend Lines: Understanding whether the market is in an uptrend, downtrend, or sideways pattern can guide trading decisions.

Indicators

Moving Averages: The simple moving average (SMA) and exponential moving average (EMA) can help identify trends.

Relative Strength Index (RSI): This momentum oscillator can indicate overbought or oversold conditions.

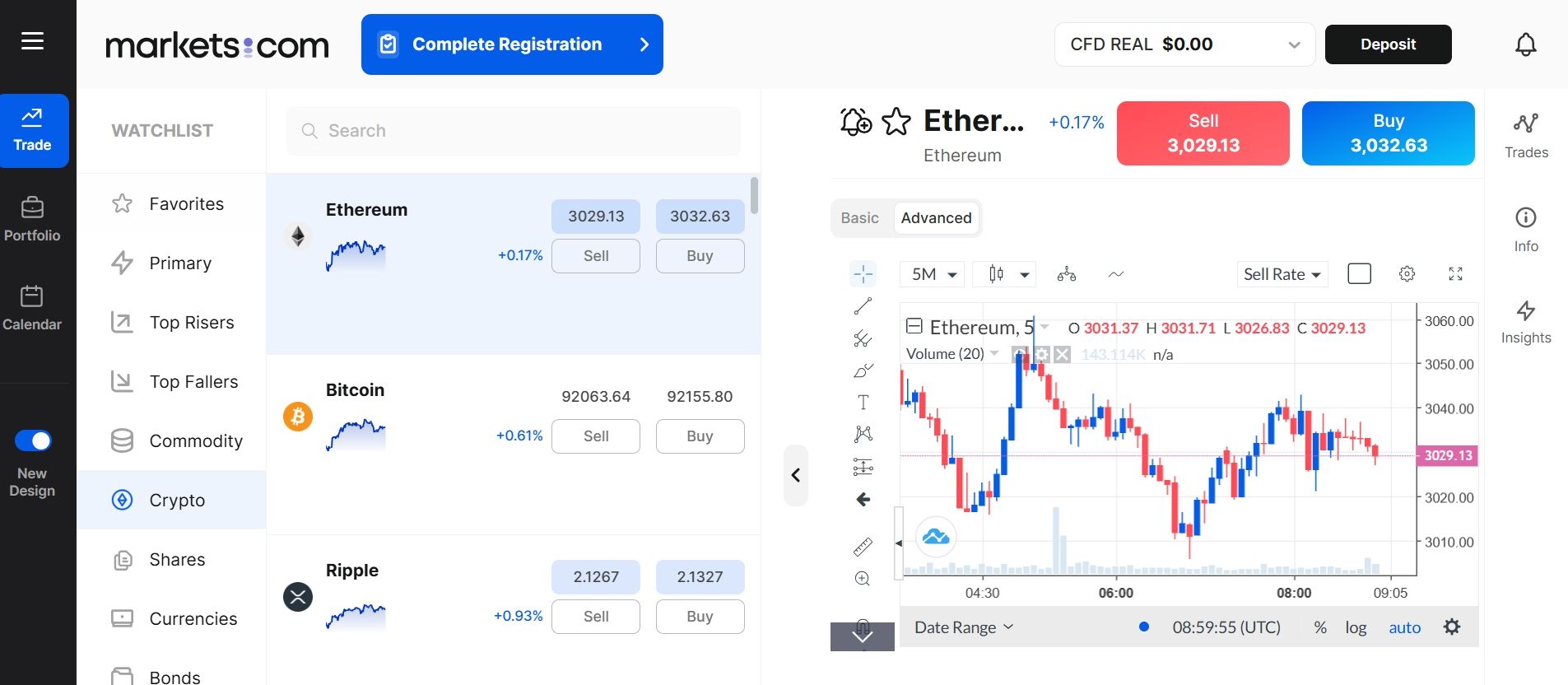

1. Open Your Account: The first step is to register for a trading account with Markets.com. The process is quick, secure, and designed to get you set up with minimal hassle.

2. Fund Your Account: Once your account is active, you need to deposit funds. Markets.com offers various secure payment methods, allowing you to choose the one that is most convenient for you.

3. Research the Gold Market: Before making a move, take time to understand the factors influencing gold prices. Analyze market trends, study technical charts, and develop a trading strategy that aligns with your risk tolerance.

4. Execute Your First Trade: With your research complete, you are ready to execute your first gold CFD trade. Open the trading platform, find the gold instrument (XAU/USD), and place your buy or sell order based on your market analysis.

Short-Term vs. Long-Term Trading

Decide whether you want to engage in short-term or long-term trading. This will influence your approach, including time frames for entry and exit, and analysis techniques.

Setting Trading Goals

Define what you aim to achieve through trading. Establish realistic goals based on your risk tolerance, investment capital, and time commitment.

Risk Management Strategies

Effective risk management is vital for long-term success in trading. Consider these strategies:

Entry and Exit Points

Identify optimal entry and exit points for your trades based on analysis. Timing is crucial in maximizing profitability.

Emotional Discipline

Maintaining discipline is essential when trading. Avoid making impulsive decisions based on fear or greed. Stick to your trading plan and strategy.

Trend Following

This strategy involves identifying and following prevailing market trends. Utilize technical indicators like moving averages to confirm trends before entering trades.

Range Trading

Range trading capitalizes on price oscillations between support and resistance levels. Traders enter long positions at support and short positions at resistance.

Breakout Trading

Breakout trading involves identifying key levels where the price is likely to break out of a defined range. Traders often place buy orders above resistance or sell orders below support.

Understanding Market Sentiment

Market sentiment reflects the collective attitude of traders toward gold. Analyzing sentiment can provide insights into potential price movements.

Tools for Measuring Sentiment

Commitment of Traders (COT) Report: This report provides insights into the positions held by various market participants.

Sentiment Indicators: Metrics such as the Fear and Greed Index can help gauge market sentiment.

Utilizing News and Events

Stay informed about global economic news, geopolitical events, and other factors that may influence gold prices. Scheduled reports and unexpected events can lead to significant price shifts.

The Role of Psychology in Trading

Psychological factors can greatly impact trading decisions. Common emotional pitfalls include:

Fear of Missing Out (FOMO): This can lead to impulsive buying at high prices.

Loss Aversion: The fear of losing can prevent traders from closing losing positions or taking profits.

Developing a Healthy Mindset

Cultivating a healthy trading mindset involves:

Staying Educated: Continuously learning about market dynamics and trading strategies can boost confidence.

Practicing Patience: Good traders wait for the right opportunities rather than rushing into trades.

Trading gold CFDs can be a lucrative opportunity for those willing to invest the time and effort to understand the markets. By combining technical and fundamental analysis, developing a sound trading strategy, and implementing effective risk management, traders can navigate the complexities of gold trading with greater confidence.

As with any investment, it is crucial to stay informed and adapt to changing market conditions, continually refining your approach. With discipline and education, trading gold can be both rewarding and fulfilling.

Looking to trade gold CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.